Summary:

- Palantir Technologies Inc.’s Q4 2023 revenue grew by 20% YoY to $608.4 million, driven by streamlined go-to-market and increased customer acquisition in the U.S. commercial sector.

- Palantir expects upward growth of at least 40% in the U.S. commercial segment for the year, highlighting strong revenue momentum.

- Despite anticipating a market correction, the long-term outlook for Palantir Technologies remains positive, supported by solid fundamentals and aggressive growth strategies.

- Following the strong bull run YTD, a pullback in Palantir Technologies is necessary before breaking into new highs.

ko_orn

Investment Thesis

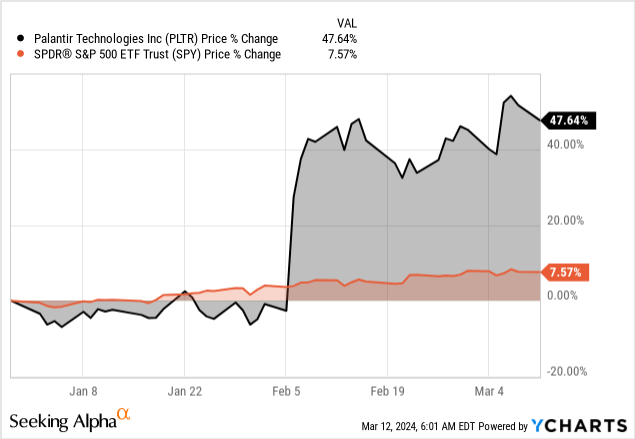

Since our in-depth analysis of Palantir Technologies Inc. (NYSE:PLTR) in February 2022, when we first presented a bullish stance on the stock, the company has remarkably validated our conviction, richly rewarding patient investors.

Our confidence was well-placed; since doubling down on our position, PLTR has delivered a staggering return of over 230% in less than 17 months. This exceptional performance is underpinned by consecutive profitability milestones, robust growth metrics, impressive conversion rates, and the impactful deployment of AI capabilities, all contributing to a sustained bull run.

However, despite the significant gains, we anticipate a necessary pullback correction before PLTR reaches new heights. This expected correction should be viewed not as a deterrent, but as a potential opportunity for investors to enter or increase their positions in anticipation of further growth.

Therefore, our long-term investment thesis remains intact, underpinned by Palantir’s solid fundamentals, strategic growth initiatives, and the broadening application of its AI technologies.

Powering Growth and Diversification in the Commercial Sector

Artificial intelligence platforms (AIP) momentum drives new customer conversions and existing customer expansions. The transformative effect of AIP on the business is best highlighted in the U.S. commercial bookings and backlog. Palantir experienced noteworthy achievements in the U.S. commercial sector, the most significant being shorter times to conversion and expansion (from a prototype to a product in months).

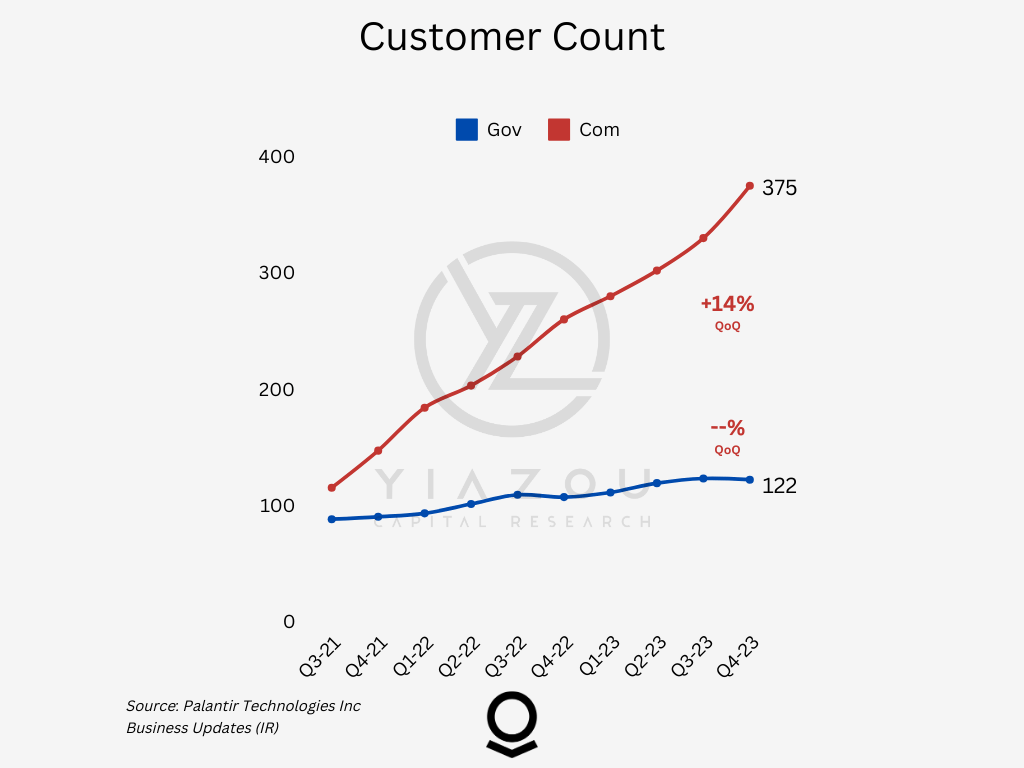

By the 31st of December 2023, PLTR had 497 customers, with the commercial segment reporting high customer count growth of 14% quarter-over-quarter, while the government segment remained flat. The commercial segment experienced significant growth, with fourth-quarter revenue increasing by 32% year-over-year (YoY) and full-year revenue growing by 20%, exceeding $1 billion for the first time.

Additionally, the US Commercial revenue in Q4 surged by 70% YoY, reaching $131 million. With a revamped go-to-market strategy and piloting approach followed by significantly compressed sales cycles, the U.S. customer count grew by 55% YoY to 221, reflecting a robust market presence. This acceleration is attributed to a surge in demand, resulting in the highest commercial Total Contract Value (TCV) booked in a quarter, showcasing a 156% growth YoY. Hence, the strategic expansion and increased demand in the U.S. contributed majorly to this growth.

Author

Palantir’s accelerated customer acquisition process stems from three key drivers. First, boot camps are rapidly transitioning into paying customers. In Palantir boot camps, participants and potential users learn how to apply AI to mission-critical operations within their organizations. They progress from having no prior knowledge to building practical use cases.

Once they feel empowered by Palantir’s AI capabilities, the majority of them will convert into paying customers. Second, there’s growth among existing customers and those with longstanding engagements with Palantir. Third, the introduction of AIP has further fueled this momentum. Despite these gains, Palantir recognizes that they have merely scratched the surface of their total addressable market, or TAM; they’re only just getting started.

The firm also reported a meaningful increase in their US commercial TCV on a dollar-weighted duration basis, up 107% YoY and 42% sequentially. In the fourth quarter, TCV booked was 1.15 billion, up 192% YoY and 38% sequentially. Net dollar retention was 108%, an increase of 100 basis points from last quarter. They ended the fourth quarter with $3.9 billion in total remaining deal value, an increase of 5% sequentially. AIP boosted Palantir’s total addressable market, with the TCV in the U.S. commercial segment reaching $343 million, showcasing a remarkable 107% growth YoY.

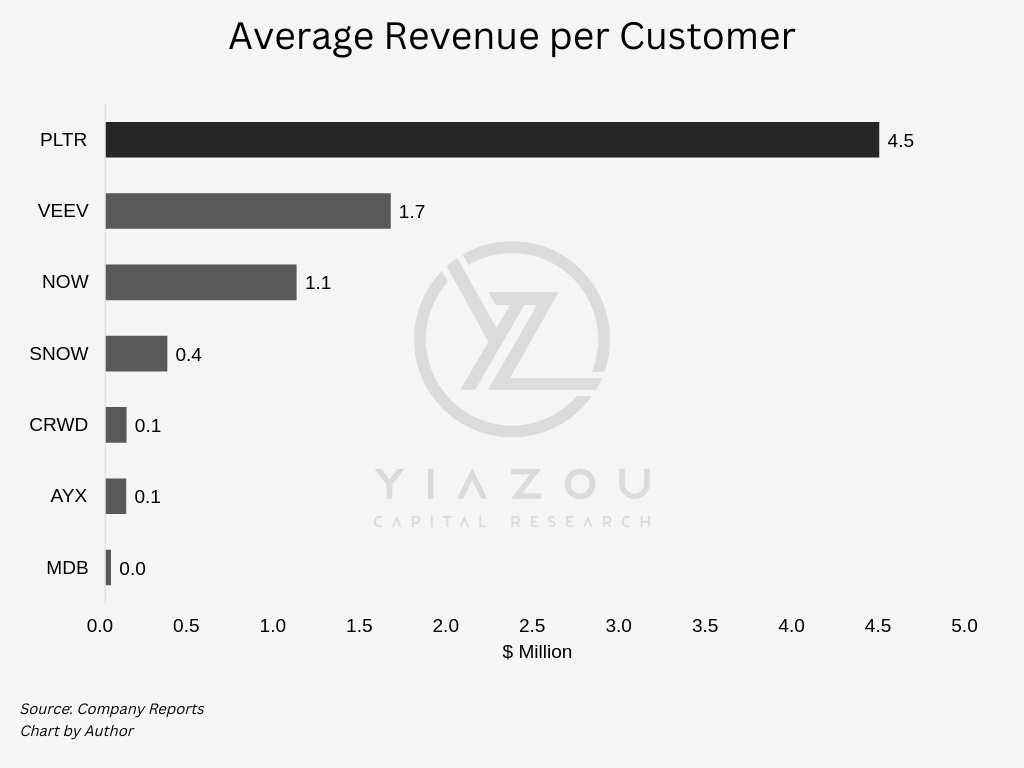

Additionally, Palantir remains an outlier among its peers, as the company’s average revenue per customer (ARPC) remains off the chart compared to its peers, delivering a staggering ARPC of $4.5 million. The top 20 high-value customers drive most of Palantir’s revenue. However, reliance on these customers is slowly declining, signifying the company’s effort to serve an expansive and diverse market. On the positive side, the top 20 customers’ contribution to total revenue dropped to 49.4% based on TTM as of December 2023, compared to 57.1% in FY21. As a result, the average revenue per customer of PLTR dropped below $5 million based on the latest TTM revenue, compared to $6.5 million in FY21.

Author

Finally, Palantir’s remaining performance obligations (RPO) recovery also suggests improving revenue growth in the coming quarters. The company’s net dollar retention remains above 100.0%, which indicates that the PLTR platform’s stickiness has remained intact. Net dollar retention does not include revenue from new customers they acquired in the past 12 months and, therefore, does not yet fully capture the acceleration in their U.S. commercial business.

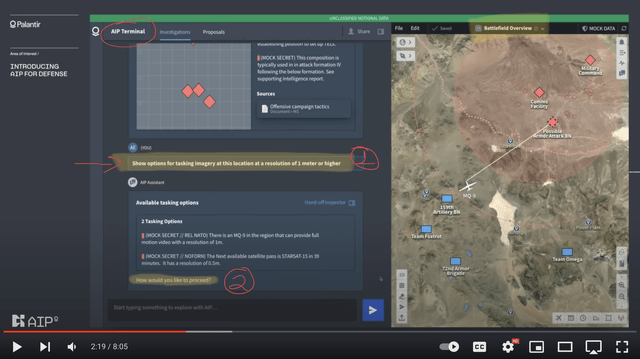

AIP Upgrade: Seamless LLM Integration for Quicker Decisions and Market Expansion

Palantir Technologies has recently enhanced its AIP platform by integrating large language models (LLMs), augmenting user-friendliness and power. AIP facilitates the seamless connection of LLMs with user data, aiding decision-making. The AIP Bootcamp expedites customer onboarding, contributing to remarkably swift time-to-market.

Integrating LLMs with Foundry through AIP significantly broadens the accessibility of deploying use cases, expanding the addressable market. While the company is observing initial momentum, it acknowledges that it is still at the initial stage of capturing this expanded market. Palantir has successfully covered nearly 200 use cases from AIP Boot camps, underscoring the potential of this approach, with a focus on data integration as a core value-driving principle.

AIP enables the integration of diverse data types, such as video conferences, incident response calls, Slack rooms, PDFs, images, video, and audio, leveraging the power of LLMs and ontology. The acceleration in AIP customer engagement is anticipated to continue, fueled by its adaptability and versatility.

The recent quarter saw Palantir signing multiple U.S. commercial deals, where AIP played a pivotal role in driving various deal archetypes. New customers attending boot camps swiftly signing enterprise contracts, AIP-driven conversions of ongoing pilots, and expansions in existing accounts are illustrative examples. Internationally, AIP reinforces partnerships in Continental Europe and fosters growth in select markets.

Lastly, Palantir’s focus on enhancing product usability and charisma through AI-driven developments, particularly in LLMs, marks a convergence aimed at broadening Foundry’s market appeal. Current research and development efforts are directed toward deploying software, models, and assets at the edge, aligning with the growing market trend of edge computing – positioning Palantir favorably to secure a substantial share in this evolving landscape.

Turning Complex Challenges into Competitive Advantage with AIP Bootcamps

Rather than rejecting projects with risky and resource-intensive installation requirements, Palantir actively seeks them out. They’ve obtained strict government clearances, manage complex data environments, offer cloud-agnostic integration, and don’t shy away from long sales cycles. These are substantial barriers to entry for competitors.

Still, their fundamental competition is their own customers’ internal software development. AIP Bootcamp makes platform onboarding much easier and forcefully addresses this competitive risk. Bootcamp teaches end-users how to use AIP effectively.

Additionally, Palantir is strategically intensifying efforts to convert boot camps into enterprise deals, evident in the noteworthy impact on sales cycles and the accelerated rate of new customer acquisition. In Q4, U.S. commercial saw a sequential rise of 22%, a substantial increase compared to 12% and 4% in Q3 and Q2, respectively.

The success stories include new customers attending boot camps and promptly signing enterprise contracts, demonstrating the efficacy of this conversion strategy. Cold outreaches leading to boot camps and subsequent enterprise agreements highlight the streamlined approach.

AIP-driven conversions of ongoing pilots constitute another facet of Palantir’s successful strategy. Companies engaged in a pilot, during which AIP was introduced, ultimately converted to enterprise agreements. Moreover, AIP has been instrumental in driving expansions within existing key accounts. Demonstrating speed to value at boot camps, Palantir showcased its ability to deliver new use cases atop existing ontologies in as little as 24 hours, contributing significantly to successful agreements.

In tandem with the emphasis on boot camps, Palantir is strategically deepening its distribution channels to swiftly capitalize on opportunities in specific regions, focusing on expanding its presence in Japan. Hence, these strategic maneuvers underscore Palantir’s commitment to driving efficient conversions, expanding market reach, and solidifying its position as a leader in the data integration landscape.

How Palantir’s Self-Selling Software Soars Beyond the Aviation Industry

Palantir’s greatest strength is product-led acquisition. They have dedicated support agents for each deployment. Then, they let the software sell itself by deepening existing relationships or cross-selling to businesses that work with their customers. The prime example is Skywise, initially built for Airbus SE (OTCPK:EADSF) but which has expanded throughout the airline industry.

Skywise is an aviation platform that is the central operating system of the airline industry. Adoption has been swift. Since June 2017, Skywise has expanded from zero to more than one hundred airlines. Each one is now an existing or potential customer – this is a product-led acquisition – something that will be an industry-agnostic tailwind for PLTR growth in the coming years.

When other airlines saw the benefits of PLTR software, they swiftly engaged with the company. No outbound sales efforts were needed because the platform sold itself. This platform initially grew from a single customer relationship with Airbus.

The platform’s ability to garner new clients without outbound sales efforts, relying on the software’s intrinsic value, underscores the effectiveness of Palantir’s strategic approach and positions the company favorably for sustained expansion across diverse sectors.

Unlocking Value Beyond the Surface

Despite the initial impression that Palantir is trading at elevated multiples, a more in-depth analysis reveals a nuanced perspective. About a year ago, the company achieved a significant milestone by transitioning to profitability. While its valuation might appear high initially, it likely reflects the market’s recognition of PLTR’s improved margin and, critically, the substantial potential of AIP.

This potential can extend the company’s market reach beyond government contracts, venturing into diverse use cases within the commercial segment. Palantir’s substantial government contracts and growing presence in pivotal industries like defense, healthcare, and finance, bolstered by strategic partnerships, further underscore its considerable long-term potential in the market.

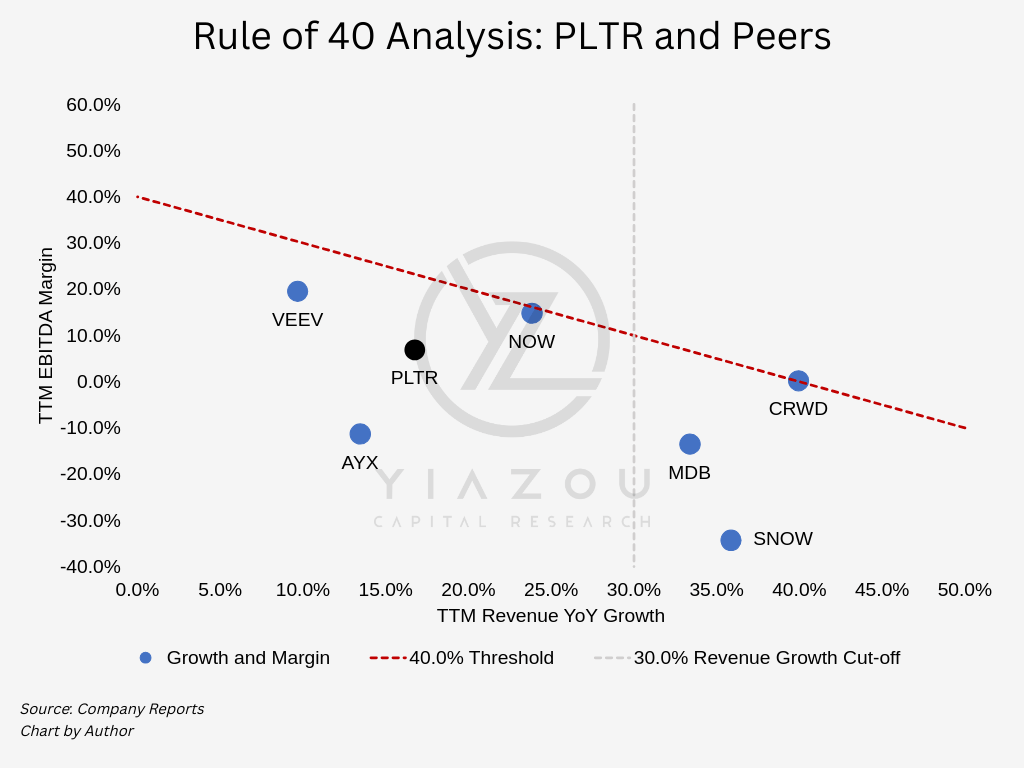

Rule of 40 analysis holds significance for software or SaaS companies, signifying that those attaining a combined score of 40.0% in revenue growth and margin (with EBITDA margin in this instance) are more likely to achieve sustainable growth. PLTR can exceed the 40.0% threshold (sum of growth and margin) by revitalizing its revenue growth beyond 30.0% and continuing the upward trend in profitability margin.

Author

Takeaway

Palantir Technologies Inc. has outperformed expectations, delivering impressive returns and highlighting its strategic prowess and robust growth in the AI sector. Despite anticipating a market correction, the long-term outlook for PLTR remains positive, supported by solid fundamentals and aggressive growth strategies.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.