Summary:

- Palantir Technologies Inc. is a misunderstood business with a niche market and high operational costs.

- The company’s software products compete in the enterprise software market, but are not critical for competitive advantage.

- Palantir lacks diversification, with a large portion of its revenue coming from a few customers, leading to high initial costs and spending.

Andreas Rentz

Investment Thesis

I think Palantir Technologies Inc. (NYSE:PLTR) is the most misunderstood business on the stock market today. Part of this stems from the novelty of its product, but mostly because of inconsistent messaging from the company. In the world of business communication, the company’s eccentric founder isn’t winning any prizes either, adding fuel to the flames by pulling PLTR into distracting political controversies, as noted in the previous article.

In this piece, our analysis suggests that PLTR’s market might not be as big as many predict, nor is its ability to lower operational costs, at least without sacrificing growth, a stark contradiction to what one would expect from a Software-as-a-Service model.

Steep Learning Curve and High Maintenance Costs

PLTR’s founder boldly states that the Colorado-based company doesn’t have competitors, calls PLTR’s software products “operating systems,” and uses words such as “ontology” to describe their features. So, what exactly does PLTR do?

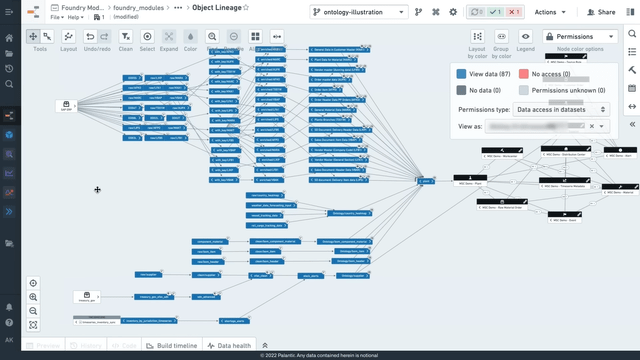

At its core, PLTR’s flagship products, Gotham and Foundry, are essentially data integration and analysis platforms. Below is a picture of Foundry software visualizing the data flow of a demo enterprise.

Palantir YouTube Video Presentation

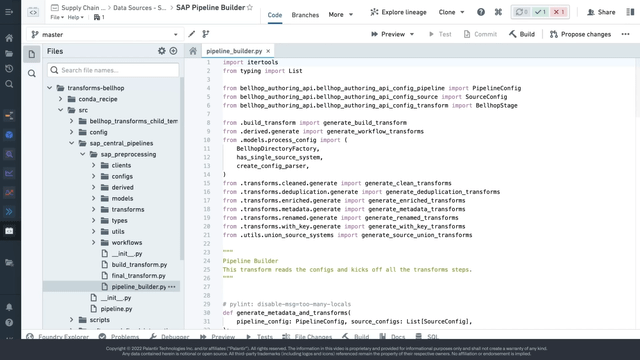

What makes PLTR’s software unique is its flexibility, functioning as a “blank canvas,” enabling a company’s IT department to consolidate and analyze enterprise data from various sources. This flexibility comes from the ability to create actions and links between various databases using code. The picture below shows a code snippet associated with one of the nodes in our demo example. The point is that PLTR’s software solutions are custom-made, not an off-the-shelf product.

Palantir YouTube Video Presentation

The problem is that this flexibility comes at a great cost; a steep learning curve and high maintenance costs, requiring dedicated data scientists and software engineers to create and maintain the models that analyze these data sets, which brings us to the next point.

Erroneous Gross Margins

Currently, PLTR’s customers rely heavily on it to build the modules on Foundry and Gotham to make them useful. The expenses related to these activities are recorded as Sales, Marketing, and R&D costs, which, in my view, is a bit misleading. PLTR’s CEO calls its software an “operating system” because they are by design ‘white canvases’ that require further customization and development beyond the point of sale. They are not off-the-shelf solutions, which means narrower opportunities for economies of scale. Sales and Marketing expenses stood at $193 million last quarter, constituting nearly a third of revenue, one of the highest I’ve seen in the enterprise software space. R&D expenses were $110 million, chipping away a further 17% of revenue. These expenses also touch on the high Stock-Based Compensation, as it is a common practice for software companies to pay their Sales and R&D personnel using stock options to better align their interest with the company.

Now, don’t get me wrong, economies of scale do exist, but one can’t help but notice these variable expenses that seem at odds with a typical SaaS business model, which begs whether PLTR’s 74x P/E ratio is justified given its high operating expenses tied to its revenue growth.

Just Another Enterprise Software

Large companies that have embraced digitalization run various software products. For example, the Sales team might use SAP (SAP) or Salesforce (CRM) Customer Relation Management (“CRM”) tools to board new clients and follow customer orders, complaints, and feedback. A procurement department might be using Kissflow, a cloud-based vendor management system. Data from these programs could be added to a centralized Enterprise Resource Management ‘ERP’ such as those provided by Microsoft (MSFT), giving the company directors a comprehensive view of the company’s operations.

The point is that PLTR’s software isn’t critical for competitive advantage. A modern enterprise can run on multiple, application-specific software products, and connect them with a centralized ERP perfectly. Having said that, one must acknowledge PLTR’s flexibility advantage. But this comes at a cost, a very steep learning curve and expensive running costs. To fully exploit Foundry and Gotham’s capabilities, you need a dedicated team of programmers to create the algorithms that connect the data that is “left on the table,” as PLTR’s Chief Architect put it.

Lack of Diversification

PLTR isn’t as popular as its $2.2 billion annual sales suggest. First, this figure is too small in the enterprise market. American companies spend multiple times this figure on Microsoft Office alone. Secondly, the top 20 customers represent nearly half of PLTR’s sales. 55% of revenue comes from government customers, and only 45% comes from commercial customers. The company touts the ability to deploy Gotham and Foundry in days, which might be true, but making these “white canvases” useful requires significant expenditure.

The company provides an example of a government department spending $1 billion on an ERP solution that failed to work as planned. PLTR offers an organized “white canvas” for these customers wishing flexible solutions. But then, what is the market size for this specific niche? The question remains whether PLTR’s software is as transformational/critical for modern enterprises as management would like us to think.

The Land and Expand Myth

The concept of Land and Expand is often touted by management as an exceptional opportunity for more revenue. Last quarter, PLTR stated that the average revenue of its top 20 customers increased by 9%. But there is a big question on whether, beyond this loyal customer cohort, PLTR’s customers are really embracing its software products. I don’t believe so. The high maintenance costs most likely alienate smaller customers who got reeled in by the company’s aggressive marketing strategy, including free trials, and free initial modules. Beyond its top 20 customers, PLTR doesn’t provide figures of average sales per customer.

However, in 2021, PLTR began making equity investments in a bunch of companies in return for purchasing PLTR’s products. This forces PLTR to report sales from these customers under the “Related Party Disclosure” SEC requirements, which shows that these customers are actually cutting off their spending on PLTR. In 2023, the company reported $87.3 million from its “Strategic Commercial Partners,” compared to $118.4 million in 2022, debunking the land-and-expand claims, which also casts a shadow over its expensive marketing strategy, which brings us to the next point.

Overhyped AI Bootcamps

In early 2023, PLTR started what it calls Artificial Intelligence Platform “AIP” bootcamps, which help integrate Large Language Models “LLM” into its Gotham and Foundry products. Since the program’s launch, PLTR has engaged 915 customers and touted the success of the program in lowering the sales cycle. However, the data doesn’t support these claims, and the benefits of the AIP Bootcamps are marginal if existent at all, casting a shadow over the program’s cost/benefit.

Before the boot camps, PLTR was growing faster than it did after starting the program. For example, in 2022, the commercial segment grew by 29%, adding $190 million in sales compared to the prior year. After the bootcamps started, growth decelerated. In 2023, commercial sales grew at a slower rate (20%), adding only $168 million to 2022 revenue. This is also true for government sales.

| Sales ($ Millions) | 2023 | 2022 | Amount Change | Percentage Change (%) |

| Government | $ 1,222 | $ 1,072 | $ 150 | 14% |

| Commercial | $ 1,003 | $ 834 | $ 169 | 20% |

| Total revenue | $ 2,225 | $ 1,906 | $ 319 | 17% |

| Sales ($ Millions) | 2022 | 2021 | Amount Change | Percentage Change (%) |

| Government | $ 1,072 | $ 897 | $ 174 | 19% |

| Commercial | $ 834 | $ 645 | $ 190 | 29% |

| Total revenue | $ 1,906 | $ 1,542 | $ 364 | 24% |

Final Thoughts and How I Might Be Wrong

A few weeks ago, I read a comment left by a subscriber regretting not buying PLTR because they thought it was a consulting firm. The ambiguity surrounding the company stems from its unique product, which is just about a “white canvas” that necessitates customization to become useful. This creates flexibility, which might be appreciated by some. But the high cost of ownership, manifested in the need for dedicated teams to manage the system, limits PLTR’s addressable market.

During the latest earnings call, PLTR’s leadership addressed this problem (indirectly), stating that their engineers continue to create SDKs and programming toolkits for their clients to help them maintain and fully utilize its software’s potential. If they succeed, then their growth story might continue far longer than implied in this article. The odds of that happening seem to be fully priced in the ticker, which trades at 74x forward P/E ratio (P/E TTM is 87x). Growth has already decelerated, as AIP Bootcamps failed to revive growth, which lends confidence in our sell rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.