Summary:

- Palantir has become profitable, joined the S&P 500, expanded margins, and accelerated revenue growth, driving its stock price increase.

- It excels at transitioning AI prototypes to production, a challenging area in which it has invested over a decade in deep technical capabilities.

- The company’s unique technologies and focus on real-world applications differentiate it from competitors, addressing market bottlenecks in AI software production.

- Various valuation methods suggest the market is overvaluing the stock.

hapabapa

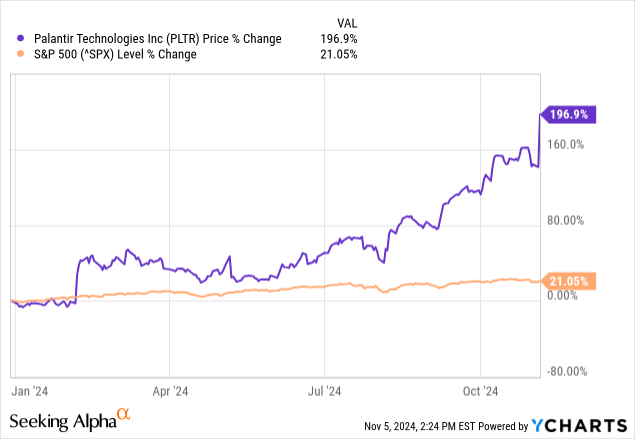

Since I last wrote about Palantir (NYSE:PLTR) in August, giving it a hold recommendation, it has gained admission into the S&P 500 Index (SPX), rapidly expanded its margins, and accelerated revenue growth. The company’s new artificial intelligence platform (“AIP”) Boot Camp has proven a successful sales tactic, and management looks like they can do little wrong. Between multiple expansions and underlying business growth, the stock has soared since the beginning of 2024, up 197%.

Since my hold recommendation, the stock is also up around 69%; some may wonder if I made that hold call in August too soon. However, I initially recommended buying Palantir in October of 2023 at $16.11. If you had bought it, you would have been up approximately 218% compared to the S&P 500’s 36.58% rise. Still, I think my hold call was prudent. I understood the stock could go on a solid run for a year, but as its valuation rises, the risk skyrockets that investors buying at these rising valuations won’t benefit in the short or the medium term. Seeking Alpha ratings section shows that Wall Street analysts, Seeking Alpha analysts, and the Quant are all at a hold recommendation.

This article will discuss what differentiates Palantir from other Artificial Intelligence (“AI”) companies. It will also discuss its stellar third-quarter results, high valuation, risks, and why I still maintain a Hold on the stock.

From prototypes to production

Palantir can be a difficult company to analyze for people who have little expertise in software or AI because it can be challenging to understand why it has outperformed many software and AI solution companies in 2024. The big difference between Palantir and many well-known software companies is that it specializes in helping customers build software that customers can use today in real-world applications. That capability is even more critical with AI applications than with standard software.

Palantir’s Chief Technology Officer (“CTO”) Shyam Sankar said on the company’s second-quarter earnings call when asked, “What is Palantir doing to be different from its AI competitors?” (emphasis added):

Well, all the value and where the market is completely bottlenecked is on that transition from prototyping to production. And that happens to be the place that we are most differentiated. That differentiation is built on more than a decade of deep technical investments. Technologies like the ontology, OSDK, the primitives that we have that permeate the platform, security, functions on objects, actions, write-back, machinery, automation, and a deep product pipeline that really is focused on addressing this very problem on this transition from prototyping to production. And I think when you think about the ChatGPT moment, it’s so very clearly invalidated the thin product playbooks of the past. I think this bottleneck is doing that same thing to AI software. It is so easy to create an AI prototype, the equivalent of effort of making a PowerPoint slide, but it’s actually very, very hard to get that in production, probably 10 to 100 times harder than traditional software transitioning to production. And therein lies our entire opportunity in the market.

What Shyam Sankar means in the statement above is that ChatGPT is only a prototype and was not built specifically to help companies with real-world problems. OpenAI built ChatGPT to comprehend general knowledge and not help solve specific business problems. It is a prototypical AI application that shows people what may be possible.

Sankar implies in the above quote that it may be challenging for companies to build practical AI applications using ChatGPT or competing chatbots using different AI models. He mentions ontology, the basic science behind helping AI understand real-world concepts. Earley Information Technology discusses the importance of ontology in the following quote:

AI works only when it understands the soul of your business. The ontology is the key to that understanding. It is a representation of what matters within the company and what makes it unique, including products, services, solutions, processes, customer descriptors, organizational structures, methods, and every imaginable type of data and content. If you build it correctly and apply it appropriately, it makes the difference between the raw promise of AI and delivering sustainably on that promise.

CTO Sankar’s reference to OSDK is shorthand for the company’s Ontology Software Development Kit. This kit allows customers to create bespoke applications using industry-specific, organization-specific, or customized ontologies. In more straightforward language, Palantir’s software helps users build effective custom software and AI applications. Alternatively, Sankar accuses many of its competitors of using “thin product playbooks,” meaning hyping software with little actual use. His commentary suggests that that strategy won’t work well for AI applications.

AI models are little more than science experiments; they are exciting proof of concepts but cannot solve real-world problems. Sankar beat on that same drum when he said in the third quarter 2024 earnings call:

The market has been focused on AI supply, the models. We see this clearly in the progress, but also in the capital sunk into these models. Indeed, the models continue to improve, but more importantly, the models across both open and closed source are becoming more similar. They are converging, all while pricing for inference is dropping like a rock. This only strengthens our conviction that the value is in the application and workflow layer, which is where we excel.

The above quote means that most AI-focused companies have primarily focused on and spent significant capital to develop foundational models like GPT-4, DALL-E, LLAMA, Gemini, Claude, Stable Diffusion, and more. Yet, these models have developed similar sophisticated capabilities and become commoditized. Palantir management believes the value in the market is not in building the AI models but in creating a system that can effectively use these models to solve real-world problems, which is where Palantir has significant expertise. An AI model is only as good as the data that people feed it, and Palantir is primarily a data company. It excels in preparing data for AI ingestion, selecting the most suitable AI model and customizing it for specific applications, designing user-friendly interfaces, and integrating AI models into a system that can make helpful and relevant predictions or decisions.

Investors may want to be cautious of companies solely focused on building AI models and prototypes because that may not create the most value for shareholders. Deploying AI models into practical solutions is where the money is at, and that’s Palantir. Wall Street has recognized that distinction in 2024, which is why the stock is among the best performers this year.

Company fundamentals

The growth of our business is accelerating, and our financial performance is exceeding expectations as we meet an unwavering demand for the most advanced artificial intelligence technologies from our U.S. government and commercial customers. The world is in the midst of a U.S.-driven AI revolution that is reshaping industries and economies, and we are at the center of it.

Chief Executive Officer (“CEO”) Alex Karp in Palantir Third Quarter 2024 Letter to Shareholders

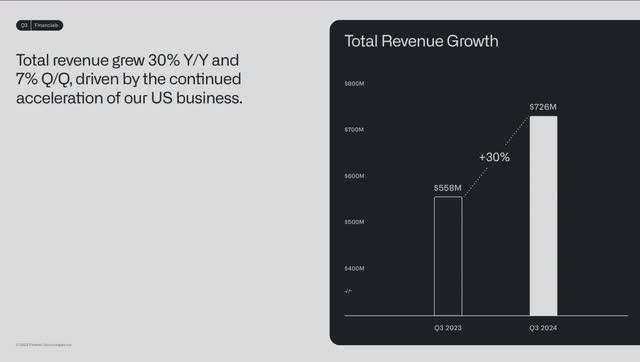

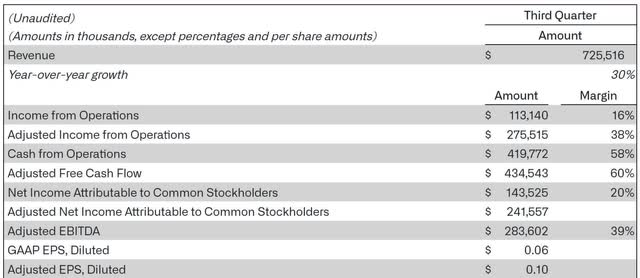

Coming into the quarter, investors were looking for at least 30% year-over-year revenue growth, and that’s precisely what they got. Third-quarter revenue of $726 million also beat consensus analysts’ expectations of $703.69 million.

Palantir Third Quarter 2024 Business Update.

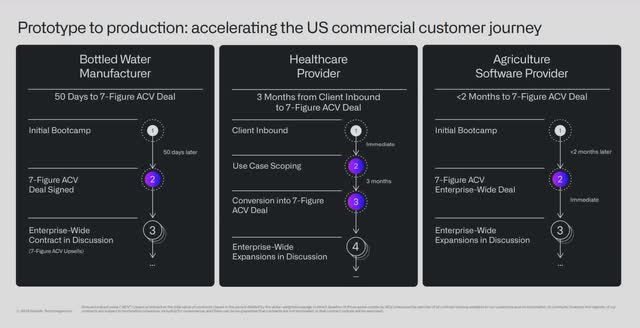

Palantir can grow revenue rapidly because its new AIP Boot Camp allows it to move from initial contact with a company to seven-figure deals within months.

Palantir Third Quarter 2024 Business Update.

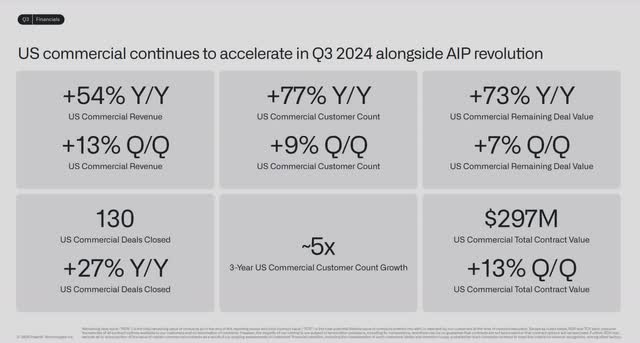

Investors have also started valuing Palantir more based on its diversification efforts into commercial. Although the government business has been its bread and butter for many years, governmental contracts can be a less reliable source of income for several reasons, including political risks, the possibility of delayed payments, the potential for changes in government spending priorities, and burdensome regulatory requirements. The market values the government business less than the commercial, and the larger the commercial business becomes, the higher the valuation the market is willing to award the stock. The most significant part of its commercial business is within the U.S. market, and it’s growing like a weed due to the high demand for AI applications.

Palantir Third Quarter 2024 Business Update.

The above numbers represent the success of the AIP in the U.S. commercial market. Although the company has conducted AIP Boot Camps for entities outside the U.S. commercial market, Palantir mainly uses it for U.S. commercial businesses. The company’s 54% year-over-year growth to $179 million in U.S. Commercial revenue represents solid growth. The next most crucial number behind revenue growth is the U.S. commercial count. One significant issue that some have had with the company is its low customer count due to its products’ high prices. This company had a sales problem until it started using the AIP Boot Camps. Now, the increased sales speed from using Boot Camps is reflected in its customer count, and the commercial deals closed. The remaining deal value (“RDV”) and total contract value (“TCV”) metrics represent a future revenue pipeline. When TCV and RDV grow faster than revenue, the potential for revenue acceleration in the U.S. commercial business in the coming quarters rises.

Palantir’s third-quarter GAAP (Generally Accepted Accounting Principles) gross margin was 79.78%, and its non-GAAP adjusted gross margin was 82%. Be aware that the company emphasizes non-GAAP numbers in its presentation and guidance. The adjusted non-GAAP numbers exclude stock-based compensation (“SBC”), which was approximately 21% of third-quarter 2024 revenue and 2023 full-year annual revenue.

Palantir Third Quarter 2024 Earnings Release

Chief Financial Officer David Glazer said the following about operating expenses on the earnings call:

Q3 adjusted expense was $450 million, up 6% sequentially and 14% year-over-year, primarily driven by our continued investment in AIP and technical talent. We continue to expect expenses to ramp through the fourth quarter as we invest in the product pipeline and accelerate the journey from AI prototype to production.

As long as revenue grows faster than operating expenses, the company can continue investing in growth initiatives and increase the operating margin. Its third-quarter GAAP operating income rose 182% to $113.14 million, and the operating margin rose 9 points from the previous year’s third quarter to 16%. Its non-GAAP operating income rose 69% to $275.52 million, and the non-GAAP operating margin expanded 9 points year-over-year to 38%. The company’s operating margins rose for the eighth consecutive quarter, and investors cheered the growing profitability.

Palantir’s third quarter 2024 diluted GAAP earnings-per-share (“EPS”) grew 100% year over year to $0.06, beating analysts’ estimates by $0.02. The third quarter of 2024 GAAP profit margin was 20%. Adjusted diluted EPS grew 43% year over year to $0.10. The third quarter of 2024 adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) rose 65% over last year’s third quarter to $283.602 million. Adjusted EBITDA margin expanded 8 points to 39%.

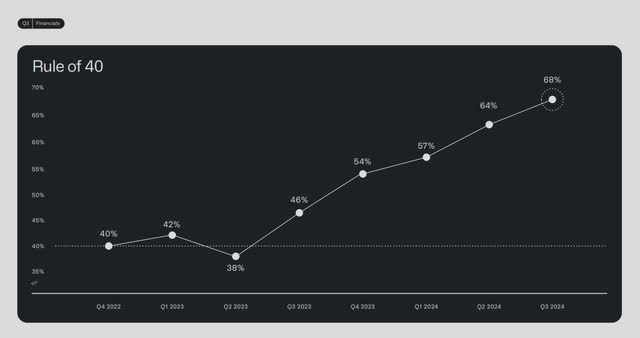

Palantir’s Rule of 40 score, which is its revenue growth + adjusted operating margin, rose 4 points to 68%. The Rule of 40 states that a healthy subscription business’s combined revenue growth rate and profit margin should be at least 40%. The higher the number is over 40%, the better. Palantir has the highest Rule of 40 that I am aware of, and it’s a substantial reason why the market values the company above other SaaS companies.

Palantir Third Quarter 2024 Business Update.

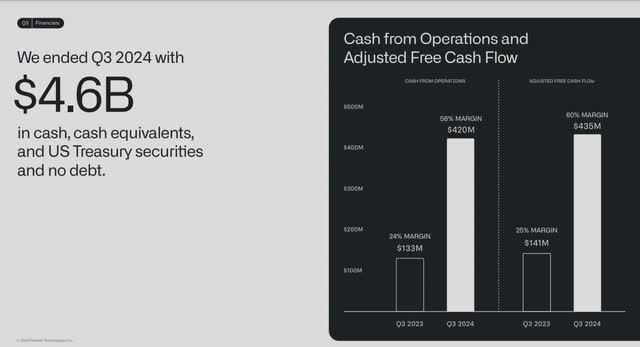

In the third quarter of 2024, the cash flow from operations (“CFO”) was $419.77 million. CFO margin was 58%, which means that for every $1.00 of revenue, the company produces $0.58 in cash flow. Since the company spends little on capital expenditures, most of its CFO translates to free cash flow (“FCF”). It produced a third-quarter 2024 FCF of $416 and an adjusted FCF of $435 million. The third quarter adjusted FCF margin was 60%. Trailing 12-month (“TTM”) CFO was $994.7 million, and TTM FCF was $980 million.

Palantir Third Quarter 2024 Business Update.

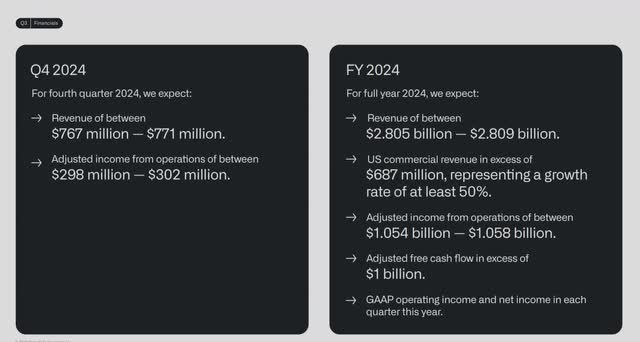

One of the most significant reasons the stock rose 23.47% the day after the company released earnings was that management raised full-year 2024 revenue guidance to between $2.805 billion and $2.809 billion, beating analysts’ consensus 2024 revenue estimates before earnings of $2.76 billion. If the company hits the midpoint of updated guidance, it will grow annual revenue by 26% over 2023, accelerating from last year’s annual revenue growth rate of 17%. This updated guidance gives Palantir bulls more leeway to drive the valuation higher. Management’s fourth-quarter revenue guidance of $769 million at the midpoint also beat analysts’ revenue estimates for the fourth quarter before earnings of $744 million.

Palantir Third Quarter 2024 Business Update.

Management also raised its 2024 annual U.S. Commercial revenue growth guide from 47% to 50% year-over-year and its 2024 annual adjusted FCF guidance from $900 million at the midpoint to $1 billion. These results boosted investor confidence in the company, pushing it to even higher valuations.

Valuation

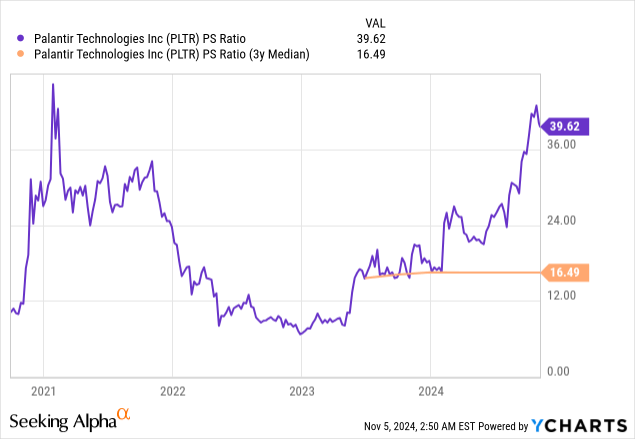

Palantir’s price-to-sales (P/S) ratio is 36.92, well above its three-year median of 16.49, suggesting the market overvalues the stock. For the company to return to its P/S median valuation, either the stock price needs to come down or sales will need to increase faster than the stock price goes up. This valuation level means investors expect the company to maintain high revenue growth while expanding profit margins. If the company has the slightest disappointment on the top or bottom lines, investor enthusiasm for holding the stock could lessen, leading to a potentially significant decline in stock price.

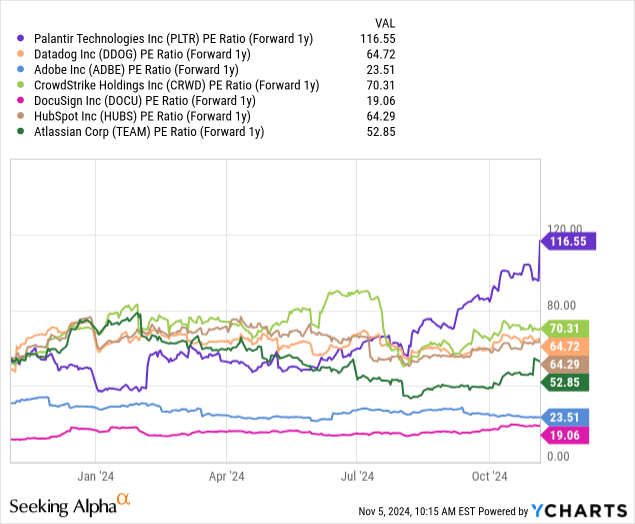

Palantir’s one-year forward price-to-earnings (P/E) ratio is 116.5, much higher than a few other rapidly growing SaaS (Software-as-a-Service) businesses. Some may argue that the market overvalues the stock. Yet others might say the company’s fundamentals and Rule of 40 score justify a premium.

Palantir’s price-to-earnings-to-growth (“PEG”) ratio is 4.43 (One-year forward P/E divided by 2025 EPS growth rate), well above the PEG ratio of 2.0, which growth investors usually allow a stock before considering it overvalued. If the stock traded at a PEG ratio of 2.0, the stock price would be $18.48, a 63% decline from its $50.01 price on November 5, 2024, at 10:45 AM.

The following is Palantir’s reverse discounted cash flow (“DCF”), which I am using to determine what the November 5 intraday price of $50.01 implies about the stock’s cash flow growth rate over the next ten years. This reverse DCF uses a terminal growth rate of 4% because the company should grow cash flow above the GDP (Gross Domestic Product) long-term growth average once it exceeds the forecast period. I use a discount rate of 9%, which is the opportunity cost of investing in the stock, reflecting a slightly lower than medium risk level. This reverse DCF uses a levered FCF for the following analysis.

Palantir Reverse DCF

|

The second quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$980 |

| Terminal growth rate | 4% |

| Discount Rate | 9% |

| Years 1 – 10 growth rate | 20.6% |

| Current Stock Price (November 5, 2024) | $50.01 |

| Terminal FCF value | $10.153 billion |

| Discounted Terminal Value | $85.775 billion |

| FCF (Trailing 12 months) Margin | 37% |

If it can maintain an average FCF margin of 37% over the next ten years, Palantir would need to keep an average annual revenue growth rate of 20.6% to justify the current stock price. Maintaining that revenue growth rate over the next ten years seems like a stretch since only a few of the largest companies can afford its products, and Palantir limits the countries it is willing to work with to the U.S. and its allies. Assuming it can achieve 18% revenue growth over the next ten years, the stock would need to maintain an average FCF margin of 69% over the next ten years, which is unlikely. I believe the market has vastly overvalued this stock at the current prices. As long as the company achieves revenue growth above 20% and FCF margins above 37%, investors will likely support the current valuation. If revenue growth or FCF underperforms, investors could get nervous and flee the stock.

Risks

The higher the valuation, the more demanding investor expectations will become until the company eventually cannot meet them. Then, the market may balk at the company’s valuation, and the stock could flatline or go down temporarily as the company grows into its valuation. Temporarily could mean one week, month, year, or more. The risk of a suboptimal result is rising for momentum or short-term investors. Buying at the current price may pay off, but only for investors willing to hold for the long term. This valuation risk is what Raymond James cites as the reason for downgrading the stock on September 23. A Seeking Alpha article about the downgrade states, ‘”While we remain enthusiastic about Palantir’s longer term positioning in AI, we are downgrading our rating to Market Perform from Outperform given our view that shares need to consolidate stellar gains over the last couple of years and grow into its rich valuation,” analyst Brian Gesuale wrote in an investor note.’

Competition is a long-term risk for the company. Although Palantir may have a first-mover advantage in AI by focusing on the application and workflow layer, some companies in the market perform similar services, which may develop into significant competition. These companies include C3.ai (AI) and Adarga.ai, a UK-based artificial intelligence company very similar to Palantir in its early days when it focused on the defense and intelligence sectors. If Adarga decides to branch out to enterprise customers, it could become an alternative to Palantir’s services. Companies like International Business Machines (IBM) and Deloitte are larger, more well-known companies that can provide stiff competition if they decide to move in that direction. So, while Palantir has little competition today, its growing success has been noted, and investors should expect competition to emerge over time. If one of its emerging competitors comes up with a lower-priced solution, it could prove disruptive.

Palantir remains a Hold

Aggressive growth investors who intend to hold Palantir for five years or more could still benefit from buying it at the current valuation. However, at this valuation, it’s a high-risk, high-reward stock. It may go up an additional 200% over the next year. Alternatively, it may collapse by 20% or more within the next several quarters due to disappointing quarterly reports. Investors should not forget that revenue growth was very lumpy before the success of the AIP Boot Camp. If, for some reason, revenue growth should have a hiccup, the stock could sell off and flatline until it grows into its valuation.

If you have concerns about valuation, avoid buying at current prices. If you own shares, continue holding them because the stock has long-term upside, considering it has few competitors in the AI market that can convert prototypes into practical AI applications as fast as Palantir.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.