Summary:

- Palantir’s partnership with Microsoft is symbolic of greater integration of Palantir within the Western commercial and government ecosystem. It lays a foundation for future EPS and revenue upward revisions.

- Despite strong sentiment for Palantir stock that has allowed it to trade at a P/S ratio 2.36 times greater than Snowflake’s, its revenue growth rate estimates are lower.

- Based on a fundamental analysis approach, Palantir stock cannot be a Buy. Despite this, its developments in big tech integration, commercial segment expansion, and diversification could sustain high investor sentiment.

xijian/iStock via Getty Images

In my last coverage of Palantir (NYSE:PLTR), I analyzed its Q2 results, which were definitely historic and showed excellent progress. However, I maintained my Hold rating at the time due to persisting valuation concerns. Some investors have enlightened me to the notion that the company could sustain such a high valuation related to sentiment based on its advanced AI, defense, and corporate synthesis. While I think investing in this rather than the fundamentals and peer analysis is risky, it does have some weight. This is especially true considering Palantir’s recent partnership with Microsoft (MSFT), which is a pivotal development that provides some indication that management will be consolidating its position and strengthening its AI offerings more. While still speculative at this time, I do believe there is evidence that further big tech partnerships could manifest.

Palantir & Microsoft

When I first heard about Palantir’s partnership with Microsoft, I knew this was a strong moment for the company. Not only does it indicate that Palantir is going to have higher AI capabilities, but it also positions it to continue to further establish its reputation with big tech partnerships. The news came after a successful partnership was announced with Oracle (ORCL) in April and with Voyager Space in June.

To be specific, Palantir’s partnership with Microsoft integrates its LLMs and AI capabilities with Palantir’s platforms, like Foundry and Gotham, in classified environments. The greatest operational accretion here seems to be in harnessing Microsoft’s LLM capabilities, including that of OpenAI, for U.S. defense and intelligence agencies through Palantir. This is crucial because recently, Palantir’s government sector has seen slower growth compared to its commercial segment. Therefore, the Microsoft partnership is seen as fundamental in helping the company to revitalize this segment. Palantir will also be able to harness Microsoft’s Azure Government and classified cloud services. This will allow it to offer more secure and scalable AI solutions, increasing the adoption of AI technologies across federal operations.

Furthermore, the partnership supports Palantir’s commercial operations, too. These include significant advantages in healthcare and finance. The impact of the partnership has been significant for healthcare in particular, with one provider using Palantir’s Foundry platform and Microsoft Azure reporting a 25% reduction in patient wait times and a 15% increase in patient satisfaction. This is supported by the unification of fragmented datasets and real-time analytics, both of which can reduce wait time and improve response times in cases of emergency.

Many analysts raised their price targets on news of this partnership, and the stock grew 11% in price following the announcement. However, it still doesn’t change that Palantir stock is priced for perfection at best and potentially overvalued. While sentiment for the stock is definitely supported by the partnership, I believe management will need to show further big tech integrations and developments to sustain the high sentiment. I do not believe that its fundamentals are enough to support its forward P/E non-GAAP ratio of 86.

Peer Analysis

Palantir is certainly a one-of-a-kind company. However, it still needs to be assessed relative to peers on its fundamentals to avoid being too speculative in an investment approach. Two companies that stand out to me in its list of direct competitors are C3.ai (AI) and Snowflake (SNOW).

- C3.ai is an AI application development platform that enables organizations to build and deploy AI applications at scale.

- Snowflake is a cloud-based data platform providing data warehousing, data lake, and data sharing services.

Both of the companies use AI, but Palantir is notably different from Snowflake because its projects are used in high-stakes and often classified environments, including national security. C3.ai does have exposure to this market, but it is significantly less established than Palantir, with a market cap of just $2.95B versus Palantir’s $68.49B. Palantir, therefore, has much more of a lead to consolidate its moat and establish itself as the Western leader in AI defense.

| Company | FWD P/S Ratio | FWD Revenue Growth Estimate | FWD P/E non-GAAP Ratio | FWD Diluted EPS Growth Estimate |

| Palantir | 24.8 | 20.4% | 86 | 92.9% |

| C3.ai | 7.8 | 20.5% | No profit | No profit |

| Snowflake | 10.5 | 28.2% | 183 | 55.3% |

Based on the above table, it is clear that Palantir is richly valued, and I believe it is important to focus on the P/S ratios over earnings because both Snowflake and C3.ai are currently not profitable on a GAAP basis, and Palantir has only been since Q4 2022. Understandably, Palantir does deserve a higher valuation as a result of this, but arguably not more than double that of Snowflake and three times that of C3.ai.

Palantir’s forward P/S ratio is 3.18 times that of C3.ai and 2.36 times that of Snowflake. Palantir’s forward revenue growth is almost identical to that of C3.ai’s and 0.72 times that of Snowflake’s. Therefore, it is quite clear that on a pure relative P/S ratio valuation basis, Palantir is overvalued.

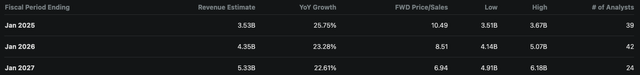

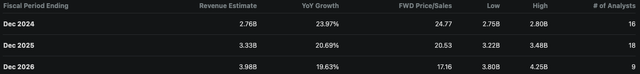

Furthermore, Snowflake has higher revenue growth estimates from analysts than Palantir through to January 2027.

Snowflake Revenue Growth Estimates (Seeking Alpha) Palantir Revenue Growth Estimates (Seeking Alpha)

Therefore, if one is to assess Palantir purely on the fundamentals, I believe it is overvalued. It is also important to remember that while Snowflake currently shows a GAAP loss, it had non-GAAP earnings, including FY25 normalized EPS growth of 55.25%, expected by 41 analysts on consensus, compared to Palantir’s 21.40% expected by 18 analysts on consensus.

The notion that Palantir is, therefore, worth holding based on its position in the market requires substantial EPS and revenue upward revisions to sustain it. I believe that the Microsoft partnership developing, and further big tech collaborations to support government and commercial classified operations is arguably the strongest element of its operations to currently support this. However, its current P/S ratio still makes buying the stock now speculative in my opinion. I am hesitant to allocate a Sell rating because I firmly believe in the company’s long-term prospects, so a Hold rating seems more justified with a caveat of near-term to medium-term volatility expected, purely based on the valuation.

While Palantir’s P/S ratio of nearly 25 is too high, I believe it could sustain this high sentiment based on goodwill and dominance in the classified AI market, particularly if it continues to partner in big tech. However, I would be much more comfortable buying Palantir at a P/S ratio of 17.5; Palantir would currently need to contract in price by 30% for this entry point to occur. This is an outlook I have held for a while, and on my deeper analysis of the company’s Microsoft partnership here, I maintain that the valuation is currently too risky based on its predicted fundamental growth rates as it stands.

Risk Analysis

One considerable risk for Palantir is that big tech companies, which it is seeking partnerships with, could further consolidate positions in data management for most businesses and even segments of sensitive businesses, which do not require a classified or advanced high-security approach. This restricts Palantir’s position in the market considerably and means that management will likely be focusing on niche use cases. This is why I am more bullish on Palantir Gotham, as it relates to the high-barrier-to-entry defense and intelligence fields, than Palantir Foundry, which is targeting commercial clients. That being said, with Palantir’s new Bootcamp sales model, it is managing to show strong growth in its commercial segment. It is possible that management will develop unique AI-led data management tools that are heavily differentiated from big tech cloud services and AI tools, which could create further bullish momentum. However, competition in the commercial sector is problematic, in my opinion. In addition, I think management has been shrewd in focusing on the space sector, with its space station management venture with Voyager Space showing immense foresight and a target market that, I think, could be of high long-term growth for the company as space travel becomes more concrete at scale.

Furthermore, as Palantir is currently diversifying into new markets and focusing on the expansion of its commercial segment, there are risks to diluting its expertise. On the other hand, Palantir has been renowned historically for being reliant on just a few key clients, which is a perception that is beginning to change as it scales its commercial revenues and ventures into new territory like space station management. The execution risks that come with client diversification are important to bear in mind, especially if new customers act as a distraction from its very high-profile government defense and intelligence contracts, which are extremely important to retain to keep up the strong sentiment in the stock market.

Conclusion

I am long-term bullish on Palantir, as I believe we aren’t anywhere near the company’s full potential. However, we also have to keep in mind that the stock’s valuation makes it very risky to initiate a position at the moment. Doing so could result in significant near-term or even medium-term losses, in my opinion, as the market finds a fairer valuation for it. Because I consider investing on sentiment to be speculative as opposed to investing on fundamentals, I believe Palantir stock is still a Hold, despite the fact that its Microsoft partnership and the indication of continued big tech integration could sustain sentiment if these develop further quickly and with strong momentum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.