Summary:

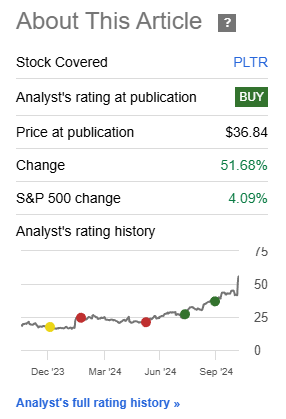

- Palantir has outperformed the S&P500 by +47.59% since my last ‘Buy’ rating on the stock. After Q3 FY24 results, I am retaining my bullish view.

- Palantir’s AIP drastically improves enterprise productivity, making it essential for business survival in a winner-take-all AI economy, with mass adoption still far off.

- Strong execution with significant revenue and EBIT margin beats, coupled with robust remaining performance obligations, signals continued growth momentum in the short to medium term.

- Despite a high 123x 1-yr forward PE, PLTR’s stock rise is driven by genuine earnings growth, not irrational exuberance or overhype.

- Technically, PLTR is in a powerful uptrend relative to the S&P500, with no signs of bearishness, reaffirming my ‘Buy’ rating.

IvelinRadkov

Performance Assessment

Palantir (NYSE:PLTR) has handsomely outperformed the S&P500 (SPY) (SPX) (IVV) (VOO) by +47.59% since my last update on the stock:

Performance Since Author’s Last Article on Palantir (Seeking Alpha, Author’s Last Article on Palantir)

Thesis

Q3 FY24 earnings results proved yet another quarter of flawless execution. I am maintaining my buy bias on the stock:

-

Productivity boosts and RPOs provide confidence of huge growth ahead

-

Execution continues to surpass expectations via larger beats

-

Valuations are optically high but the stock is rising due to sustainable earnings growth

-

There are no signs of technical bearishness

-

Margins track is a monitorable

Productivity boosts and RPOs provide confidence of huge growth ahead

What makes me very bullish on Palantir is the massive impact its AIP has on its enterprise customers’ productivity:

…reducing the typical underwriting response time from over 2 weeks to 3 hours… increasing its on-time in-full delivery rates from 40% to 90%… 3 months to get to a functional workflow with a $30 million impact to its bottom line.

– Chief Revenue and Legal Officer Ryan Taylor in the Q3 FY24 earnings call, Author’s bolded highlights

As Palantir enables such drastic leaps in business productivity, I believe it is only natural for companies to eventually realize that Palantir’s AIP is as essential as email or spreadsheet software; without it, an enterprise is likely to be run over by competitors in a winner-take-all AI economy:

winner-take-all AI economy, the divide is widening between those who are leveraging AIP and those who are not…

– Chief Revenue and Legal Officer Ryan Taylor in the Q3 FY24 earnings call

Noteworthily, Palantir may be the only company currently with the prerequisite ontological foundations to enable such AI-driven value in applications and workflows. I have discussed more about Palantir’s unique capabilities here in my prior coverage. And this message continues to be reinforced in every earnings call:

Years of foundational investments in our infrastructure and in ontology have positioned us uniquely to harness and deliver on AI demand.

– CTO Shyam Shankar in the Q3 FY24 earnings call, note author’s bolded highlight of “uniquely”

CEO Alexander Karp described Palantir’s competitive edge the best in the Q1 FY24 earnings call:

I would say, I don’t believe we have competitors. So I don’t believe in the U.S. commercial market, we have competition… I don’t believe in the U.S. government market, we have competition… We are differentiated because in order to actually make AI work, you need an ontology. No one has an ontology. To Shyam’s point, you have a lot of people running around saying the data isn’t ready. Of course, it’s not ready because they don’t have foundry. If you have foundry and the ontology, it is ready.

– CEO Alexander Karp in the Q1 FY24 earnings call

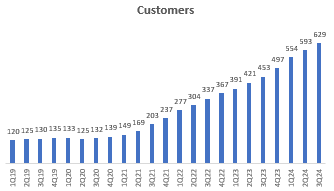

Currently, Palantir serves a mere 629 customers today:

Customers Count (Company Filings, Author’s Analysis)

I think this is a tiny fraction of what Palantir can grow into; I encourage readers to refer to my last article, where I outlined how Palantir’s AIP can become as essential as email or a spreadsheet program, which can lead to it becoming as big as Microsoft (MSFT), if not bigger. This would correspond to an almost 24x multiplier from Palantir’s current market capitalization of $133 billion.

Overall, I contend that Palantir is far from its peak potential since mass adoption of its services is still yet to begin. This reminds us of the longer term growth potential of the company.

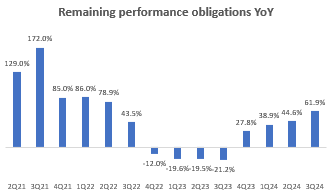

From a short-medium term operational momentum perspective, the remaining performance obligations (RPO) (a leading backlog/future indicator of revenues) is showing accelerated growth at almost 64% YoY:

Remaining Performance Obligations YoY (Company Filings, Author’s Analysis)

Thus, this gives me confidence that the growth momentum is robust over the next few quarters as well.

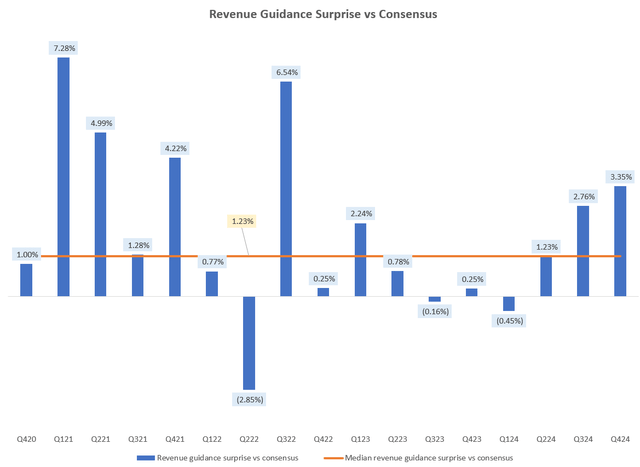

Execution continues to surpass expectations via larger beats

Another reason to be bullish on Palantir stock is management’s ability to continually surpass expectations by larger and larger degrees. This is evidenced by a 3.35% revenue guidance beat vs consensus – the largest beat over the last 9 quarters:

Revenue Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

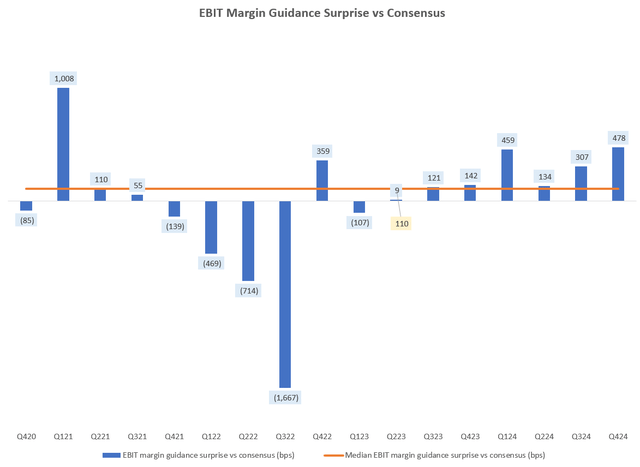

And a 478bps EBIT margin guidance beat vs consensus – the largest over the last 15 quarters:

EBIT Margin Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

I view this as evidence that the market is still not pricing in the true potential of Palantir.

Valuations are optically high but the stock is rising due to sustainable earnings growth

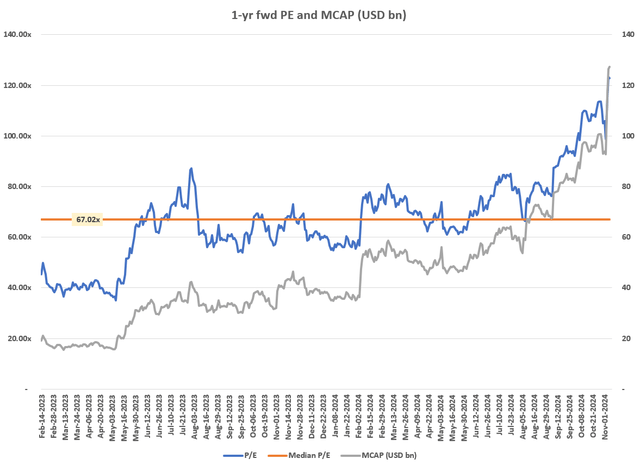

The tremendous growth in PLTR stock has led to a sharp increase in both its market capitalization to the >$100bn club, and its 1-yr fwd PE to almost 123x:

1-yr fwd PE and MCAP (Capital IQ, Author’s Analysis)

Of course, this seems very high. That said, I believe simply looking at a high 1-yr fwd PE and crying “over-valuation” is not a sound method of analysis for high growth stocks. A better smell-test of overhype and overvaluation can be conducted by dissecting the drivers of price or market cap movements into earnings expectation revisions and valuation multiple re-ratings or de-ratings:

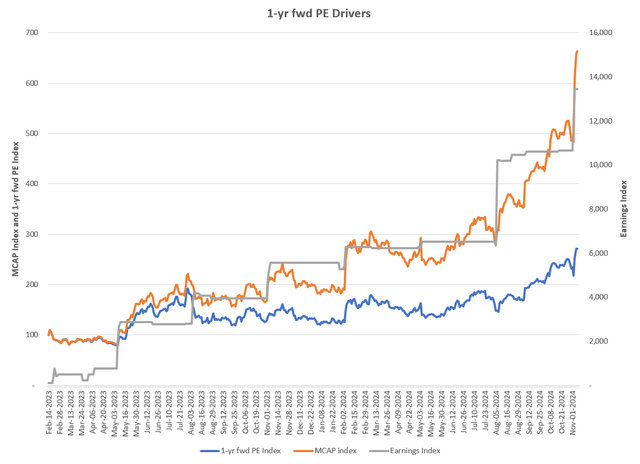

1-yr fwd PE Drivers (Capital IQ, Author’s Analysis)

Looking at the chart above, it is visually clear that PLTR’s recent rise in the stock price (orange line) is driven more by genuine earnings upgrade revisions (grey line) and to a relatively smaller degree, a rise in the 1-yr fwd PE multiple (blue line). I believe this is healthy and not a sign of irrational exuberance.

There are no signs of technical bearishness

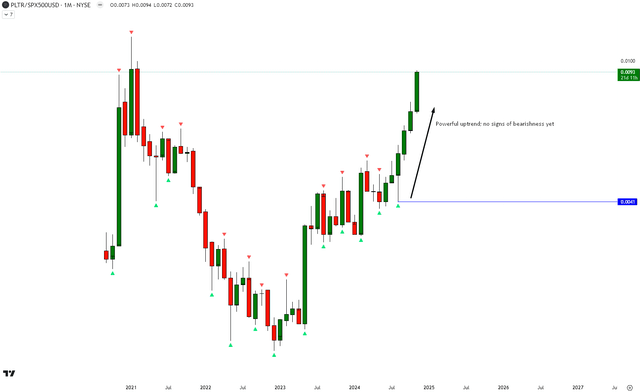

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of PLTR vs SPX500

PLTR vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

PLTR relative to the S&P500 is in a powerful uptrend in the latest monthly swing leg. I see zero signs of bearishness so far. Hence, I anticipate the uptrend and hence outperformance of PLTR vs the broader market to continue.

Margins track is a monitorable

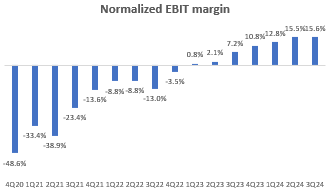

One interesting observation I made upon my perusal of Q3 FY24 results is the fact that normalized EBIT margins have remained broadly stable QoQ, pausing a prior trend of steady margin expansion:

Normalized EBIT Margin (Company Filings, Author’s Analysis)

Is the company approaching a stage wherein they prefer to give more value to customers in an attempt to acquire them faster, at the expense of margins? Note that the EBIT margin guidance for Q4 FY24 implies a small 100bps improvement from Q3 FY24 levels. In any case, I view this as a monitorable going forward.

Takeaway & Positioning

My bullish Palantir thesis is playing out very well. Q3 FY24’s update only reaffirms my buy bias. Palantir’s AIP is enabling customers to make tremendous improvements to business productivity, the extent of which is so large that I believe it would make non-adopters of AIP uncompetitive, making Palantir more of an essential need for business survival. With a strong monopoly position on its technological capabilities, and a mere 629 customers to its name relative to the thousands of global enterprises out there in the West, I posit that the company is nowhere near its peak potential since mass adoption is still a long way away.

Regarding shorter to medium term momentum, Palantir’s remaining performance obligations (a leading indicator of revenues) and guidance beats on both revenues and margins for Q4 FY24 signal continued strong momentum ahead.

Of course, some investors may be put off by an optically high 123x 1-yr fwd PE. However, I argue that for high growth stocks such as PLTR, it is wrong to simply be swayed by a high valuation multiple alone without dissecting the drivers of stock appreciation. When this is done, it is evident that much of PLTR’s meteoric rise in the stock is mostly driven by genuine earnings growth rather than mere multiple expansion. This tells me that irrational exuberance and overhype is not yet present for Palantir.

Technically vs the S&P500 too, PLTR is in a powerful uptrend and there are no signs of bearishness. For all these reasons, I maintain my ‘Buy’ rating on the stock.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.