Summary:

- Palantir stock appreciated by 50% since my last recommendation, outperforming the broader market.

- Recent developments look positive, supporting my long-term bullish outlook.

- However, valuation analysis suggests no upside left after recent bull run.

JHVEPhoto

Introduction

Last time I wrote about Palantir (NYSE:PLTR) was in May. The stock price appreciated by 50% since my “Strong Buy” recommendation. I am very happy because the broader market grew much slower with a 5% increase over the same period.

Palantir’s fundamentals are strong and improving, the company demonstrates impressive growth across all vital metrics. The operating leverage is strong, but valuation analysis suggests that there is no upside left after the recent bull run. Therefore, I downgrade PLTR to ‘Hold’ despite remaining quite bullish from the long-term perspective.

Fundamental analysis

Recent developments are very positive for PLTR’s investors, which supports my bullishness. For example, the company recently teamed up with one of the largest tech companies in the world, Microsoft (MSFT). Under this collaboration, PLTR and MSFT will integrate Azure OpenAI service with Palantir’s AI Platform (‘AIP’) for governmental projects. The fact that such a superstar like Microsoft selected Palantir as its vital technological partner is a strong quality sign for PLTR.

Wedbush Securities are quite optimistic about this information. According to analyst Dan Ives, this partnership will help Palantir to fortify its presence in the federal sector. Moreover, Wedbush gave Palantir an ‘Outperform’ rating with a $38 price target.

Northland Capital is another reputable source that is optimistic about Palantir’s prospects as they see strong potential in AI operating system driven by the company’s Ontology offering. Northland Capital’s price target for PLTR is $35.

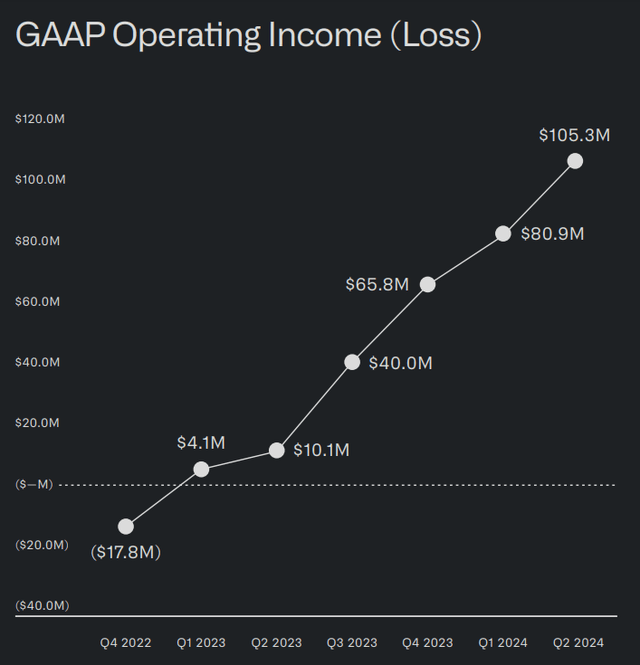

When I look at the company’s latest earnings presentation, I understand why Wall Street analysts are optimistic. Consolidated revenue grew by 27% YoY, which is notably better compared to a 21% revenue growth in Q1. Profitability is also improving rapidly with the company’s non-GAAP EPS increasing from $0.05 to $0.09 on a YoY basis. Operating leverage is very impressive, according to the below graph.

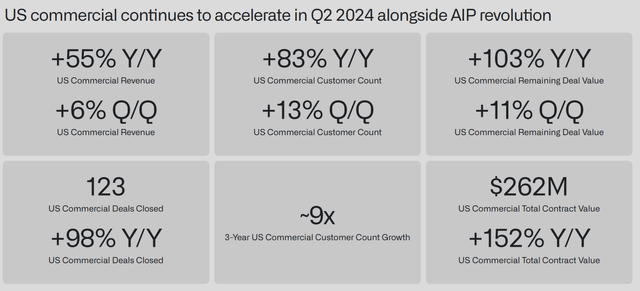

Commercial revenue was the major growth driver again with a 33% YoY growth. Within this segment, the U.S. market was leading with a massive 55% YoY growth. Government revenue growth was not that fast, but also impressive with a 23% YoY increase.

The company ended Q2 with a massive $4 billion cash position and only $260 million in total debt. Palantir’s financial position is a fortress, meaning that there are ample resources to invest in new endeavors and developing existing products.

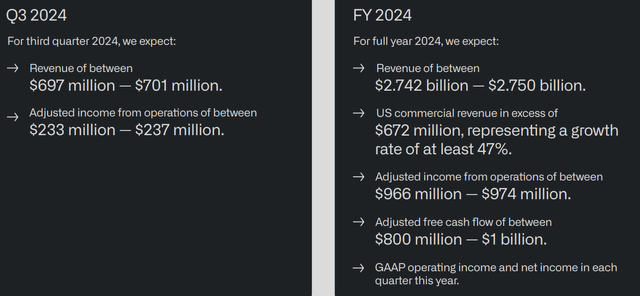

Last but not least, the management raised its full-year guidance. Full-year revenue guidance at midpoint is $2.746 billion, representing a 23% YoY growth rate. Commercial revenue is expected to continue gaining momentum as the management expects a 47% growth in this segment. The expected adjusted full-year free cash flow of around a billion represent a massive portion of the company’s revenue and will create more opportunities to fortify the company’s balance sheet.

Valuation analysis

The stock price is currently close to its all-time high of $35 per share which was achieved in January 2021. The price is now more than four times higher than compared to the 2022 dip. After such a massive bull run of the last two years, PLTR is now a $73 billion company.

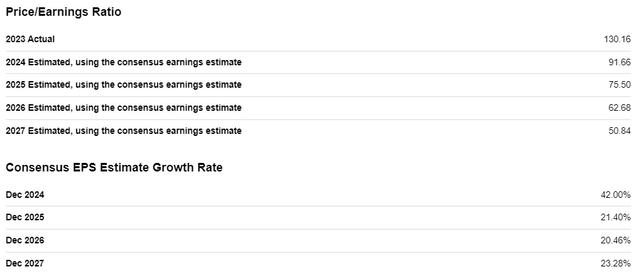

PLTR’s current P/E ratio is extremely high. Even if the company maintains above the 20% annual EPS expansion, the FY 2027 forward P/E ratio will still remain above 50. This indicate that the market prices in a very aggressive profitability expansion, which is inherently risky from the valuation perspective.

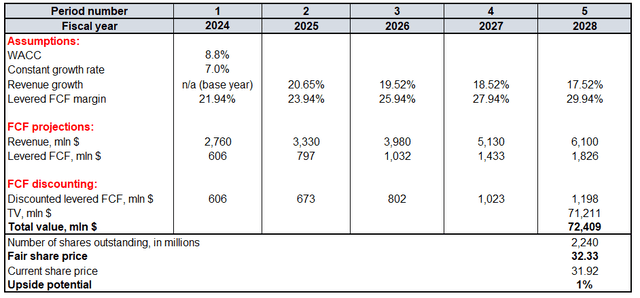

On the other hand, PLTR’s valuation ratios were historically sky-high, and it was never an obstacle for the stock price to continue soaring. The reason is because of the company’s massive revenue growth, which we saw in my fundamental analysis. Therefore, simulating a discounted cash flow (‘DCF’) model will likely be a fairer valuation approach since it incorporates the effect of profitability growth beyond FY 2027.

The discount rate I use is an 8.8% WACC. Consensus revenue estimates for the next three years look like a reliable source since it is the average opinion of at least 9 Wall Street analysts. For the years beyond FY 2026 I incorporate a 100 basis point yearly revenue growth deceleration. PLTR’s TTM levered FCF margin is 21.94%, which I incorporate for my base year. For the next few years, I project a 200 basis points yearly FCF margin improvement. My FCF growth assumption is aggressive because consensus expects an aggressive EPS expansion. According to Seeking Alpha, there are 2.24 billion PLTR shares outstanding.

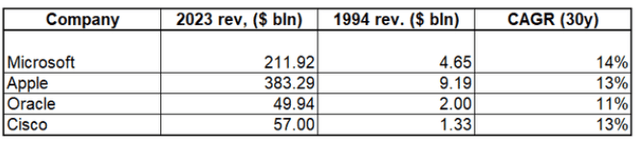

Constant growth rate to calculate the terminal value (‘TV’) is quite a controversial topic. In my previous analysis, I used an 8% constant growth rate, which some people called unrealistic. On the other hand, if we look at how revenue of some of today’s mega caps grew over the last thirty years, we would not be so pessimistic.

All companies mentioned in the above table captured a mega trend of rapid digitalization that started in 1980s. However, Palantir is also an early winner in the AI revolution that started just a couple of years ago. Due to the company’s excellent performance so far, I think that it is highly likely that PLTR can outpace GDP growth or inflation over the next several decades. On the other hand, I realize that the larger PLTR will become, revenue growth will decelerate. Therefore, this time I downgrade constant growth rate from 8% to 7%. PLTR’s fair share price is around $32, which aligns with my previous valuation analysis. Since the stock currently trades very close to $32, there is no upside left after the massive bull run of the last three years.

Mitigating factors

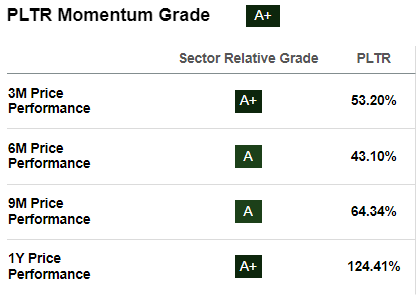

Downgrading a stock that delivered a 50% share price growth over the last three months is always a risk for any author. PLTR’s momentum looks unstoppable and at this stage of the stock’s rally the FOMO factor is highly likely notable. Therefore, how far the stock price can go depends on the market’s sentiment and not valuation models. What I am trying to say is that the show can go on for a while, depending on the extent of optimism in the stock market.

SA

Nvidia (NVDA) reports its quarterly earnings next week. In case of a new jaw-dropping guidance boost from Nvidia, all stocks with AI exposure might rally again. There are indirect clues that indicate that there is an elevated probability of Nvidia crashing all expectations again. For example, Wall Street analysts are quite bullish about the upcoming earnings release. Moreover, Taiwan Semiconductor’s (TSM) sales soared by 45% in July.

Conclusion

Palantir’s recent bull run left no room for further rally, according to my DCF model. On the other hand, fundamentals are still strong as the company continues demonstrating robust growth across all key metrics. I think that downgrading PLTR to ‘Hold’ is reasonable, but FOMO factor might fuel optimism further.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.