Summary:

- Paramount Global has two realistic options to relieve and structure for a sunnier future: Sell off units but better yet, sell the company.

- Apple is among the most logical possible buyers to vault its growth in the streaming space at a far more reasonable cost than other strategies.

- Paramount holders might consider building positions in Para because transaction buzz on its units is heating up. A deal for the entire company could appear–Apple, a no-brainer.

Vertigo3d

The faint crunch of wagon wheels encircling Paramount Global (NASDAQ:PARA) is getting louder by the week. The sense of the market is that the buzz on possible transactions focuses on two prospects: One, PARA opening its “store” and putting its goods on sale; BET TV, Simon & Schuster, and most recently, Netflix (NFLX) sniffing around the edges of the Para legacy film studio. Whether any of these possibilities materialize or not, ranges from the obvious to the realm of mission impossible. The persistence of rumors are usually more telling than any single report or assumption by Wall Street. And the mill seems to be churning full time on this PARA business or that one.

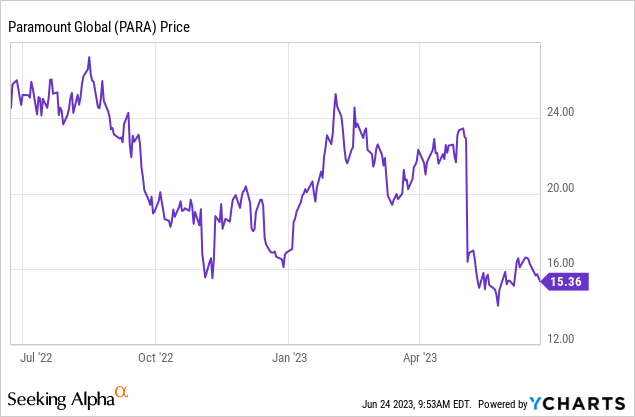

Above: The dip is reaching a screaming buy level for the right acquirer.

BET, presumably, is in process, but reportedly encountering price resistance by a possible buyer. Simon & Schuster talks are in motion and, most recently, long lingering eyeballing from NFLX on the Warner film studio division. What they all have in common is a recognition of the widening gulf between what the company could be worth and the trading range of the stock.

It begins to look like some kind of deal could loom in the crosshairs for Para units or the entire company. It’s the one road the company can take to relieve financial pressure in reasonable time that doesn’t materially destroy the business. Otherwise, it’s a foot slog ahead for years to put the house in order, as it is for Para’s media competitors.

What has not been explored amid all the chatter is the prospect that a potential buyer might be interested in the entire company, given the fact that the shares have drifted into a real interesting trading range. Clearly, amid all the gems on the Paramount jewelry counter, there is no shortage of zircons. Any acquirer would unquestionably buy it all with the idea of then spinning off or selling various businesses that did not match the core strategy of its acquisition.

Paramount Archives

Above: The studio offers a solid library, plus more recently tested age-proof IP and a good track record on making periodic hits.

Apple as a buyer: A mind experiment

We cite an Apple buys Para scenario with the stipulation that thus far, in theory, AAPL might well have entered casual conversations among its honchos in Cupertino. Whether this is accurate or not we do not know. But among many potential buyers of Shari’s store, Apple, it would seem, has the most to gain and the least to lose.

Paramount archives

The ATT debacle is a word to the wise—but not a true model

The ugly memories of ATT’s (T) venture into the wild and wooly precincts of show business are still vivid in the minds of many on the street. That massive blunder who’s offspring is the jerry-built Warner Brothers/Discovery(WBD) entry, debuting since early 2022 is still in the process of finding its sea legs. WBD CEO Zaslav, seeing no elegant solution to the heritage woes, has taken the only sensible road: Cut costs, put the goods on sale and trim the company to a profitable, smaller competitive bundle of selected assets the street will love. It’s a good strategy for WBD, given its panoply of businesses that really don’t cohere into a vision of a clearly understood future company by investors.

It’s the same problem Disney faces (DIS). It has assets like ESPN, Hulu and others, that shorn from the parent, will make DIS an organic media/entertainment whole with sharply reduced debt and perhaps a new management vision, to beguile investors again. Paramount is a different story. Among all competitors in the space, it makes the best case to be acquired as a whole, for the right buyer. In our view, that buyer could be Apple (NASDAQ:AAPL).

Our reasoning here begins with the scale of such a deal.

It is a deal theory that is a classic best case move of the whale consuming the minnow, not the other way around as is so often the case. It is also the easiest ground on which a corporate culture can be grafted. One immediately saw how utterly idiotic ATT was in dreaming its old school culture could mesh with the legacy wildcatters at Warner Media.

It would appear to us that the cultures of Para and AAPL are far more amenable. Both businesses are innovation dependent, both have important elements aimed at entertaining customers, both are already in the streaming business. Para has content, AAPL TV is shy of content. There is no iPhone lurking somewhere in the AAPL future that we or anyone else really can grasp at this time.

Financials that make sense for both

If you consider Para as a whole company acquisition, the first consideration is who has the financial heft to close such a deal without putting it into even more horrendous debt than that which now sits on the books? Count them on your fingers. AAPL must be among the top five under such basic considerations.

The second is that in such a deal, AAPL would become the seller for all or any of the acquired units under the deal to smaller buyers with an eye toward using proceeds to reduce the total cost of the deal and not burden it with debt.

The fact is that Para has now descended into a trading range that it is very hard to prove is not way undervalued in terms of its assets, salable or not. You can do the math ten different ways and come up with long, boring treatises, tons of graphs, and operating assumptions. That falls within the pay grade of the investment bankers, who have been known to put lipstick on lots of pigs. No such case here. This one, no matter how you calculate, is a deal spun of pure gold for all.

Para’s 52- week range is ~$13 to $27 against its price at this writing of $15.40. This means that a cash rich acquirer like AAPL can wolf down the entire company with a nifty premium for shareholders to begin with yet not have to give away the store. Shareholders could be overjoyed by the prospect of Para moving under the AAPL imprimatur in terms of a brighter future, lots of real synergies (not just management happy talk) and a solid financial foundation. My calculations arrive at a price of ~$21.50 for the company. Say a 30% premium.

Alternatively, an all-stock swap deal that gives Para holders X number of AAPL shares is a happy prospect for them and for AAPL holders, adds $30b in annual revenue at sale time not readily apparent from products or services in the near term AAPL research labs. Para would bring a decent 8% revenue boost to AAPL at a cost probably below anything in sight now.

After the closing, we arrive at the real secret sauce of the deal in two stages. First, separate the gems from the zircons. We use the zircon metaphor with care. We don’t imply Para has worthless units here. Zircons after all have been around a long time. They exist because, yes, there is a lively market for them, as any jeweler will tell you. We think there could be markets for them all, either by outright sale, or spun off. An AAPL zircon could be a gem to a smaller operator who would value building it steadily over time at a low cost.

The main event comes when AAPL can move to 1) Merge its 25m subscribers with Para’s 60 m. Beginning at an 85 m base, it is reasonable to assume that rather than generating churn, the inherited Para content would cheer AAPL subscribers and easily make the case for an attractive, competitive subscription pricing policy. And 2) you have AAPL now availing themselves of both the existing IP of the Paramount Studios and Library as well as the skill sets of the studio in developing cost-effective new content especially for the streaming service.

So now AAPL no longer has to be at the mercy of the content makers entirely to guess their way into the crap game of choosing potential winners vs. losers. You inherit existing Para content with established track records against a realistic cost/value equation target. You then have the cash to develop new projects tailored to specific budgets against an 85 m subscriber base, as opposed to the 25 m you now have.

Debt: Para now sits on $17.25b (mrq) with a current ratio of 1.12 and cash on hand of $2.1b. The company shows an operating cash flow of ($556m), one of the core reasons the stock sits where it does. Simply Wall Street puts an intrinsic valuation on the shares at $16.32, near its current trade. To me this is telegraphic in the sense that it’s gems alone are worth far more and, on any basis, it could be acquired at a workable premium for AAPL.

Speaking of AAPL, it currently has $55.87b in cash, a levered FCF of $83b (ttm). Its debt at $109b doesn’t begin to suggest that the acquisition of Para could impose any kind of strain on its finances. Interesting note here: AAPL’s ttm interest expense is $3.2b, virtually offset by $3.09b in interest income.

I leave deep diving into the AAPL valuations here to those who follow the stock in detail and regularly report their calls. My brief here is quite simple:

Like all great deals, everyone gets most everything of what one wants to make it work.

1.Para’s Shari Redstone makes out like a bandit with lots of AAPL stock. The shareholders get a nice premium and a far rosier future under the Cupertino flag than what it looks like now.

2.AAPL gets Paramount+ and its 50m subs at a far cheaper cost per eyeballs than it would launching massive marketing deals or rolling the dice on lots of what if content.

It gets a film studio and IP that has much future value, as well as letting go of the need to keep producing legacy IP product as it fades and ages away.

3. Para get immense financial relief, whatever timeline it needs to unload its goods, Simon & Schuster, BET, and whatever seems financially viable enough to attract shoppers.

Clearly, whether a target for AAPL or another behemoth BUY.

Investment bankers: Snap those suspenders and get busy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress “The Smartest ever Guide to Gaming Stocks” – free to existing members and new subscribers.