Summary:

- The year 2022 has been a huge disappointment to PayPal investors.

- Looking ahead, many of the headwinds could persist, such as transaction costs, credit losses, and also competition intensification.

- However, the market seems to be too focused on the negatives and is neglecting the positives.

- Its accounting EPS substantially underestimates its true earning power. And I am seeing signs of costs to be under control.

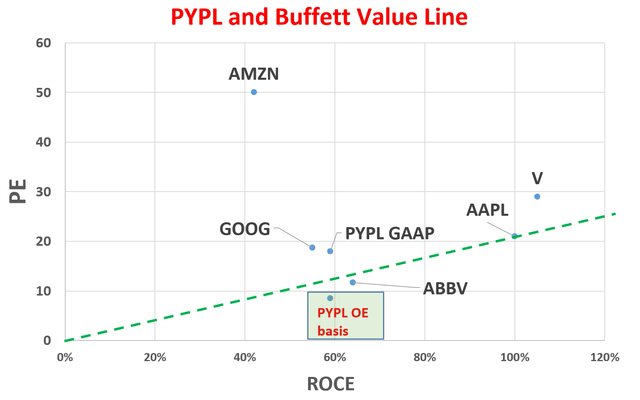

- When plotted against what I call the Buffett value line, the stock now trades at a discounted valuation for a Buffett-type compounder.

Spencer Platt

Thesis

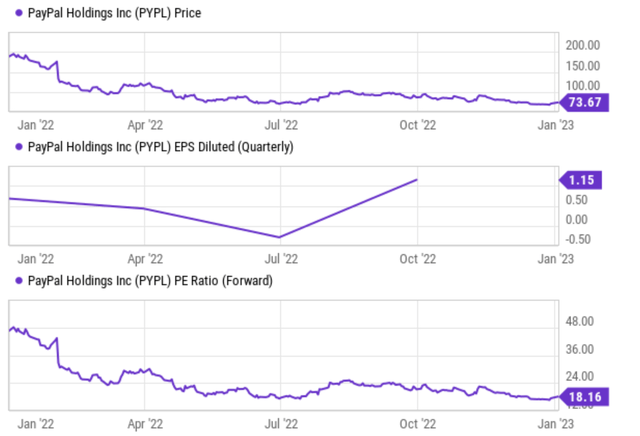

The year of 2022 has been brutal to PayPal (NASDAQ:PYPL). The stock price plunged from about $200 to the current level of $73 during 2022, and for good reasons. As you can see from the mid panel in the following chart, its earnings have been under pressure during 2022. And its bottom line even dipped into the red in the June period (it reported a loss of $0.29 per share in the second quarter). The pressure largely came from higher transaction expenses, credit losses, and other expenses. Looking ahead, these headwinds could persist longer.

However, the main thesis of this article is to argue that the market has focused too much on the negatives and has neglected the positives. Specifically, the remainder of this article will detail 3 reasons to be bullish on it in 2023:

- First and foremost, its accounting EPS underestimates its true earning powers and does not paint an accurate picture of its true profitability.

- Furthermore, its operating costs, such as general & administrative and R&D, began to show signs of cooling, suggesting potential for improved profitability ahead.

- And finally, its valuation correction is overdone. Its true PE based on owners’ earnings is even lower than its PE of 18.1x.

Reason 1: accounting EPS underestimates its earning power

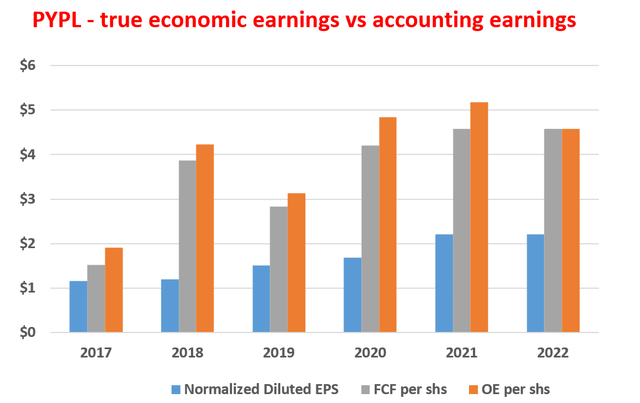

The accounting EPS quoted above does not reflect PYPL’s true economic earning power. The accounting earnings actually underestimate its true earning power by a substantial amount as shown in the next two charts.

The first chart shows PYPL’s accounting EPS (fully diluted), free cash flow (“FCF”) per share, and owners’ earnings (“OE”) per share in the past 5 years between 2017 and 2022. As seen, its FCF has consistently above its accounting EPS, which already signals that the accounting EPS is an underestimation of its true earning power. And bear in mind that the FCF itself is an underestimation of the owners’ earnings (“OE”). The reason is detailed in my earlier writings in case you are interested. The gist is quoted below:

In the calculation of FCF, ALL CAPEX expenses have been considered a cost. However, only the maintenance CAPEX should be considered as a cost. And the owner’s earnings should be free cash flow plus the portion of CAPEX that is used to fuel the growth (i.e., the growth CAPEX). As a result, the OE is even higher, as shown by the orange bars in the first chart below.

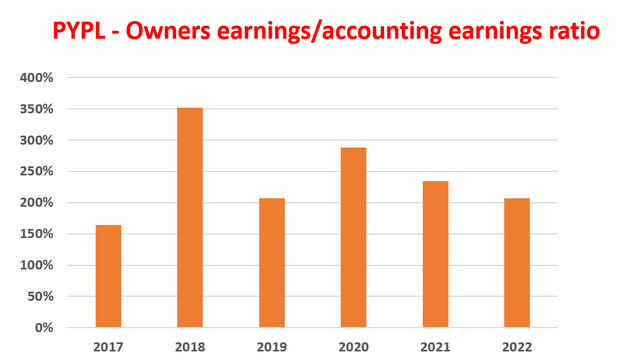

In PYPL’s case, the dominant portion of its CAPEX (~68% on average in the past 5 years) was growth CAPEX. Once the growth CAPEX is adjusted for, its OE is higher than the accounting EPS by a substantial amount (in the range of 1.5x to as high as 3.5x as seen in the second chart below). For 2022, its OE is more than 2x higher than its accounting EPS.

Author based on Seeking Alpha data. Author based on Seeking Alpha data.

Reason 2: cost pressures are cooling off

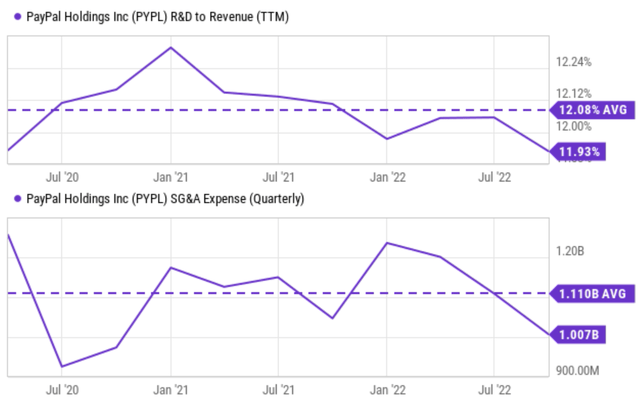

As aforementioned, PYPL has been suffering from upticks in costs ranging from transaction expenses to operation expenses and to general inflation during much of the past year. However, I am seeing signs of operating costs cooling off. For example, general & administrative and R&D costs both showed signs of cooling off since they peaked earlier in 2022.

As you can see from the next chart, its R&D expenses peaked at ~12.3 percent in the beginning of 2021 and have been in steady decline since then. Currently, its R&D expenses sit at 11.9% of its total revenue, near a bottom level in the past two years. And as you can see from the bottom panel of the chart, its SG&A expenses have also been under control. These expenses peaked in January 2022 and exceeded $1.2 billion on a quarterly basis. And it was only $1 billion in the most recent quarter, about a 20% decline from the peak.

Reason 3: valuation correction is overdone

Onto valuation. As aforementioned, its current PE hovers around 18x on accounting EPS basis, and its true PE based on OE is even lower. Of course, it is not meaningful at all to comment on PE multiples in isolation without considering the quality of its earnings.

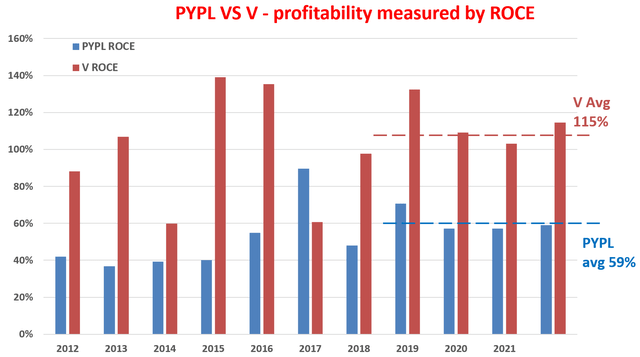

And the next chart compares PYPL’s ROCE (return on capital employed) to that of Visa (V), the gold standard of payment processing business in my view. First off, V’s ROCE is obviously much higher as expected. V’s ROCE has been averaging around 115% in the recent 4 or 5 years. In comparison, PYPL’s ROCE has been averaging “only” 59%, about half of V. I am putting only in quotation mark here because a 59% ROCE is already superb by all measures. The general economy ROCE is on average 20% and the average ROCE for the FAAMG group is in the range of 50% to 60% in recent years.

Author based on Seeking Alpha data.

With the above background, the next chart is my favorite way of evaluating a business’ valuation under the context of its profitability. As detailed in my earlier articles:

This chart compares PYPL’s PE adjusted for ROCE against Buffett-type compounders including Apple (AAPL), Visa (V), Amazon (AMZN), AbbVie (ABBV), et al. The green line is what I’d like to call the Buffett value line. It is a line linking A) the origin (a business that has 0% ROCE should be worth 0x PE), and B) Buffett’s largest holding, Apple, which also happens to have one of the highest ROCE.

You can see that PYPL is now quite close to this green line even on a GAAP basis. And it is below this line (as highlighted in the green box) once you considering the following adjustments:

- As aforementioned, its true OE far exceeds its accounting earning

- And there is about $5.81 of cash behind each of its shares, representing 8.2% of its share price as of this writing.

Author based on Seeking Alpha data.

Risks and final thoughts

As mentioned, PYPL is certainly facing some pretty strong headwinds. Besides the upticks in transaction costs and credit loess, there are also other risks. Competition is quite intense in the digital payment space. Just for mobile payments, there are currently more than 20 top options for users and merchants. Besides cost control, the company also faces geopolitical risks as commented by CEO Daniel Schulman in its recent earnings report (abridged and emphases added by me):

Russia, Ukraine and China are contributing to increased global uncertainty and incremental inflationary and supply chain pressures. And more specific to PayPal, forecasting normalized consumer e-commerce spending, as we come out of the pandemic, is exceedingly complex.

To conclude, my main argument here is that the market has focused too much on its negatives and has neglected the positives. It is true that its EPS has been suffering during 2022. But investors need to keep in mind that the often-quoted accounting EPS underestimated its true economic earning power significantly.

Furthermore, I am seeing signs that its operating costs are beginning to cool off. Both SG&A and R&D costs have declined substantially from their peak levels in the past 1 or 2 years. And finally, its valuation correction is overdone. When adjusted for its ROCE and cash position, the stock now lies below what I call the Buffett value line, signaling a discounted valuation on a Buffett-type compounder.

Disclosure: I/we have a beneficial long position in the shares of AAPL, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.