Summary:

- PayPal is set to benefit from a strong U.S. economy, with recent job reports showing better-than-expected growth and a 6.4% year-over-year pay increase.

- The company made strides in reducing operating costs, with a non-GAAP operating margin of 22.7% in Q1, and plans to grow its margin by >100 basis points in FY 2023.

- PYPL’s strong free cash flow and potential for stock buybacks, along with a discounted valuation compared to competitors, make it an attractive investment opportunity.

chameleonseye

Last week’s jobs report showed that the U.S. economy may be able to avoid a recession altogether in 2023. PayPal (NASDAQ:PYPL) could be one company that benefits from a strong labor market as well as resilient consumer spending. Additionally, PayPal has potential to increase its stock buybacks, which would make sense since the fintech’s share trade for at a very low P/E ratio. Lastly, I see upside potential for PayPal as the fintech keeps cutting expenses and restructures its cost base and thereby improves its operating margin. For those reasons, I see PayPal as a serious rebound candidate!

I believe there are three reasons why investors may want to consider PayPal at this point of time.

1. The US economy is in much better shape than investors think

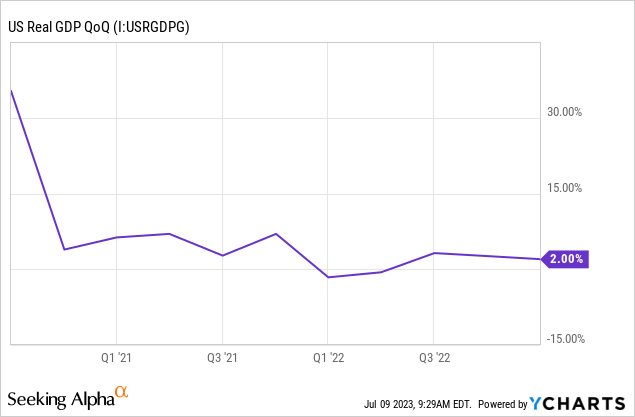

ADP’s National Employment Report from last week has shown that the U.S. economy is in much better shape than investors have thought: private employers have generated approximately half a million new jobs in June, which was more than twice as good as the estimate of 220 thousand jobs that the market expected.

Workers, according to the ADP National Employment Report also received a 6.4% year-over-year pay increase, suggesting that consumer spending in the second-quarter stayed resilient. I believe these favorable trends in job creation, wage growth and consumer spending will ultimately benefit spending-focused fintech companies like PayPal that take a cut from each online transaction.

The U.S. economy keeps growing which should be a positive for consumer spending as well: in the first-quarter, U.S. GDP grew 2%, well above the estimate of 1.3%. If the U.S. keeps adding new jobs, the economy might be able to avoid a recession altogether.

2. Operating income improvements

PayPal is under pressure to reduce expenses and the company has already had some successes in making this happen due to efficiency initiatives as well as job cuts: PayPal announced a major reduction in its headcount in the first-quarter as the company said that it will lay off 2,000 employees which was roughly 7% of its workforce.

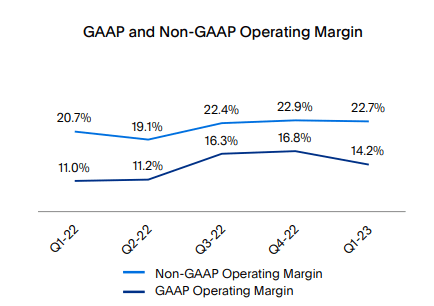

In the first-quarter, PayPal reported a non-GAAP operating margin of 22.7%, which was up 2 PP year over year as the company has pushed for cost cuts. According to PayPal’s outlook, the fintech seeks to grow its operating income margin, non-GAAP, by more than 100 basis points in FY 2023, while it previously expected a 125 basis point increase.

Source: PayPal

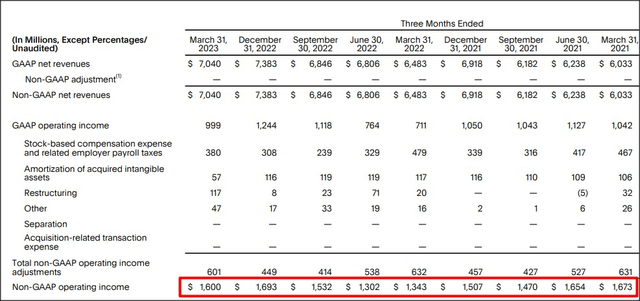

The general trajectory of PayPal’s operating income, however, is positive and has fundamentally improved in the last year as well. In the first-quarter, PayPal’s operating income was $1,600M, showing 19% year over year growth. In the last nine quarters, the fintech achieved average quarterly operating income, non-GAAP, of $1.53B.

3. Free cash flow and buyback potential

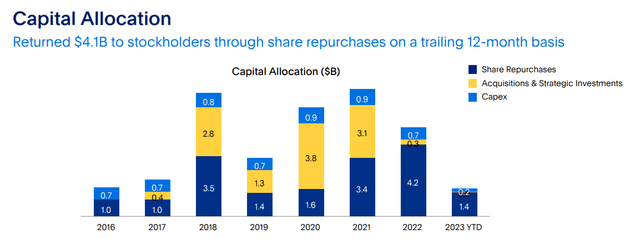

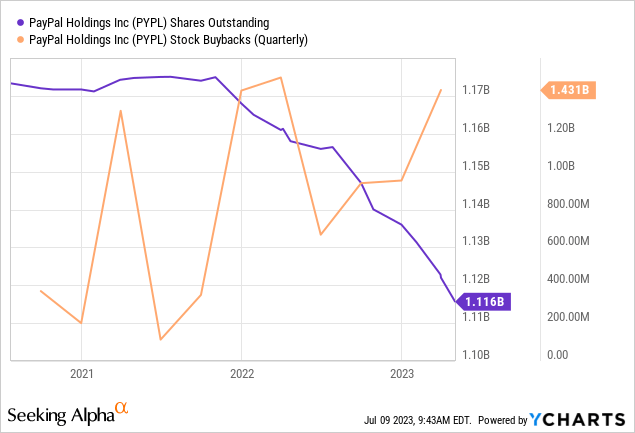

On a trailing 12-month basis, ending with the first-quarter of 2023, PayPal generated $5.1B in free cash flow which calculates to a quarterly average of approximately$1.27B. I believe PayPal’s free cash flow is ultimately the reason why investors would want to buy PayPal’s shares: PayPal invested $9B of its free cash flow since FY 2021 into stock buybacks.

Since the payment platform allows PayPal to generate consistently high levels of free cash flow, I believe PayPal continues to have a lot of potential to add to its buyback program: PayPal currently expects to spend $4.0B of its expected $5.0B in free cash flow in FY 2023 on buybacks which calculates to an 80% free cash flow return ratio.

PayPal has relatively low capital expenditures which means it can use its free cash flow freely and could increase its buyback to $5B annually. In the last three years, PayPal reduced the number of its outstanding shares by approximately 5%.

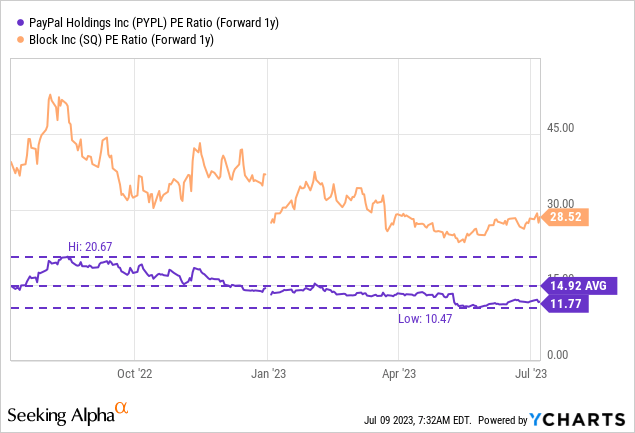

PayPal has a hugely discounted valuation

With $5B in free cash flow expected in FY 2023 and a market capitalization of approximately $74B, shares of PayPal are valued at 14.8X FY 2023 FCF. The fintech is also valued at a P/E ratio (FY 2024) of 11.8X which is approximately 21% below its 1-year average P/E ratio.

Block (SQ), a fintech competitor which owns the popular Cash App, is trading at a much higher P/E ratio than PayPal, but also has stronger growth potential due to the company’s Cash App momentum. While I prefer PayPal over Block from a valuation perspective, I also believe that Block, despite its much higher valuation relative to PayPal, has a strong opportunity for growth in the international market as well as in its core product, the Cash App.

Risks with PayPal

The biggest risk for PayPal is a potential slowdown in net new active account growth which has slowed to just 1% in the first-quarter. A decline in PayPal’s total account size would likely further concerns about a contracting business. What would change my mind about PayPal is if the company saw a material decline in its free cash flow as this would directly impact the company’s buyback potential.

Closing thoughts

The biggest advantage of PayPal right now is that the company is extremely lowly valued based on P/E while generating consistently a ton of free cash flow. PayPal also sufficient free cash flow to repurchase at least a billion dollars’ worth of its own shares each quarter, so I definitely see a pathway for the fintech to accelerate its stock buybacks. Additionally, the employment report suggests that the U.S. economy as well as the labor market are in great shape which could boost PayPal’s growth as a cyclical fintech. If the U.S. economy avoids a recession, I would expect analysts to upgrade PayPal’s earnings estimates which then would result in a lower P/E ratio. Operating income improvements are also realistic as the company has embarked on a series of cost-cutting efforts that are meant to boost profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.