Summary:

- PayPal’s moat has disappeared, as the fintech industry grew underneath it and has gained its own foothold.

- Multiple leadership changes seem to have affected its vision, allowing these newer players to rise.

- PayPal can still rely on its global presence with customers and merchants, enjoying modest growth rates over time.

- Getting a good return therefore warrants a good entry price, and I think PYPL’s ought to be lower before taking a bit.

Hill Street Studios/DigitalVision via Getty Images

More than two decades into its life, PayPal (NASDAQ:PYPL) has come a long way. With a market cap of $73 billion, it sits happily in the pantheon we call the S&P 500. Yet, anyone who has paid attention over the years might notice a change in the air: PayPal no longer leads the charge that it started. Its moat seems to have magically disappeared.

It’s a strange thing to happen to a company, especially one whose own origin arguably marks the birth of fintech, particularly in the sense of the word that we have come to understand it. Despite its legacy, I think other players have crept up and displaced PayPal. The company isn’t doomed, and it still has something to offer, but it warrants modest assumptions going forward, and that’s why I think this giant is merely a Hold for now.

Personal Retrospective

I remember PayPal within its first few years as a company, at the turn of the New Millennium. I was about eight years old at the time, and you might wonder why a young child would have even paid attention to something like PayPal. It starts with eBay (EBAY), which eventually acquired PayPal before spinning it off in 2015.

ebay.com

For those who remember the golden age of NASCAR in the 90s and into the early Aughts, my father got into a phase of buying those cast iron collector’s car models. Sometimes he would look in the toy section of a brick-and-mortar store, but often specific paint jobs that drew his attention required him to look online.

As a fan of both Dale Jarrett and Ricky Rudd, you’d better believe he was excited when their cars were painted in the style of Batman and the Joker. (Interestingly, in 2024 people are still selling these on eBay).

The important part is this. I remember watching him browse and bid. He pulled up an offer and checked how they received payments. He pointed at the PayPal icon on the page and told me he would not buy from a vendor unless they accepted payments through PayPal because then he knew he could trust them. There was no other bona fide way to make payments over the Internet quite like PayPal at the time. It’s weird to reflect how different the world was even then.

That was a mark of both brand strength and a moat right there. It was something that would last for about the next decade. As I got older and noticed how online payments would be accepted, I noticed the PayPal icon was almost always present as an alternative to paying by card, usually with no other alternatives besides them.

Departure of the Founders

Those who have read Zero to One are familiar with Peter Thiel’s account of the birth of PayPal. Namely, that which we call PayPal today is the hybrid of two companies: Thiel’s PayPal.com and Elon Musk’s competitor: the original X.com.

With headquarters only three blocks apart in San Francisco, he humorously recounts the bitter war between the two for selling what were essentially identical services, often pushing their staff to 100-hour work weeks to remain competitive. Eventually, they met in person to discuss a merger, which used the name of Thiel’s company.

After PayPal’s first IPO in 2002, which quickly resulted in its acquisition by eBay, Thiel and Musk took their winnings and moved onto a other ventures, such as Palantir (PLTR), Tesla (TSLA), SpaceX (SPACE), and more recently the new X.com (former Twitter). For more than a decade, PayPal would be run to fit eBay’s vision.

As we get into the 2010s, of course, we know things change. For one, Amazon displaced eBay (a statement in itself). Block (SQ) enters the fray as Square, allowing small businesses to take electronic payments in person. They also champion the digital wallet with Cash App, even copying PayPal’s own strategy of customer acquisition (that $5 reward you get for referring a friend). PayPal eventually responded by acquiring Venmo, but that was already a sign of how slow they had gotten.

Moreover, as more people got used to doing business online and as the nature of these transactions got more secure, people felt more comfortable simply entering their card information into websites to run a payment and not needing a secure middleman all the time.

Thiel also mentions that part of his original vision for PayPal was to have a decentralized, digital currency, a role that Bitcoin (BTC-USD) would later fill, much to the enthusiasm of Thiel.

For PayPal, the visionary founders are not only absent; they seem wholly disinterested in what remains of the company they created from scratch. The results appears to be a world in which several more electronic payment methods exist that don’t need PayPal.

I already mentioned the likes of Square, Cash App, and BTC. Then there’s Visa (V), Mastercard (MA), Discover (DFS), Google Pay (GOOG), Zelle (big banks), Chime, Varo, Stablecoin (COIN), AliPay (BABA), and so on. There are a lot more fish in this ocean now.

Global Company

If there is still something of a hopeful future, it’s the fact that PayPal doesn’t need a moat to continue growing. I’ll quote CEO Alex Chriss from the latest earnings call:

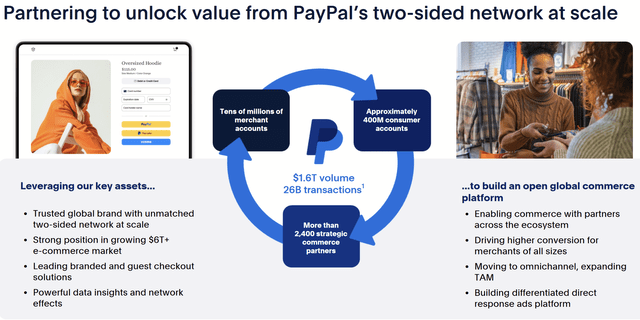

We are building an end-to-end platform, spanning the full commerce journey with superior customer experiences and sales conversion from start to finish. PayPal is one of the only players with both sides of the network, consumer and merchant at scale globally and with the infrastructure to support it. That is incredibly hard to replicate and a powerful foundation on which to launch new innovations including Fastlane and the Ads platform that we are in the early stages of building.

Their loss of a moat in fintech is largely a tale of what happened in the market of the United States and the developed world. Globally, there is still opportunity for growth.

As an established, American company, I believe this does give them credibility internationally. As more of the world modernizes and gets online, they should be positioned to benefit from it.

Moreover, these customer/merchant networks do not come up overnight, and I suspect they are somewhat sticky as people typically don’t like to mix up or change their payment methods frequently.

Valuation

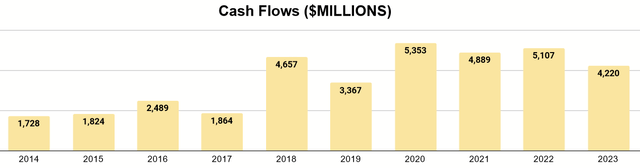

To calculate intrinsic value, I will be using a Discounted Cash Flow model. First, let’s review the history of free cash flow.

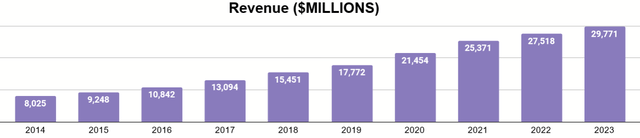

FCF stepped up in the latter half of the past decade but has been sideways since then. Revenue growth, however, has been consistent.

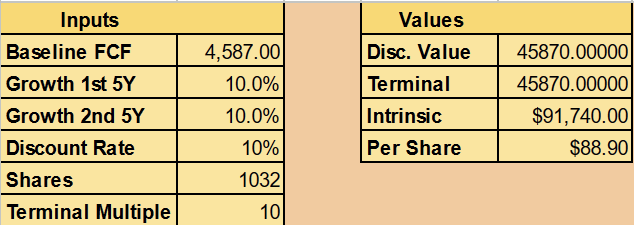

As such, I expect FCF will trend toward growth over the long run as well. I’ll make the following assumptions in my calculation:

- About $4.6B in baseline FCF

- 10% CAGR for the next decade

- Terminal multiple of 10

$4.6B is the average FCF of the last five years, so I think it captures the current capacity of the company well. I think 10% CAGR is attainable with a global market ahead of them, but explosive growth like in their past just seems unlikely with all the other fintech options out there.

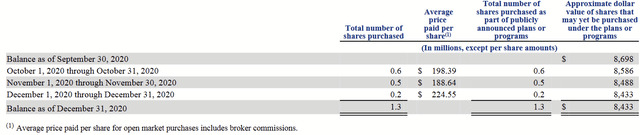

I’m keeping my terminal multiple somewhat low at 10 not just because I expect the growth to be low but because I know that there could be some years of valuation deletion through poorly timed buybacks.

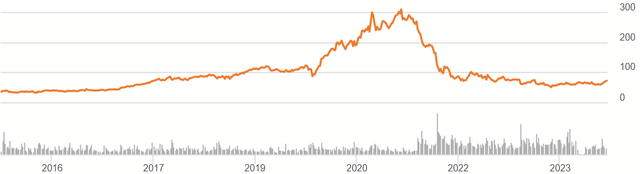

PYPL Full Price History (Seeking Alpha)

We see that the current share price is one of its lower periods, but the bull market of 2020 – 2021 showed it a few times higher.

Some buyback were as high as $224! Altogether, the average repurchase price throughout 2020 was reported as $136.19, almost double the current price. Thankfully, buybacks were significantly reduced in 2021, but there is this precedent that capital might not be as efficiently allocated through repurchases again.

Author’s calculation

Priced for 10% discount rate (typical return of a broad market index), these assumptions would give PYPL an intrinsic value of about $92B, for almost $89 per share.

Yet, as I think the assumptions behind it are somewhat optimistic, I’m inclined to want more of a margin of safety.

Conclusion

PayPal played a big role in the establishment of fintech and still has a role to play. It’s just not quite at the forefront that it used to be, given its age, how its ownership has changed hands a few times, and how its priorities have changed with that.

It seems to be on a good track now, but with other strong players filling voids that used to be unique to them, we can’t assume explosive growth as in the past. Rather, I think PayPal will be a modest compounder at best if it keeps up with competition and rides the growth of the global economy.

Lacking an attractive margin of safety, I don’t find PYPL to be dead money, but I prefer to treat it as a Hold until there’s a better discount.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.