Summary:

- Earnings season presses on, and a strong overall beat rate is encouraging for the bulls.

- I see upside long-term potential with PayPal, even with risks from competitors.

- Still, the chart warrants caution, and I outline key price levels to watch around Monday’s evening Q1 report.

Justin Sullivan

Another major week of earnings around the world and across the market cap spectrum is on the way. Monday afternoon kicks things off with PayPal (NASDAQ:PYPL). With a solid EPS beat rate history and low valuation, I have a buy rating on the stock despite a concerning technical look.

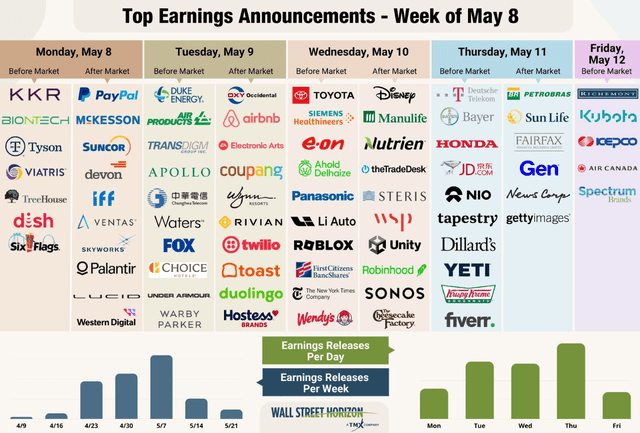

Earnings On Tap

According to Bank of America Global Research, PYPL is a global, technology-driven payment platform with over 400 million direct customer relationships in more than 200 countries. It empowers a streamlined digital and mobile payment experience in-browser, on mobile devices, and in-app. PayPal is accepted at 75%+ of the largest 100 internet retailers.

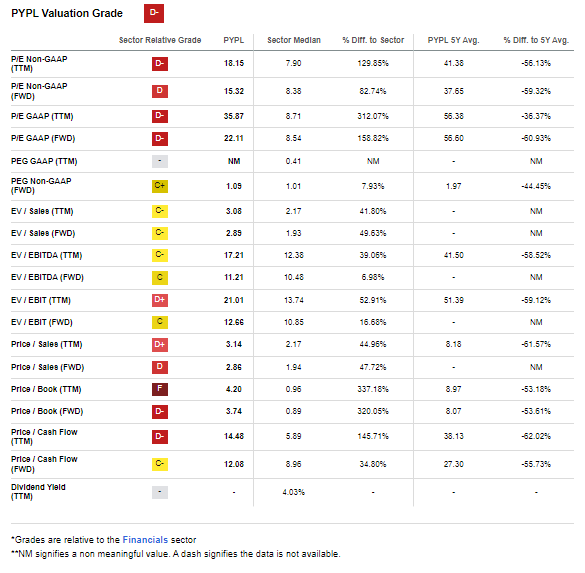

The California-based $84.2 billion market cap Transaction and Payment Processing Services industry company within the Financials sector trades at a high 35.8 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

PayPal was one of a host of fintech companies slashing headcounts earlier this year. Layoff announcements have largely rewarded shareholders, but the stock has not caught a major bid over the last several months. The business’s skew to lower- and middle-income consumers is a risk during this phase of the business cycle. Moreover, increasing competition from payment providers could high ARPU metrics this year – that will be a key metric to keep your eye on in the upcoming earnings report.

Amongst some management changes, it is key that the next phase of the business’s growth has a clear focus. It’s expected that guidance will only be given one quarter at a time, but a guidance raise would certainly help the share price – and I think we could get that based on decent numbers from other firms in the industry.

Competitive Risks

PYPL has exposure to how the macro consumer picture evolves. Should a deeper recession take place, then the firm will struggle. Also, I think too much focus on slashing expenses could be a risk to market share – if that mindset cuts into high-ROI initiatives, then its competitors could pounce. I also have apprehension regarding how the new CEO will lead as smaller transaction players grow. What’s more, new regulations in the industry could hurt a larger player like PayPal and potentially favor smaller companies with less dominance.

Peer Comparison

Relative to its competitors, PYPL is priced with a mid-range valuation. I took a look at Fiserv (FISV), Adyen (OTCPK:ADYEY), Block (SQ), Fidelity National Financial Information Services (FIS), and Global Payments (GPN). Forward operating P/Es range from 9.4 on the low end (FIS) to more than 70 with ADYEY. PYPL’s 1.09 PEG is attractive compared to its peers – only GPN has a lower ratio using forward estimates.

But PYPL sports better revenue growth than GPN in the out year, with a better net income margin. PYPL is also the leader in the space with its $84 billion market cap, and market share should be protected should the management team execute well on PayPal’s next stage of growth.

Catalysts

I’ll be looking for what the new CEO has to say on upcoming product developments as it introduces upgrades to Venmo and other digital wallet services. If those come to fruition, then there’s a reasonable chance that 2023 EPS guidance of $4.87 could be raised.

What could help support the stock this year is the firm’s stock buyback plan. With about $5 billion of net free cash flow in FY23, there’s ample room for at least $3 billion.

Another upside catalyst is activism from Elliott Management. That pressure could result in further cost-cutting initiatives. In addition to buybacks, a dividend announcement can’t be ruled out – I assert that would be viewed positively by the market since the company has plenty of FCF to reward shareholders while still funding growth projects. A new, streamlined PayPal may be needed in this competitive landscape.

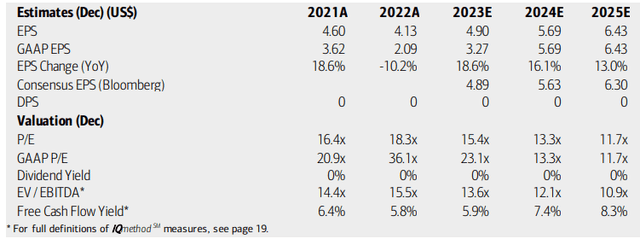

Valuation

On valuation, analysts at BofA see earnings rebounding sharply in 2023 after declines last year. Per-share profits are seen as continuing to rise at a double-digit pace through 2025. The Bloomberg consensus outlook is about on par with what BofA projects. No dividends are expected to be paid on the stock, but PYPL is solidly free cash flow positive.

PayPal: Earnings, Valuation, Free Cash Flow Forecasts

Using out-year estimates, the earnings multiples are attractive on the stock considering the high growth outlook. What’s more, the EV/EBITDA ratio is about in line with the market. Overall, if we assign just a 20x forward P/E (a sharp discount to its 37.7 5-year average), then the stock should be near $98. Lastly, the forward PEG ratio is very low at 1.09 compared to the 5-year mean of 1.97.

PYPL: Steeply Discounted Versus Long-Term Valuation Metrics

Seeking Alpha

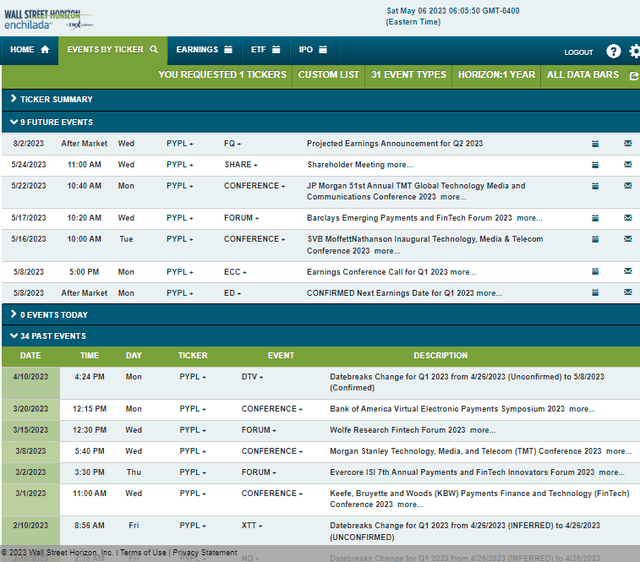

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2023 earnings date of Monday, May 8 AMC with a conference call immediately after the earnings hit the tape. After that, expect the possibility of some volatility around a trio of conferences that take place from Tuesday, May 16 through Monday, May 22. Finally, the company’s annual shareholder meeting takes place on Wednesday, May 24.

Corporate Event Risk Calendar

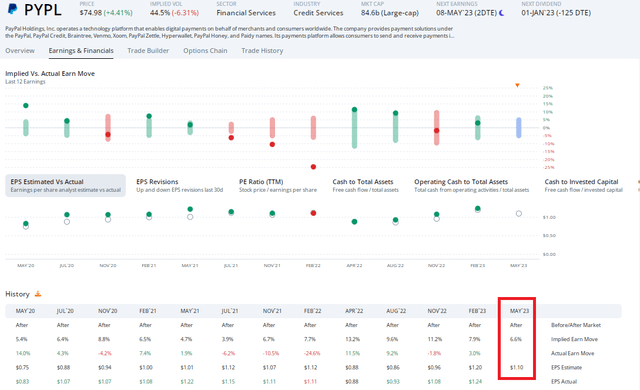

The Options Angle

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $1.10 which would be a strong 25% climb from $0.88 of per-share profits earned in the same period a year ago. ORATS reports that there have been six analyst upgrades of EPS estimates since the February quarterly report. With a strong beat rate history, topping estimates in 11 of the 12 last instances, an earnings beat is likely. But shares have a mixed performance history following earnings dates.

This time around, the options market has priced in a 6.6% earnings-related stock price swing. That is the cheapest straddle dating back to July of 2021. With a lower VIX today, it makes sense. Also, notice small moves in the stock in the previous pair of earnings reactions. Overall, I see the options as fairly priced given these dynamics.

PYPL: A Strong EPS Beat Rate History, Straddle Priced Lower

The Technical Take

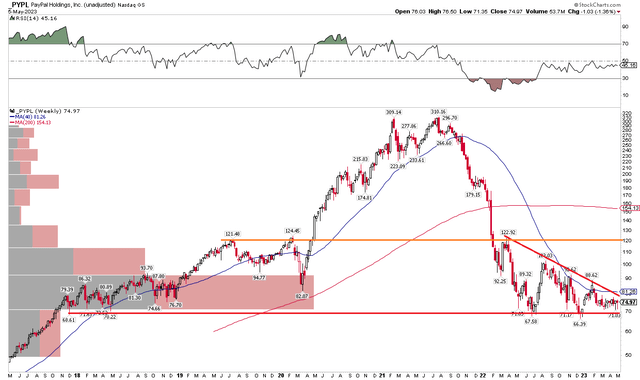

With an attractive valuation and fairly valued options before Monday evening’s earnings release, the chart is less sanguine. Notice in the graph below that shares are consolidating in a descending triangle pattern. The presumption is that price action will resolve in the trend of larger degree – which is lower in this instance. A breakdown under $65 would imply a measured move price objective at an absurdly low level based on the top of the pattern being near $120, so we need a more realistic support bogey.

There is longer-term support in the low to mid-$40s that likely attracts buyers. But a move above $90 would help support the case for a bullish breakout from the pattern. Also, the $81 level represents the flat 200-day moving average (the 40-week moving average is essentially the same thing), so rising above that on a weekly closing basis would be bullish.

PYPL: Bearish Descending Triangle, Support Near $66, $89 Resistance

The Bottom Line

I am bullish on PYPL based on valuation, though I recognize some risks with the chart.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.