Summary:

- PayPal’s stock has surged nearly 30% since September, driven by solid financial performance, positive catalysts, and strong management execution, maintaining a ‘Strong Buy’ recommendation.

- The stock’s robust technical setup, including trading above key moving averages and strong institutional participation, supports continued momentum and potential for further rally.

- PayPal’s aggressive R&D spending and strategic partnerships, such as with Mollie and Ooredoo, are expected to drive future growth and enhance customer value.

- Despite competition and psychological market barriers, PayPal’s attractive valuation with a P/E below 20 and a fair share price estimate of $107 presents a compelling investment opportunity.

hapabapa

Introduction

PayPal (NASDAQ:PYPL) has been performing quite well since September when I shared my ‘Strong buy’ recommendation. The stock gained almost 30%, while the S&P 500 grew by 9%. The solid bullish run was backed by fundamental factors, and I see several positive catalysts that might help the stock to climb higher. The financial performance is solid, and the management delivers on its turnaround promises. Growth initiatives look good, and the company is firmly positioned to build more value for shareholders. PYPL’s valuation is still quite attractive, and I maintain a ‘Strong buy’ recommendation.

Catalysts analysis

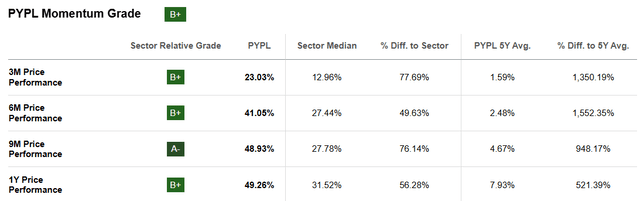

The stock currently trades at this year’s record levels, and the momentum is solid. The stock currently boasts a 4.89 ‘Strong Buy’ rating from SA Quant. Quant ratings have a solid record of success, and accelerating momentum might also be quite a robust catalyst for further rally.

SA

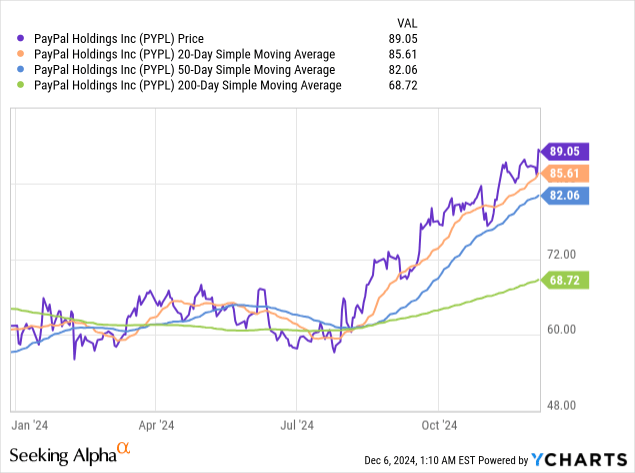

Strong momentum is likely to be supported by a robust technical setup. The share price currently trades above all three major moving averages, including the 200-day SMA. The 50-day and 20-day SMAs are upward sloping, which confirms strengthening trends. High-volume up days during recent breakouts highly likely indicate strong institutional participation.

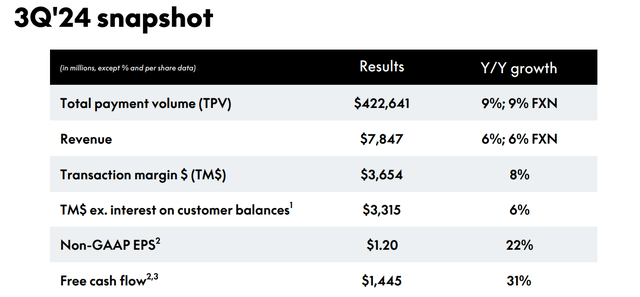

Strong momentum and robust technical setup are likely to be solid share price tailwinds because PYPL’s fundamentals are continuously improving. The Q3 earnings release was solid with a 5.8% YoY revenue growth with an above 200-bps expansion in the operating margin. The company delivered solid growth on key business metrics including the TPV and transaction margin.

PYPL

The above figures suggest that the new management’s pivot to improving flexibility and experience for customers pays off. The R&D spending also remains robust at almost $3 billion on a TTM basis. In my opinion, such an aggressive R&D spending means that PYPL’s customers will enjoy several new interesting features and products in the near future.

One of the notable product features rolled out recently is the new pooling feature aimed to simplify group expenses. The product is available in the U.S., Germany, Italy, and Spain. The feature looks interesting as it allows users to easily collect and manage funds with their friends or family for group expenses. I am positive about everything that creates value for customers because PayPal’s user-friendly approach is the company’s core strength that allowed it to scale up to one of the largest players in the industry.

PayPal’s strong brand and reputation also allow the company to strengthen its ecosystem through partnerships. Partnership with Mollie that was announced in late November looks interesting. The development is positive for the company because the partnership will result in integrating PayPal as a payment option for Mollie’s marketplace customers. Mollie is one of the fastest growing European unicorns, which makes the partnership quite promising.

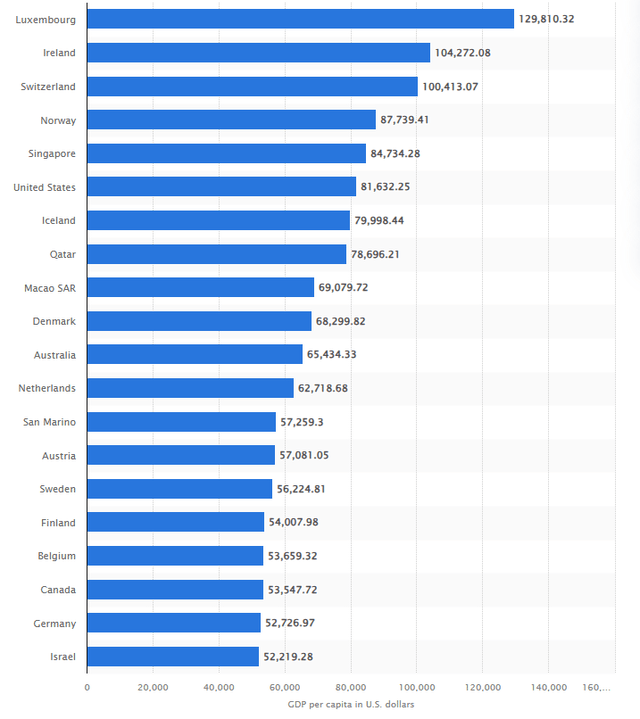

Statista

Another interesting partnership that might unlock a new growth driver for PYPL is its partnership with Qatari fintech company Ooredoo. The collaboration will enable Ooredoo Money users to transfer money between their wallets and PayPal accounts. The partnership also provides access to PayPal’s global commerce capabilities for Qatari consumers and small businesses. Qatar is a relatively small market from the population perspective, but the country boasts one of the highest GDP per capita. Moreover, successful expansion to the Qatar market will highly likely be helpful to expand into other oil-rich Middle East markets like Saudi Arabia or the UAE.

As we see, the management works hard on delivering on its promises related to focusing on profitable growth and maximizing value for customers. New partnerships look interesting, and the company’s massive $3 billion R&D budget suggests that we will highly likely see more new products and features rolled out in early 2025.

Valuation analysis

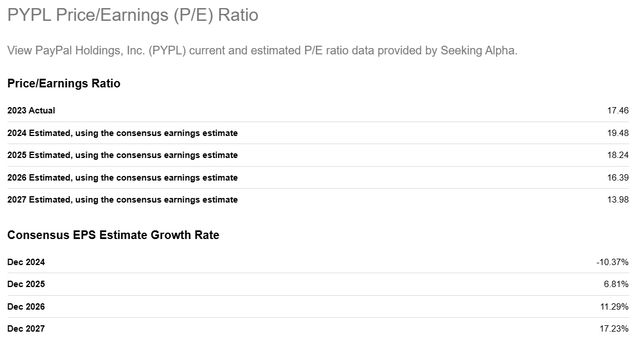

PayPal looks really cheap from the perspective of the P/E ratio. The current P/E is below 20, and the metrics is expected to shrink significantly over the next few years. Therefore, the projected P/E ratio’s trajectory suggests that PYPL is very attractively valued.

SA

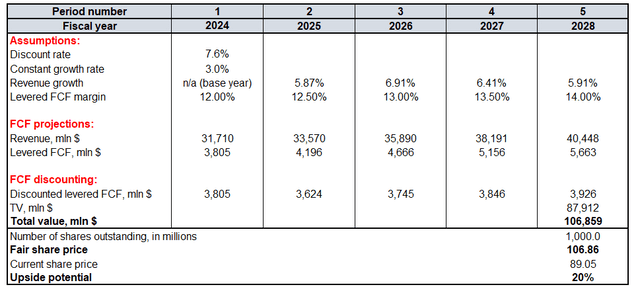

The DCF model will help in determining the upside potential based on the fair value estimation. PayPal’s WACC is 7.6%. The company’s FY2024-2026 revenue projection is covered extensively by Wall Street analysts (31 analysts), which makes consensus a reliable source. For FY2027-2028, a steady revenue growth deceleration is incorporated. The levered FCF margin is almost 12%. Since the management focuses on profitable growth (and delivers on its promises), I expect the FCF margin to expand by at least 50 basis points annually. The constant growth rate is conservative at 3% and Seeking Alpha suggests that there are 1 billion shares outstanding.

Calculated by the author

The fair share price estimate is $107. This is around 20% higher than the last close, and I find such an upside potential quite attractive.

Mitigating factors

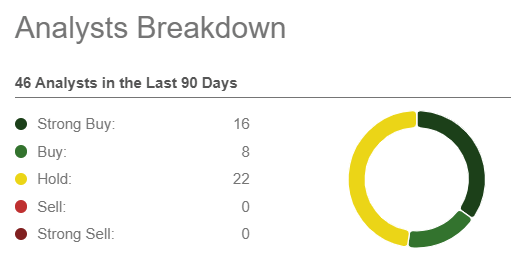

A notable portion of Wall Street analysts is not so firmly confident in further rally. The projected upside compared to the consensus target price is tiny, and almost half of the total 46 analysts consider PYPL a ‘Hold’. Quite cautious opinions from prominent Wall Street analysts might be the obstacle for further rally.

SA

Moreover, PYPL will need to overcome a significant psychological barrier to reach my $107 target share price. Market psychology can sometimes be even more influential than fundamentals and valuation estimates. If PYPL fails to break through the $100 resistance level after several attempts, it could lead to considerable investor disappointment, potentially leaving the stock stuck in the $90-$100 range for several months or even quarters.

Intensifying competition appears to be the biggest business risk for PYPL. The largest technological companies like Apple, Google, and Amazon already have notable footprints in the industry. Apart from these giants, new disruptive players like Block (SQ) also enter the market. PayPal needs to be highly committed to innovation and improving customers’ experience in order to protect its market share, which is inherently challenging.

Conclusion

I think that PYPL still presents a compelling investment opportunity as the stock is still attractively valued and its improving fundamentals are supported by the strong momentum and favorable technical setup.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.