Summary:

- PayPal’s Q3 earnings exceeded EPS expectations. The Fintech saw growth in active accounts, reversing a six-quarter decline.

- The Fintech generated $1.5B in free cash flow, showing 35% Q/Q growth, and expanded its free cash flow margin to 20%.

- Total payment volume is driven chiefly by branded and unbranded checkouts. Transactions per account are also growing, indicating robust platform engagement.

- PayPal’s valuation remains attractive, trading at just 17X forward earnings.

BlackJack3D

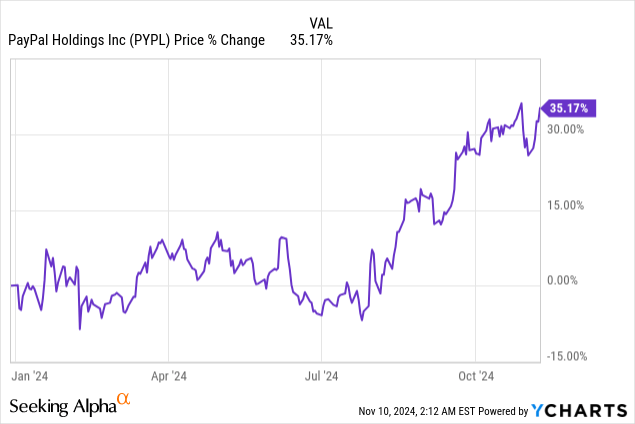

PayPal (NASDAQ:PYPL) made a good impression with its third quarter earnings sheet at the end of October: the Fintech reported better than expected revenue and non-GAAP earnings and saw an uptick in customer accounts which was a weak spot in recent years for PayPal and which marks an inflection point for the business. The company also generated once again a very healthy level of free cash flow and FCF margins expanded to 20% in the third-quarter. In my opinion, PayPal offers exceptional value for long term growth investors and I believe that the risk profile is skewed to the upside, especially with PayPal seeing growth in its active account base!

Previous rating

I rated PayPal’s shares a strong buy in August — Hard Not To Love At This Price — due to the Fintech’s persistent free cash flow strength and laudable stock buybacks. PayPal was on track to return 100% of this year’s free cash flow back to shareholders and the Fintech achieved about 80% of this target in the first nine months of the year. PayPal also raised its earnings guidance, suggesting that investors are underestimating PayPal’s earnings potential. Since PayPal‘s business continues to develop in the right direction in Q3’24, I maintain my strong buy rating for the Fintech’s shares.

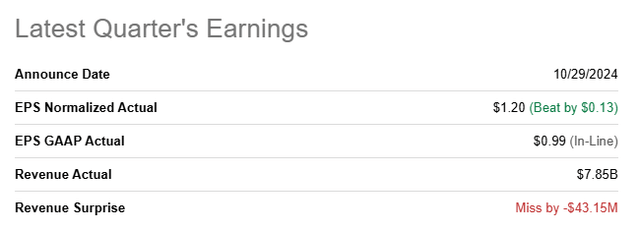

PayPal beat estimates

PayPal reported better than expected earnings in Q3, but missed top line predictions: the Fintech earned $1.20 per-share in adjusted earnings which beat the consensus estimates by $0.13 per-share. The top line came in at $7.85B which missed the average prediction by $43M.

Seeking Alpha

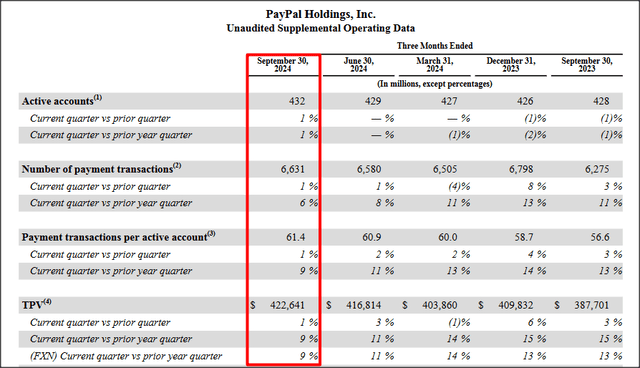

PayPal reported its first quarter of growth (+1% Y/Y) in terms of active accounts since Q1’23, meaning the payment processing company successfully reversed a six-quarter streak of account losses in the September quarter. As of the end of the September quarter, PayPal had 432 million active accounts in its ecosystem.

Additionally, PayPal benefited from 9% year-over-year total payment volume/TPV growth. TPV quantifies the total amount of transactions passing through a payment ecosystem and it is a key metric for financial services companies and Fintech start-ups. Further, PayPal is seeing a higher number of payment transactions per account which is also a healthy indicator of platform expansion. Payment transactions per account increased to 61.4 in Q3’24, showing 9% Y/Y growth as well.

PayPal

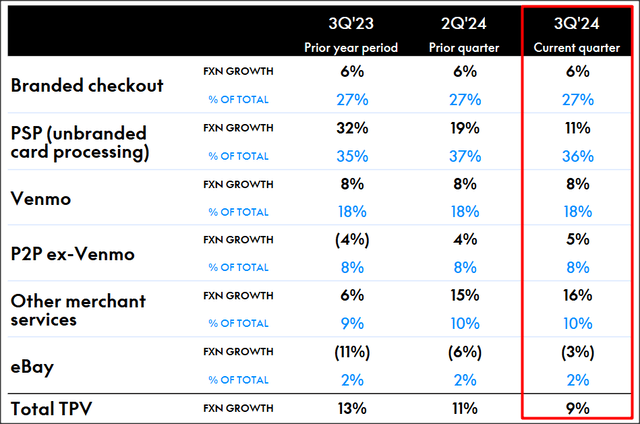

Total payment volume is driving by a number of platforms for PayPal, including (PayPal)-branded checkouts, unbranded checkouts and Venmo, for the most part. Branded checkout and PSP (unbranded checkout) are seeing by far the biggest growth in the PayPal ecosystem. Since PayPal is often used to complete commerce transactions online, the Fintech is still a preferred choice for many consumers. Therefore, PayPal’s total payment volume growth is fundamentally attached to the expansion of the e-Commerce industry.

PayPal

Once again, PayPal excelled in terms of its free cash flow. The Fintech earned $1.5B in free cash flow in the last quarter, showing 35% quarter -over-quarter free cash flow growth. The free cash flow margin was a healthy 20 % and showed 6 PP expansion Q/Q.

|

PayPal |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

Growth Y/Y |

|

Revenues ($M) |

$7,418 |

$8,026 |

$7,699 |

$7,885 |

$7,847 |

6% |

|

Adj. Free Cash Flow ($M) |

$1,911 |

$774 |

$1,856 |

$1,140 |

$1,540 |

-19% |

|

FCF Margin |

26% |

10% |

24% |

14% |

20% |

— |

(Source: Author)

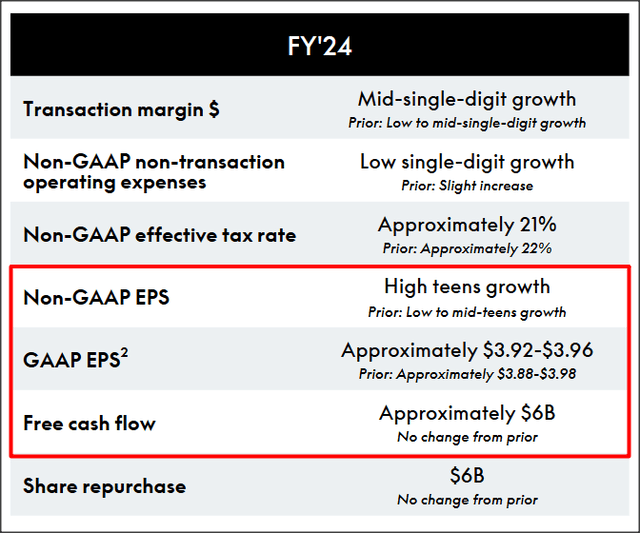

Guidance for FY 2024

PayPal is now guiding for high-teens EPS growth in FY 2024 (previously: low to mid-teens), on an adjusted level, and the Fintech slightly revised its GAAP EPS outlook slightly upwards: the Fintech now expects $3.92-3.96 per-share (previously: $3.88-3.98/share) in earnings and $6.0B in free cash flow/stock buyback this year (unchanged).

PayPal

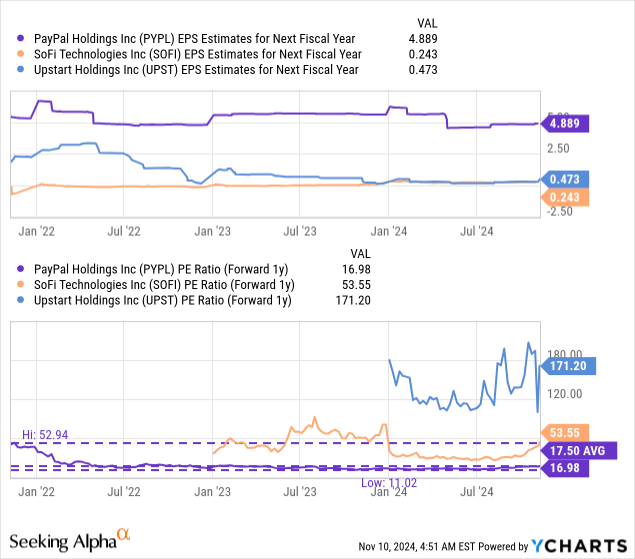

PayPal’s valuation

PayPal has been struggling on a number of fronts in recent years: it had high operating costs, suffered from a declining account base and failed to excite investors with its growth story. As a result, PayPal’s shares continue to be priced at a depressed earnings multiplier relative to the Fintech’s history: PayPal trades at just 17X forward earnings (FY 2025). In FY 2022, shares of PayPal have traded as high as 52X forward earnings, driven by a pandemic boost. SoFi Technologies (SOFI) is much more of a growth play than PayPal as the Fintech is expected to grow its EPS much faster. Upstart (UPST), which is another lending-focused start-up, is too expensive for me with a forward P/E of 171X, despite an improving profitability profile.

In my last work on PayPal I stated that I saw a forward P/E ratio of ~20X as fair given that PayPal owns such a large payments platforms and generates such a high amount of recurring free cash flow. With PayPal now returning to growth in terms of its active accounts as well, I believe a ~20X forward P/E ratio may actually be conservative. However, if we remain conservative and apply a 20X earnings multiplier to next year’s consensus estimate of $4.89 per-share, shares of the Fintech could have a fair value of $98 (+$8 per-share compared to my previous estimate).

What provides support here, in my opinion, is that PayPal repurchases a ton of its shares. For its current fiscal year, the payment processing company has guided for $6.0B in free cash flow of which $4.8B have already been returned January through September through stock buybacks (80% of the estimated full-year total).

Risks with PayPal

The biggest risk for PayPal is a potential decline in free cash flows if customers migrate to other Fintech platforms, many of which also offer fully functional digital wallets. Since the numbers on the PayPal platform increased Q/Q in Q3’24, this is much less of a concern for me after the Fintech’s third-quarter earnings. What would change my mind about PayPal is if the company were to see a decline in either its total payment volume or transactions per account growth. These are the two most important metrics for PayPal’s payments platform, in my opinion, and a deterioration here would likely spell trouble for growth investors.

Final thoughts

PayPal is growing its active accounts, its earnings and its free cash flows which I believe underscores the bullish investment case for the Fintech. PayPal is still very much underrated, in my opinion, as the third-quarter earnings sheet has shown: active accounts are growing, TPV is growing at 9% Y/Y and free cash flows surged 35% Q/Q to $1.5B. As a result, I believe PayPal continues to offer exceptional value to long term investors in the Fintech market and I am raising my fair value estimate to $98. With the Fintech returning to account growth in Q3’24, I also believe that PayPal has achieved a crucial inflection point in its business and that the risk matrix has improved here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.