Summary:

- PayPal shares have dropped significantly in the past few years due to changes in outlook and high multiples.

- Competition in the digital payments industry poses a threat to PayPal’s core business.

- Despite good fundamentals and attractive pricing, caution is advised in investing in PayPal due to structural risks and market unpredictability.

hapabapa

PayPal (NASDAQ:PYPL) shares have already accumulated a drop of 80% since their peak in mid-2021 and around 49% in the last 5 years. The factors responsible for this drop were a mix of factors, but mainly the changes in the outlook that were incorporated into the prices (multiples).

Unlike more bullish analysts, who believe that the thesis is a bargain and should be considered an opportunity, I believe that this repricing of PayPal was correct and that the company really shouldn’t be traded at high multiples, given that its main service is becoming a commodity.

As a disclaimer, although I don’t think the company is super attractive, I understand that at current prices the investment in the thesis can generate good results in the medium term, considering that the company has good quality and interesting results, which at current prices don’t need to achieve aggressive growth to have a good free cash flow yield.

PayPal Core Business Is Very Threatened

The payments’ industry has changed a lot over the last few years and in various parts of the world, including emerging markets. The most obvious, and most talked about, is Apple (AAPL) pay, which already has more than 50 million users in the U.S. and with growing projections and continuous innovation. At WWDC 2024, Apple announced tap to cash, which, along with the company’s focus, is expected to improve in aspects such as flexibility, customization, and security, in addition to already having a complete ecosystem.

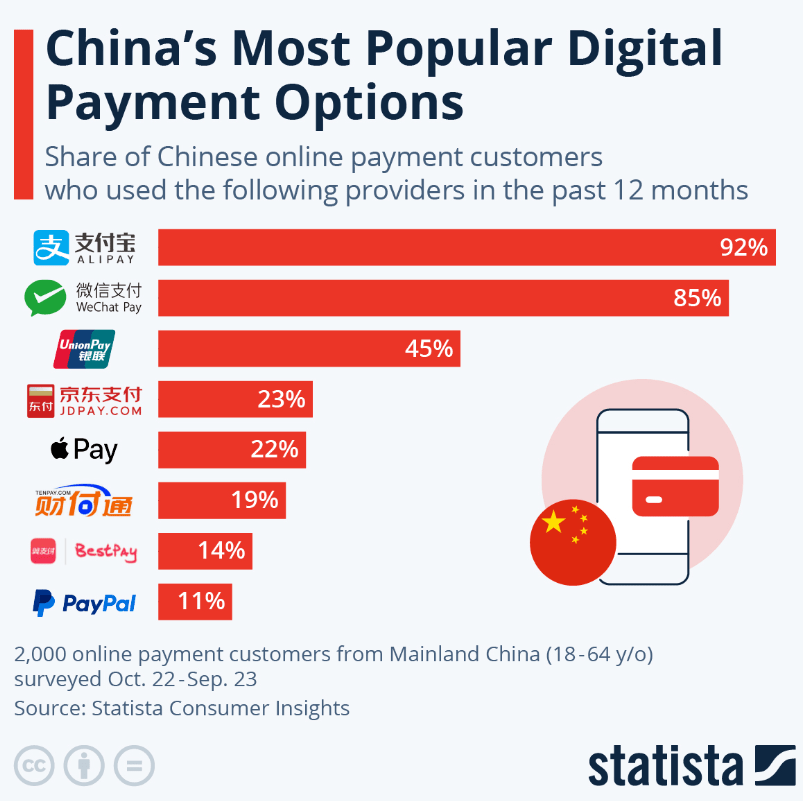

Apple Pay also has an interesting share in China, a very advanced country in the digital payments segment, and is among the benchmarks for this sector. There, PayPal appears to be the seventh most popular, being overshadowed by WeChat Pay and Alipay (BABA). In India, this market is also very dynamic, with PayPal appearing in a better position in the ranking, but still behind Indian and other American tools such as Google Pay (GOOGL) and Amazon Pay (AMZN).

Statista

If you think that this trend is exclusive to developed countries, you’re wrong. In Brazil, Pix – created by the Brazilian Central Bank in 2020 – has already become the most relevant means of payment in terms of monthly volume (surpassing even credit cards), which is an instant digital payment method, at no cost to the user and which can be made through various financial institutions via cell phone numbers, e-mail, QR codes and the like.

The bottom line is that the digital payments market is evolving very quickly and competitively. A number of companies want a piece of this market, including digital methods shaped by the government and central banks, which also have specific interests due to traceability and oversight. And with some pricing options available, the outlook for PayPal becomes very cloudy and could have many outcomes. With faster and faster payment methods competing for users, it is possible that: 1. there will be pressure on PayPal’s margins; 2. there will be an increase in the cost of acquisition per customer and also in the prospects for growing the customer base; 3. there will be an increase in the churn rate; 4. the company will have to reinvent itself and continue innovating not only in its core market but also in new services.

Even if all this uncertainty doesn’t materialize in the form of poor fundamentals in the future, it must somehow be reflected in share prices.

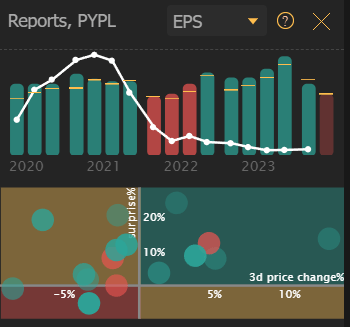

Fundamentals Up And PayPal Stock Down

When we look at the EPS of PayPal’s last few quarters, we see that most of them were positive and above market estimates (indicated by the yellow line). Even so, the stock price (indicated by the white line) showed a free fall. This fall can be explained by several factors, from the macroeconomic scenario to some micro factors in quarters where PayPal may have disappointed the market, such as in customer growth and the like. But I think it’s possible to summarize this fall in one sentence: PayPal shares were mispriced.

TrendSpider

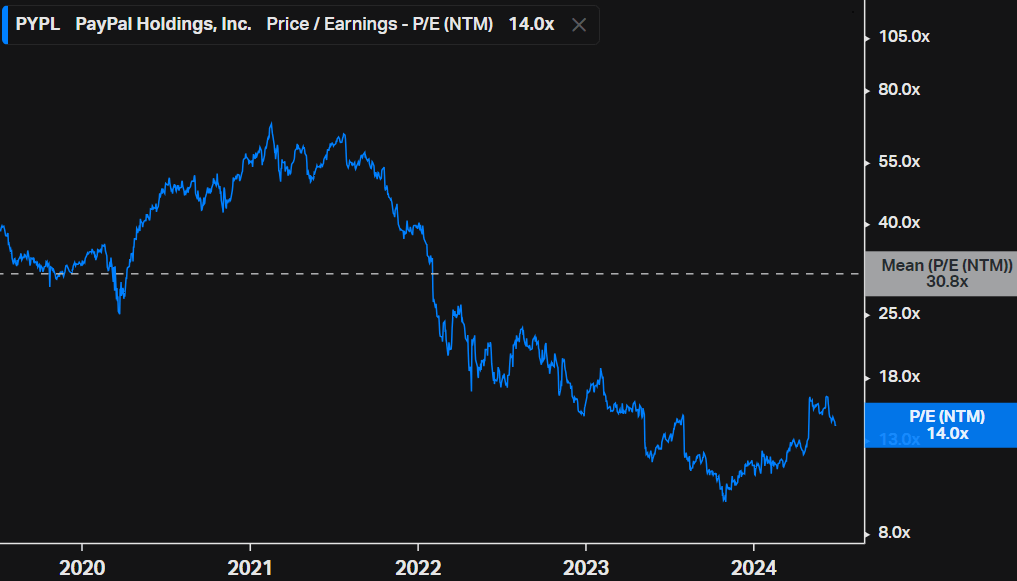

If the EPS even went up, the fall in the shares is explained by strong pressure on the company’s multiples. At the same time that the shares were trading close to their all-time high in 2021, their forward price-to-earnings ratio was over 70x. For a company that is worth 70x its annual profit for the next 12 months to remunerate its shareholders above the risk-free rate, there needs to be very significant growth, something like a trigger that makes it double its profit or at least achieve a consistently high CAGR.

And that wasn’t the case with PayPal, as much as the company did reasonably well on the fundamentals, that wasn’t enough to maintain a CAGR of profit or operating indicators that justified such a multiple. I therefore believe that the market made a mistake at the time. Consequently, this invalidates comparative analyses with its recent history, the shares being traded today at a much lower multiple than their average over the last 5 years means nothing since the outlook has changed and this previous multiple was inflated.

Koyfin

The Brighter Side of PayPal

The good thing is that fundamentally, PayPal is doing well for a company that trades at 14x earnings. In Q1, the company was able to beat its guidance and maintain healthy revenue growth, around 10%, and operating margin with a certain evolution (reaching 18.2%), which already allows it to generate shareholder value. Despite this, Q1 2024 showed a 1% decrease in active accounts, and as much as this was offset by the increase in transactions and the like, it is a very bad sign, indicating that PayPal’s business is at a more mature stage.

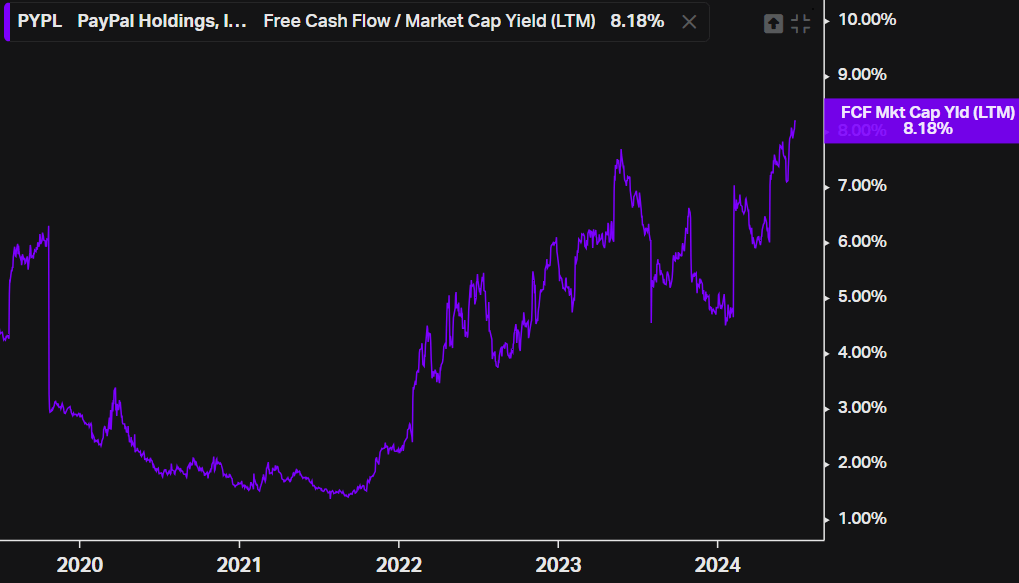

Returning to the positive side, PayPal’s business model is asset-light and very profitable, which allows for incredible free cash flow generation. In Q1, adj. free cash flow was $1.85bn, with the guidance of around $5bn for the year 2024, indicating a price-to-FCF of ~12.5x and a free cash flow yield (free cash flow/market cap) of 8%. If the company manages to remain evolving and competitive in this market – i.e. not be disrupted and continue to show even modest growth – 8% is already an excellent level and should turn into a good investment.

Koyfin

A simple reverse DCF (done using online calculators) confirms that the assumptions built into the price of PayPal today are conservative. An FCF growth rate of 6% in the first decade, declining to 5% in the terminal stage and with a discount rate of 11%, would arrive at a value very similar to the price of PayPal stocks today. Therefore, for those investors who believe that PayPal has the capacity to maintain growth greater than this, it would be possible to capture returns of over 11% per year at current prices.

Management also seems to be looking to solidify its moats, highlighting in the presentation some priorities for the year 2024 that I find interesting, such as creating more value for customers (ideal for mitigating competition) and improving operational efficiency.

PayPal’s Investor Relations

Everything Has A Price, But I Choose Caution

Summing up everything presented in the previous sections, it can be seen that: 1. PayPal’s market landscape is extremely dynamic and competitive; but 2. PayPal is still a company with good fundamentals and an attractive price.

At current prices, PayPal is an interesting play, more likely to be a value play than a value trap. Even so, I’m choosing not to give the company a buy rating, but rather a hold.

At a delicate time in the market, with very low predictability, caution is important, the risk of PayPal seems to me to be a structural risk, where it will be challenging and will require resources and perhaps even luck to continue growing at an interesting rate and even though it is possible and likely that growth of 6% per year will be achieved in the short and medium term, I don’t think it’s worth the risk of a possible disruption in the coming decades. I usually look for positions to carry into the long run.

Among the factors that could make me upgrade this rating, I would highlight the greater clarity of this market, as well as a better perspective on how management is dealing with this problem since there are some scenarios where PayPal manages to solidify its moats and become a company that not only has a good price and reasonable prospects but is also strong enough to mitigate these threats.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.