Summary:

- PayPal’s Q2 earnings report led to a sell-off, despite in-line EPS, a revenue beat, and strong guidance.

- Concerns about declining active accounts and negative free cash flow contributed to the sell-off.

- The market undervalues PayPal stock compared to similar companies like Shopify, presenting a potential buying opportunity.

Justin Sullivan

PayPal (NASDAQ:PYPL) just reported its Q2 2023 earnings, and shares plunged after the bell on August 2. When I look at PYPL, it has a lot of resemblance to Meta Platforms (META) regarding its chart prior to META’s move upward. In just over two years, PYPL has declined from its highs of $308.58 by -79.66% (-$245.83), and over the past year, PYPL has declined by -35.31%. Despite being largely profitable, shares of PYPL have been stuck in a perpetual downtrend, and no matter what they do, shares have ultimately declined. Based on its valuation, PYPL looks like a deep-value play, and investors may have been presented with another long-term opportunity this past week. I wouldn’t be surprised to see a rally going into the end of the year if PYPL delivers on its outlook.

Seeking Alpha

Despite in-line EPS, a revenue beat, and strong guidance shares of PYPL sold off after earnings

This was not the reaction many investors wanted to see as shares of PYPL plunged after earnings. PYPL delivered in-line EPS of $1.16 and a revenue beat of $30 million as revenue grew YoY by 7.4% to $7.3 billion in Q2 2023. PYPL saw its total payment volume (TPV) increase by 11% to $376.5 billion YoY, while its payment transactions increased to $6.1 billion, a 10% increase. Two negatives stood out, in my opinion, and those were PYPL’s metrics and negative free cash flow (FCF).

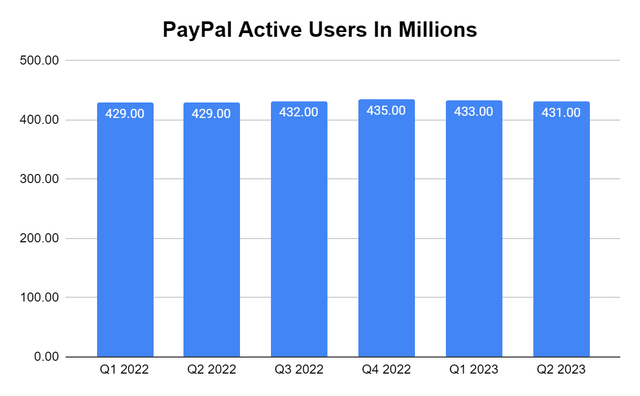

Some may be questioning PYPL’s moat due to its metrics. Over the previous six quarters, PYPL is seeing lower margins on its total take rate, transaction take rate, and transaction margin. PYPL has also experienced its second consecutive quarter of active account losses. While the number of active accounts hasn’t declined by much, it’s overshadowing the 10% YoY growth in payment transactions and the 11% YoY growth in total payment volume. The decline in active users is minimal, but it doesn’t paint a strong picture because some could extrapolate this into a story where this becomes an ongoing trend that decreases the number of transactions conducted on the platform and, ultimately, the TPV.

Steven Fiorillo, PayPal

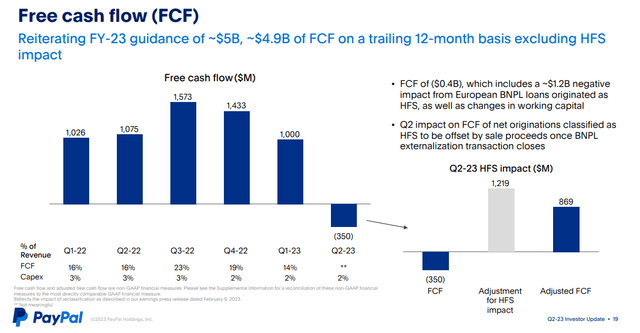

The other aspect that I feel could have contributed to the decline in share price is the negative FCF in Q2. While there was a good reason, as PYPL recognized a -$1.2 billion impact from European buy now pay later (BNPL), the -$350 million in FCF could have optically impacted PYPL. The combination of lower active user accounts and negative FCF in Q2 could have certainly been contributing factors to the sell-off, regardless of guidance and TPV.

PayPal

PayPal sold off and I think there is still an opportunity just as I did with Meta Platforms

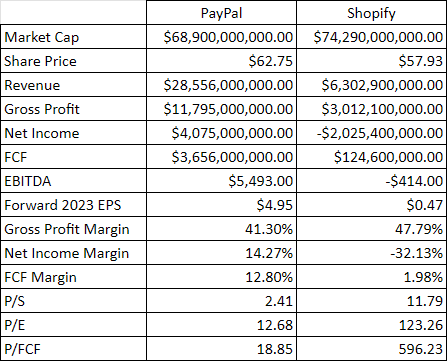

While it looks like investors are losing faith in PYPL, I think the market just gave everyone another opportunity to purchase undervalued shares. Before going into the aspects I like about PYPL, I want to show how the market values companies differently. PYPL and Shopify (SHOP) were both pandemic standouts that are well off their highs. When I look at these two companies on a side-by-side basis by the current TTM numbers, something seems off. The market is valuing SHOP as a larger company by $5.39 billion, yet PYPL generated 77.93% more revenue, 74.46% more gross profit than SHOP, and $4.07 billion in net income compared to SHOP losing over -$2 billion. SHOP trades at a P/S of 11.79 compared to 2.41x for PYPL and 123.26x 2023 earnings compared to 12.68x for PYPL. How the market values companies and what investors are willing to pay for companies is mindboggling sometimes, as PYPL is a massively profitable company buying back shares, and SHOP is unprofitable, generating a fraction of the revenue that PYPL does, yet it’s a larger company.

Steven Fiorillo, Seeking Alpha

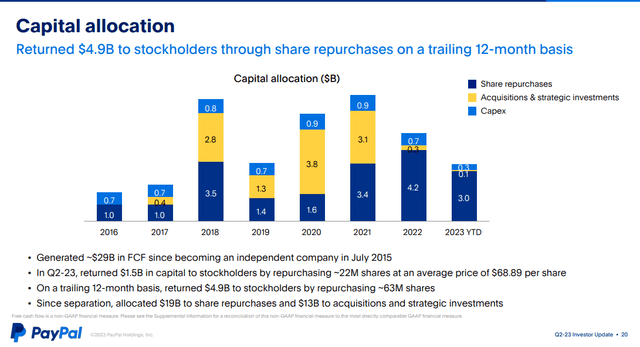

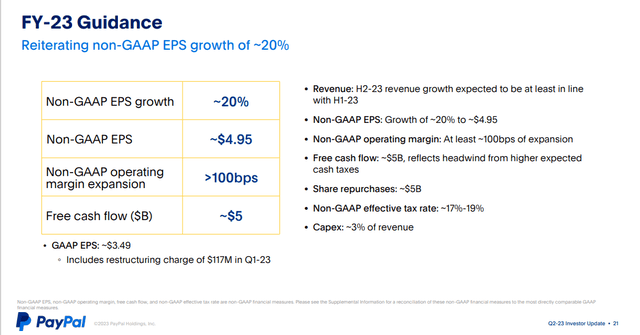

Despite the FCF loss in Q2, PYPL still projects that it will generate $5 billion in FCF in 2023. PYPL has a strong track record of returning capital to shareholders through buybacks, and in Q2, PYPL repurchased 22 million shares at $68.89 per share. Every year since 2016, PYPL has repurchased at least $1 billion worth of shares and is projecting to allocate $5 billion in buybacks in 2023, meaning that another $2 billion in buybacks will be conducted in Q3 and Q4. Based on the current market cap, PYPL is projected to repurchase 2.9% of the float in the next five months.

PayPal

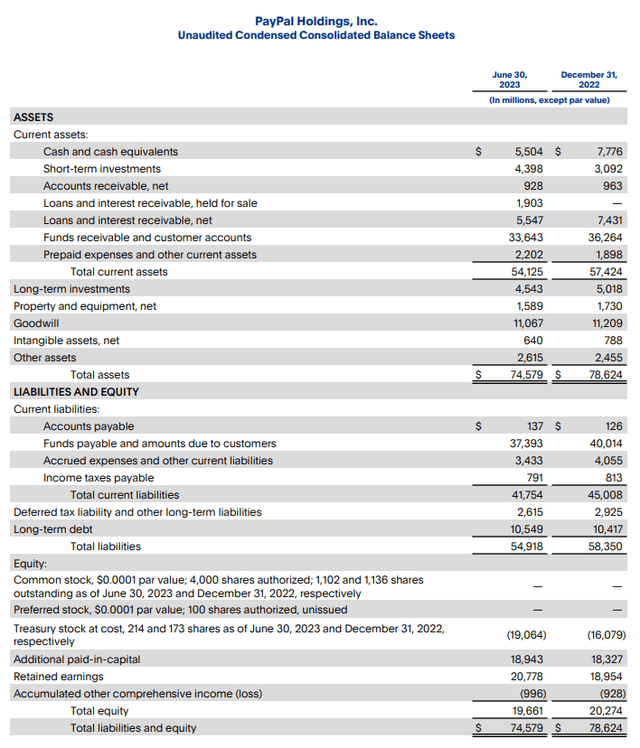

In addition to generating billions in FCF and buying back shares, PYPL has a strong balance sheet with a large war chest. PYPL has $9.9 billion in cash on hand, with an additional $4.54 billion in long-term investments. PYPL has $14.45 billion in total on-hand liquidity, which dwarfs the $10.55 billion of debt on the balance sheet. PYPL could eliminate 93.86% of its current cash debt and 100% of its debt by tapping into its long-term investments. From a business perspective, PYPL is an unlevered company with a fortress balance sheet.

PayPal

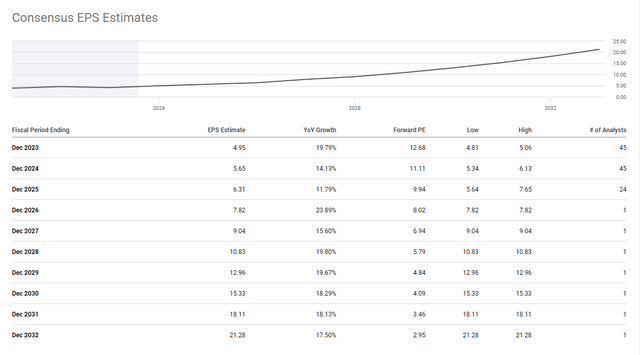

The current valuation of PYPL is shockingly low to me. PYPL reiterated that in 2023 they would generate $4.95 in Non-GAAP EPS and $5 billion in FCF. Looking at the analyst estimates, 45 analysts expect PYPL to generate $4.95 in 2023 EPS, and 45 analysts are projecting $5.65 in 2024 EPS. There are also 24 analysts who are projecting that PYPL will generate $6.31 in 2025 EPS. This would mean that from the close of 2022 thru 2026, PYPL would add $4.21 to its EPS (200.47%) as it would have increased from $2.10. The analysts are projecting that PYPL will grow its EPS in 2023 by 135.71% YoY, then by 14.14% YoY in 2024, and by another 11.68% in 2025. Today you’re paying 12.68x 2023’s earrings, 11.10x 2024 earnings, and 9.94x 2025 earnings. When you factor in the TTM FCF, you’re paying a 18.85 multiple, and if you look at the $5 billion projection for 2023, you’re paying 13.78x PYPL’s FCF on the current valuation.

PayPal

Seeking Alpha

Conclusion

From a valuation perspective, shares of PYPL look inexpensive. I think the sell-off is an opportunity, and lower active accounts overshadowed PYPL’s financial power. Today you’re paying less than 15x 2023’s FCF and 11.10x next year’s earnings. PYPL will allocate another $2 billion of capital toward buybacks before the year is over, and will probably continue allocating capital toward buybacks in the future, just as they have done every year since 2016. When I look at how the market values PYPL vs. companies such as SHOP, then what the projections are for PYPL’s future EPS, it makes me believe there is an arbitrage opportunity for shares of PYPL if you have time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.