Summary:

- PayPal Holdings, Inc. beat expectations for Q3 earnings, reporting $1.1B in free cash flow.

- The company returned a significant portion of its free cash flow to shareholders through stock buybacks in FY 2023.

- PayPal’s non-GAAP operating income margin sequentially improved.

- Despite losing accounts in Q3 2023, PayPal’s strong free cash flow and profitability provide fundamental value to investors.

- Shares are very attractively valued, especially in relation to other U.S.-based FinTechs.

chameleonseye

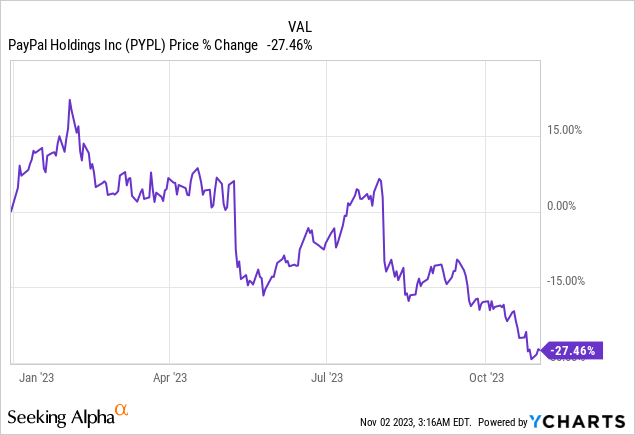

PayPal Holdings, Inc. (NASDAQ:PYPL) delivered a solid Q3 earnings sheet that once again highlighted the Fintech’s value as a free cash flow play. PayPal beat top line and bottom line expectations for the third quarter and reported $1.1B in free cash flow (“FCF”) as well as aggressive stock buybacks. The company also saw an improvement in its non-GAAP operating income margin in Q3 ’23. PayPal did see continual headwinds in the terms of account growth in the third-quarter, but I believe that strong transaction per account growth and an incredibly attractive valuation near 1-year lows compensate for the risks of an investment in PayPal!

Previous rating

The key reason behind me downgrading PayPal after the submission of the second quarter earnings sheet was that the Fintech lost a considerable amount of customer accounts: PayPal Q2 Earnings: A Disaster. PayPal’s active account total decreased by 2M to 431M accounts by the end of Q2’23.

Account growth headwinds and a second consecutive decline in its non-GAAP operating margin were reasons for me to at least be a bit more cautious about PayPal at the time. PayPal’s active accounts skidded again in Q3 ’23, but the Fintech continued to generate a ton of free cash flow as well as returned a ton of cash to shareholders. I am upgrading based on FCF strength, transaction momentum and valuation.

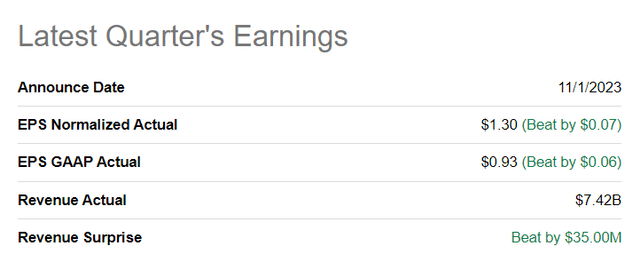

PayPal beats estimates

PayPal beat estimates for the third quarter in regards to both the top and the bottom line: EPS came in at $1.30, $0.07 per share better than the consensus prediction. PayPal also slightly beat in terms of revenues and delivered a beat of $35M.

PayPal’s Q3: The good, the bad and the ugly

A number of items stand out in PayPal’s Q3 earnings report that are worthy of a broader discussion.

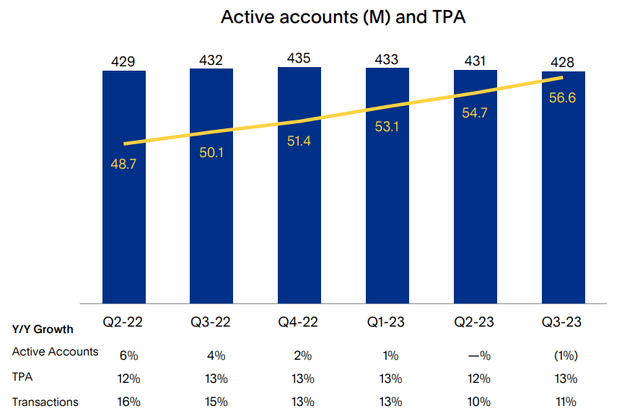

One number that caught my attention (again) was the number of net new active accounts which measures PayPal’s platform expansion. The Fintech reported 428M active accounts in its ecosystem, showing a decline of 3M compared to the previous quarter. However, transactions per account continued to rise strongly with remaining customers on the PayPal platform being more active and using the firm’s payment services more often: transactions increased 13% year-over-year to 56.6 per account.

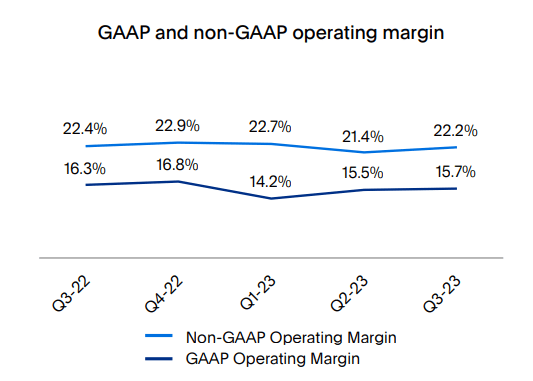

PayPal also saw a sequential non-GAAP operating margin improvement in the third quarter, partly due to a focus on cutting costs. The non-GAAP operating margin increased to 22.2% in Q3’23… which was the first increase since Q4 ’22. PayPal has guided for a non-GAAP operating margin of 75 basis points in FY 2023, a slight reduction compared to its previous forecast of a >100 basis point increase.

Source: PayPal

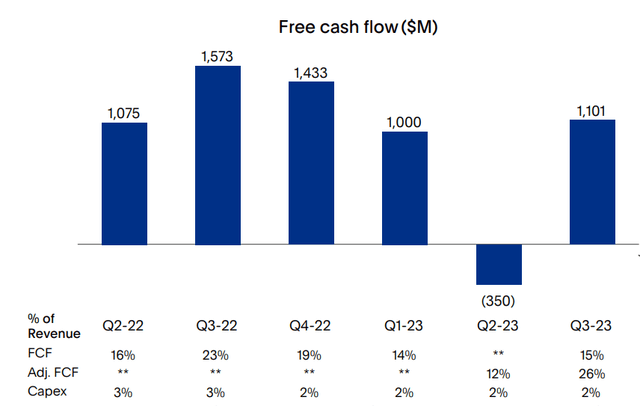

PayPal’s free cash flow

In the third quarter, PayPal generated $1.1B in free cash flow. However, PayPal sold some Buy Now, Pay Later (“BNPL”) loans which caused such loans to be classified as held for sale/HFS (in the amount of $810M). If it wasn’t for this specific accounting treatment, PayPal would have reported $1.9B in free cash flow for the third quarter.

Free cash flow is ultimately the main metric that owners should be concerned about because it quantifies the amount of cash that can be taken out of a business. With regards to free cash flow, PayPal is enormously profitable, and the Fintech generated an average free cash flow of $950M during Q3’23. The average adjusted FCF, which corrects for the HFS accounting, was $1.4B.

Enormous free cash flow return potential

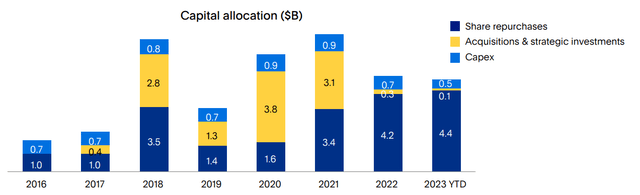

PayPal continues to be generous when it comes to returning cash to shareholders. In the last quarter, Q3’23, PayPal returned a total of $1.4B to shareholders as stock buybacks and the Fintech stuck with its previous guidance to spend approximately $5B on buybacks this year. In the first nine months of FY 2023, PayPal spent $4.4B on stock buybacks and the company is set to return the majority of its free cash flow to its shareholders this year.

The Fintech has guided for at least $4.6B in FCF in FY 2023 (a downgrade from $5.0B previously). Since PayPal generated approximately $1.0B on average in free cash flow quarterly in the last year, I believe PayPal will continue to buy back a ton of shares going forward… at an extremely attractive valuation as well.

PayPal’s valuation

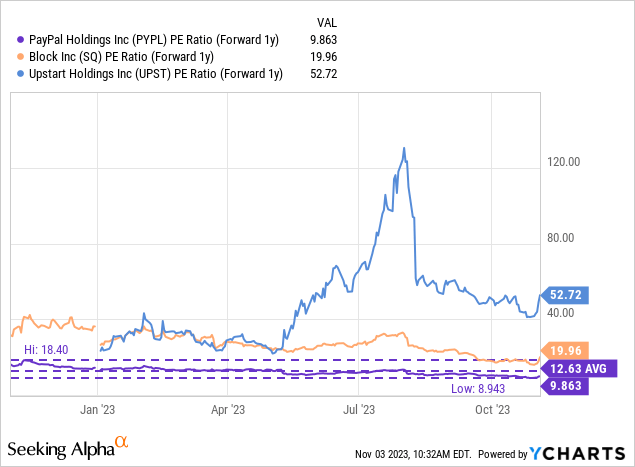

PayPal is growing more slowly than other Fintech start-ups as it operates a mature payment processing business at its core. PayPal is expected to generate 8% top line growth this year and 9% next year. However, PayPal is possibly best seen and understood as a free cash flow return play… that is trading at a very attractive valuation multiplier near 1-year lows.

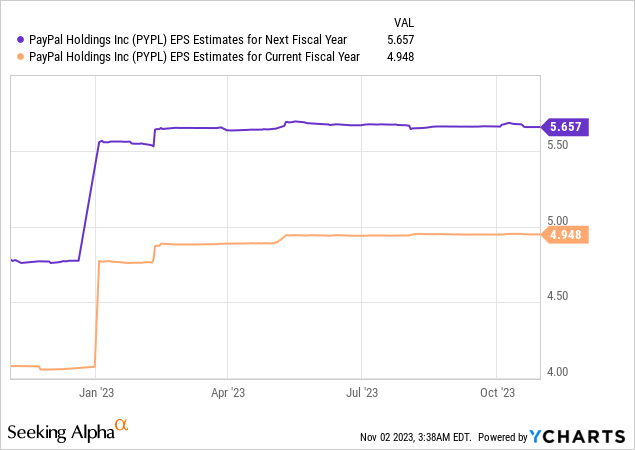

PayPal’s EPS estimates have been broadly stable and investors project that the Fintech could earn $5.66 per share in earnings next year, implying 14% Y/Y growth. I believe PayPal could trade at 14-15X earnings given its large account base and strength in free cash flow, implying a potential fair value range of $79-85.

In relation to other Fintechs, PayPal has an extremely low valuation: shares trade at only 9x FY 2024 earnings, well below the P/E ratios of higher-growth rivals in the Fintech space.

Although PayPal is growing at a slower rate than Fintech’s like Block, Inc. (SQ) or Upstart Holdings, Inc. (UPST), the valuation near 1-year lows is very attractive for long-term investors, in my opinion. Block, which is seeing great momentum in its Cash App business and which is moving towards operating income profitability, is valued at 20X earnings. Upstart has been a fast-growing start-up as well and analysts expect the Fintech to be profitable next year. The growth potential is reflected in a high P/E of 53X.

SoFi Technologies, Inc. (SOFI), which is not yet profitable (and which, therefore, doesn’t have a positive P/E ratio) just had an extremely strong quarter, and I rate the Fintech’s shares as a strong buy as well.

Risks with PayPal

There are risks regarding PayPal’s account base. PayPal lost 3M accounts in the third quarter, potentially raising concerns about PayPal’s product strength and rising competition from other Fintechs that are moving onto PayPal’s turf. What reduced risks in the third quarter, in my opinion, was that PayPal improved its non-GAAP operating income margin and that it remained a highly free cash flow profitable enterprise.

Final thoughts

PayPal Holdings, Inc.’s third quarter was decent, and although the Fintech lost a good number of accounts again, I am a bit more optimistic about the payment processing company due to the resilience of its free cash flow, high free cash flow return potential, non-GAAP operating income margin expansion, and growth in the number of account transactions. Additionally, I just believe that PayPal’s valuation is too cheap to be true and an unbeatable bargain: investors can buy a premier Fintech franchise that generates about a $1.0B per quarter in free cash flow at a P/E ratio of 9X. I believe the risk profile near 1-year lows is very attractive and further margin improvements could drive shares of PayPal into a new up-leg!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.