Summary:

- PayPal’s new management is refocusing the business to improve profitability.

- PayPal is diversifying into digital advertising and is in a prime position as merchants try to find alternative advertising channels.

- Fastlane can be the sustainable innovation PayPal needs to protect its market share against the competition.

- Unbranded business is a drag on PayPal’s margin, but things can turn around as PayPal turns its attention towards Small and Medium businesses.

- PayPal’s new management will emphasize profitable growth as the payment segment consolidates.

bizoo_n

Investment thesis

Financial Institution inefficiency, digitalization, and regulation, such as PSD2, led to the explosive growth of fintech, which proliferated into payments, insurance, asset and wealth management, and real estate. PayPal Holdings Inc. (NASDAQ:PYPL), the leading US fintech payment company, benefitted from this industry development by providing a secure and frictionless payment experience.

With competitors such as banks, big tech, and other fintech companies eager to grab a slice of this fintech segment, PayPal is at a crucial inflection point. It needs to respond or risk losing market share to its competitors.

The new management and its strategy to refocus PayPal on its core competence, emphasizing profitable growth, and PayPal’s stock selling at a 25% discount convinced me that PayPal is an excellent profitable growth stock you can buy right now.

New Management, Refocusing PayPal

PayPal has gone on an acquisition spree to improve its payment service, from Coupon to Logistics. However, these acquisitions have contributed little to what customers want from PayPal: secure and frictionless transactions between merchants and consumers. After its acquisition spree, the company did too many things at a time instead of focusing on sustaining innovation, such as improving its branded checkout experience by making it more seamless or frictionless.

PayPal’s New CEO, Alex Chriss, acknowledged this in his interview at the Morgan Stanley Technology, Media & Telecom Conference last March 4, 2024.

I’ll tell you a story. I started September 27. That was a Board meeting week. The week after, I’ve gathered all of our product leaders in Austin for a product review. We sat down. It was a three-day review. Four hours in, I stopped the meeting because we were reviewing 300 different items. And I said, “Not all of these are created equal. It’s time for us to focus.”

Dedicated to refocusing PayPal on its core competence, PayPal’s new management divested and is looking to divest some of these acquisitions. Alex Chriss remarks when asked how PayPal plans to improve its Transaction margin growth.

Then we have another component of really other products and services that we have that are a drag to the business. These are a combination of acquisitions that we’ve done over the course of the year, products that have been defocused and were, in many ways, orphaned throughout the organization. And we’re now looking at top to bottom as a leadership team and understanding, are they core to the business? Are they places that we should invest in? Are they areas that we should divest because they’re just not core anymore and they’re boat anchors to the business? And we will address those over the course of the year.

PayPal recently sold Happy Returns, a logistics company, to UPS (UPS), which indicates that it will sell any businesses that are dragging PayPal’s profitability and don’t contribute additional value to PayPal’s payment service.

I expect further divestment or restructuring of some of the acquisitions, now subsidiaries of PayPal, as the management continues refocusing its business to its core competence, which can improve PayPal’s profitability. Additionally, the new management will be particularly motivated as their stock compensation will be granted during a period of low valuation for a high-growth company like PayPal. Consequently, they have a solid incentive to improve PayPal’s profitability and growth.

PayPal Advertising Business

PayPal is processing approximately $1.5 trillion in transactions annually on its platform. Along with its huge data on customer’s buying behavior and merchants’ offerings, it is in a prime position to enter the digital advertising market.

With its 426 million active accounts and 36 million merchants in over 165 countries transacting inside its platform, It already has the required scale needed to make this business economically viable cause it no longer has to spend so much money trying to acquire new customers.

With digital advertising costs continuing to increase in recent years, merchants are trying to find alternative advertising channels, such as retail media. PayPal is in a prime position to take advantage of this trend and is leveraging all the data being processed on its platform by introducing ‘Smart Receipts,’ where they leverage AI to analyze the customers’ buying history or patterns and recommend products on its receipts through email or app, in which the customer might have a particular interest. Additionally, they have introduced PayPal’s Advanced Offer Platform; similar to how Meta (META) or Google (GOOG) handles its advertising business, PayPal is again leveraging AI to provide recommendations to consumers based on their buying patterns. For example, if you have historically purchased luxury beauty products, PayPal will recommend a product based on your buying interest. Moreover, unlike Google and Meta, they will charge merchants for advertisements based on performance, not impressions, providing tremendous value proposition for merchants trying to find other advertising channels. Lastly, PayPal can benefit from the ‘Network Effect’ as they scale this business.

Digital Advertising is forecasted to grow at 9.1% CAGR; PayPal, along with its high growth payment business potential, can tap into another high growth market.

Fast Lane

With 60% of online purchases still done on ‘Guest Checkout,’ PayPal introduced ‘Fast Lane,’ aiming to provide a more frictionless transaction. This feature takes advantage of customers who have used PayPal once during their past purchases to fill out their payment details automatically, resulting in more seamless transactions that provide a tremendous value proposition for merchants wanting to increase their checkout conversation among customers who want to keep their debit or credit card information private and customers who wish to have a smooth guest checkout experience.

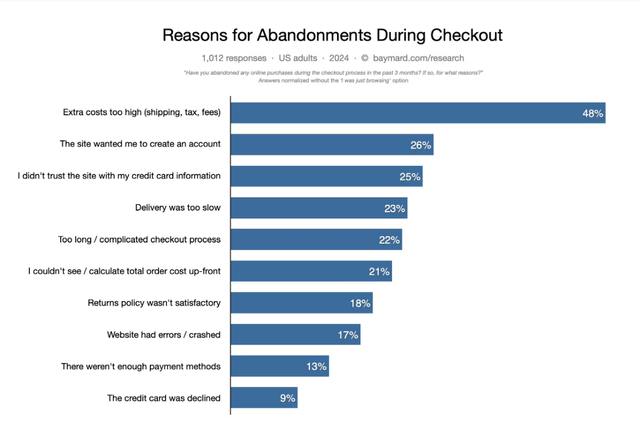

Reason For Abandonments During Checkouts – Baymard

According to research done by Baymard, 25% and 22% of the consumers abandoned during the checkout process due to not wanting to provide credit card information and the complicated checkout process, respectively. PayPal Fast Lane can provide a solution that is on par or better than the competition.

While I believe Fast Lane isn’t the “Breakthrough Innovation” that convincingly beats the competition and can gain market share, it provides the sustaining innovation PayPal needs to protect its market share against other fintech and big tech trying to steal market share from them by providing an even more frictionless online payment experience.

By enticing customers with rewards, PayPal is also leveraging Fast Lane to onboard consumers who want to avoid logging in to their PayPal account.

PayPal CEO Alex Chriss comments on how they will leverage Fast Lane to onboard customers on their platform at the Morgan Stanley Technology, Media & Telecom Conference.

What that does from a branded perspective, though, is that now allows us to follow up with that customer and say, “Hey, thank you for purchasing and doing the guest checkout through Fastlane. Did you know that if you actually used PayPal, you could have saved 2% or you could have gotten this reward?”

This is a smart move by PayPal; they are leveraging their innovation to onboard potential consumers onto their platforms, benefiting their advertising business.

Declining Gross Margin

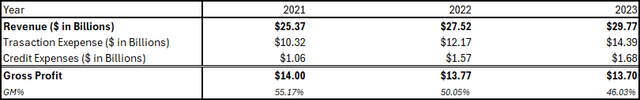

PayPal experienced a gross margin decline from 2021 to 2023, which resulted in the stock price plunging by 80% since peaking in 2021.

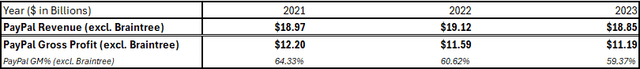

Author’s Compilation – PayPal’s Revenue and Gross Profit

Former PayPal CEO Dan Schulman attributed this to the increasing percentage of revenue from its unbranded checkout business, which mostly comes from Braintree, pressure on discretionary spending due to elevated inflation, and the slowing growth of E-Commerce transactions due to the easing of COVID restrictions.

While these factors, excluding Braintree, will continue to be a significant headwind for PayPal. They are expected to correct themselves as the economic cycle normalizes. We will instead focus on Braintree since this is where PayPal has control.

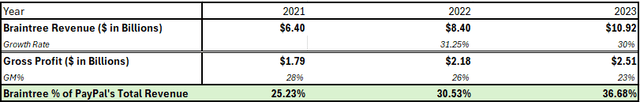

No public records of Braintree’s financial performance are available. Still, we will rely on a Forbes article and PayPal investor presentation to estimate its revenue, gross margin, and percentage of Braintree’s revenue into PayPal’s total revenue.

Author’s Compilation – Braintree’s Revenue and Gross Profit

Braintree experienced a greater than 30% revenue growth from 2021 to 2023. PayPal CEO Alex Chriss remarked that they priced aggressively to gain market share, which serves as a beachhead in this segment. They are now in a position to add more value to their offerings. Thus increasing their price to value.

On unbranded, this is a processing business that we have established growth in and established a beachhead in over the last few years. But now is the time for us to take all that great innovation, the value-added services, the proof points that we put into the market and price to value and ensure that we’re driving profitable growth from a processing business as well. You add on top of that new innovation that we brought to market, things like Fastlane, that enable us to now delight customers with best-in-class checkout conversion experience. And we believe that’s a wonderful opportunity to monetize.

While this may turn out to be true, it doesn’t change the fact that Braintree’s high growth rate and PayPal’s core payment stagnation resulted in PayPal’s consolidated gross margin declining from 55.17% to 46%.

Author’s Compilation – Braintree’s Revenue and Revenue Percentage to PayPal’s Total Revenue

Although Braintree is an important strategic business for PayPal—PayPal bought it for $713 million in 2013 and generated around $2 billion in gross profit in 2023—this part of the business constitutes a lower margin due to the nature of the customers in this segment. Typically, large enterprises such as Uber (UBER), Adobe (ADBE), and Airbnb (ABNB), among others, have pricing power due to their scale and have in-house software developers who can do most value-adding activities, such as complex coding or integration. Thus, Braintree’s ability to charge a premium in this business is limited.

Dan Schulman comments on concerns about unbranded checkout’s profitability on Management Presents at 51st Annual JP Morgan Global Technology, Media and Communications Conference.

I also want to grow the profitability of it as well and so we know exactly what we need to do there as well. We need to expand internationally because there are better margins. We are predominantly on Braintree domestic right now. We are going to move down market with PayPal Complete Payments, PPCP, which has higher margin structures, and we are adding value-added services on top of that, that have higher margins.

PayPal is turning its attention to its PayPal Complete Payment Platform(PPCP), which targets Small to Medium Sized Businesses(SMBs). This segment is a higher margin business for PayPal since most value-adding activities, such as integration or coding, are now done by PayPal with its promise of No or Low Code Integration for its customers. They can charge a premium for this service since the customers in this segment have lower pricing power and can avoid hiring expensive software developers to handle the value-adding integration and coding activities, which can increase their overhead costs and allow them to focus on their core business.

PayPal’s unbranded and overall margin should also improve as this business scales.

Emphasizing Profitable Growth

Like any industry, it experiences periods of high growth and low profitability into a period of low growth and focus on profitability. During times of high growth, businesses in an industry often prioritize growth and scaling their business over profitability. Eventually, the industry enters a period of consolidation along with slower growth, forcing companies to focus on increasing their profitability.

In the fintech payment segment, scale matters cause businesses aren’t using your offering if only a few consumers use you, or consumers will not use you if they can’t use your offering to buy from multiple merchants or if they need to go from your platform to another platform to pay the merchant, which create friction. This is why only firms that have managed to be successful in this segment are incumbents such as PayPal, AliPay, and Stripe, and Big Tech Firms such as Apple (AAPL), Samsung, Amazon (AMZN), and Google that have existing ecosystems where payment can play a vital role in increasing the value proposition to their customers and prevent them from switching to other ecosystems that provide a similar experience; Apple into Android or Samsung Ecosystem and vice versa.

The above reasons led PayPal’s CEO, Alex Chriss, to focus on ventures that promise profitable growth.

Look, every company is at a different stage and gets to decide what they want their True North and their North Star to be. For me, it’s now a time at this stage of the company to focus on profitable growth. I’ve been consistent from day one, it’s where we’ve organized the company around, it’s the way we do our operating mechanisms and the conversations that our leadership team has with each other and the way that were compensated. And so that is the North Star for the company.

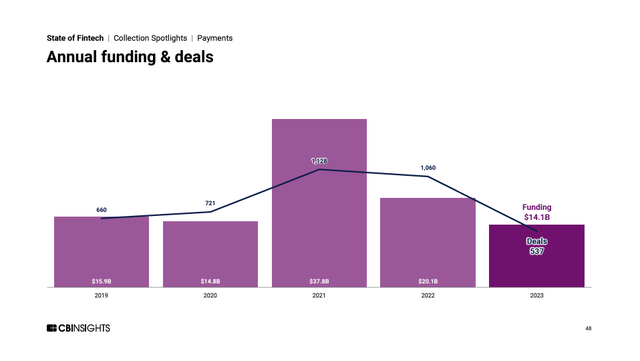

Additionally, while the payment segment still receives the lion’s share of capital funding in fintech, there is a clear declining trend in the amount of capital investments made into the fintech payments segment, which could lead to fewer startups challenging the incumbents and further consolidation where the incumbents are buying all the smaller players to eliminate competition or increase their scale.

Fintech Payment Annual Funding – CBInsights State of Fintech 2023

While some can argue that the high-interest environment causes lower funding, I argue with what I said earlier. The payment segment will be dominated by players that the majority of people already use, such as PayPal, Apple Pay, Stripe, Samsung Pay, etc… Upcoming startups will most likely structure their business on providing value-added service to certain parts of the digital payment business value network or niche part of the digital payment market, where scale doesn’t provide a competitive advantage.

Valuation

According to multiple research firms, digital payment is forecasted to grow at 12-20%. Although estimates widely vary, they show the potential growth of the market in which PayPal participates.

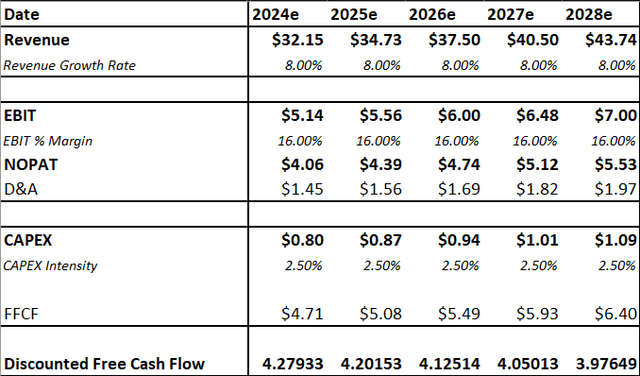

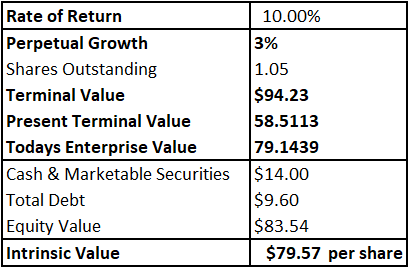

I will use the Discounted Cash Flow Method to valuate PayPal.

I will conservatively project an 8% revenue growth rate to emphasize that even if PayPal underperforms the industry growth rate, it shows that PayPal is still undervalued.

Author’s Intrinsic Value

With an intrinsic value of $79.57 per share, it is undervalued by around 25%, which is a decent margin of safety for the company’s growth potential.

Risk

Competition

PayPal has experienced a decline in active accounts since 2020 due to competition from other digital wallets, such as Apple. I expect further intense competition from companies with existing ecosystems and scale, where embedding finance services such as digital wallet and payment services enhances the value proposition of their main business, such as Meta’s Facebook with Metapay, Google’s Google Pay, and Grab’s Grab Pay, among others. Ultimately, it will come down to if people continue to value PayPal’s other value propositions, which others don’t have, such as Seller & Buyer Protection.

Economic Cycle

Like any business, PayPal is sensitive to the ebb and flow of the economic cycle since a significant amount of its Transaction Volume comes from discretionary spendings, which tend to get less prioritized by consumers since they are switching some of their discretionary budgets into staple ones. But as I said earlier, economic cycles usually correct themselves in a long course. It’s just a matter of when it will correct itself, which is always hard to guess.

Conclusion

PayPal is entering a crucial inflection point. Even with competition heating up, I believe it is not too late for PayPal to turn the ship around; well, there’s no ship to turn around since they only need to partially correct a ship that has been slightly coursed in the wrong direction. The management is doing the right thing by focusing their attention on PayPal’s competence and diversifying in the ads business, which is a natural extension of their business due to the amount of data they are processing on their platform. Plus, You get to buy PayPal at a price where these potentials aren’t even factored in, and more importantly, you buy a profitable fintech company, which is a rare breed in this space.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.