Summary:

- Apple’s new payment products released at the WWDC pose a direct threat to PayPal.

- PayPal continues to innovate enough for solid growth, but the payments company has failed to create the types of products to distinguish the company from competition like Apple Pay.

- The stock remains undervalued, trading at ~12x full non-GAAP EPS estimates, though the company has confused the market by now including SBC in estimates.

Yulia Romashko/iStock via Getty Images

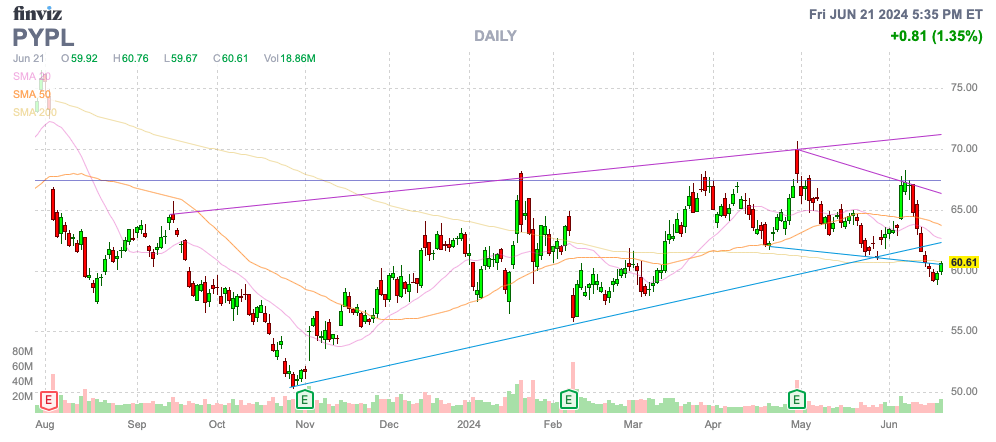

Apple (AAPL) just released some payment products with a potential direct impact on PayPal Holdings, Inc. (NASDAQ:PYPL) (NEOE:PYPL:CA). The global payments company offers an intriguing value, yet questions about growth linger, especially following a disappointing innovation event earlier this year. My investment thesis remains Bullish on the stock due to valuation, with the mobile payments company generating billions in annual cash flow while the stock trades at multi-year lows.

Source: Finviz

Apple Fears

At the WWDC, Apple announced new features to Apple Pay in apparent direct competition with PayPal. The prime new features from Apple are “Tap to Cash” for Wallet and Apple Pay online.

The Tap to Cash feature allows users to simply hold two iPhone devices together to send and receive Apple Cash. Apple is clearly making it easy for consumers with iPhones to utilize the Apple Pay digital wallet.

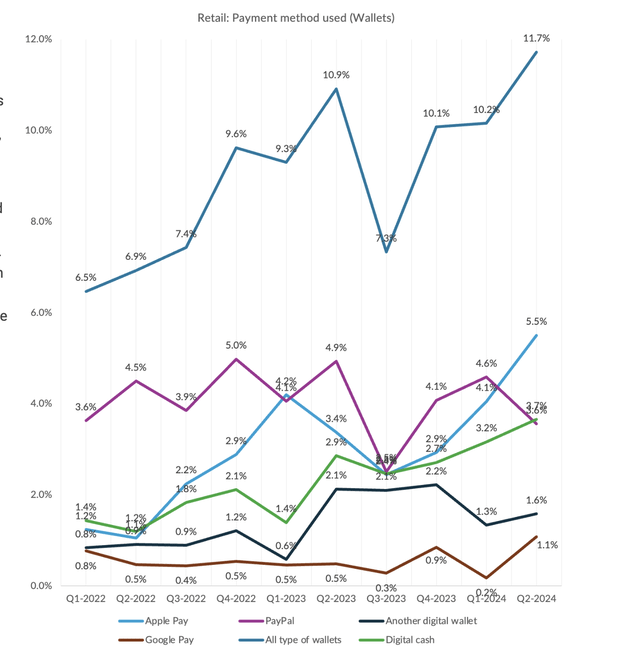

According to PYMNTS, Apple Pay has already overtaken PayPal as the digital wallet of choice. The research firm has research showing that 60% of consumers use digital wallets, but only 12% used a digital wallet for their last retail purchase.

Source: PYMNTS

Apple Pay has clearly been a headwind to restrain the growth rates of PayPal. The company still reported TPV grew 14% during Q1’24 leading to 9% sales growth, 10% on a currency neutral basis.

PayPal continues to generate substantial growth in unbranded card payment processing, with growth of 26% in Q1. This part of the business accounts for 37% of the TPV now and the CFO made the following comments at the RBC Financial Technology conference suggesting the company provides a huge advantage to merchants as follows:

So when a consumer goes through a checkout process, if they don’t select a branded mark, which is about 40% of the time, then they typically go through some form of guest checkout. So 60% of flows don’t pick the branded marks. And what that leaves is a real opportunity for drop off for consumers.

While PayPal is making technology changes, the biggest concern is the development of a product that moves the needle. The digital wallet improvements from Apple Pay continue to pressure overall payments volumes and question the ability to compete with Apple over time.

The new Fastlane by PayPal feature launching in the 2H of the year will provide an improved checkout process for a new one-click guest checkout experience. The other technology announcements released along with Innovation Day are nice additions, but nothing expected to move the needle.

Again, CFO Jamie Miller was positive on the features potential at the RBC conference as follows:

The second piece is once they’re in the Fastlane experience, they convert at about an 80% rate, meaning the conversion of that purchase. That’s compared to about a 40% to 50% rate. So that’s a double-digit uplift on conversion for a merchant.

PayPal is innovating, but the company isn’t providing dramatic innovation improvements or new innovative products to alter the growth dynamics. As Freda Duan at Altimeter Capital highlighted when announcing an investment in the payments company, PayPal is spending far too much on customer service ($2 billion annually) and a legal team of 10K employees, leading to excess expenses.

The company cut 9% of the workforce to start the year, helping to boost Q1’24 profits. The opportunity definitely exists to boost margins via additional cuts in the above categories.

Big Capital Returns

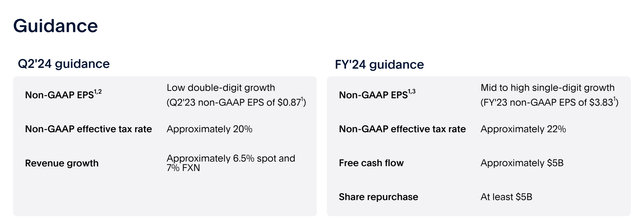

PayPal forecasts producing $5 billion worth of free cash flow in 2024. The company forecasts returning the whole $5 billion to shareholders this year.

Source: PayPal Q1’24 presentation

The payments company has a strong balance sheet with a large cash balance of $17.7 billion with debt of $11.0 billion. PayPal already has enough excess cash to make the stock buybacks without needing to use additional free cash flow.

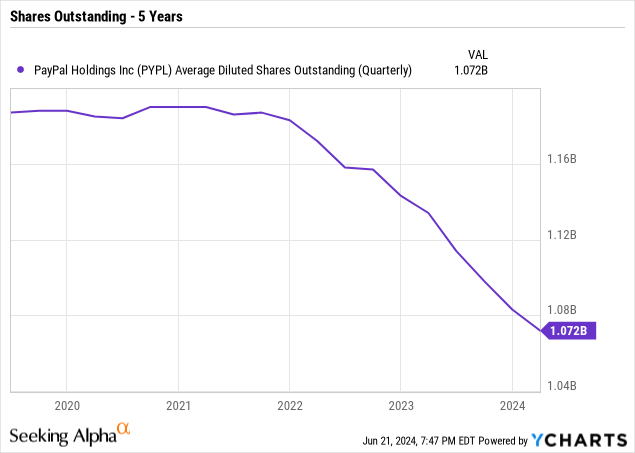

Due to ongoing share buybacks, the diluted share count had dipped from 1.13 billion last Q1 to only 1.07 billion in Q1’24. PayPal forecasts spending an incredible $5 billion on share buybacks this year with the market cap at only $63 billion now, leading to a share repurchase amounting to 8% of the outstanding shares.

Apple has successfully boosted the stock over the years by repurchasing shares while the stock was cheap. The key to the Apple story was the company continuing to grow the business during the process, allowing share buybacks to boost the EPS by up to a 10% annual rate initially and now in the 3% to 4% range.

PayPal is listed as trading at just 15x 2024 EPS targets and only 13x the 2025 EPS targets of $4.56. Remember, though, these are non-GAAP EPS estimates including stock-based compensation.

For some bizarre reason, PayPal decided to change the reporting numbers to help shareholders, but the company reporting lower EPS estimates hasn’t helped the stock. What investors really want is for the company to cut the level of actual stock-based compensation.

The Q1’24 SBC impact was $0.32 and the annualizing this number leads to an EPS target in the $5.41 range for 2024. Remember, PayPal reported a 2023 non-GAAP EPS of $5.10 and originally guided to a similar level for 2024.

The elimination of SBC pushes the 2025 EPS target closer to $6, leaving the stock trading at hardly above 10x EPS targets. As well, investors can simply value the stock based on the $5 billion FCF and the $58 billion enterprise value, leaving the stock trading at ~12x FCF estimates.

Takeaway

The key investor takeaway is that PayPal is exceptionally cheap due to fears over competitive threats like Apple Pay. The payments company is definitely struggling with the innovation needed to generate exceptional growth, but PayPal is making the types of moves to place the company on a solid growth trajectory.

The stock is too cheap here, and the stock buybacks should boost EPS, reminding us of Apple in the prior decade when the tech giant was regularly buying shares at a discount.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start June, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.