Summary:

- PayPal Holdings, Inc.’s user count continues to decline, raising concerns about the company’s growth potential.

- Disastrous management decisions, including controversies and reputation damage, have further impacted PayPal’s outlook.

- PayPal’s Q4 earnings may appear solid, but the decline in active user accounts and worsening profitability indicate underlying challenges.

Justin Sullivan

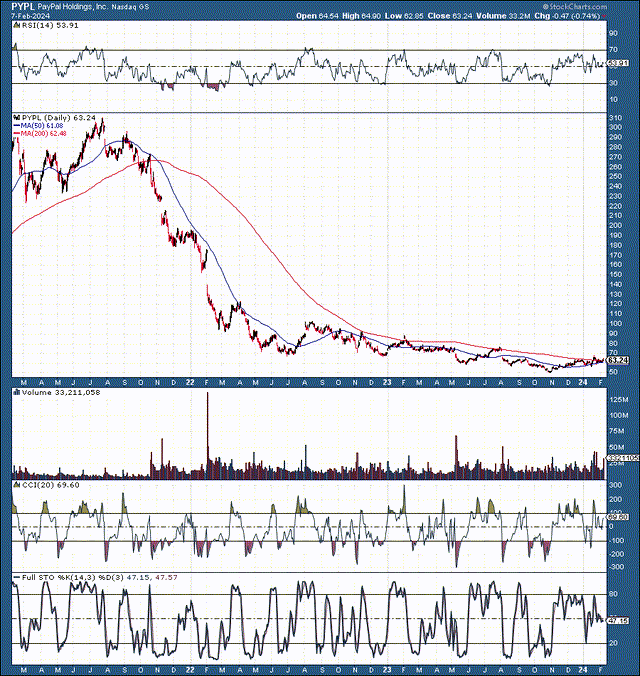

I’ve been bullish on PayPal Holdings, Inc. (NASDAQ:PYPL) around the lows recently. I even wrote a bullish article about its rebound possibly being “epic” (if it occurs). Some of my reasoning behind my bullish thesis included PayPal’s dirt-cheap valuation, increasing revenues, its slowdown possibly being transitory, significant market presence, a new management team, and other constructive factors.

However, PayPal’s recent Q4 earnings announcement is deeply troubling. While PayPal’s top and bottom line numbers appear solid, the guidance could have been much better. User count continues declining, and 2024 YoY earnings are expected to be flat. Under the hood, margins continue struggling, and GAAP profitability worsens. Competition from Apple Pay and others remains intense.

Due to PayPal’s challenging position, it could continue to miss earnings estimates, leading to more downside pressure on its stock. The $64,000 question is whether this disastrous downturn is transitory, or whether PayPal is in terminal decline.

The User Decline Is More Serious Than Expected

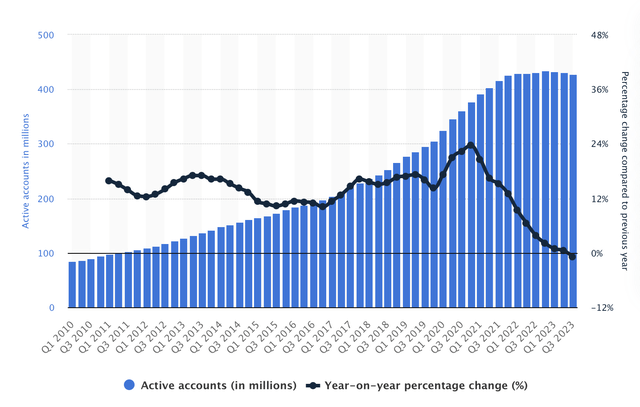

PayPal user growth (Statista.com)

I initially thought that PayPal’s user decline phase had a high probability of being temporary. A slow economy and other factors could have contributed to the stagnation in users, but PayPal now has fewer users than in Q3 2021. Theoretically, modest user growth should have returned in 2023. Instead, it continues to decline.

The market became highly saturated by PayPal, and intense competition from Apple Pay (AAPL) and other growing payment processing platforms is contributing to the deterioration in PayPal’s user base. Of course, it is a massive market, and PayPal’s user growth could return, but the company’s management could have done better.

Disastrous Management Decisions Destroy Confidence

PayPal hit an ATH of approximately $310 around two and a half years ago. The stock has dropped by over 80% since its highs, and that doesn’t mean it’s destined to go back up. The company penalized users $2,500 for “spreading misinformation.” Then, there was the Charlotte incident, which may have alienated users. PayPal’s former CEO, Dan Schulman, was perceived to be playing politics, using PayPal as a personal tool, launching crusades that cost PayPal customers money and potentially ruined PayPal’s image for many Americans.

Mr. Schulman may have forgotten that his primary objective and fiduciary duty as the CEO of a publicly traded company was to make money for shareholders. It’s excellent that Schulman stepped down, and now PayPal has a new CEO (Alex Chriss). Unfortunately, the damage has been done. It’s far easier to damage a reputation than to build it back up. Therefore, it may take considerable time for PayPal to return to user growth, and its earnings continue to suffer.

Q4 Earnings: It’s Worse Than It Seems

PayPal’s headline numbers looked fine. The company reported $1.48 in non-GAAP EPS, beating by 12 cents. Revenue came in at $8 billion ($130M beat), up 8.1% YoY. Q4 TPV increased by 15% YoY, and payment transactions increased by 13% YoY to $6.8B. However, active user accounts declined by 2% YoY to 426 million. Also, the increases in revenues, TPV, and transactions are coming off extreme lows during the height of the slowdown period. Therefore, future growth may be lower than perceived.

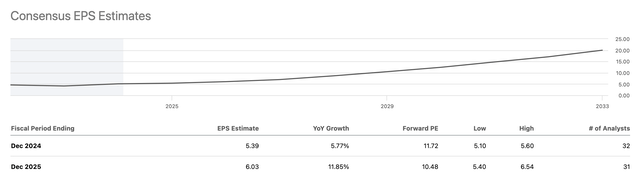

We see the bearish growth dynamic in PayPal’s guidance. PayPal guided to FY 2024 EPS of $5.10 (flat YoY). Also, PayPal is likely not sandbagging here, which raises a question: what if PayPal fails to achieve its $5.10 goal? $5.10 is considerably lower than the $5.53 consensus estimate, and the actual result could be worse. This dynamic alone implies that PayPal may be a value trap and is more expensive than it seems.

PayPal expects mid-single-digit EPS growth in Q1 2024, implying EPS of $1.23 vs. the expected $1.26. Meanwhile, despite providing little growth potential, PayPal expects about $1.4 billion in stock-based compensation and related payroll taxes next year. GAAP EPS is expected to drop to $3.60 from $3.84 in 2023 (6.25% YoY decrease).

PayPal’s profitability is declining on a GAAP basis, and the company is struggling to provide stagnant YoY non-GAAP EPS. This dynamic is troubling and illustrates that PayPal’s financial situation is declining. While PayPal may appear “cheap” at a 10-12 forward P/E ratio using non-GAAP, it looks expensive around a 17 forward P/E ratio with declining GAAP EPS.

The Bottom Line: PayPal May Be A Value Trap

Earnings estimates (seekingalpha.com )

PayPal looks dirt cheap, and that’s likely what attracts most people to its stock. However, there is a reason for PayPal’s ultra-low valuation. The growth image is highly uncertain, and future EPS estimates could come down even more. Worse even, what if PayPal’s time has passed? What if the company continues experiencing active user declines? What if the average revenue per user worsens?

PayPal just guided to $5.10 in EPS for this year, which is the very low end of the EPS estimate range. This dynamic illustrates that we can disregard next year’s estimates, and PayPal could earn about $5.40 or less. Also, we see profitability worsening on the GAAP EPS side, implying adjusted EPS could get dragged down more than expected in future quarters, putting more pressure on PayPal’s stock.

Due to PayPal Holdings, Inc.’s worse-than-anticipated guidance, I’ve downgraded PYPL from a buy to a hold. Also, it needs to be clarified if a turnaround is likely and, if it occurs, how long the process may take. I’ve already incurred opportunity costs holding PayPal in recent quarters. Therefore, I will likely sell my shares to take advantage of better opportunities in the stock market. There are many much better stocks to own.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!