Summary:

- PayPal has already offered its customers a large, convenient ecosystem while it is expanding the list of products.

- The digital wallet market is growing rapidly, but the potential for further penetration of services into everyday life remains high.

- PayPal’s strategic partnerships will continue to be a strong catalyst for further TPV and revenue growth.

- PayPal’s margins should grow due to the development of its transactional infrastructure, credit externalization and a slowdown in ad expenses.

- PayPal stock is significantly undervalued by the market. We see a good buying opportunity for the long term.

Justin Sullivan

Investment thesis

We believe that PayPal (NASDAQ:PYPL) is currently one of the best buying options in the long term. The company is growing steadily and is showing successful financial results, despite the unfavorable macro environment. Strategic initiatives should help maintain a steady business growth rate and significantly improve its margin.

Updated strategy already brings its benefits

PayPal business has traditionally been based on cyclical products and used to depend heavily on eBay (EBAY). A few years ago, management launched a series of reforms, and now PayPal is very different.

Today PayPal is a rich ecosystem with a wide variety of products aimed at increasing user engagement. It offers almost everything from money transfers and digital wallet payments to BNPL lending, cryptocurrency purchases, and debit card issuance in partnership with Mastercard (MA).

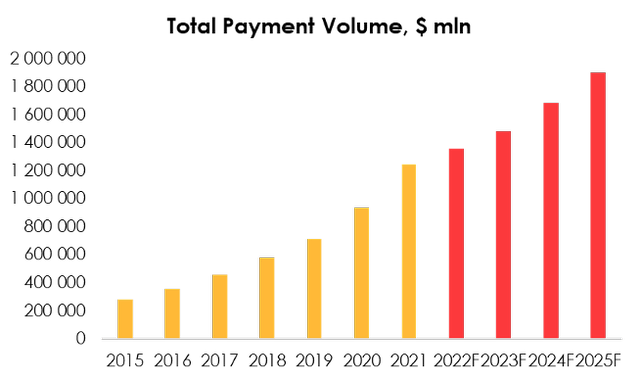

Such a significant expansion of services allows the company to grow rapidly in the digital payments market. In 2015-2021 the average growth of Total Payment Volume amounted to 28.11% per year.

We expect the company to maintain high business growth rates in the future due to successful implementation of management’s development strategy, which is paying off even amid macroeconomic uncertainty.

Firstly, PayPal has moved away from aggressive takeover and user retention, focusing on middle- and high-income customers. This is positive because the company’s target audience (a substantial portion of its TPV is generated from e-commerce and cyclical goods) remains less sensitive to real income declines and slowdowns. Therefore, we do not expect a significant drop in average ticket or number of transactions amid recession.

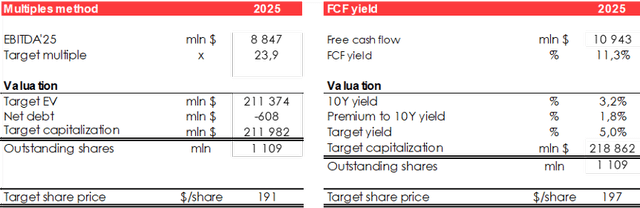

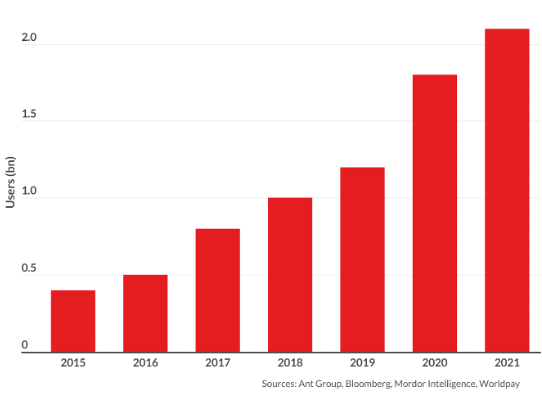

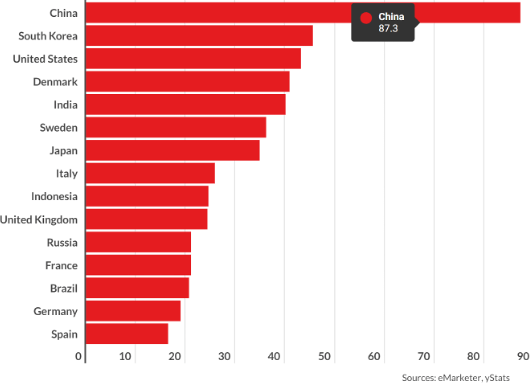

Secondly, the digital payments market continues to grow and replace cash. According to BusinessOfApp, the number of users of mobile transaction systems as of the end of 2021 was ~2.1 bn (mostly in China).

Electronic transaction services still have significant potential in both developing and developed countries. The penetration rate of similar systems does not exceed 30% even in Spain or the UK.

BusinessOfApp BusinessOfApp

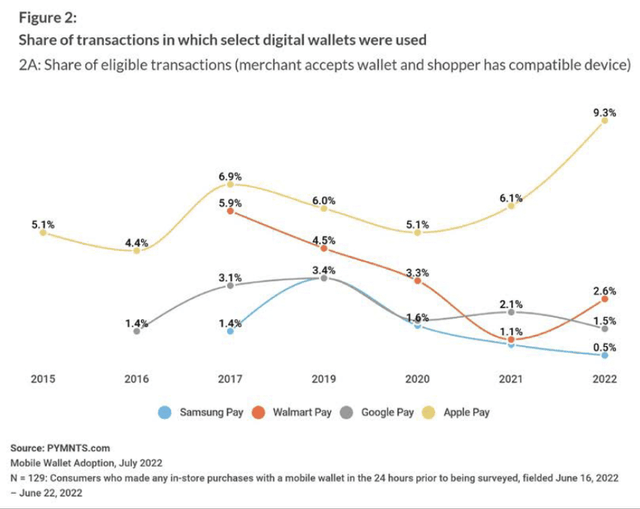

Finally, strategic partnership remains an important catalyst for PayPal organic growth. Now the company is focused on contactless payment systems. In 2023, users in the US will be able to add Venmo and PayPal credit cards to their Apple Pay system, which is currently the most popular contactless payment method worldwide, according to PYMNTS.

According to our calculations, PayPal TPV will increase at an average rate of 11.17%, driven by conservative growth in Active Customer Accounts (we expect the number of users to increase to 495 mln by the end of 2025) and more significant growth in transactions per account, as its evolving ecosystem, service adaptation for everyday use and general transition to digital payment methods will boost service penetration in the day-to-day life of users.

Significant margin expansion

In addition to organic revenue growth, PayPal has excellent prospects in terms of expanding the profit margin.

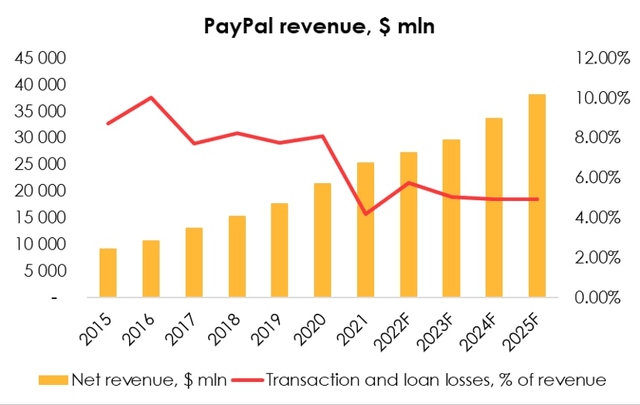

Following the Q3 report, the management announced intentions to expand organic margin in 2023 by about 100 b.p. by reducing transaction costs.

However, we believe the fact that PayPal is pursuing a policy of externalizing its credit relationships is still important. In other words, it partially removes interest-rate risks, which is especially relevant during the period of increasing interest rates and reduces the risks of bad debt accumulation in the company’s assets. We don’t expect PayPal to get rid of consumer lending entirely because of the popularity of the BNPL system, but we believe that involving third-party partners will help reduce losses on loan loss provisions to 4.93% of revenue by 2025.

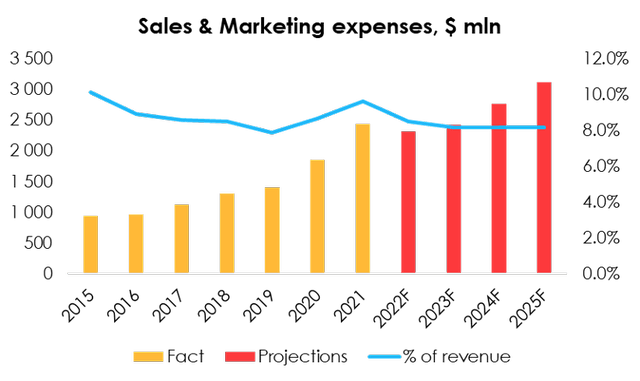

Moreover, shifting the company’s focus to a specific price segment of the audience will simplify marketing interaction with customers. We believe that this will help reduce the growth rate of advertising costs and have a positive impact on the business margin.

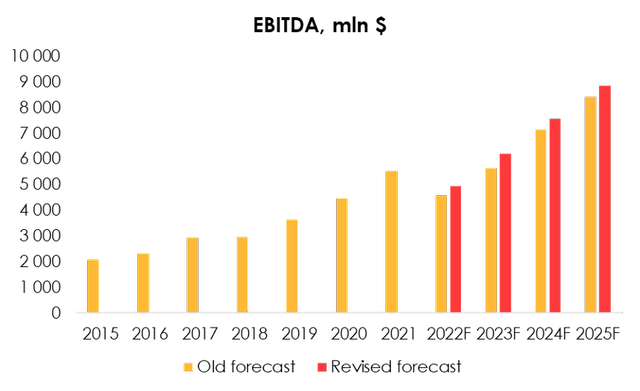

Given the significant strategic initiatives we expect PayPal operating margin to increase to 19.2% by 2025, which would be equivalent to 23.2% EBITDA margin.

Valuation

After Q3 earnings we have lowered the EBITDA forecast for $97.6 bn (+7% y/y) to $91.4 bn (+0.2% y/y) for 2022 and from $99.1 bn (+2% y/y) to $97.0 bn (+6.2% y/y) for 2023 due to:

- The ongoing impact of the high dollar rate relative to world currencies;

- A lower forecast for profitability amid a change in the product mix and the decline of the cost-per-click metric;

- A revision of the forecast for the recovery of the advertising market: According to the updated estimates, the impact from the decline and recovery will be smoother.

We are evaluating PYPL’s fair value price based on 2025 EV/EBITDA multiples and FCF Yield methods, and think the fair value price for the stock is $148. We are evaluating the fair value price of PayPal stock by discounting projected prices in 2025 at the rate of 13%. Fair value prices in the tables depicted below are without discounting at the rate of 13%. We are maintaining the rating for the shares at BUY. The potential upside is 88%.

Conclusion

We believe PayPal will significantly outperform the index in the medium-term. New management strategy, audience targeting with high LTV, and work on the margin are strong drivers of future financial performance. We believe that PayPal has been successful at combining the qualities of a value and a growth company. Despite the economic slowdown in 2022, PayPal has demonstrated strong operating efficiency and solid financial performance.

We recommend buying the stock at the current price but allow for possible swings due to expectations of further declines in the major indices and the fact that the market is now very cautious about growth technology companies.

To manage the position, we recommend keeping an eye on financial statements of PayPal, industry research, and reports of its competitors (Square, Affirm, Visa, MasterCard).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.