Summary:

- PayPal’s stock has had a terrible year, losing 35.11% and trading at a six-year low.

- The company has nearly doubled its revenue over the last six years but faces negative market sentiment due to slowing user growth, competition, and higher inflation.

- Despite the stock’s decline, investors may want to take a bullish stance on PayPal due to its profitability, increasing free cash flow, and growing EPS.

Justin Sullivan

During the pandemic, PayPal Holdings (NASDAQ:PYPL) was riding high, with its stock trading around $300 in 2021. However, times have changed and the stock price has plummeted to a six-year low, losing 35.11% value over the last year. Recent years have been unkind to PayPal due to the end of its 19-year partnership with eBay, economic challenges in 2022, and heightened competition. Despite these challenges and investor doubts, PayPal’s financial performance has been impressive, almost doubling its revenue over the past six years. This demonstrates the company’s resilience in a constantly evolving industry.

Stock trend since spinoff (Seeking Alpha)

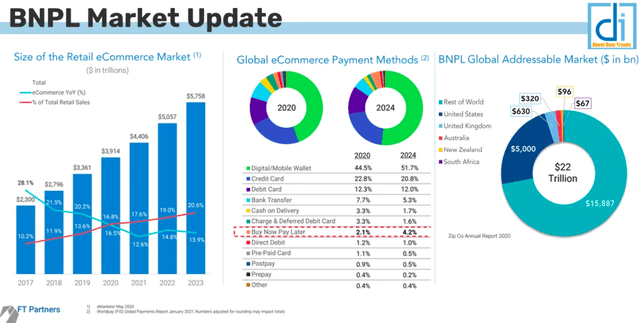

While the concerns are valid, dominating a market with 26,300 fintech competitors in 2023 won’t be a walk in the park. But there’s a promising angle to consider: the company’s position in the “Buy now, pay later” (BNPL) market, currently valued at $6.13 billion and projected to grow at a steady 26.1% CAGR from 2023 to 2030. Furthermore, despite past investor setbacks, the company’s financial health is robust, boasting profitability, a solid balance sheet, positive free cash flow, and an anticipated boost in EPS for both FY 2023 and FY 2024. Therefore investors may want to take a bullish stance on this stock

Company overview

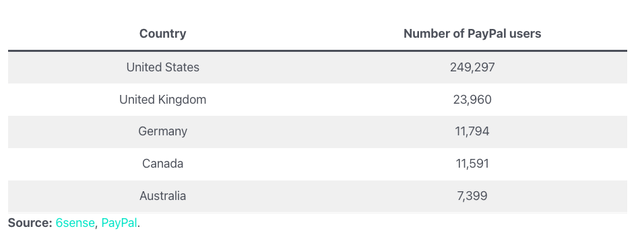

PayPal has established itself as a prominent global fintech giant, boasting a substantial market cap of $60.18 billion and a remarkable 40.52% share of the global payment service segment. Since its establishment in 1998, it has been a trailblazer in reshaping the landscape of financial transactions. With remarkable agility, it garnered worldwide recognition, crossing the monumental threshold of 100 million users in 2006. Today, the platform serves an impressive 431 million active users, firmly securing its position in the financial landscape. The U.S. remains its largest market by number of users.

PayPal users by country (Demand Sage)

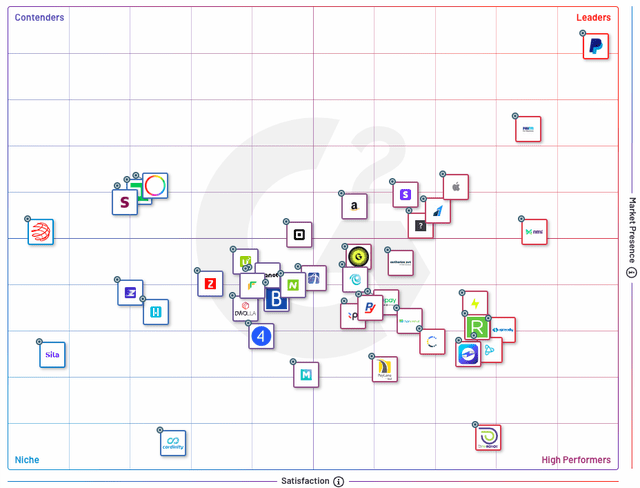

Despite many alternatives, PayPal’s frontrunner position allows it to benefit as the clear leader in the field.

Top Payment Gateways products (G2)

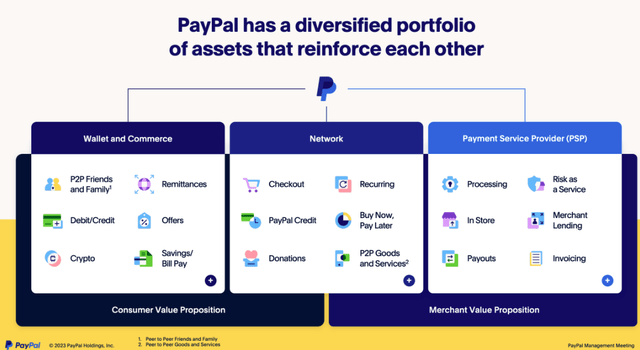

PayPal caters to both consumers and merchants. One of PayPal’s primary segments is the high-margin branded checkout button, which contributed to 30% of PayPal’s total payment volume (TPV) in 2022. Another significant growth segment is the unbranded Braintree segment, even though it operates at lower margins. Acquired for $800 million in 2013, it’s on the path to becoming a dominant part of PayPal’s portfolio. With a TPV of $400 billion in 2022, it stands shoulder-to-shoulder with the branded checkout service as a pivotal driver of results. Additionally, there’s the peer-to-peer service known as Venmo. Sporting a 2022 TPV of nearly $250 billion, it represents the third-largest aspect of PayPal’s business. What sets Venmo apart is its ability to leverage network effects: when friends need to send and receive money among themselves, there’s a compelling reason to join the service. This means it becomes even more effective as its user base expands.

Three main segments (Investor presentation 2023)

Market and major growth catalyst

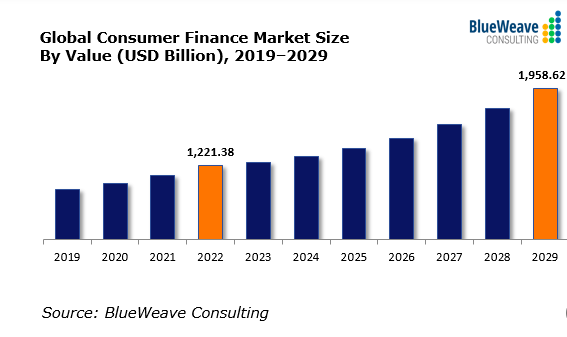

The financial services sector is poised for strong growth, buoyed by increasing consumer financial needs and the widespread embrace of cutting-edge technologies. Additionally, a rising interest rate environment is set to benefit financial services companies by boosting their profit margins. According to a report from BlueWeave Consulting, the global consumer finance market is projected to expand at a healthy CAGR of 7.1%, potentially reaching a substantial value of $1.96 trillion by 2029. This signifies promising opportunities in the industry for the years ahead.

Market growth forecast (BlueWeave Consulting)

One of the exciting advancements in finance is the emergence of “Buy Now, Pay Later” applications, often referred to as BNPL. As the name implies, BNPL is quite straightforward – it’s all about making purchases more affordable for consumers. It provides a way for people to make instant buys and offers various options for spreading payments without incurring any interest charges. This comes as a relief in a financial landscape where traditional banks often decline loans or high interest rates.

With ongoing expansion and increased annual funding, this business model is set to sustain its growth, attracting both customers and investors. BNPL online applications are quickly becoming the financial institutions of choice for the new generation and a changing world. The global market for BNPL reached an estimated value of $6.13 billion in 2022, and it’s expected to maintain its rapid growth with a projected CAGR of 26.1% from 2023 to 2030. This indicates a significant shift in the way people manage their finances and make purchases.

Buy Now Pay later market (Substackcdn.com)

PayPal holds the top spot in the U.S. market, boasting a commanding 50% market share. This places them in a prime position in an industry that’s brimming with tremendous growth and opportunities. Moreover, we’re witnessing an influx of companies venturing into this market, such as Galileo Buy Now, Pay Later by SoFi Technologies (SOFI). This trend isn’t just a U.S. affair; it’s gaining substantial momentum on a global scale, particularly in the Asian market. What’s noteworthy is the swifter adoption among the younger demographic, marking a promising path ahead.

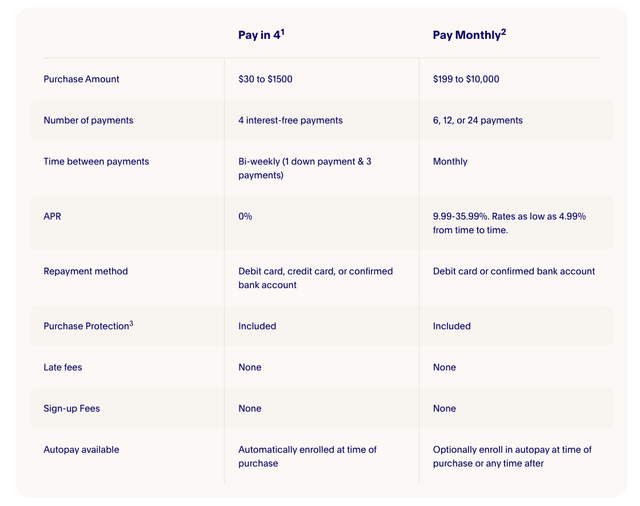

BNPL PayPal offerings (PayPal)

Financials

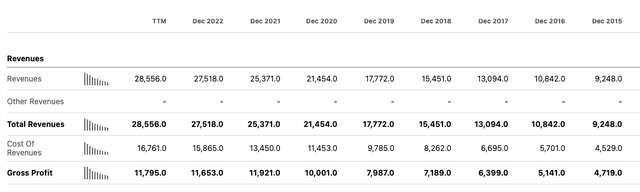

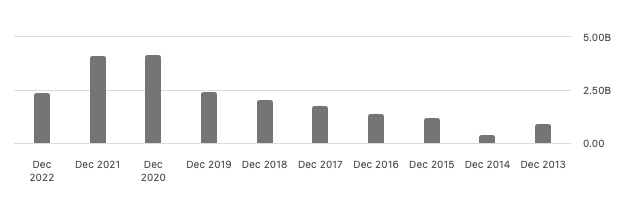

Although the stock price might appear volatile, a closer look at the financials tells a more upbeat tale. Over the past decade, the company has consistently been boosting its revenue, achieving an impressive 5-year CAGR of 14.48%. This growth has led to a significant increase in revenue, climbing from $15.45 billion in FY2018 to a substantial $28.556 billion in the TTM. However, when we shift our focus to the company’s gross profit, we observe a narrowing margin. It has declined from 52.56% in FY 2015 to 41.30% in the TTM.

Annual revenue trend (Seeking Alpha)

Annual gross profit % (Seeking Alpha)

Over the past three years, net income has shown impressive growth at a CAGR of 16.4%. However, it’s worth noting that the journey for net income has had its share of ups and downs. In FY2022, there was a decline in earnings, primarily driven by a decline in expected users. PayPal reduced the number of new account additions, as they were not contributing substantially to the company’s income. This strategic pivot meant sacrificing some short-term growth in favour of a more sustainable long-term trajectory. The good news is that the net income in the TTM has rebounded significantly, now standing at a robust $4.075 billion, reaffirming PayPal’s continued financial strength and adaptability.

Annual net income (Seeking Alpha)

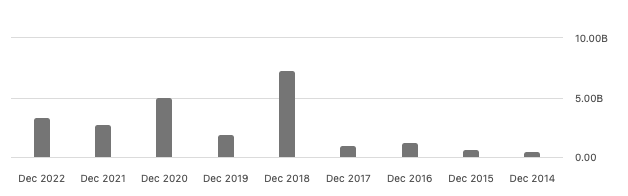

Over the past decade, the levered free cash flow has shown a positive trend, albeit with some fluctuations. The company has demonstrated a consistent ability to generate free cash flow, with a total of $3.7 billion TTM. The management actively deploys this cash by initiating share buybacks, with plans to repurchase stocks worth $5 billion throughout this year. This strategic move underscores their commitment to enhancing shareholder value.

Levered free cash flow (Seeking Alpha)

PayPal’s balance sheet paints a reassuring picture. As of June 30, the company held $14.4 billion in cash, cash equivalents, and investments, while shouldering a manageable debt load of $10.5 billion. This robust financial standing not only offers investors a sense of security but also empowers PayPal to actively explore and invest in new avenues for growth.

Valuation

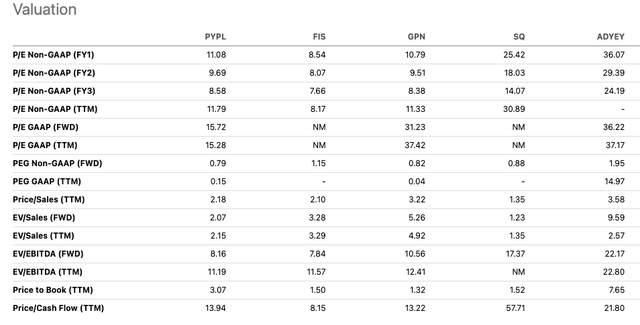

PayPal’s stock is currently trading at a six-year low, despite the company’s improved financial performance. Wall Street, with input from 48 analysts, rates PayPal with a solid 4.1 Buy rating, and the stock is trading well below its average price target of $84.55. The Forward GAAP Price-to-Earnings (P/E) ratio stands at 15.72x, lower than several rising competitors, suggesting undervaluation. When looking at the Forward Non-GAAP Price/Earnings to Growth (PEG) ratio, which considers growth prospects, PayPal’s 0.74x ratio is lower than all major competitors, indicating a promising investment opportunity.

Relative peer valuation (Seeking Alpha)

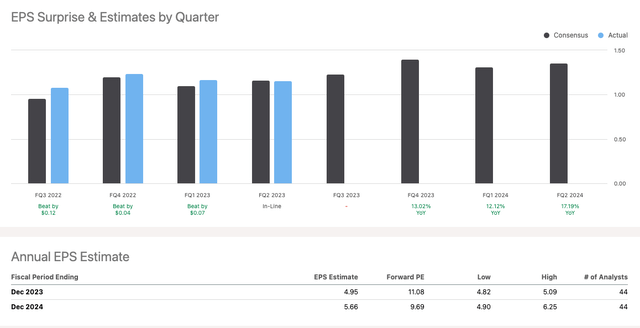

The company is set to announce its Q3 2023 Earnings Call on November 1, 2023. It’s worth noting that the estimated EPS for the full fiscal year 2023 stands at $4.95, showing an improvement from the previous fiscal year, 2022, when the company achieved an EPS of $4.13.

Earnings Estimates for FY2023 (Seeking Alpha)

Risk

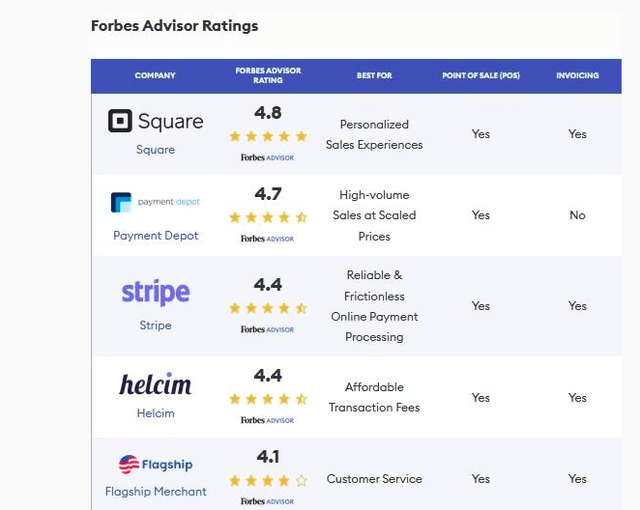

PayPal faces several specific risks. It has dominated its market, but the industry can change rapidly through digital advancements and new competitors. One concern is the risk of commoditisation, as the services it provides are not entirely unique and can be replicated by competitors, although PayPal’s scale provides a certain level of security. The company’s comparatively higher pricing, in contrast to some competitors, might potentially impact its future growth as more affordable alternatives become increasingly available. For instance, Square offers transaction fees that begin at 2.6%, along with a 10-cent fee for card payments, which is lower than PayPal’s pricing, and they do not entail hidden fees or mandatory contracts, posing a genuine challenge to PayPal’s competitive edge.

PayPal alternatives (Forbes)

Final thoughts

PayPal, despite facing challenges, maintains a commanding presence in the online payment platform landscape. This solid foundation hints at continued financial growth in the long run. Additionally, while competition looms in the fintech arena, PayPal’s prominent role in the burgeoning “Buy now, pay later” market, valued at $6.13 billion and set for a steady 26.1% CAGR from 2023 to 2030, offers a promising growth avenue. Factor in the company’s robust financial health, including profitability, a stable balance sheet, positive free cash flow, and anticipated EPS increases for FY 2023 and FY 2024, and it becomes an attractive choice for bullish investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.