Summary:

- Investors rushing in to buy PayPal Holdings, Inc. after the stock’s recent decline should be prepared for more pain ahead.

- The earnings release was not as bad to justify an 11% drop on the day, but that doesn’t mean that the market will change its mind on a dime.

- I remain optimistic on PayPal’s business model, but I don’t expect a quick turnaround, either.

Tero Vesalainen

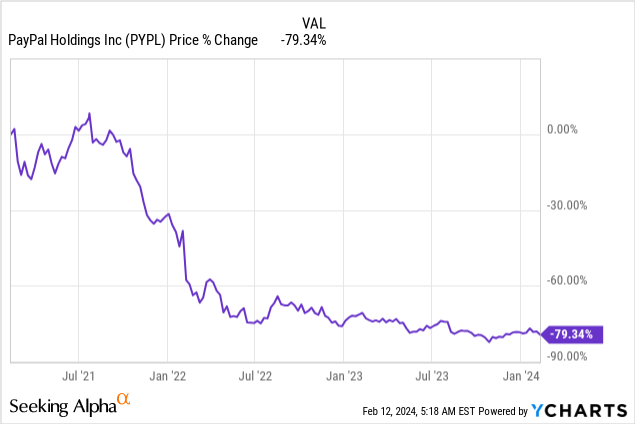

PayPal Holdings, Inc. (NASDAQ:PYPL) reported its full fiscal year results last week, and once again the opinions on the stock are very divided. On one hand, we have investors looking for value who are seeing a significantly undervalued opportunity, and on the other end of the spectrum is the market that continues to punish the stock.

For one of the most recognized online payment brands, PYPL surely looks attractive as it trades at roughly an 80% discount to its 2021 highs. Having said that, however, PYPL did fall 11% on the day it reported earnings last week, and this is a sign that even value investors should not ignore. Simply assuming that the market is being irrational for some strange reason is a foolish assumption in my view.

Having said that, I remain optimistic on PayPal’s stock prospects, but I also expect a bumpy road ahead and investors should not expect instant gratification.

A Disappointing Earnings Release?

As it happens sometimes, the views of long-term investors and the market could diverge. Either building a successful business or transitioning an existing one always requires some initial pain in the form of high expenditures that do not bring any immediate gratification in the form of profits or top-line growth.

When the expected payoff of such reinvestment initiatives is significantly longer than one fiscal year, however, the inherently short-term market tends to get cautious. That is why, as PayPal’s new CEO is making changes to the business that won’t have any immediate impact, the market reacts accordingly.

While the commentaries from the recent quarterly results were mostly focusing on the negative implications from this, I was very intrigued by the following shift in strategy:

(…) focus on profitable growth. We will prioritize high-quality, profitable growth and driving improved transaction margin dollars through more rigor and discipline.

Source: PayPal Q4 2023 Earnings Transcript.

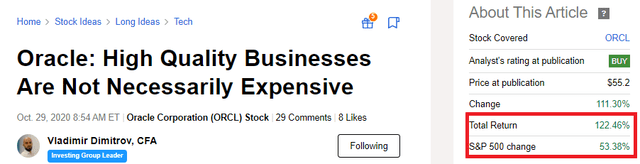

To an extent, it reminds me of Oracle’s (ORCL) case a couple of years ago, when the company was prioritizing profitable growth as opposed to pursuing any growth initiative possible just to appease short-term investors and analysts.

Of course, PayPal’s situation is different given its business model and industry positioning, but as far as the stock price is concerned, there are similarities that are hard to miss.

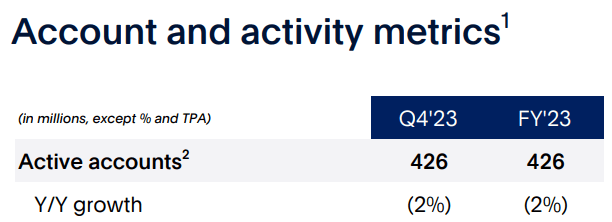

One of the key concerns for short-term investors has been the slight decline of PayPal’s active accounts, which has been ongoing for a number of quarters now

PayPal Investor Presentation

The reduction of workforce and overall size of the company has been troublesome for investors who view PayPal as a growth stock and have a hard time repricing it as a more mature company.

(…) we announced that we will reduce our global workforce by approximately 9% through both direct reductions and the elimination of open roles over the course of the year. As I mentioned in our last earnings call, our size has been slowing us down.

Source: PayPal Q4 2023 Earnings Transcript.

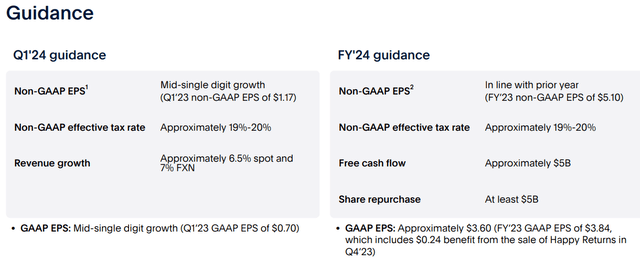

The 2024 guidance was also quite disappointing for anyone expecting an immediate business turnaround. The prospects of a flat year-on-year Earnings Per Share growth is quite scary for investors who have gotten used to double-digit growth rates in the fintech industry.

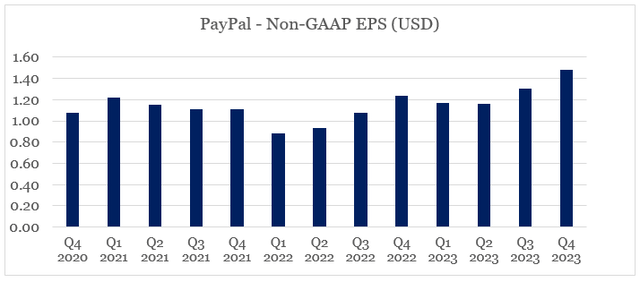

In a sense, I would have been quite disappointed by this guidance, if I was holding PYPL and looking forward to sell the stock in 2024. But for anyone with a longer investment horizon, the prospects of a zero year in terms of top line and EPS growth is hardly a reason to sell, especially when PayPal’s Non-GAAP EPS has already surpassed its pandemic lockdown highs.

prepared by the author, using data from quarterly earnings releases

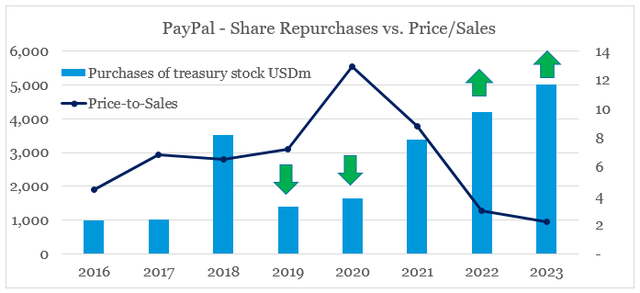

Another area that does not get as much attention as it should is PayPal’s capital allocation, and more specifically the countercyclical nature of the company’s share repurchases. When it comes to capital allocation decisions made, I am always pleasantly surprised when a business spends lower amounts on share repurchases during periods when the stock is trading at high sales multiples and vice versa. Something that has been the case for PayPal, and given the $5bn share repurchase guidance for 2024, it is likely to hold true for 2024 as well.

prepared by the author, using data from SEC Filings

Overall, to me, the negative market reaction to PayPal’s earnings appears to be overdone in the long run. At the same time, however, it prices-in short-term risk and uncertainties related to the business restructuring – a process that rarely goes in a straight line. Therefore, one’s opinion on the stock should be ultimately influenced by the investment term horizon.

All About Revenue Growth

With all that in mind, the recent price reaction has made PayPal even more attractive for long-term holders due to another dynamic and namely – the priority that the market gives to topline growth as opposed to profitability.

This is a process that I described in detail back in 2021 within the context of the cloud sector, and was one of the reasons why I decided to make Oracle one of the first high conviction ideas for my investment group.

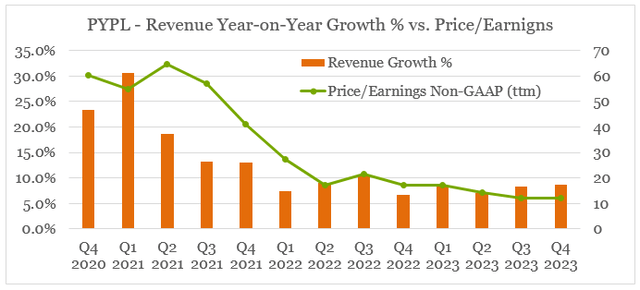

As we see from the graph below, PayPal’s Price/Earnings ratio has closely followed the company’s revenue growth on a quarterly basis for the past 3-years or so.

prepared by the author, using data from quarterly earnings releases

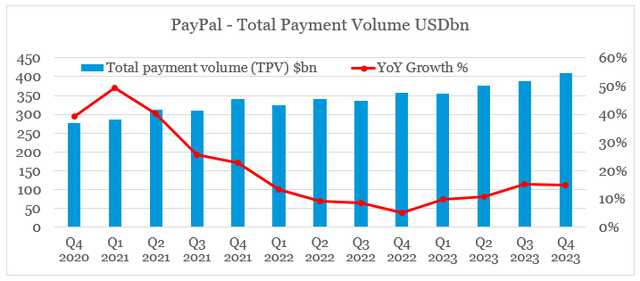

Even though total revenue growth remained at near double-digits and payment volume continued its upward trajectory (see the graph below), the market has repriced PayPal to a forward GAAP P/E ratio of 15.

prepared by the author, using data from quarterly earnings releases

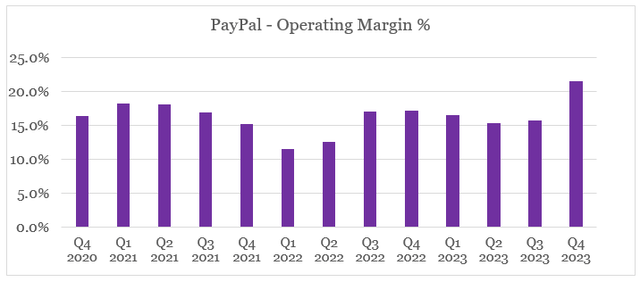

More importantly, however, from an operational point of view, PayPal’s margins have been improving from their 2022 lows as efficiency improves and non-transaction-related expenses fall.

prepared by the author, using data from quarterly earnings releases

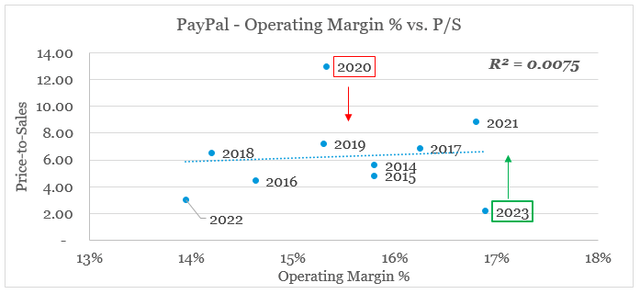

This is now in a very stark contrast to FY 2020, when PayPal’s price/sales multiple was prohibitively high while margins were at lower levels.

prepared by the author, using data from Seeking Alpha and SEC Filings

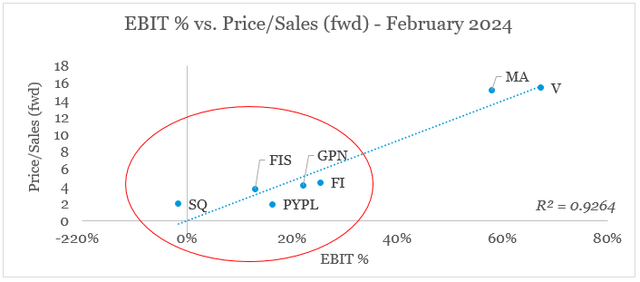

It is worth mentioning that the R-squared value on the graph above is close to zero, meaning that the market does not care all that much for profitability yet. Even on a cross-sectional basis (against competitors), we see a very weak relationship between margins and sales multiples once we exclude the major processors within the industry – Mastercard (MA) and Visa (V).

prepared by the author, using data from Seeking Alpha

This is also due to the fact that the market does not yet perceive PayPal’s margins as sustainable over the long-run. Therefore, long-term investors should not expect any immediate upward repricing of PYPL even if profitability is sustained in 2024. In a similar fashion to Oracle’s case that I mentioned above and that of Fiserv (FI) – it could take years before the market rewards PYPL with a multiple more akin to its current profitability profile.

Conclusion

Deciding on whether or not to invest in PayPal at its current levels largely depends on your investment horizon and ability to endure short-term pain. Although the business model is in a very good standing at the moment, the stock price could be subject to further downside risk given the pricing mechanisms of the equity market. Not to mention execution risks as the company undertakes a shift in its pre-existing strategy. With that in mind, my view on the company has not changed and should the management continue to execute on its current strategy, I will be looking to add it to my portfolio of high conviction ideas in the near future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

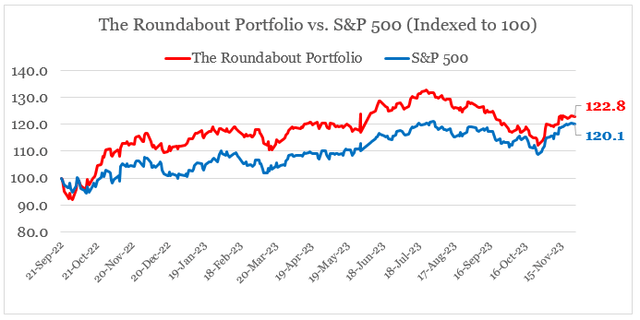

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.