Summary:

- We believe PYPL’s stock price has been overly moderated against its peers, despite the excellent double beat in FQ4’22 and impressive forward guidance.

- It appears that there is a disconnect between its stock valuations and fundamental performance, suggesting an improved margin of safety for those looking to add.

- PYPL’s forward performance may also be boosted by its core merchant payment platform, Braintree for large enterprises, and PPCP for SMBs.

- We shall discuss further.

AlexSecret/iStock via Getty Images

The Undervalued Investment Thesis

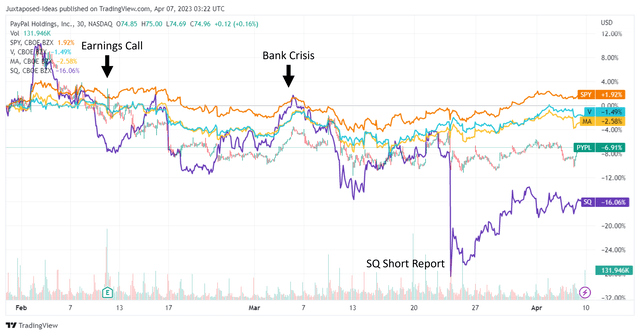

PYPL 2M Stock Price Action

PayPal (NASDAQ:PYPL) has continued to trade range-bound over the past two months, despite the excellent double beats in the FQ4’22 earnings call and impressive forward guidance.

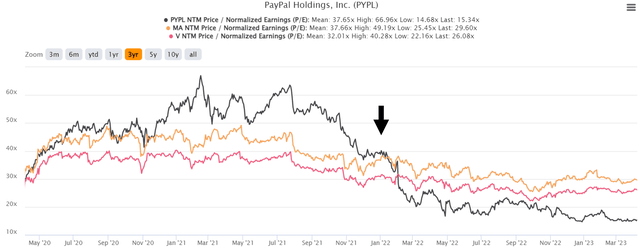

PYPL, V, & MA 3Y P/E Valuations

The disconnect in PYPL’s stock valuations and fundamental performance has been visible since February 2022, further destabilized by the recent banking crisis from the elevated interest rate environment.

This was likely attributed to its expanding unrealized losses of $592M (+580.4% YoY) in available-for-sale [AFS] securities of $22.86B in FY2022. However, we must also highlight its relatively low ratio of 2.5%, compared to the US big banks, such as Citibank (NYSE:C) at 2.5%, Bank of America (NYSE:BAC) at 2.11%, JPMorgan (NYSE:JPM) at 5.1%, and Wells Fargo (NYSE:WFC) at 6.6%.

In addition, PYPL highlighted that it’s unlikely that they would be required to sell any of these securities, given its robust cash/ investments of $13.72B (+5.7% YoY) in FY2022. This was on top of the fact that 56.6% (+17 points YoY) was comprised of cash at $7.77B (+49.7% YoY), suggesting its excellent liquidity at the moment.

Furthermore, despite the uncertain macroeconomic outlook, the fintech’s percentage of consumer loans and interest receivable > 90 days outstanding of 1.4% (-0.1 points YoY) and merchant loans > 90 days outstanding of 3.7% (+0.6 points YoY) in FY2022 remained well below FY2019 levels of 2.2% and 4.2%, respectively.

The rising interest rates also contributed to the expansion in PYPL’s interest income to $174M (+205.2% YoY) in FY2022. However, the net effect appeared to be negative for now, given the increase in its interest expenses to $304M (+31% YoY) at the same time.

The Fed’s continuous rate hikes have also drastically expanded the fintech’s transaction and credit losses to 0.12% (+0.3 points YoY) at $1.57B (+48.1% YoY) in FY2022. While these were below pre-pandemic levels of 0.19% and $1.38B in FY2019, its operating expenses have risen to $23.68B (+12.2% YoY) in FY2022.

This was significantly worsened by PYPL’s increasing transaction costs to $12.17B (+18% YoY). The latter was mostly attributed to Braintree, its payment processing platform for large clients, which usually utilized unbranded cards with higher expense rates. As a result, the fintech had reported lower operating margins of 14% (-3% points YoY) and net income margins of 8.7% (-7.4 points YoY) in FY2022, impacting its adjusted EPS which came in at $4.13 (-10.2% YoY).

However, we prefer to look at Braintree’s growing transaction costs as a positive tailwind. This is why:

PYPL’s Braintree is a vertically integrated payment platform that is capable of serving high-demand and high-volume global customers, such as Airbnb (NASDAQ:ABNB) and Uber (NYSE:UBER). As highlighted by Frank Keller, SVP of Merchant & Payments in PYPL:

So we’ve made huge progress with these large global brands in providing full stack processing, alternative payment methods, pass-through pricing, payments optimization, off-rate optimization, treasury reconciliation. So it’s really a full stack service. We’re in 50 markets across U.S., Europe, Australia, Canada, Brazil, 230-plus currencies. Our Braintree vault that stores consumer credentials, financial instruments and other customer data is actually one of the most sophisticated in the industry. (Seeking Alpha)

PYPL’s Braintree had been highly successful in onboarding merchants in FY2022, with the unbranded processing volume expanding by +40% YoY to $400B. Given that it comprised 29.4% of the fintech’s Total Payment Volume [TPV], we believed that the volume growth more than made up for the lower margins.

Furthermore, with the Fed’s earlier “policy firming” with a projected terminal rate of 5.25%, we may only see another 25 basis point hike in the short term, with a pivot likely by early 2024 once the rising inflation is tamped down in our view.

Therefore, it seems apparent that PYPL’s headwinds are only temporary, attributed to the rising interest rates instead of its fundamental performance, especially given PYPL’s excellent FY2023 adj. EPS guidance of $4.87 (+17.9% YoY).

This was on top of the consistent growth in TPV to $1.36T (+13% YoY FXN), the number of payment transactions to 22.3B (+16% YoY), and the Net New Active Accounts of 8.6M (+2% YoY) in FY2022, suggesting an excellent consumer stickiness despite the uncertain macroeconomic outlook.

Furthermore, PYPL had also competently moderated its other operating expenses, such as customer support, sales/marketing, general/ administrative, to $6.46B (-2.4% YoY) in FY2022, while refocusing on its tech/ development efforts to $3.23B (+7.2% YoY). This underscored the fintech’s laser focus on delivering innovation and top/bottom line growth, while staying lean with the 7% reduction in headcount.

Therefore, while other players have also entered the crowded digital payment market, such as Amazon Pay (NASDAQ:AMZN) and Apple Pay (NASDAQ:AAPL), we are not concerned at all, attributed to PYPL’s success with Braintree thus far.

In addition, the fintech is already eyeing the Small-to-Medium Businesses’ $750B in Total Addressable Market, with PayPal Complete Payments [PPCP] to be launched by H1’23, suggesting further tailwinds to its top and bottom line growth.

So, Is PYPL Stock A Buy, Sell, or Hold?

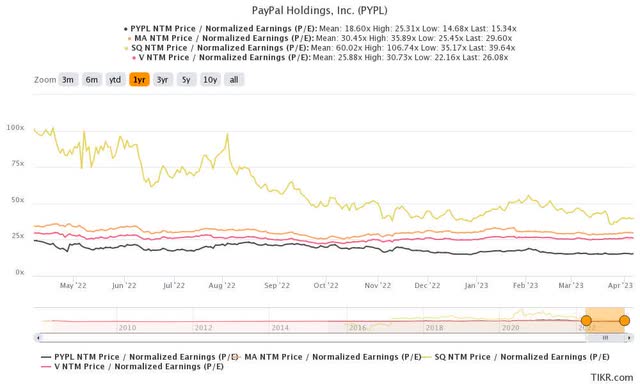

PYPL, SQ, V, & MA 1Y P/E Valuations

Despite the stellar guidance, PYPL continues to trade at a NTM P/E of 15.34x, lower than its 3Y pre-pandemic mean of 32.63x and 1Y mean of 18.60x. The pessimism is surprising indeed, compared to its peers such as Block (NYSE:SQ) at NTM P/E of 39.64x, Visa Inc. (NYSE:V) at 26.08x, and Mastercard (NYSE:MA) at 29.60x.

In addition, PYPL’s guidance suggests a normalized CAGR of 11.95% since FY2019, against SQ at 7.7%, V at 11.3%, and MA at 11.1% at the same time. Assuming a similar cadence over the next few years, PYPL may also achieve an excellent FY2025 EPS of $6.10, based on Braintree’s success thus far and the potential contribution from PPCP.

Despite the elevated Share-Based Compensation [SBC] expenses of $1.26B (-8% YoY) in FY2022, PYPL managed to keep its share count relatively stable at 1.15B (-2.3% YoY) as well. This was attributed to the sustained share repurchase program, with $4.2B (+23.5% YoY) repurchased in FY2022 and $15.86B unexercised with no expiry date. With the fintech guiding for another $3.75B of share repurchases in FY2023, we reckon the future expansion of its EPS may meet our ambitious projections after all.

These factors point to a notable disconnect between PYPL’s stock valuations and fundamental performance, in our view, giving interested investors an improved margin of safety for long-term investing. Based on our FY2025 projections and moderate upward rerating in its P/E valuations to 20x, we are also looking at a bullish price target of $122, suggesting an excellent upside potential of up to 62.7% from current levels.

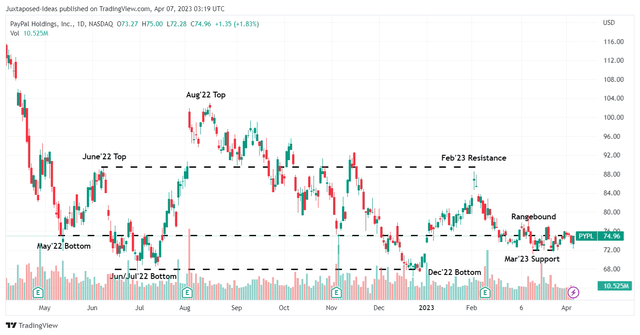

PYPL 1Y Stock Price

The PYPL stock has been well supported at the March 2023 bottom as well. Combined with the fact that it is trading below its 50/ 100/ 200-day moving averages, we continue to rate the stock as a buy here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.