Summary:

- PayPal has improved the EPS growth trajectory and is showing the same EPS growth momentum it had pre-pandemic.

- Between 2015 and 2019, the EPS grew from 0.8 to 2.1 which is equal to 22% CAGR and the recent EPS growth projections show a similar trend line.

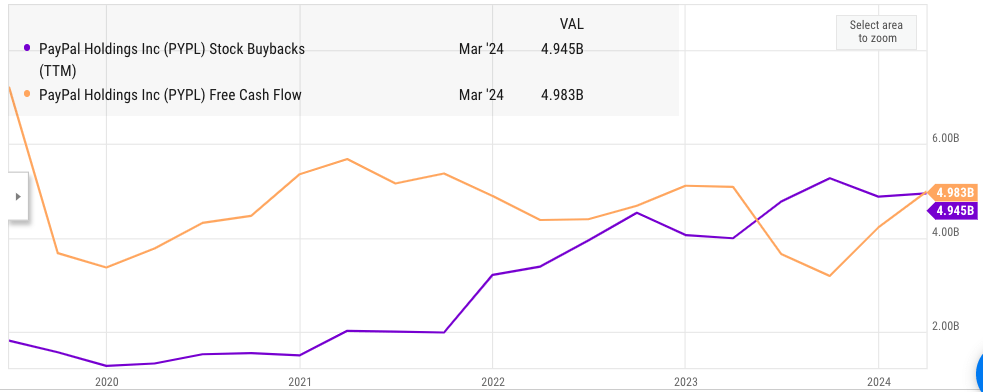

- PayPal is investing close to $5 billion annually on buybacks which should improve EPS growth by 8%-10% on a standalone basis.

- The recent drive to optimize headcount should also improve the margins and have a significant impact on EPS growth.

- Despite the rising competition from Big Tech and other competitors, PayPal should be able to show high single-digit revenue growth.

chameleonseye

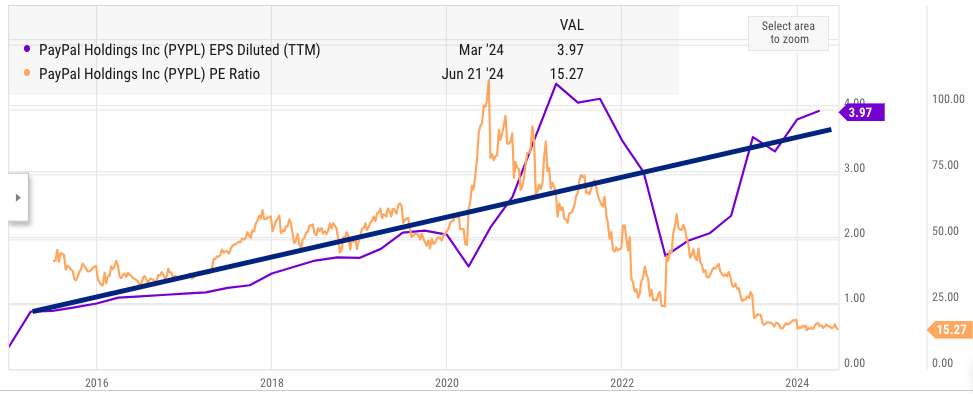

PayPal (NASDAQ:PYPL) (NEOE:PYPL:CA) stock has continued to face negative sentiment from Wall Street and has been range-bound between $55-$65 for the last few quarters. On the other hand, the company is showing silver linings in terms of key metrics. The EPS growth trajectory is reaching the trend we saw before the pandemic. Between 2015 and 2019, PayPal’s TTM diluted EPS increased from $0.8 to $2.1 which is equal to 22% CAGR. The recent quarterly GAAP EPS growth was 18%.

The forward EPS growth trajectory looks promising. PayPal is spending close to $5 billion annually on buybacks, which will increase EPS by 8%-10% at the current price on a standalone basis. The company is also undergoing a massive cost optimization drive and will cut 9% of the headcount in 2024. These two factors should increase the EPS by 16%-18% in the next few quarters.

However, PayPal is facing increasing competition from Big Tech and other competitors. Recently, after Apple (AAPL) Pay announced Wallet’s Tap to Cash initiative, PayPal stock dropped for seven straight sessions, losing 11%. This shows that Wall Street is very cautious over the changing competitive environment faced by PayPal. However, PayPal is still showing strong double-digit growth in key metrics like the number of payment transactions and payment transactions per active account. The real issue with PayPal is the marginal 1%-2% decline in active accounts. The recent initiatives launched by PayPal should help in turning the active account metric positive by the end of the year. There is a strong upside potential for PayPal stock due to its rock-bottom price and a good EPS growth trajectory.

Improvement in EPS trend

YCharts

Figure: PayPal’s EPS trend over the last few years. Source: YCharts

We can see in the above chart that PayPal’s EPS growth trend is now getting close to its pre-pandemic trajectory. Between 2015 and 2019, the company improved its EPS by 22% CAGR. After a massive bump in the pandemic and a big dip in 2022, the TTM EPS is now close to $4. However, this is not reflected in the PE multiple. Prior to the pandemic, PayPal was trading at a PE ratio range of 50-60. This has now dropped to 15. The low PE multiple reflects the increasing caution of Wall Street towards the business model of the company. However, this also gives investors a good entry point who believe that the current EPS growth will inevitably change Wall Street’s perception in the next few quarters.

YCharts

Figure: Increase in stock buybacks by PayPal. Source: YCharts

The management has ramped up stock buybacks in the last few quarters and is now investing almost the entire FCF towards buybacks. At the current price, PayPal is able to expunge close to 8%-9% of the outstanding stock every year. This leads to almost a similar jump in EPS growth on a standalone basis. It is highly likely that this buyback initiative will go on for a few more quarters, which should provide a massive tailwind to the EPS trajectory.

The management had also announced that they would be cutting the headcount by 2,500 or 9% in 2024. The impact of these optimizations will take a few quarters to reflect but it is likely that the overall effect could be as big as the efficiency drive undertaken by Meta (META) in 2023. It should be noted that the company had reported 9% YoY revenue growth in the recent quarter and is hoping to deliver a similar range of growth in the next few quarters. Together with headcount optimization, this could lead to a strong margin improvement, which will help improve the EPS projection for the stock.

Threat of competitors

Beyond the EPS trend, Wall Street is very cautious about the ability of PayPal to compete with Big Tech players like Apple, Google (GOOG), and Amazon (AMZN). All these companies have massive resources and are looking to grab a bigger share of the digital payments ecosystem. The recent double-digit drop in PayPal’s stock after Apple’s announcement of Tap to Cash initiative is a good example.

However, the threat of higher competition faced by PayPal is likely overstated. One of the reasons is that the digital payments ecosystem is unlikely to be a winner-takes-all market. The financial industry is highly regulated in all regions, and it is unlikely that regulators will allow a few Big Tech companies to corner the entire industry. Recently, Apple stopped offering loans through its Apple Pay Later option. This shows that even Apple might not succeed with every financial product. It also shows that regulatory scrutiny would increase as Apple and other tech companies increase their presence in the financial space. PayPal has a long history of dealing with different regulatory environments, and it is in a better position to weather any regulatory issues.

Another major reason why competitive headwinds for PayPal are overstated is that the online payments industry is still growing rapidly. There are a lot of new innovations which are taking place. PayPal is investing in outside companies and is also launching new products. This should be a long-term tailwind for the company as the overall digital payments industry grows.

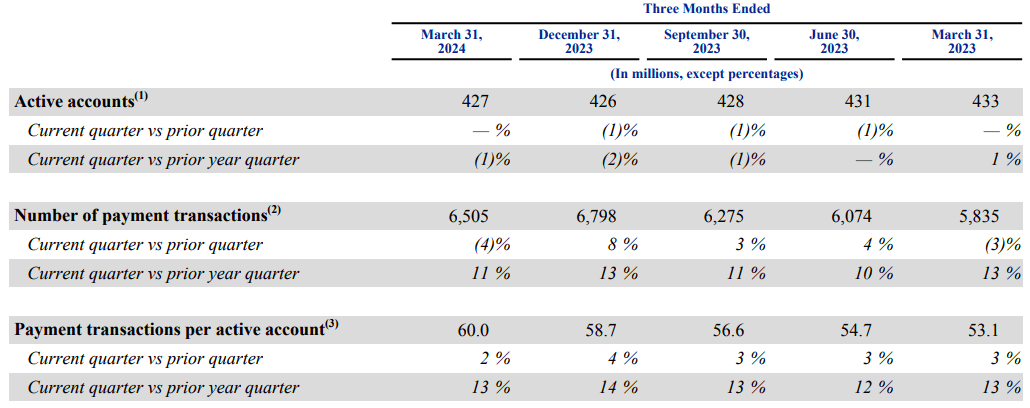

PayPal is also showing good progress in several key metrics. The company reported 11% YoY growth in number of payment transactions and 13% YoY growth in payment transactions per active account in the recent quarter. This was followed by double-digit YoY growth in the previous four quarters, which is a good sign that the overall business model is strong and the usage of its products is increasing at a healthy pace.

Company Filings

Figure: Key metrics of PayPal. Source: Company Filings

However, the biggest argument made by bears is the decline in active accounts. PayPal’s active accounts declined to 427 million from 433 million in the year-ago quarter. This is equal to a 1% decline. Over the last few quarters, PayPal has reported 1%-2% decline in active accounts. I believe that this headwind is overstated. PayPal could turn this metric positive by the end of the year as new products come online.

Future stock trajectory

PayPal stock is trading at 15 times its PE ratio, which is quite cheap considering the forward EPS growth projections. Even in a base case scenario, PayPal should be able to deliver over 20% EPS growth for 2024. The revenue growth is still quite strong at 9% YoY growth. If the company manages to deliver double-digit YoY revenue growth and is able to improve the active accounts metric, we should see a massive upward swing in the sentiment toward the stock.

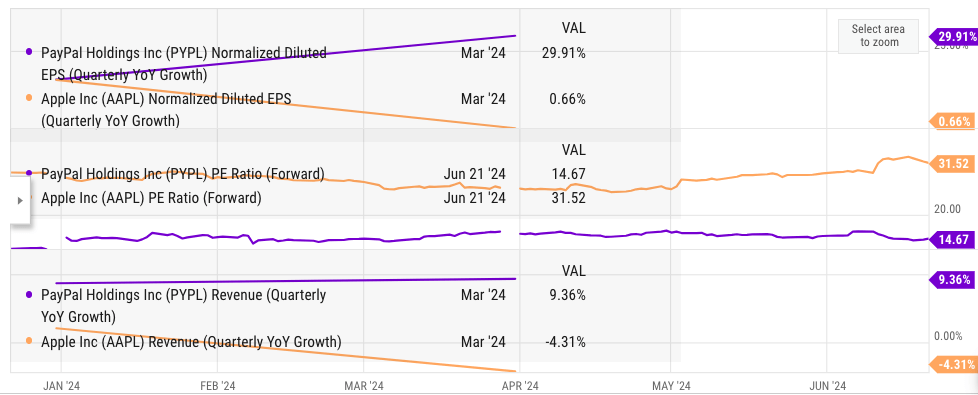

Most of the bearish coverage of PayPal mentions the growth of Apple Pay. Hence, it is important to compare some of the basic metrics of PayPal and Apple.

YCharts

Figure: Comparison of Apple and PayPal metrics. Source: YCharts

PayPal’s forward PE is less than half of Apple, while its EPS growth trajectory is significantly higher. The revenue growth of PayPal is also much better than Apple, which has been showing negative growth for a few quarters.

While PayPal does face headwinds, they are not insurmountable. A few more quarters of good EPS growth trajectory should build better sentiment toward the stock. The current price point is quite attractive and gives investors an option to gain from an upside swing while having few risks associated with the stock.

Investor Takeaway

PayPal stock has been beaten down as the competitive threats have been hyped up. The company can give good EPS growth due to its stock buybacks and also improve margin through significant cost optimization. The key metrics for the company are still quite strong and show double-digit growth. The YoY revenue growth is also close to 10%. Improvement in macroeconomic situation should provide a strong tailwind to the company and improve the sentiment towards the stock, making it a Buy at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.