Summary:

- PayPal’s stock price reaches a 6-year low at $53.94 per share, signaling investment potential.

- Massive user base of over 431 million, which will keep generating revenue for the company.

- Even if price drops more, it is unlikely that a potential acquisition will yield a price per share less than $56.

Sean Gallup

Investment Thesis

While PayPal’s (NASDAQ:PYPL) stock has recently hit a six-year low at $53.94 per share, the anticipation of a remarkable threefold increase in the projected EPS to $4.95 for the coming year paints a compelling growth story.

Despite this growth potential, the stock price hasn’t seen a corresponding uptick, raising questions about market dynamics and competition from players like Stripe and Adyen.

Nevertheless, PayPal’s position as a market giant is emphasized by its extensive user base, exceeding 431 million, solidifying its role as a formidable player. In comparison, its main competitors, Block with 44 million active users and Adyen serving a modest 10,000 businesses and 40,000 consumers, operate on a significantly smaller scale. With a conservative P/E ratio of 9 and the potential for a substantial valuation increase, it would be unwise to overlook an investment in a company consistently generating significant cash flows year after year.

Market Perception is Questionable

The downward spiral in PayPal’s stock to a six-year low at $53.94 per share triggers memories of a time when it enjoyed a sterling reputation as a prime investment in June 2017. Back then, the company dazzled investors with an impressive EPS of $1.47. The stark contrast between then and now raises questions about the challenges and shifts in the financial landscape that PayPal now navigates.

Anticipation looms for PayPal’s future as analysts project an EPS of $4.95 for the coming year, marking a remarkable threefold increase over the past six years. It’s a compelling growth story that, curiously, hasn’t translated into an uptick in stock price. The juxtaposition prompts contemplation on the broader market dynamics and how PayPal positions itself against a sea of formidable competitors-Stripe (STRIP), Adyen (OTCPK:ADYEY), and Block (SQ) among them.

In the face of these challengers, PayPal remains a giant, set to achieve an EPS of $5.6 next year. While some might view it as a mature company with limited growth prospects, its ace lies in the colossal database it commands-over 431 million active users. This sheer scale places PayPal in a league of its own, a valuable asset in an era where data is akin to gold.

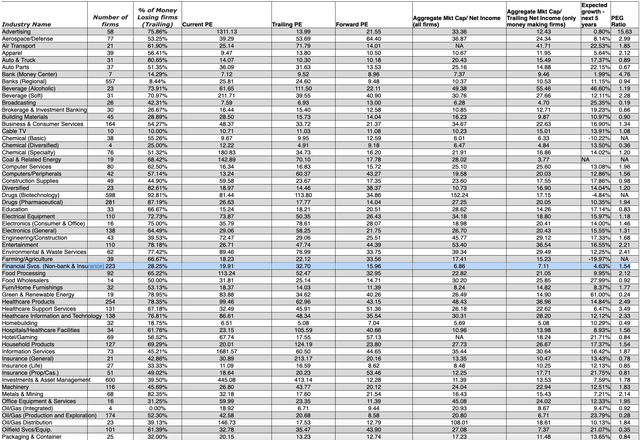

PE Ratio by Sector (Stern NYU)

Digging into valuation metrics, PayPal’s P/E ratio of 9, compared to the sector’s average of 15, raises eyebrows. The current market sentiment seems to undervalue PayPal, perhaps overlooking its formidable user base and the potential it holds. Even at this seemingly conservative multiple, PayPal becomes an enticing acquisition prospect.

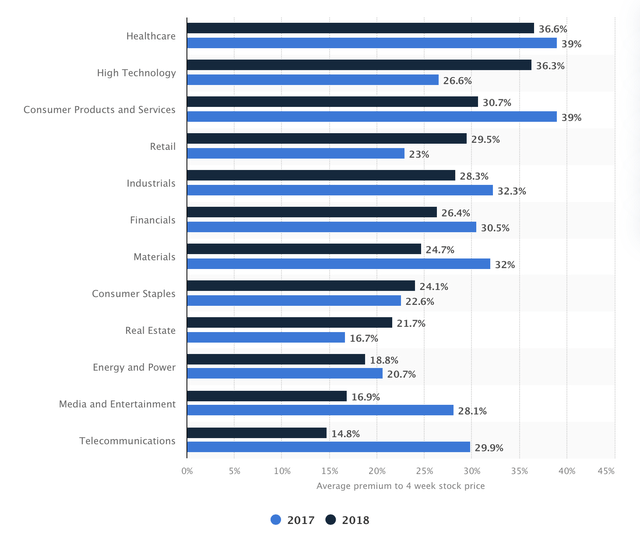

M&A premiums (Statista.com)

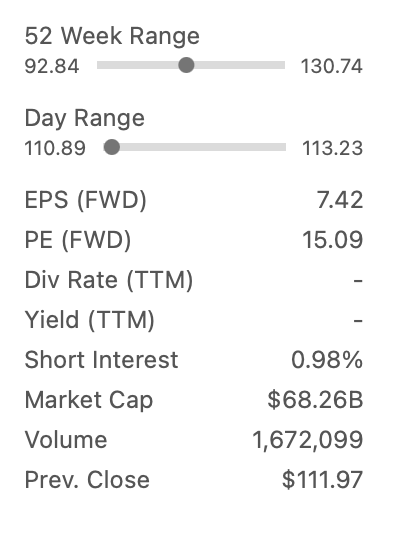

At 8 times earnings, the valuation pegs PayPal at $44.8, a figure that might seem low given its strategic advantage. Even matured companies and competitors like Fiserv, have an average P/E of 15.

Fiserv Financial Data (Seeking Alpha)

However, when historical premiums for financial companies are factored in at 26-30%, according to Statista, a potential sales price of $56.5-$58.24 emerges. This figure seems to mark a point of stabilization-a bottom where PayPal’s true worth might be recognized.

In essence, beyond the market fluctuations and price tags, PayPal’s story is one of adaptation and latent potential. As it weathers the storms of competition, the company’s vast user base could prove to be its trump card, making it a compelling prospect for strategic acquisitions and partnerships in the ever-evolving financial landscape.

Risks

Investing in PayPal carries risks, including fierce competition in the dynamic fintech sector, potential regulatory hurdles, and the constant threat of cybersecurity breaches. The company’s reliance on technological infrastructure and susceptibility to economic downturns add layers of vulnerability. Additionally, currency exchange fluctuations and the dependence on partnerships underscore the multifaceted nature of risks. While PayPal’s global presence and massive user base offer opportunities, prudent investors must navigate these challenges and stay attuned to market dynamics for a well-informed investment strategy.

Conclusion

PayPal Holdings, Inc. is currently valued at just 9 times next year’s projected EPS. However, this seemingly modest valuation fails to capture the true essence of PayPal’s potential. Even without flashy prospects, the company is poised to yield substantial returns. In essence, the current market sentiment appears to undervalue PayPal, overshadowing its formidable user base and the latent potential it holds.

In summary, beyond the transient ebbs and flows of the market and numerical values, PayPal’s narrative echoes one of adaptability and untapped potential. As it navigates the competitive landscape, the sheer magnitude of its user base emerges as a strategic advantage-a trump card that positions PayPal as an enticing prospect for strategic acquisitions and partnerships in the ever-evolving financial landscape.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.