Summary:

- PayPal’s stock analysis suggests competition risks are exaggerated, with strong financial performance and room for growth in the digital payments industry.

- PayPal’s consistent growth across key financial metrics and recent guidance boost are not indicative of a company struggling to protect its market position.

- Intrinsic value calculation indicates PYPL is significantly undervalued, with a potential market capitalization significantly higher than its current value.

franckreporter

My thesis

My PayPal’s stock (NASDAQ:PYPL) analysis suggests that fears around the competition risks are highly likely exaggerated. The dynamic of PayPal’s financial performance does not look like the performance of a company that struggles to compete. The competition is indeed intensifying, but the industry is still expanding rapidly and there will be room for all players to enjoy deeper penetration of digital payment solutions. Moreover, PayPal is the industry’s pioneer with a compelling value proposition for both customers and merchants. The management is proactive by working on improving customers’ experience while keeping costs under control. PayPal’s current market capitalization is significantly below the company’s intrinsic value, which presents a great buying opportunity and makes PYPL a Strong Buy.

PYPL stock analysis

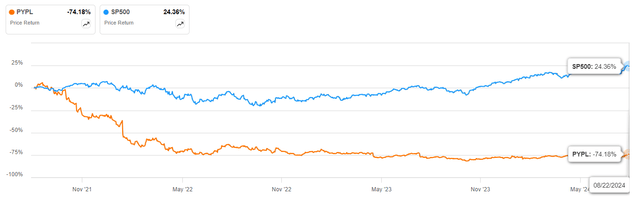

PayPal’s investors likely enjoyed the COVID-19 pandemic very much. The global lockdown has led to the rapid growth in e-commerce. Soaring e-commerce sales volumes meant more demand for digital payments. As a result, PayPal’s stock outpaced the broader market in 2020-2021. However, in 2022, much of the market faced a substantial correction. While the broader stock market demonstrated a rapid rebound in 2023 and positive dynamic in 2024, PYPL’s investors continued suffering.

There is an apparent big risk factor for PayPal, which is the rapidly intensifying competition. The digital payments environment is evolving, and it does not look like it did 10 years ago. Apart from steady adoption of crypto currencies as payment means for products and services, several large players are now direct competitors to PYPL. For example, Apple (AAPL) Pay recently dethroned PayPal as favored in-store mobile wallet. Google (GOOGL) Pay is also in the race in this niche. While I tend to agree that competition risk exists, I think that this risk is exaggerated.

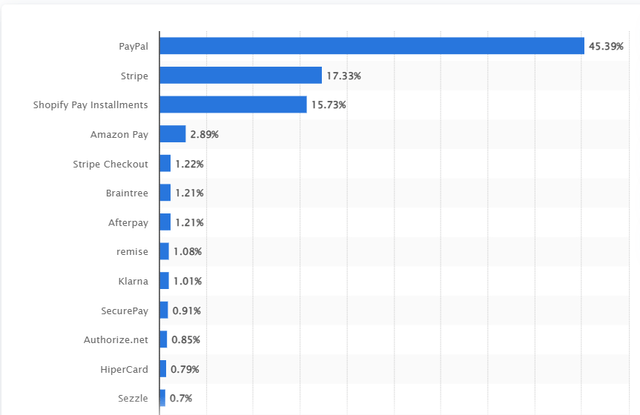

First of all, digital payments industry still significantly outpaces the global GDP growth, and it is expected to observe a 9.52% CAGR by 2028. That said, there will likely be enough room for all players to drive revenue growth. Moreover, readers should understand that the digital payments industry is not only about paying with your mobile wallet. It is a much more diverse industry, where PayPal’s footprint is notable. For example, PYPL has a massive 45% global market share in payment gateways and ‘buy now, pay later’ (BNPL).

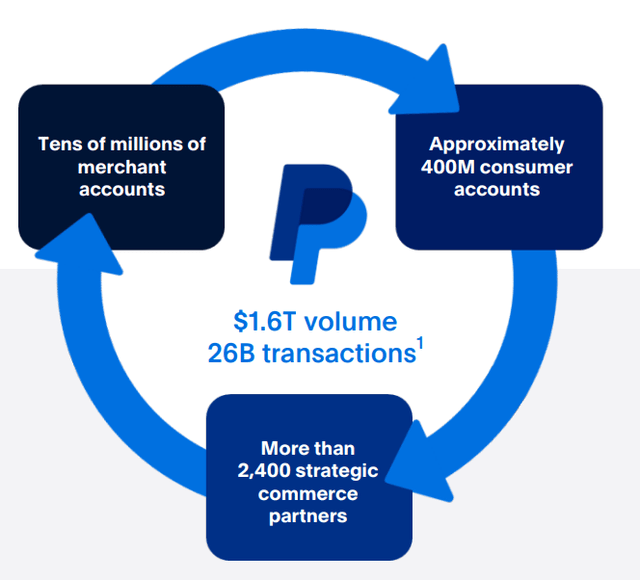

PayPal’s overall footprint in the digital payments industry is massive as the company’s TTM total payments volume is $1.6 trillion for 26 billion transactions. Building such a massive scale is not something easy to replicate, which provides PYPL with a solid moat against competition. The company has vast amounts of data about consumers’ spending behavior, which is also a formidable asset. Therefore, I think that the company’s initiative to launch its targeted advertising platform has solid potential. The company conducted billions of transactions for ages, meaning that the quality of data to train its targeting algorithms will highly likely be high-quality.

Secondly, PYPL is not just a random digital payments company. The company is a pioneer in digital payments and the company has a strong brand and record of success. A prudent approach to risk management and PYPL’s tokenization systems ensure the safety of transactions, which is crucial in maintaining trust from customers. The platform is an end-to-end experience that provides direct connection between customers and merchants, which also increases attractiveness of PYPL’s ecosystem.

Another reason why I believe that PYPL is able to cope with competition risks is that the management is proactive in addressing the evolving environment. The company consistently rolls out new products and features. This helps in expanding its reach and improving experience for customers. PayPal also has strong strategic partnerships with Visa (V) and Mastercard (MA), companies that dominate the credit cards’ market in the U.S.

For example, just yesterday it was announced that PayPal partners with Adyen, a Dutch payment processing platform, which is a prominent player in Europe. The partnership will expand PayPal’s reach as its Fastlane offering will now be available for Adyen’s customers. Expanding outside the U.S. is a solid potential growth driver for PYPL as the company mostly generates revenue domestically.

Another example of PYPL’s commitment to improve customer experience is working on its offerings diversification. Earlier this year PayPal has partnered with MoonPay to introduce a new fiat-to-crypto transaction service for US customers. Apart from recognizing secular trends in crypto assets, PayPal also leverages AI capabilities. In January 2024 the company introduced new AI-powered features to streamline experience of customers.

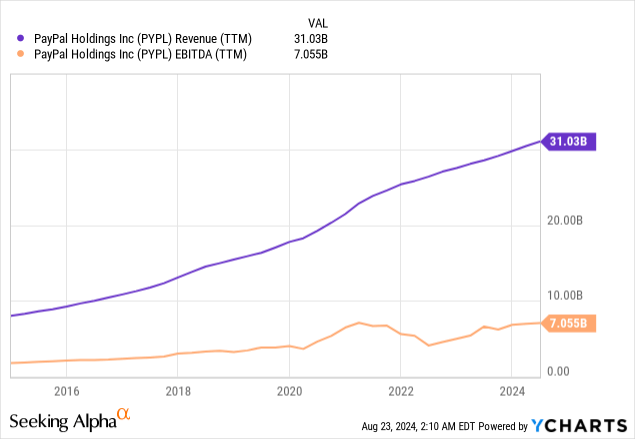

PayPal’s competitiveness is underscored by the company’s consistently growing top line and improving profitability profile. Revenue growth is apparent, and the growth trajectory of EBITDA is also impressive. Thus, PayPal’s financial performance does not look like the performance of a company that is unable to compete.

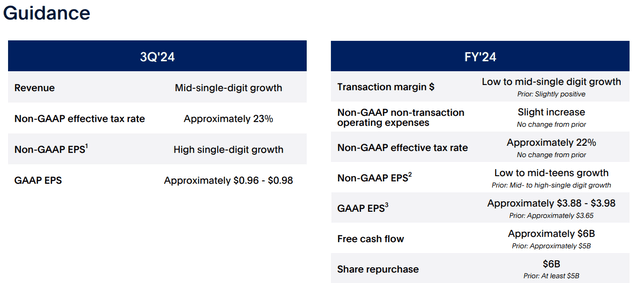

Moreover, the company raised its 2024 full-year guidance across most of crucial metrics in its Q2 earnings presentation. A billion-dollar increase in the company’s share buyback plan is a robust indication of the management’s confidence in PayPal’s ability to drive more revenue and profitability growth. This confidence in the availability of spare cash to buyback stocks is also likely based on the company’s focus on cost efficiency as part of the turnaround plan. What I like the most about the management’s turnaround strategy is that the company now focuses on profitable growth instead of just growth. The bottom line is the one that matters the most at the end of the day, and focusing profitable growth is a more sustainable approach than just ‘growth at all costs’.

I think that these are solid reasons to believe that competition fears around PayPal are overestimated, and there are more positive indications than negatives. My opinion coincides with Argus Research as they upgraded PayPal’s stock to Buy after the Q2 earnings release.

Intrinsic value calculation

PayPal’s valuation ratios are very low for a growth stock with FY2025 forward P/E ratio at 14.81. Another indication that the stock is undervalued is a very low 9.99 TTM Price/Cash Flow ratio.

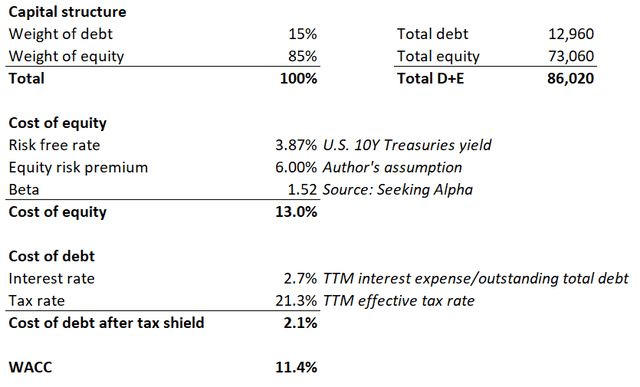

To simulate the discounted cash flow model (DCF), I need to figure out the weighted average cost of capital (WACC) first. In the below working I outline my CAPM calculations explaining why PYPL’s WACC is 11.4%.

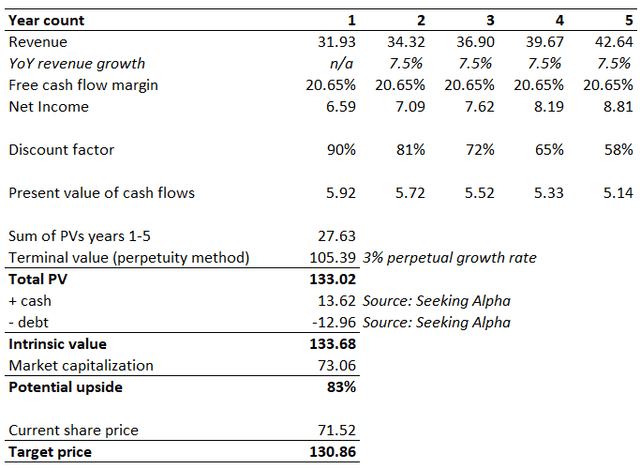

A $31.93 billion revenue for year 1 is the projection from consensus. PYPL’s last decade’s revenue CAGR was around 15%, but penetration of digital payments is now much deeper compared to ten years ago. Moreover, competition in the industry is intensifying. Therefore, I think that incorporating a 50% haircut is fair, and my revenue CAGR for the next five years is 7.5%. The constant growth rate is 3%, one percentage point ahead of long-term inflation average. The TTM levered FCF margin is 20.65%, expected to stay flat due to intense competition.

The intrinsic value of the company is almost $134 billion. This is significantly higher than PYPL’s market capitalization. The stock looks too cheap to ignore, in my opinion.

What can go wrong with my thesis?

I might be underestimating the competition risk and PYPL can fail to achieve revenue growth rate and FCF margin level that I have incorporated into the DCF template. My DCF model takes into account only quantitative factors, but qualitative ones might be more important in perception of the stock market. For example, the market might start considering PayPal’s offerings inferior compared to competitors. This will likely adversely affect the stock price even if PYPL’s financial performance remains robust.

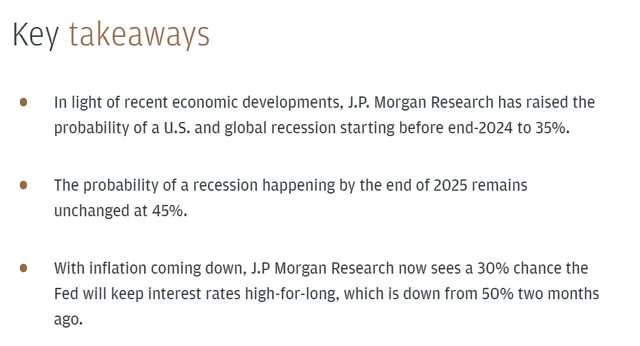

As a company that benefits from volume of consumer spending, PayPal is dependent on the health of broader economy. The U.S. unemployment rate continues rising steadily, which might adversely affect PYPL’s total payments volumes. Recession is also a big risk for PYPL. In their recent report, analysts of JPMorgan Chase (JPM) shared an opinion that there is a 35% probability of a recession happening in 2024. There is also a 45% probability of a recession happening by the end of the next year. Recession will likely adversely affect the company’s financial performance. It will also inevitably lead to an overall stock market selloff.

Summary

PayPal’s valuation looks too attractive to miss such an opportunity. I think that the market is likely overestimating competition risks as there are several robust indications that PayPal is strong enough to protect its market position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.