Summary:

- PayPal stock price has been weakened by the departure of Elliott Investment Management, presenting a contrarian buying opportunity.

- PayPal has made progress in cutting costs and buying back stock, appealing to investors.

- Despite the exit of Elliott Investment Management, PYPL is on a good path with expense cuts and share repurchases.

chameleonseye

PayPal Holdings Inc. (NASDAQ:PYPL) suffers from ongoing stock price weakness and a couple of developments have hurt investor sentiment lately, particularly the departure of Elliott Investment Management, whose involvement with the fintech was widely seen as a catalyst for PayPal Holdings’ stock.

The payments giant’s stock slumped to new 52-week lows shortly after the activist investor threw in the towel, which I think is a good opportunity to consider PayPal Holdings from a contrarian point of view.

PayPal Holdings made progress in the second quarter by cutting costs and buying back a boatload of stock, which should appeal to investors in addition to a low earnings multiple.

PayPal Holdings Is A Contrarian Buy After Elliott Investment Management Exits Fintech Stake

Elliott Investment Management recently disclosed in its 13F filing that it is no longer invested in payments technology company PayPal Holdings which has added to selling pressure following the fintech’s quarterly earnings release.

Just about a year ago, Elliott Investment Management’s $2.0 billion investment in the fintech created excitement with investors hoping for share repurchases and a more focused initiative to control operating expenses. As far as I know, the investor has not given an official explanation about why it sold its investment.

Though PayPal Holdings has made quite considerable progress bringing its expenses back under control, the exit of Elliott Investment Management has further weighed on PayPal Holdings’ sentiment and helped drive the company’s stock price to a new 52-week low of $57.29. From a technical point of view, the setup is bearish as PayPal Holdings’ stock broke through both the 50-day and 200-day moving average trend lines.

Moving Averages (Stockcharts.com)

Despite the exit of the activist investor, PayPal Holdings is on a good path in terms of expense cuts and share repurchases that will benefit shareholders even if Elliott Investment Management no longer invests.

With revenue and profit growth slowing, PayPal Holdings has been under pressure to reset its operating expenditures across expense categories, and the fintech has seen some accomplishments in this regard.

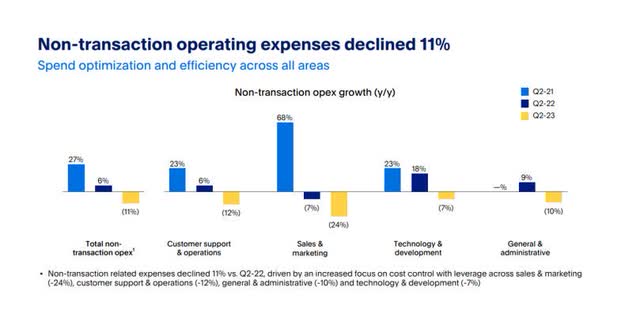

PayPal Holdings lowered its non-transaction related operating expenses by 11% to $1,788 million in 2Q-23 and expenses declined on a YoY basis in all areas of the fintech’s business. The largest percentage decline occurred in the sales and marketing category, where expenses were reduced by 24% YoY.

Operating Expenditure (PayPal Holdings)

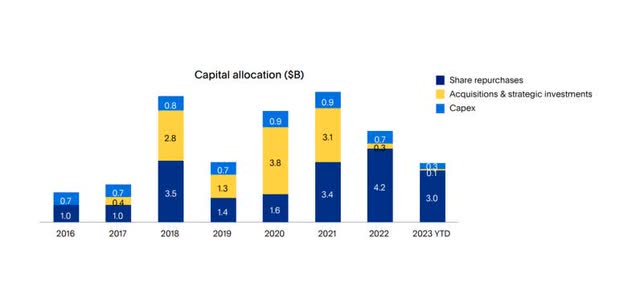

Elliott Investment Management may no longer have a stake in the fintech, but the investor pushed for higher share repurchases, which will benefit retail investors moving forward.

In the first six months of the year, PayPal Holdings repurchased $3.0 billion worth of its shares and is on track to repurchase $5.0 billion by the end of the year. PayPal Holdings upsized its repurchase target from $4.0 billion to $5.0 billion after the sale of receivables to an asset management company in the second quarter.

Capital Allocation (PayPal Holdings)

Excessive Margin Of Safety After Elliott’s Exit

PayPal Holdings presented surprisingly resilient guidance for 2023 and reiterated its expectation to earn ~$4.95 per share in adjusted earnings in the current year, which reflects 20% YoY growth.

Taking into account that PayPal Holdings’ stock price has fallen to just $60.98 last Friday, the profit outlook for 2023 implies an earnings multiple of 12.3x.

If I were to plan for just 15% earnings per share YoY growth with respect to adjusted earnings, then PayPal Holdings could be on track to earn ~$5.70 per share. I don’t think that this is a particularly aggressive assumption, and since a company’s valuation should be based on forward-looking metrics, my estimate implies a forward P/E ratio of 10.7x. I think the valuation reflects an irresistibly high margin of safety considering that PayPal Holdings is the largest fintech enterprise in the world, with 431 million customers transacting through the PayPal network.

PayPal Holdings’ Growth Opportunity

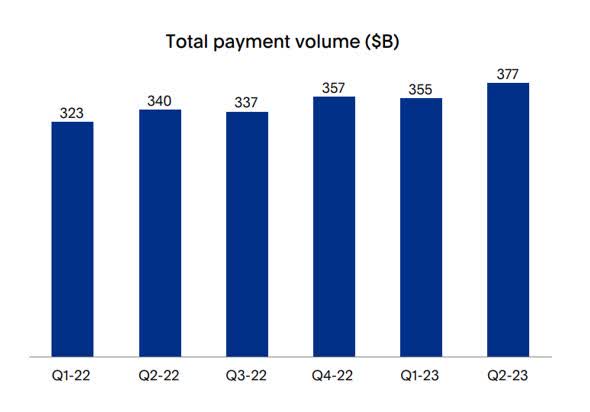

PayPal Holdings has a big opportunity to expand its BNPL (Buy Now, Pay Later) offerings in the digital payments industry, which could fuel the fintech’s total payment volume (TPV). PayPal Holdings’ TPV rose 11% YoY (on a spot and FX-adjusted basis) in the second quarter to $377 billion.

BNPL is a growth industry, and it will fundamentally boost transaction volumes for PayPal Holdings in the next decade. Based on projections from Statista, the transaction volume of BNPL payments in the eCommerce segment could rise by 28% annually between 2022 and 2026.

Total Payment Volume (Statista)

Related, PayPal Holdings signed a multi-year deal with Kohlberg Kravis Roberts & Co., which says that PayPal Holdings will sell €40 billion worth of current as well as future BNPL loans to KKR. The move will allow PayPal Holdings to quickly offload loans and focus on origination.

Why I Might Be Wrong About PayPal Holdings

I have been critical of PayPal Holdings for quite a while, particularly with regard to falling net new active accounts, and only recently changed my opinion on the payments giant primarily due to valuation considerations.

The most recent dramatic change in investor sentiment, following PayPal Holdings’ 2Q-23 and news about Elliott Investment Management, is not deserved, in my view, since PayPal Holdings is well on its way to reducing operating expenses, and the fintech even stepped up its share buyback by $1.0 billion.

PayPal Holdings also reiterated its goal to produce 20% adjusted profit growth this year, for which the fintech got no credit whatsoever.

A potential issue facing PayPal Holdings is slowing growth in the economy which might put pressure on the fintech’s total payments volume, loan origination potential, and BNPL business in general. Though I think BNPL is a big growth opportunity for PayPal Holdings in the long haul, dabbling in personal loans is a risky venture, particularly when defaults start to rise.

One strength that PayPal Holdings has is its large reach, with 431 million active accounts that imply a steady stream of transaction revenues. Incremental declines in active accounts, however, are to be seen as a major headwind for PayPal Holdings in the near and medium term.

My Conclusion

Presently, PayPal Holdings is more of a sentiment play (and a cheap one at that) than anything else.

PayPal Holdings’ stock fell to a new 52-week low after it became known that Elliott Investment Management had exited its position. With that being said, though, PayPal Holdings’ stock is a complete bargain, in my view, and it completely went over investors’ heads that the fintech reiterated its profit outlook for 2023.

Furthermore, I think the fintech is making good progress in cutting down its non-transaction related operating expenses, which could boost PayPal Holdings’ profit growth moving forward.

Since PayPal Holdings also upsized its share repurchases by $1.0 billion, I am very confident in making PayPal Holdings my largest portfolio position following news about Elliott Investment Management’s exit.

Contrarian buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.