Summary:

- Shares of PayPal and META reached all-time highs in 2021 but have since experienced significant declines.

- PYPL is facing increased competition from tech giants like Alphabet, Apple, and Amazon in the payment space.

- PYPL’s revenue growth rates and transactional metrics have been declining, raising concerns about its future growth potential.

Justin Sullivan

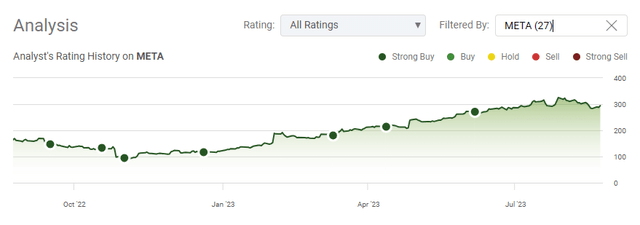

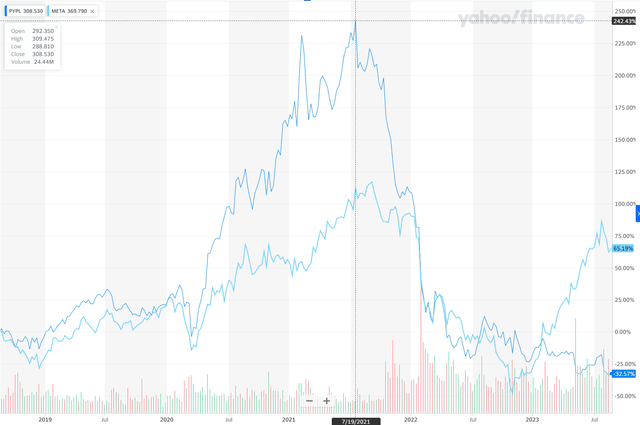

Shares of PayPal (NASDAQ:PYPL) and Meta Platforms (META) made all-time highs in the summer of 2021 as PYPL reached $308.53 on 7/19/21 and META hit $378.69 on 9/6/21. Shareholders of both companies watched tremendous gains vanish as shares of META fell -76.74% to $88.09 in November of 2022, while shares of PYPL fell -81.43% to $57.29 just the other week. Shareholders of META have a lot to be happy about as Mark Zuckerberg focused on efficiencies and profitability, which resulted in shares of META appreciating to $326.20 before the recent pullback after earnings. PYPL shareholders haven’t been as fortunate as shares continued downward throughout 2023 and are hovering around their 5-year lows. I recently started a position in PYPL and have been gradually scaling in with buys around the $62, $60.50, and $58.50 levels. With earnings season ending, I reran all the forward metrics I looked at, and PYPL looks to be in deep value territory, I believe it will have a META moment in the back half of 2023 or sometime in 2024. The valuation doesn’t make sense, and PYPL looks like a broken stock, not a broken company, to me. At today’s prices, you can pay the same valuation for shares of PYPL as you could have back in the summer of 2017. JP Morgan recently revised its price target on PYPL upward from $90 to $100 and maintained an overweight rating. I see a similar situation unfolding with shares of PYPL as I did with META, and while I don’t get everything correct, I think shares of PYPL are a deep value play and will have a META moment in the future.

Playing devil’s advocate and looking at the bear case for PYPL

There are two sides to every story, and shares of PYPL have sold off immensely. The bears have been correct with PYPL, so I examined what I consider to be the negative aspects they’re fixated on before allocating capital toward PYPL. After looking into a significant amount of negative analysis, many are looking at increased competition, revenue growth slowing, and transactional metrics deteriorating to form their bearish sentiment.

Competition

PYPL is facing increased competition from unconventional players. Over the past several years, two companies with blank checkbooks entered the payment space, Alphabet (GOOGL) and Apple (AAPL). Google Pay and Apple Pay have a large advantage because they are seamlessly integrated into the Android and iOS operating systems that power most smartphones and tablets in the U.S. Amazon (AMZN) is getting into the payment sector and has the ability to gain significant traction by utilizing its e-commerce marketplace to their advantage. The competition is no longer from traditional banks or FinTech companies such as Block, Inc. (SQ), but the largest tech companies are providing viable payment options as an alternative to PYPL’s suite of products.

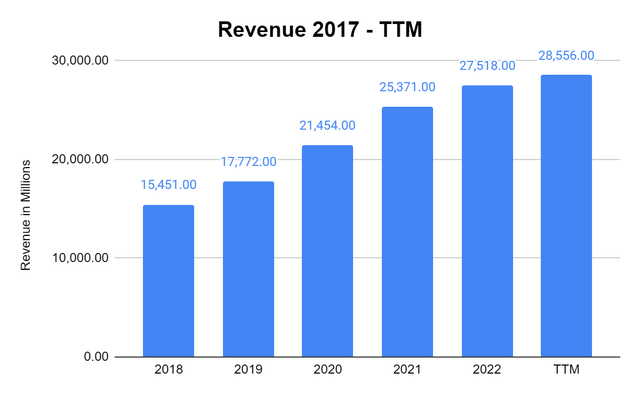

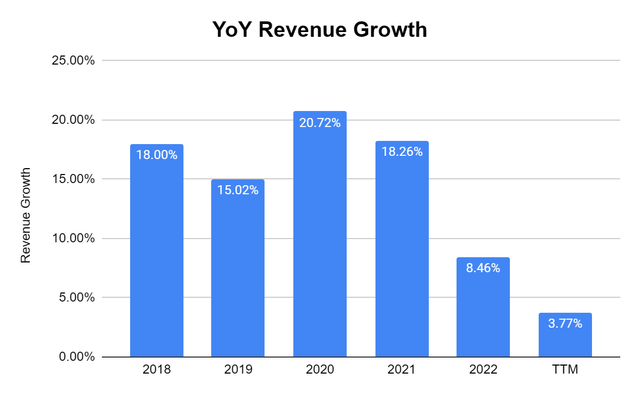

Revenue growth

While it’s normal for growth rates to decline as companies become larger, PYPL’s YoY top-line revenue growth rates are falling dramatically. Income Statement finished 2017 with $13.09 billion in revenue, which grew to $27.52 billion in the 2022 fiscal year. In 2018 – 2021, PYPL had an average YoY revenue growth rate of 18%, adding between $2.32 billion and $3.92 billion in annual revenue each year. In 2022P, PYPL’s YoY revenue growth rate declined to 8.46%, and after the first 2 quarters of data in 2023, PYPL’s YoY revenue growth rate based on the TTM is 3.77%. PYPL continues to see its increased revenue decline, and some may feel that, at some point, this could turn negative.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Transactional Data

Over the last 6 quarters, PYPL has seen its total take rate, its transitional take rate, and its transaction margins decline. The total take rate has declined from 2.01% to 1.94%, while the transaction take rate declined from 1.86% to 1.74%. PYPL transactional margins have also gotten thinner as transactional margins declined from 50.9% to 45.9%. While payment transactions and payment volume have increased, there is a bear case to be made that increased competition will chip away at the level of transactional payment volume, and when that is combined with thinner margins, PYPL will see negative growth in its revenue.

Investing in PYPL isn’t a sure thing as all investments come with risk. I am not investing in PYPL for its growth story, as it’s now a mature company. I am investing in PYPL because of its brand, profitability, and financial metrics. I think this is a company that could have a META moment because the fundamental metrics are too much to ignore further.

Why I have invested in PYPL and continue to scale into my position

As I indicated at the beginning of the article, I am buying shares of PYPL. Just because I am buying doesn’t mean that PYPL will appreciate or that it is a good investment for you, so please do your own due diligence. PYPL fits my parameters for a deep-value investment, and I believe I will generate a significant return over the next 12-24 months. I have no idea where PYPL will bottom, and while it looks like a bottom is forming, I am continuing to buy shares that way, if it falls further, I can lower my cost basis. After I am finished building out my position, I may write covered calls on half of my PYPL holdings to generate some income from the investment bi-weekly or monthly, depending on the premiums.

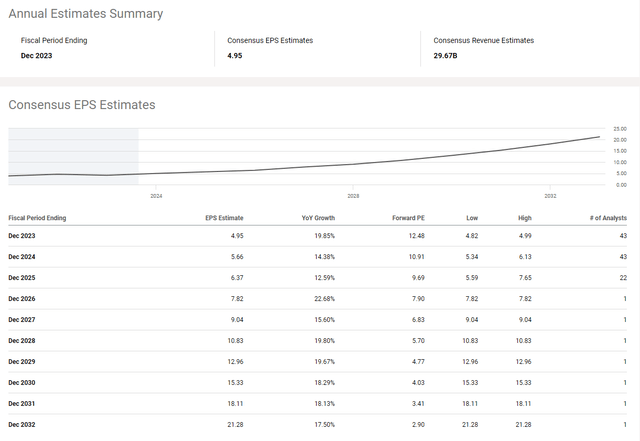

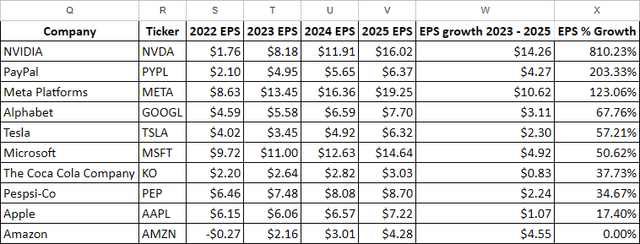

Now that earnings season is winding down and the largest companies have reported, I have updated my analysis to reflect EPS revisions and the current profitability over the TTM. Before going into the financial analysis, the street is not expecting PayPal Holdings’ Earnings Estimates to endure deterioration in its earnings. There are 43 analysts that expect PYPL to generate $4.95 in EPS for 2023 and then $5.66 in EPS for 2024. Looking at 2025, 22 analysts are expecting $6.37 in EPS. I view this as favorable because this isn’t a sentiment shared by 1 or 2 analysts, this is an overwhelming amount of firms that are indicating PYPL will significantly grow its earnings over the next several years.

When anyone invests in a company they are paying the current value for the company’s future cash flow in terms of revenue and profitability. I am going to look at PYPL compared to the following companies and compare their earnings growth based on the earnings consensus numbers, forward P/E ratios, and the price I would be paying on a price-to-free cash flow (FCF) methodology for their TTM FCF.

- Alphabet

- Apple

- Meta Platforms

- Microsoft (MSFT)

- Amazon

- Coca-Cola Company (KO)

- Pepsi-Co (PEP)

- Nvidia (NVDA)

- Tesla (TSLA)

In full disclosure, I am a shareholder of GOOGL, AAPL, META, AMZN, KO, TSLA, and PYPL. I like to use companies I am a shareholder of in these types of analyses to show I am being as objective as possible and not biased toward a company I am looking to or currently investing in. I used Seeking Alpha to pull all of the data from the financials to the earnings estimates in case anyone is interested.

Out of these 10 companies, PYPL is expected to grow its earnings over a 3-year period (close of 2022 – close of 2025) by $4.27 or 203.33%. From a dollar amount, PYPL is in the middle of the pack with the 5th largest increase in EPS, but looking at a percentage basis, PYPL is expected to have the 2nd largest percentage gain in EPS from these companies through 2025. From a value perspective, I care about earnings growth, and PYPL has it in spades. This isn’t a company that the street expects to fade away, on the contrary, its earnings potential is projected to expand a great deal.

Steven Fiorillo, Seeking Alpha

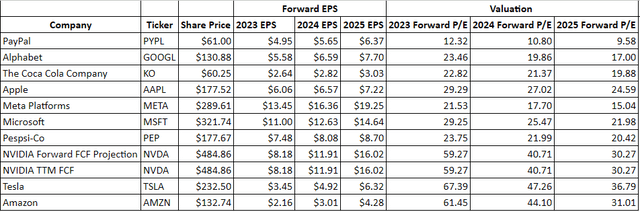

Looking at the forward price to earnings (P/E) valuations, PYPL looks to be on sale. The stock market is the one place where people are afraid of deep discounts. When large department stores run sales, nobody complains about buying at a discount, but when good companies go on sale, many investors have a hard time going against the grain. This is why I tune out the noise, look at the current and future profitability, and assess based on my personal risk tolerance.

PYPL is expected to generate $4.95 in EPS for 2023, then $5.65 in 2024 and $6.37 in 2025. PYPL is trading at 12.32x its 2023 forward P/E. Looking out past this year, PYPL is trading at 10.8x 2024 earnings and 9.58x 2025 earnings. There isn’t another company in this group that comes close to this level of discount. I put KO and PEP in the comparison because I wanted to show that even old-school consumer staple companies are trading over 20x earnings on a forward basis in 2023 and 2024. Based on the earnings growth that a wide range of analysts are projecting and what the forward P/E ratios are, PYPL is in deep value territory.

Steven Fiorillo, Seeking Alpha

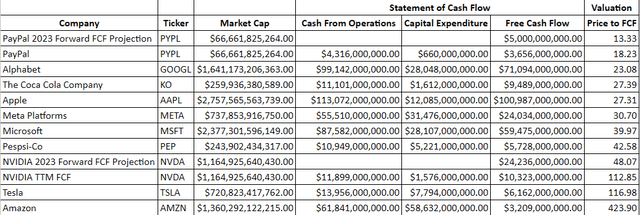

I also care about the price to FCF that I am paying. I put NVDA twice because after their blowout quarter and guidance, I wanted to show them on a TTM basis and a forward basis due to the level of growth. I also added PYPL twice to show their valuation on a TTM basis and forward basis, as management has indicated that FCF for 2023 will come in at a significantly larger level than the TTM number.

FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This also is the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions.

When I invest in a company, I look at its profitability from a separate lens. If you were to purchase a business privately, one of the first questions you would find an answer to would be how long until I make my money back. When I invest in public companies, I want to see how long they will take to generate their market cap from FCF. Generating an abundance of FCF increases a company’s ability to generate value for shareholders. PYPL has generated $3.66 billion in FCF over the TTM and is trading at 18.23x its FCF. The company with the 2nd lowest price to FCF valuation is GOOGL at 23.08x. KO is trading at 27.39x its FCF, while PEP trades at 42.58x its FCF. On a forward basis, PYPL is expected to generate $5 billion of FCF in 2023, which places their 2023 price to FCF at 13.33x. PYPL is not an unprofitable tech company as it’s generating billions in FCF on an annual basis, and the current TTM and forward multiple doesn’t make sense. If I take the forward FCF projection line items from NVDA and PYPL out and exclude NVDA, TSLA, and AMZN since they are trading at over 100x FCF on a TTM basis, the average price to FCF of PYPL, GOOGL, KO, AAPL, META, MSFT, and PEP is 29.9x, and PYPL is trading well under the average.

Steven Fiorillo, Seeking Alpha

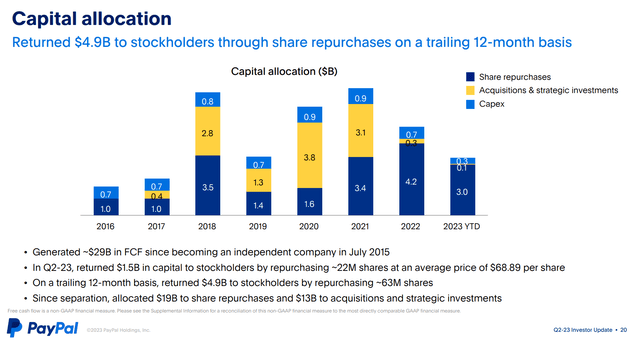

PayPal’s FCF is their ace in the hole and is allowing them to buy back massive amounts of their shares

Since 2016, PYPL has allocated $19 billion of its FCF toward buybacks and reduced its shares outstanding by -10.2%. In Q2 of 2022, PYPLrepurchased 22 million shares at $68.89 per share and is projected to allocate another $2 billion toward buybacks in Q3 and Q4. At an average price of $65, PYPL could repurchase another 2.8% of its total shares and reduce its float by 30.77 million. If PYPL continues to allocate $3 billion toward buybacks annually for the next 5 years, that would be an additional $15 billion in buybacks, which could reduce its float by an additional 14.06% if it were to pay an average of $100 per share. If shares of PYPL continue to stay at this valuation while PYPL generates this level of profitability, they could potentially buy back every share over the next 15-20 years, or even take the company private if they feel the market isn’t fairly valuing them.

PYPL has a strong balance sheet with $9.9 billion in cash on hand with $4.54 billion in long-term investments, and $10.55 billion in total debt. This is an unleveraged company with strong profitability that is creating value for shareholders by increasing their equity position in the company. With a market cap of $66.66 billion, I wouldn’t be surprised at all if PYPL becomes an acquisition target by either GOOGL or AAPL to gain further traction in the payment arena, or by one of the major credit card companies such as Visa (V) or Mastercard (MA).

Conclusion

I will make a bold statement. Based on the financials and current valuation, I feel that PYPL is the most undervalued company I follow and invest in. I could be incorrect, and shares of PYPL could continue to decline in value, but I think we’re going to see a move over the next 12 months that resembles what META has done over the past year. I think that the investment community has gotten this wrong, and I am perfectly fine going against the grain by investing in PYPL at this valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, META, AAPL, GOOGL, AMZN, KO, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.