Summary:

- PayPal’s active accounts have decreased for the second quarter in a row, threatening its growth narrative and causing its stock to slump.

- The decrease in active accounts could have greater ramifications for PayPal’s financials and share price in the future.

- PayPal also faces challenges in acquiring new customers and differentiating itself in a saturated market, as new entrants join the payment processing industry.

chameleonseye

At first, PayPal Holdings (NASDAQ:PYPL) looks like a decent stock to own as the company has been improving its business in recent quarters and its stock appears to be greatly undervalued after the recent slump. However, there’s one thing that makes PayPal a potential value trap and that is the decrease of its active accounts for the second quarter in a row. This is a big deal for PayPal since the shrinkage of the customer base destroys the company’s growth narrative and makes growth investors flee the stock despite it being undervalued based solely on the fundamentals.

Even though this decrease hasn’t greatly affected PayPal’s financials this year so far, a potential further reduction in active accounts could lead to greater ramifications and result in a further depreciation of the share price in the future. While the company’s management tries to avoid such a scenario by expanding the number of products that it offers, PayPal is likely to face several challenges that could undermine such efforts and could make its stock continue to trade at distressed levels in the following months.

Are PayPal’s Golden Days Behind It?

Earlier this month, PayPal reported its Q2 earnings results which showed that the company’s revenues increased by 7.4% Y/Y to $7.3 billion and were above the street estimates by $30 million, while its non-GAAP EPS of $1.16 was in-line with the forecasts. At the same time, the company’s total payment volume and total transactions increased by 11% Y/Y and 10% Y/Y to $376.5 billion and 6.1 billion, respectively.

Despite such a decent performance, PayPal’s shares significantly depreciated due to the shrinkage of the company’s customer base as its total active accounts stood at 431 million at the end of Q2, down for the second quarter in a row. As a result of this, PayPal’s shares are currently down ~35% in the last year despite reporting decent results, while the S&P 500 index is up ~6% for the same period.

PayPal’s 1Y Stock Price Performance (Seeking Alpha)

The biggest issue with the shrinking user base is that it represents a death of the growth narrative thanks to which PayPal’s shares have been rising in the recent decade. To try and improve the situation, PayPal launched its own stablecoin earlier this month that’s backed by the US Treasurys, and USD at a ratio of 1:1. As the adoption of cryptocurrencies and stablecoins increases, the company aims to acquire a cohort of new users that would become a part of the company’s ecosystem and improve its overall active accounts number.

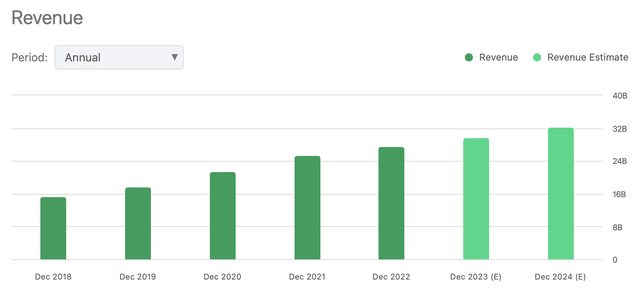

Time will tell whether that would be the case, but the good news is that PayPal expects to continue to improve its business performance in the upcoming months and guides for an 8% Y/Y increase in revenues in Q3 and a 9% to 10% Y/Y increase in revenues for the whole fiscal year. Add to all of this the fact that after the recent slump the company’s shares trade at a forward P/E of only 12x, while the street believes that the stock represents a 50% upside from the current levels, and some might decide to call PayPal a value play at the current price.

PayPal’s Revenue Forecast (Seeking Alpha)

However, despite all of this it doesn’t mean that PayPal’s stock would be able to quickly recover in the foreseeable future. We shouldn’t forget that the company reported decent numbers in the last two quarters, but they didn’t convince the market to back up the stock as the customer base decreased. That’s why even though the fundamentals are solid, there’s a risk that PayPal will become a value trap if it continues to lose customers at the current pace.

External Threats On The Horizon

There are several headwinds that PayPal faces which could make it harder for it to acquire new customers and revive the growth narrative. The biggest issue with PayPal is that it doesn’t have any major competitive advantages against its peers. While it used its first mover advantage to become one of the biggest companies to offer online payment processing and payment gateway solutions to individuals and businesses, the field is becoming too saturated, which makes it harder for the company to differentiate itself from others.

To this day, PayPal relies on fees that range from 1.9% to 3.5% to generate most of its revenues. For comparison, providers such as Wise, Payoneer, Stripe, and others mostly charge lower fees to process transactions. As a result of this, it becomes much harder for PayPal to acquire new customers given the competitive environment that’s full of providers who provide the same services at a lower price. That’s one of the main reasons why PayPal’s market share in the payment processing business has decreased from 54.8% in 2020 to 40.29% today.

What’s more, is that the additional competition from the government is likely to make it even more difficult for PayPal to attract new customers. After the Federal Reserve launched its own instant-payment service FedNow last month, which allows instant settlement at a base level, there’s no longer the need to use PayPal or Venmo for P2P transactions. The UK’s alternative called Faster Payment has been gaining in popularity in recent years, while Brazil’s own service Pix was able to become the most used means of payment in the country in just two years since its launch. Considering this, there’s a case to be made that FedNow has everything going for it to exponentially increase in popularity in the United States as well and eliminate the need to use a third-party instant settlement layer that companies like PayPal provide.

Therefore, it appears that PayPal needs to have some sort of a moat against others in order to stop the shrinkage of its customer base as its first-mover advantage slowly wanes. However, considering that the company doesn’t have any major advantages and offers the same services as other private and government-backed providers, there are risks that PayPal’s efforts to acquire new customers could fail while the stock could become a value trap.

The Bottom Line

The reaction of the market to PayPal’s shrinking customer base shows that the company’s stock is no longer a growth play. If the management fails to avert a further loss of customers, then there’s a decent chance that the company’s shares will continue to trade at distressed levels despite all the improvements to the business’s financials.

While some might think that PayPal is the next Meta Platforms (META), which lost customers for the first time in history in late 2021 but later returned to growth in the next quarter, the situation here is different. Meta experienced a shrinkage of its user base only once during a single quarter, while PayPal has seen its customer base decrease for the second quarter in a row. As such, if this downward trend continues and the customer base decreases in Q3 as well, then its stock could become a value trap as further depreciation could follow.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!