Summary:

- PayPal is delivering solid revenue growth and even stronger bottom line growth, but the stock is struggling.

- PayPal stock trades at the same levels it did in 2017.

- Wall Street appears concerned about competitive threats from Apple.

- I make the case that the risks are priced in, with margin expansion and share repurchases paving the way for potential upside.

Prykhodov

How did PayPal (NASDAQ:PYPL) suddenly become more and more like a traditional value stock? First, growth slowed down. After posting strong top-line growth heading into the pandemic, PYPL began lapping tough comparables. Second, management has shown a strong commitment to returning free cash flow to shareholders through share repurchases. Third, the stock has traded down so much that it is now trading at low-teens earnings multiple. These factors may help lead to solid forward returns for long-term investors, but make no mistake, PYPL is no longer a hyped-up tech play. Headwinds are easy to point out, though Wall Street may be underestimating the long-term secular drivers at play here. I reiterate my buy rating for the stock.

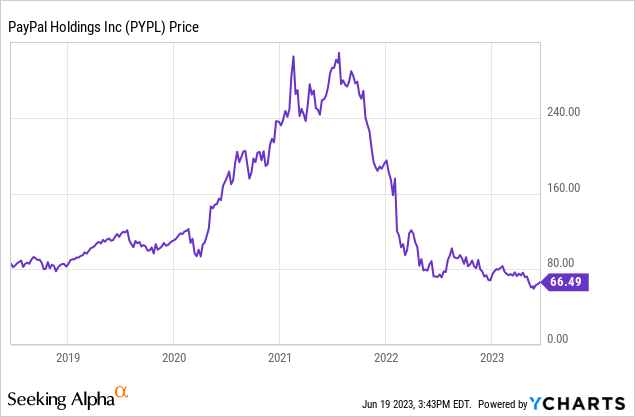

PYPL Stock Price

Despite PYPL being a prime beneficiary of the acceleration of e-commerce growth in the pandemic, PYPL stock now trades at 2017 levels.

I last covered PYPL in April where I rated the stock a buy as a beaten down tech stock. That thesis still applies as PYPL continues to show cost discipline and repurchase shares. While there is no fancy catalyst on the horizon, I expect this playbook to eventually win over Wall Street.

PYPL Stock Key Metrics

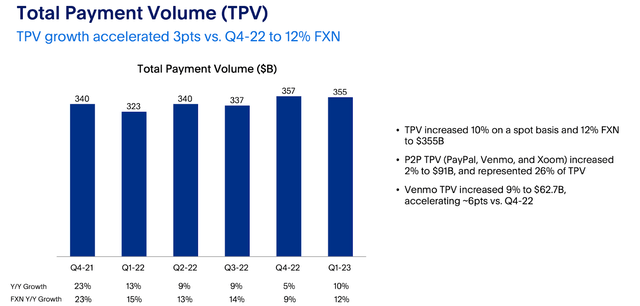

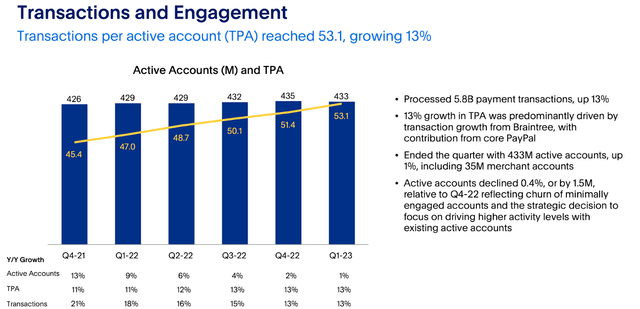

Throughout 2022, PYPL saw revenue growth come to a standstill but management continually guided for an acceleration in growth once the company finished lapping tough comparables. That acceleration has not quite come to fruition, as a tough macro environment has replaced the tough comps. Even so, PYPL did manage to show some sequential acceleration with total payment volume (‘TPV’) growing 12% on a constant currency basis.

2023 Q1 Presentation

As disclosed on the conference call, that growth was driven in large part due to 30% constant currency growth in unbranded TPV, led by their Braintree business. Recall that their Braintree business helps merchants with unbranded payment processing – I expect the unbranded business to become a more and more important part of the investment thesis given certain competitive headwinds.

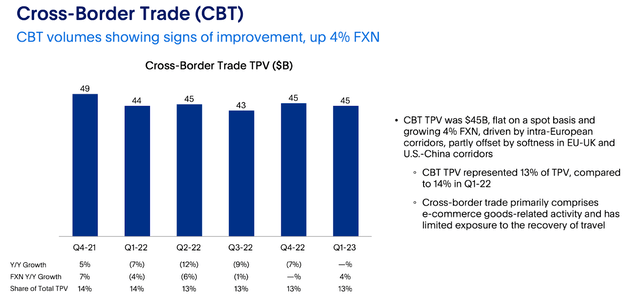

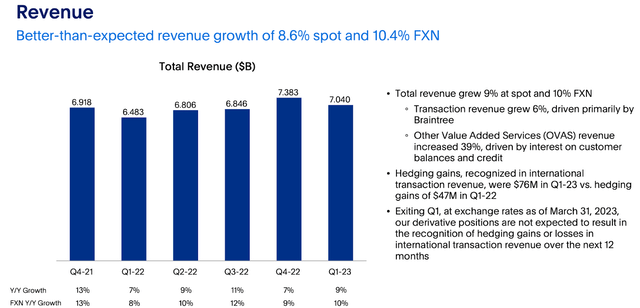

PYPL saw some improvement in cross-border trade, showing 4% YOY growth (constant currency). PYPL may be a beneficiary from a recovery in cross-border trade from both the ongoing Chinese recovery as well as any potential resolution in the Russian-Ukraine war.

2023 Q1 Presentation

It is worth pointing out that active accounts actually declined sequentially – management blamed this on closing down unused accounts. Investors however may wish to closely monitor this metric as an inability to grow the active account base may foretell an end to the secular growth story.

2023 Q1 Presentation

These factors led revenue to grow by 10.4% constant currency YOY.

2023 Q1 Presentation

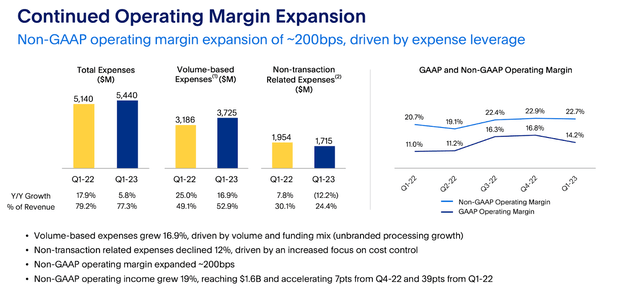

For several quarters now, PYPL has been a margin story. PYPL delivered yet another quarter of solid margin expansion, with operating margins growing by 200 bps. The rising interest rate environment has made cost discipline all the more important, and management has clearly risen to the task.

2023 Q1 Presentation

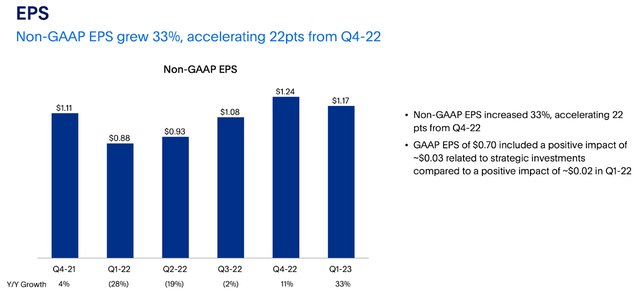

The return of some revenue growth plus management’s commitment to cost discipline and share repurchases helped non-GAAP EPS grow by 33%.

2023 Q1 Presentation

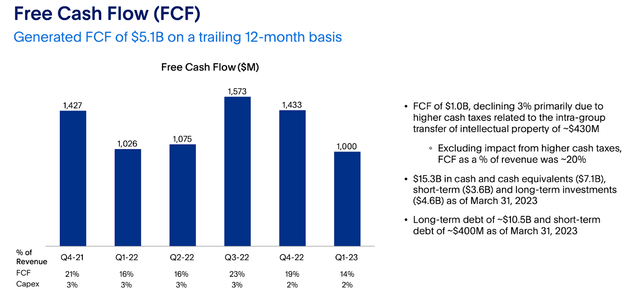

PYPL generated $1 billion in free cash flow and ended the quarter with $15.3 billion in cash and investments versus $10.9 billion in debt.

2023 Q1 Presentation

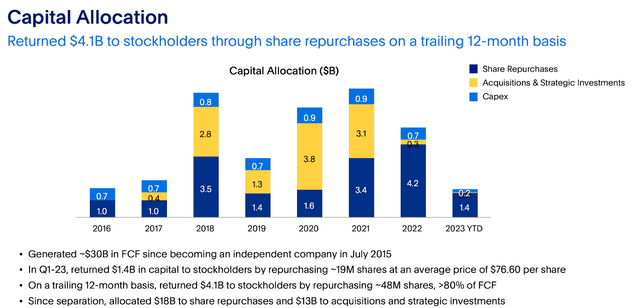

PYPL returned all of free cash flow – and more – to shareholders through share repurchases. Ever since the stock sold off due to decelerating growth rates, PYPL has focused its capital allocation on buying back stock. In hindsight, the share repurchases at higher prices were misguided though external acquisitions might not have been the clear answer as those also would have likely been at high valuations.

2023 Q1 Presentation

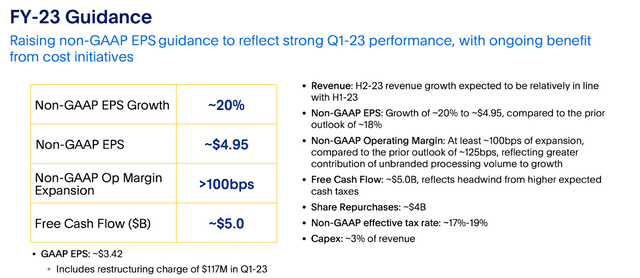

Looking forward, management increased earnings expectations and is now expecting around 20% non-GAAP EPS growth to around $4.95.

2023 Q1 Presentation

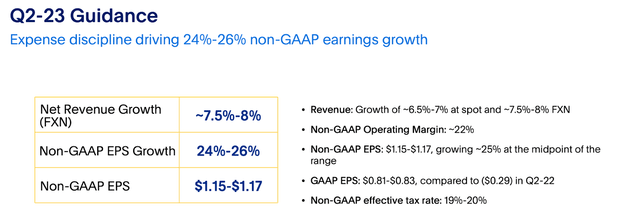

In the next quarter, management expects revenue to grow by up to 7% and non-GAAP EPS to grow by up to 26%.

2023 Q1 Presentation

While optimism for its Buy Now, Pay Later product has waned given the rising interest rate environment and entrance of mega-cap tech titan Apple (AAPL) into the mix, management noted that their BNPL offering grew at a 70% rate with $6 billion in TPV in the quarter. For reference, pure-play BNPL operator Affirm (AFRM) posted $4.6 billion in gross merchandise volume in its latest quarter. Management stated intentions to “externalize a significant portion of this portfolio” in order to reduce their balance sheet exposure. I would not be surprised if PYPL eventually achieves this in a similar manner as other fintech operators, namely through long term funding partners as well as occasionally utilizing the asset-backed-securities market.

With most of its payment volume growth coming from its unbranded clients, one may be wondering how sustainable that 30% growth rate is. Is the growth coming from just a handful of clients, with tough comparables coming around the corner? Management stated the following:

And it’s not just winning incremental clients, but we are growing our share of the overall PSP volume in our largest clients as well. Look, we did expect Braintree and we do expect Braintree to moderate its growth, lapping some big deals last year. But honestly, we’re working on some big deals this year, too.

That response does seem to imply that growth rates must moderate moving forward – consensus estimates appear to factor in a significant slowdown.

Lastly, management expects to be a beneficiary of artificial intelligence (‘AI’), as it may help the company further streamline costs and boost performance.

Is PYPL Stock A Buy, Sell, or Hold?

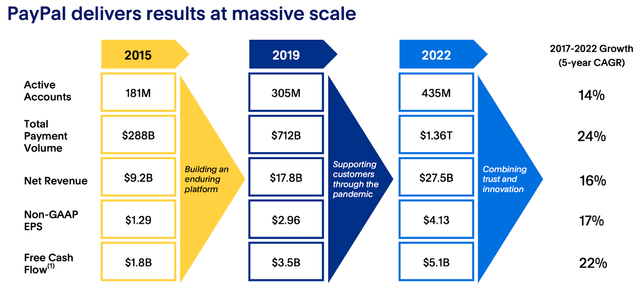

Amidst the slowdown in top-line growth, it is worth remembering that PYPL has been a consistent growth machine over the long term, delivering strong 5-year growth rates. That said, this may be a “glass half full” perspective as there is no indication that top-line growth rates can accelerate moving forward.

2023 Q1 Presentation

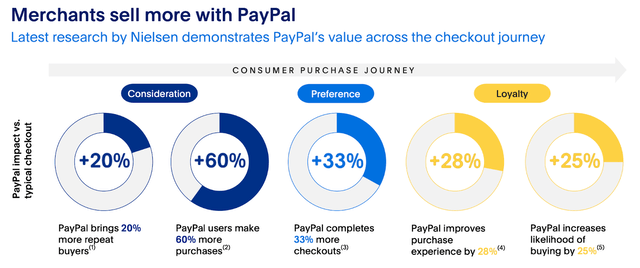

PYPL has demonstrated clear value to e-commerce merchants, with some studies showing significant benefits to conversion and loyalty.

2023 Q1 Presentation

As a PYPL user myself, I can anecdotally cite the benefit it provides in reducing friction costs, as I no longer have to take out my credit card to enter the information over and over again. Unfortunately, I can also anecdotally note that I have a great indifference to whether I use PayPal or Apple Pay, even for online merchants, and there seems to be a growing number of merchants who are only accepting Apple Pay. PYPL does seem to be offering great value to its merchants, but it is not clear if there is a moat there.

The negative sentiment regarding competitive pressures (especially from AAPL) has led the stock to trade down to low valuations, with the stock recently trading hands at a low-double-digit earnings multiple.

Seeking Alpha

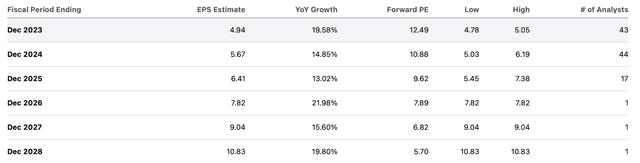

Top-line growth is expected to hover around a double-digit rate moving forward, though I caution that consensus estimates may prove too high if competitive fears materialize.

Seeking Alpha

At this point, however, PYPL stock does not need to deliver hyper-growth rates to do well for shareholders. This is a name that can likely drive 15% to 20% annual earnings growth over the next several years as management drives cost discipline and operating leverage. Even based on a reduced 8% forward revenue growth rate, I can see the stock re-valuing to at least 20x non-GAAP earnings, implying around 60% potential upside over the next 12 months. In particular, Wall Street may be focusing too much on competitive pressures on branded processing and focusing too little on the fast growth of the company’s unbranded processing.

What are the key risks? A weaker than expected macro may lead to a disappointment on top-line growth. It is unclear how fluctuations in interest rates may impact the fundamentals, especially given that AFRM has blamed the higher interest rates for slowing down its BNPL business. But I am of the view that management can likely offset any disappointments in revenue growth with ongoing bottom-line growth, as margin expansion is the main story here. Instead, the main risk is the existential threats posed by AAPL as a competitor. PYPL benefitted from its first-mover advantage, but may be facing unprecedented competitive threats – I note that Amazon Pay (AMZN) is also a notable competitor. One can argue that much of that risk is already priced in, but if growth rates were to turn negative, then multiple contraction to around 6x to 8x earnings would not be out of the question. It is for that reason that I view the unbranded processing to be a very important driver of the investment thesis as that may be more insulated from AAPL threats, though even there PYPL must compete with the likes of Adyen (OTCPK:ADYEY) and Stripe. There are ways for PYPL to drive strong returns in the near term (including debt-fueled share repurchases) but one mustn’t overlook the risks to the secular story. I reiterate my buy rating for the stock as I view the high earnings yield and ongoing share repurchases as being enough to drive strong returns in the near term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AMZN, AAPL, AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!