Summary:

- The company still trades far below intrinsic value with a large margin of safety despite the stock’s run-up and accounting for a slowdown in growth.

- Trading slower growth in the short term for a better margin profile is healthy and beneficial to the business, and we can already see the results.

- By accounting for the risks associated with the ad segment but not including the benefits, we are essentially receiving all the upside from it when it launches for free.

Justin Sullivan

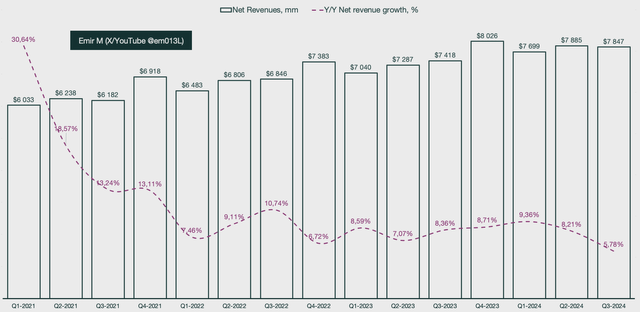

This is the fourth time I cover PayPal (NASDAQ:PYPL) on Seeking Alpha, and perhaps the first time we are starting to see some results regarding the topics I’ve been writing about. When I initiated my coverage for the company, it was priced as if it would not grow at all; I disagreed with the market. In my most recent article, the story had evolved to a point where PayPal was starting to lay out a new path for the business, seeking “profitable growth.” Now, we are actually seeing the fruit of the labor, the result of Alex Chriss 12 months at the helm.

A new beginning

The PayPal management team was very clear during the Q3 earnings call and did not mince words; a slowdown in growth is deliberate. Here are CFO Jamie Miller’s comments on the matter from the call:

As part of our price-to-value strategy, we are moving deliberately and making decisions that prioritize healthy, profitable growth rather than targeting a high proportion of processing volume at low or even negative margins.

What this looks like in practice with some of our largest enterprise customers is often a renegotiated agreement that reduces our total share of payment processing to a more balanced level. So for example, from 95% to 75%, but with better economics and with a greater breadth of products and services

It was a bit surprising to me, since there has not been any mention of deliberately slowing down growth in order to recalibrate and start growing with better margins. Investors may have inferred that PayPal has contracts, and in order to fulfill CEO Alex Chriss’s promise of “profitable growth,” there would have to be some reported periods of slowdown in order to achieve that through renegotiations.

Emir Mulahalilovic, PayPal SEC Filings

CEO Alex Chriss continues later on in the call and explains that they are in a position to do this now because they are providing more value than before:

And so the conversations we’re having with these merchants is, we’re innovating, we’re bringing Fastlane, we’re bringing ads platform. We’re bringing additional value-added services that allow us to have a healthier, stronger conversation about where we’re going. So it’s not that all the merchants were excited to have the conversations, but they understand where we’re coming from and we’re bringing more to the table.

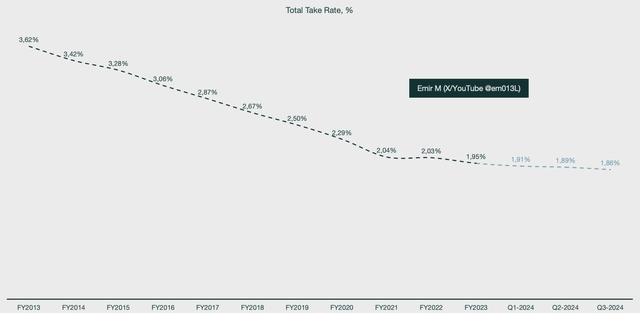

In essence, it was important for PayPal to escape the “race to the bottom” with all the other payment solution providers. With major players like Adyen and Stripe competing for the same merchants, the space was starting to get crowded, and it led to each company undercutting each other in order to gain market share. Here is what that meant, visualized in a chart:

Emir Mulahalilovic, PayPal SEC Filings

When you have limited ways to differentiate yourself from the competition, you don’t really have a lot of pricing power. Most competitors have historically offered comparable services, even though PayPal was the leader in latency metrics and other various KPIs. That is important, but as the chart tells, not important enough to drive take rate expansion.

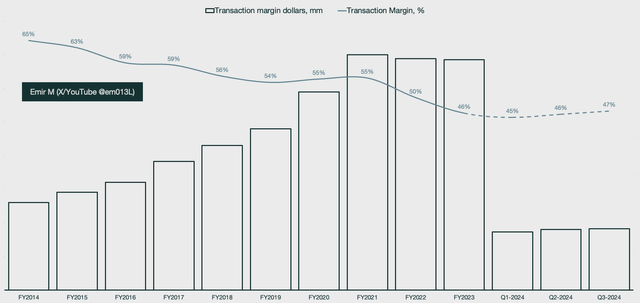

However, the total take rate is calculated by dividing net revenues by the total payment volume. We lose a lot of granular and nuanced data this way. If we take our time to look a bit deeper, we can already see the transformation of the business starting to emerge.

Emir Mulahalilovic, PayPal SEC Filings

Transaction margins are seeing an uptick. That in itself is good, but what makes it great is that the previously lowest margin segment, payment processing through Braintree, is contributing to it positively. Braintree has historically been the drag on transaction margins, related to the race to the bottom as mentioned earlier. Alex Chriss comments the following during the Q3 earnings call:

This is now the second consecutive quarter in more than two years, that Braintree is meaningfully contributing to transaction margin dollar growth. We’re having very constructive conversations with our merchants, focused on ways we can enable strategic growth opportunities that drive long-term upside for both of us.

What is different today is that we now have a suite of value added services, including payouts, risk as a service, orchestration, guest checkout and personalization capabilities that help attract new customers and convert them more effectively, in addition to world-class payment processing. We’re excited about our progress here as it is key to long-term value creation.

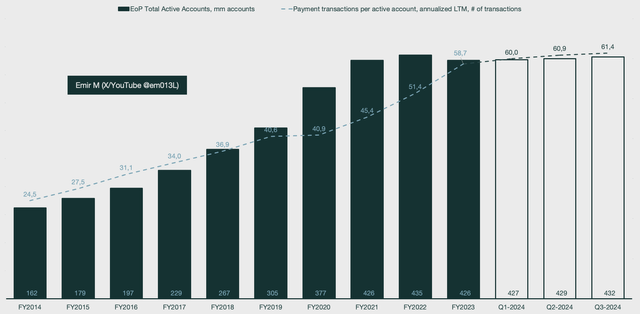

Braintree is not the only product that sees an up-tick. Customer growth is back, and existing customers continue to transact more and spend more.

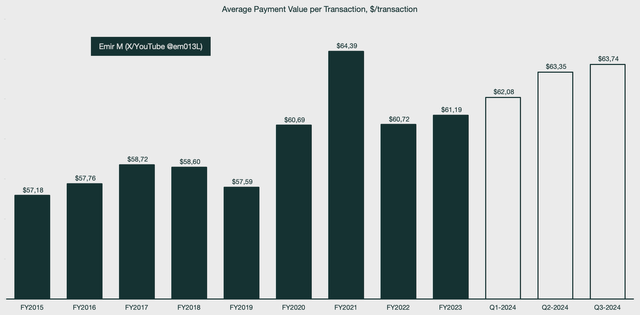

Emir Mulahalilovic, PayPal SEC Filings

The average payment value per transaction is soon at the level of the pandemic highs, a really impressive feat considering the vast amount of digital payments that were made during that period. PayPal is not only focusing on becoming the best payment solutions provider during Alex Chriss tenure; they are also working hard to improve the user experience for customers. They have launched debit and credit cards, cashback, and other various offerings. Here’s a note from Alex Chriss during the Q3 earnings call that expands on that:

For consumers, we’re redefining our value proposition with last month’s launch of PayPal Everywhere. This initiative builds on PayPal’s established brand position as an online shopping powerhouse to position PayPal as the go-to solution for spending, sending and earning rewards whether online or offline. We’re doing this through cashback incentives on the PayPal debit card, a marketing campaign with the goal of reintroducing our capabilities to consumers, who may never have thought about PayPal as more than an online payment option.

Emir Mulahalilovic, PayPal SEC Filings

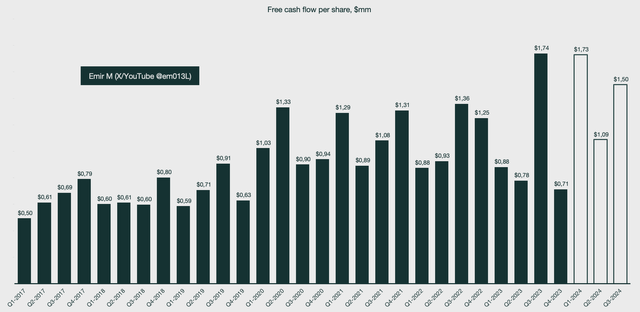

However, it is necessary to see these hints of profitability actually generate output for shareholders. We can measure that by looking at free cash flow per share, a metric that also tells the same story as we have observed so far in the article.

Emir Mulahalilovic, PayPal SEC Filings

Valuation and risk

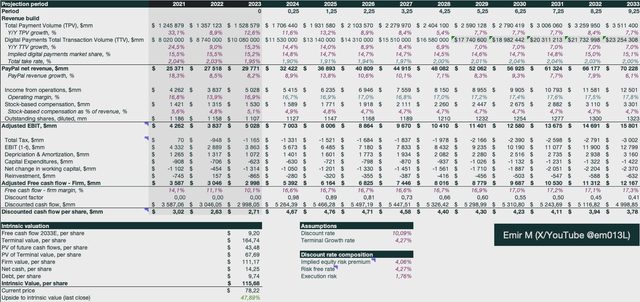

There is a lot of margin of safety in PayPal stock still. It is not quite as rewarding as when the stock quote implied that the company would have 0% free cash flow growth for the next 10 years, but the value proposition is still immense and among the best in the market, in my opinion.

In comparison to my most recent model, I have adjusted the revenue build to the downside as a result of the recent comments from management. As PayPal will take a hit to revenue growth for the remainder of 2024 and large parts of 2025, it should also be reflected in my valuation model. However, I have also increased the profitability for all periods to reflect the change in strategy. I have done so modestly, because even though we see clear hints of an improved and more efficient business, it’s only been ~1 year.

Finally, I increased the execution risk to better reflect the risk associated with contract renegotiations as well as rolling out and scaling new features, including the ad platform.

Emir Mulahalilovic, PayPal SEC Filings

As for the ad platform, PayPal is really set up well to leverage such a solution given their vast amount of consumer-specific data. The problem as an investor is that we don’t have any details regarding the offering, which makes it hard to extrapolate and value it. PayPal’s network effects are immense in the sense that an ever-expanding merchant base increases the value of the data vault, which in turn makes it more attractive to join PayPal’s network as a merchant. I will expand on this idea when we inch closer to the launch of an ad platform with tangible details surrounding it.

For now, I have increased the risk in my model for the ad platform rollout, but I have not attributed any revenue to it. This means that any output from the ad segment is given to me for free, as I already account for the risk but not the reward. I like this optionality approach in my valuations whenever possible, as it unlocks a lot of upside that I am not paying for.

PayPal is still trading with ~50% upside to fair intrinsic value per share and remains one of the most attractive businesses in the market of this scale for me.

Summary

PayPal is a business that is still operating from a strong position in the payments space. However, being content will only get you so far in such a competitive market. With every passing quarter, we can see the new vision for the business unfold before our eyes by CEO Alex Chriss. Management notes that PayPal is deliberately taking a hit to revenue growth in order to recalibrate profitability margins by renegotiating contracts with merchants. That is not great news, but because we can see the efforts resulting in higher profitability profiles in the numbers already, it lends credibility to the statement.

Even accounting for a slowdown in growth and the risk of launching so many new products, PayPal is still trading significantly below intrinsic value. We also get optionality from major business legs that are not yet operational, such as the ad platform, by accounting for the risk but not the output. This means that we receive all the upside from it for free while still paying below intrinsic value for the business. PayPal remains a strong buy, and the story is becoming more rosy with every passing quarter.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.