Summary:

- PayPal’s fundamentals remain strong despite competition from Apple Pay, Google Pay, and Stripe, as it continues to grow in transaction volume, customer numbers, and profits.

- The company’s dominant market share is due to its long-standing trust, ease of use, and compatibility with all devices and operating platforms.

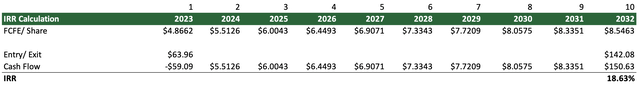

- With a potential upside of 18.63% IRR over the next 10 years, PayPal is considered a “Strong Buy” despite temporary headwinds and competitive threats.

Prostock-Studio/iStock via Getty Images

Investment Thesis

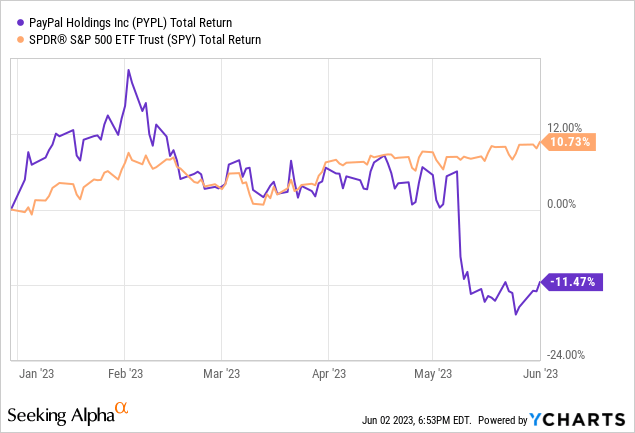

Let’s face it: it has been a difficult year for PayPal (NASDAQ:PYPL), to say the least. Despite a strong start to the year, it is currently down 11.47% YTD, compared to the S&P 500 which is up 10.73%.

Therefore, we will address the reasons why investors may be too bearish on PayPal, overestimating competitive threats and overstating temporary headwinds while the company is fully focused on returning capital to shareholders and maximizing PayPal’s efficiency. We will quantify these risks, outline what an extreme downside scenario might look like and why we think the stock could generate investors more than an annual 18% IRR over the next 10 years.

Quantifying Headwinds

Since competition is top-of-mind when it comes to investors thinking about investing in PayPal, especially the growth of Apple Pay, we discuss our take on why the market may be too bearish on the company.

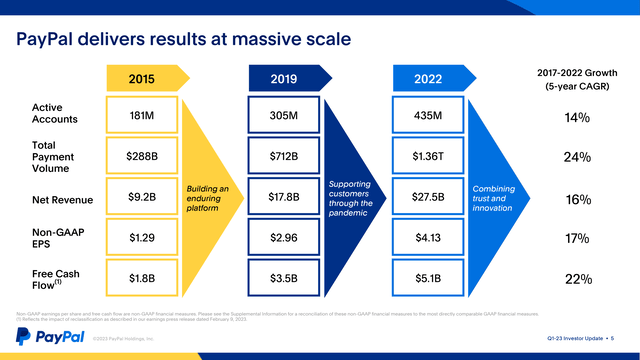

That said, we currently note that other payment gateways such as Stripe, Shop Pay (SHOP), Google Pay (GOOG) (GOOGL) and Apple Pay (AAPL) are the main perceived threats to PayPal’s business model. First, it is important to note that these payment method alternatives have not just been around since last year, either. Shopify Payments has been around since 2013, Google Pay for more than 5 years and Apple Pay since 2014. And yet, despite the growth of other payment providers, PayPal has continued to grow in transaction volume, customer numbers and profits.

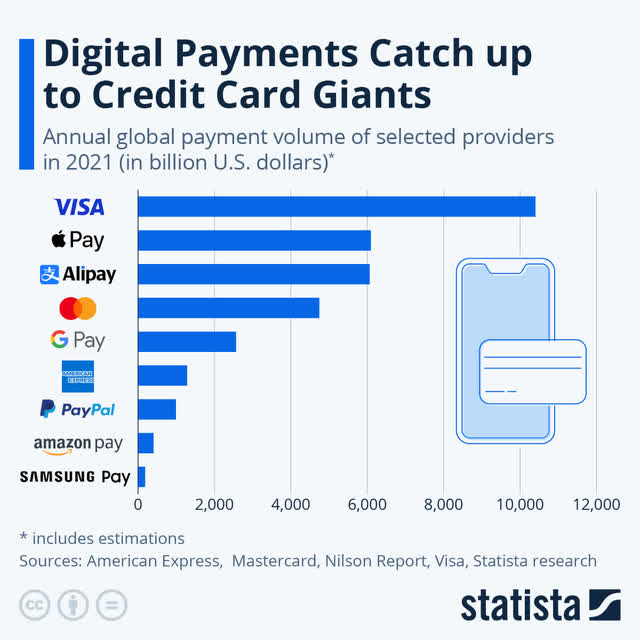

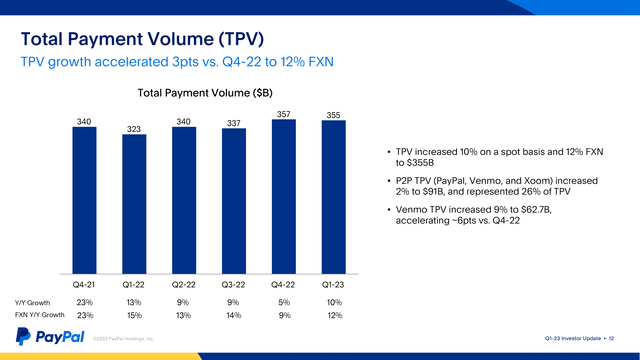

In 2022, PayPal alone processed a staggering total payment volume of $1.36 trillion, rivaling the largest credit card providers such as Mastercard (MA) and Visa (V), which have been around since the 1960s, and Amex (AXP), which was founded in the 1800s. On an annual basis, PayPal processed $1.42T in volume in the first quarter, and it is likely that this will continue even without user growth, as PayPal and the companies they represent are able to pass on the cost of inflation over time.

A company in the payments industry that is still processing $1.42T in volume and growing also does not sound like a company on the verge of bankruptcy in our eyes. Apple Pay is reportedly already processing more than $6T in transactions per year, far outpacing PayPal and even Mastercard & Amex. We ask ourselves: why is it that PayPal’s fundamentals have remained robust, while other players like Apple Pay have recently captured a huge market share?

We think PayPal’s dominant market share is mostly due to the fact that people have trusted PayPal for more than 20 years and still find it the easiest, fastest and most versatile way to transfer money and make online purchases.

Some will point to Apple Pay as a direct competitor to PayPal, but there are certainly differences between the two. First, Apple Pay operates within the Apple ecosystem and is a great way for Apple to protect its moat and provide more value to users of the Apple ecosystem. However, in the fourth quarter of 2022, Apple’s global smartphone market share was 24.1%. Despite Apple Pay being a great service, retailers offering Apple Pay only target the population of people who have Apple products. Unlike PayPal, which works on all devices and operating platforms. Merchants using Apple Pay also still have to pay the overheads they have to pay to card operators such as Amex and Visa.

We see Apple Pay as more of a competitor to Venmo, especially replacing cash/bank transfers between individuals. Venmo currently accounts for 18% of PayPal’s revenue. Unless everyone switches to Apple, Apple Pay just isn’t a universal payment method like PayPal is.

As we see it, customers will continue to use PayPal because it has always been a trusted payment method. Just as Amex, Visa and Mastercard are dominant, PayPal gets its advantage from being the payment processor that has been around the longest and has the largest network with the most businesses and customers using it.

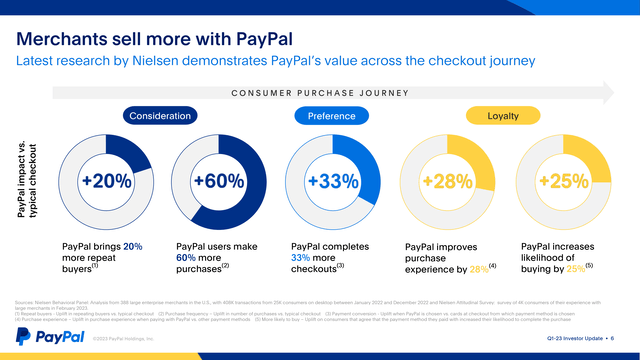

In other words, we do not believe that consumers already have a meaningful reason to stop using the service, nor does it seem likely that this will happen anytime soon in the future. If there were to be margin pressure at all, we believe it would come from the merchant side and not from the consumer side. However, we believe that margins will remain intact as long as merchants achieve significantly more conversions when they accept PayPal than without it. As it stands now, as shown in the statistics above, merchants who use PayPal typically see a 33% increase in completed checkouts compared to other card providers. PayPal also provides 20% more repeat buyers, and customers are more likely to buy because it only takes a few clicks.

Even in the unlikely event that another excellent payment processor or revolutionary technology comes up to challenge PayPal, we think it may take quite a while for PayPal customers to switch/adapt to something else, especially in the older cohort of PayPal users who have sworn by its security and ease of use.

In a sense, we see PayPal in the same way as e-mail providers such as Gmail, which is the largest e-mail provider in the world. Why do users use Gmail? The answer probably lies in the fact that it is the most widely used, safe and secure e-mail provider which is free of charge.

Are there better alternatives to Gmail? Perhaps there are. But what would be the motivation to change e-mail providers? After all, most people who use Gmail can use it for free, and switching providers would be a huge headache. Not to mention the need to change all the services/contacts still linked to your old e-mail provider. With PayPal, it is similar, as people usually have multiple subscriptions like Netflix, Uber Eats or a Lime/Bird scooter attached to an account that are automatically charged every month or when you use the service.

PayPal has also recently begun to solidify its moat, by now accepting Apple Pay as part of its “Complete Payments Solutions.” Small businesses can now accept methods such as Apple Pay, Mastercard, Visa and others while still processing through PayPal, protecting their dominance against Stripe, Android and Apple Pay.

Look Down, Not Up

From a fundamental perspective, we are always looking for companies with a lot of downside protection and a margin of safety. The saying “look down, not up” still applies if you ask us. So we look at where PayPal might bottom out, and what a worst-case scenario would look like.

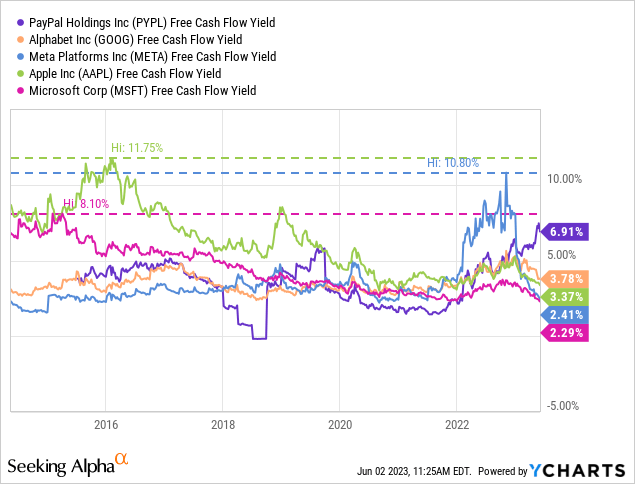

Looking across the board at other major tech giants over the past 10 years and their Free Cash Flow yield over time, a few companies stand out. Apple, Meta (META) and Microsoft (MSFT) all saw their FCF yield skyrocket during times of worry. With Meta, this was last year, when growth peaked and margins fell, and fears of competition from TikTok played a role. Apple and Microsoft, although extremely robust companies, at one point reached FCF yield of 11.75% and 8.10%, respectively. At Apple, this was likely due to concerns about demand in 2016, while Microsoft had similar concerns about future growth in the early 2010s.

We think PayPal is a similar scenario to Meta, which we also gave a buy rating when it was trading at $114.5 or an FCF yield of about 8.5%. In the same article, we believed it was only a matter of time before the headwinds disappeared and management changed course, unlocking efficiencies. Now that the headwinds have dissipated, and the company announced “the year of efficiency”, Meta is trading at an FCF yield of only 2.41% after its recovery.

But it is also important to note that Meta shot even beyond 8.5% and even crossed the 10% FCF yield threshold. In recent history, most of these tech giants achieved FCF yield of 8-9% at most. If we did the same for PayPal, at an FCF yield of 8% on a TTM basis, PayPal would have a market cap of $63.51BN at 8% or a market cap of $56.46BN at an FCF yield of 9% respectively.

With 1.12BN shares outstanding, that would equate to a price of $56.26 and $50.00 at both an 8% and 9% FCF yield, at which price we believe would be the maximum pain. Let’s say PayPal briefly crosses the 10% FCF yield threshold, like Meta, in times of extreme bearishness PayPal would trade at $45. While a $45 per share scenario represents a downside of 29.64%, it is necessary to highlight what a 10% cash flow return would express at that time. If free cash flow remains robust/flat, it would mean that PayPal could essentially use that 10% free cash flow to pay investors a 10% dividend yield or have the ability to buy out a large portion of the company with buybacks, retiring the weakest shareholders and boosting the stock price & EPS.

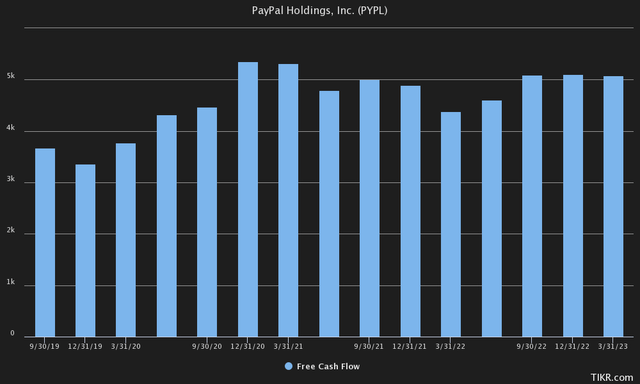

Even now, with free cash flow of $5.08BN on a TTM basis, PayPal could buy up about half of its outstanding shares over the next 7 years if free cash flow remains stable.

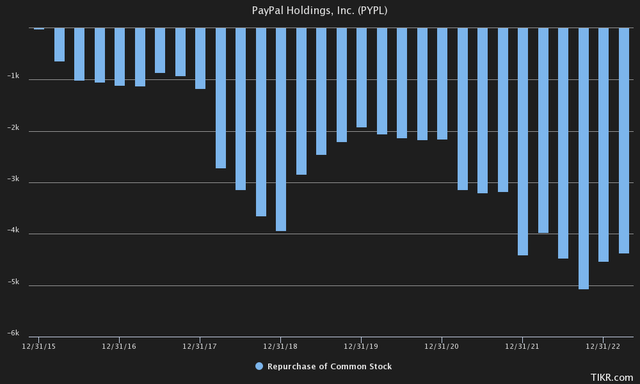

That’s also what they’ve done recently. On a trailing 12-month basis, PayPal has bought back the most shares it has ever done since 2018. Right now, they are using most of the available free cash flow and rightfully returning as much as possible to shareholders, now between $4BN-$5BN per year in buybacks. We think this trend is likely to continue if PayPal remains as undervalued as we think it is now, boosting earnings per share and pushing shareholder returns upward.

An Updated Valuation

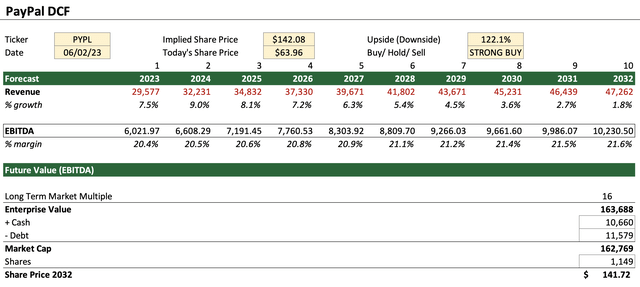

Taking into account all the recent information from the above, we have also adjusted our valuation model to reflect these changes. In terms of revenue, PayPal has a few more years of high single-digit growth to go, after which we think growth will level off to inflation levels.

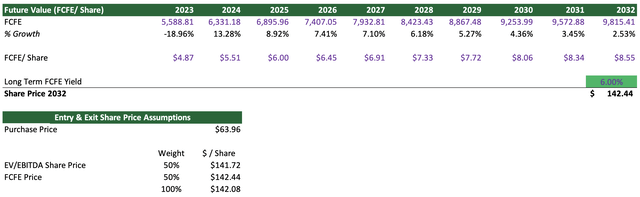

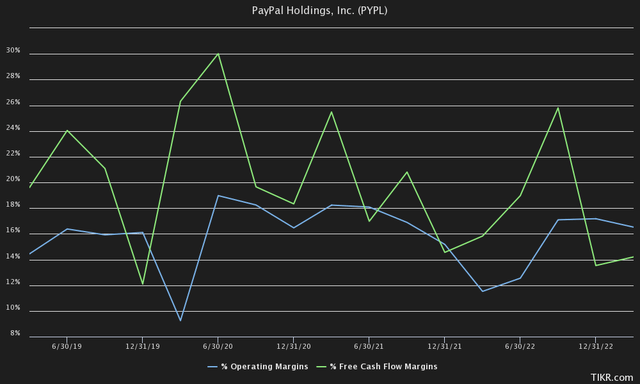

We think EBITDA margins will remain more or less in line with historical averages, with a very slight increase due to cost savings, reductions in R&D due to reaching maturity and other positive developments mentioned in the last earnings call. One of these could be AI, which could help PayPal optimize loss prevention/fraud prevention and automate more tasks such as customer service. At 16x EV/EBITDA, we consider PayPal potentially worth north of $141.72.

On a free cash flow basis, most remained unchanged, with FCFE expected to grow from $4.87 this year to $8.55 over the next 10 years. We applied a very conservative 6% yield on FCFE and arrive at a price per share of $142.44. Using a 50% weighting for both valuations, we arrive at a price target of $142.08.

However, if we plug this into an IRR calculator and take into account the strong free cash flows during the period, we think PayPal has a chance to return 18.63% of IRR over the next 10 years, which we think definitely makes it a “Strong Buy.”

The Bottom Line

We think PayPal is in the same scanning scenario as Meta about a year ago, with the market blinded by temporary headwinds such as fear of competition and slower-growing revenue.

We also think Google Pay, Apple Pay, Stripe and other competitors that have been around for a while are not as big a threat as investors may think. Although competitive threats to PayPal have arguably increased, the company is still able to maintain stunning EBITDA margins, demonstrating their strong value proposition. We believe PayPal’s values still stand because the company is too deeply entrenched in the payment provider industry from both a consumer and merchant perspective. As we see it, it may be a long time before merchants and customers stop using PayPal or taper out its use.

Thus, we expect the maximum downside for the company to be -30% to around $45, at an FCF yield of 10%, although we think this would be an extremely unlikely scenario. From a technical perspective as well, PayPal should have tremendous support at the $45 price level. On the upside, we think PayPal could yield an IRR of 18.63%, well above the historical market average, making the company a “Strong Buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.