Summary:

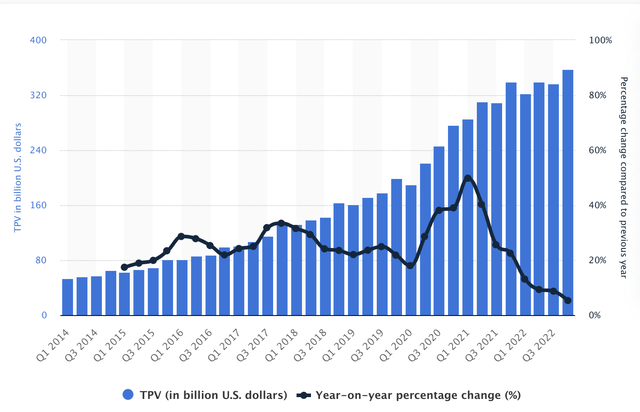

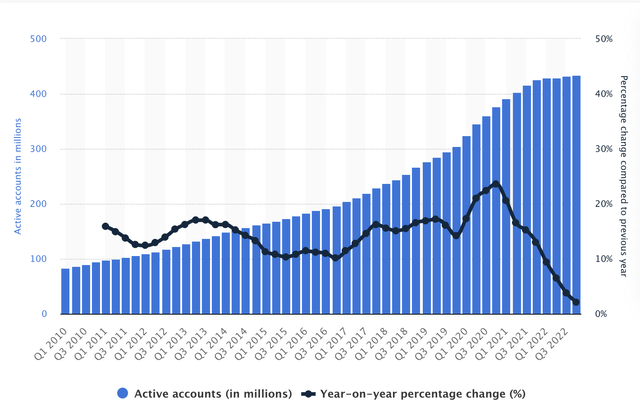

- PayPal is the leader in the FinTech industry with a total of 433 million active accounts and a whopping $355 billion in TPV being processed through the platform last quarter.

- PayPal reported its Q1 results on May 8 and showed a resilient performance with double-digit TPV growth.

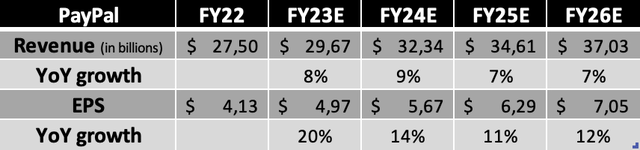

- Driven by this impressive competitive moat and its exposure to fast-growing payment segments like BNPL, the company is expected to show double-digit EPS growth over the next several years.

- Despite this, I am somewhat worried about the growth in active accounts as this turned negative last quarter. This fuels my worries about its long-term resiliency and moat.

- Considering the depressed share price, strong company moat, and solid outlook, I believe shares are a clear buy today with an upside of approximately 49% over the next 18 months, despite weakness.

Justin Sullivan

Investment Thesis

I initiate my coverage of PayPal Holdings, Inc. (NASDAQ:PYPL) and assign a buy rating to the shares following the company’s Q1 earnings release and the massive decline in share price over recent months. Despite significant revenue and TPV growth, the share price is down over 20% over the last five years, resulting in a depressed valuation for this payment processing leader.

PayPal is the leader in the FinTech industry with a total of 433 million active accounts and a whopping $355 billion in TPV being processed through the platform last quarter. The company holds an impressive moat in the industry built on its large user base, trusted brand name, and extensive network of partnerships with the likes of Amazon (AMZN) and Apple (AAPL) for example. Driven by this impressive competitive moat and its exposure to fast-growing payment segments like BNPL, the company is expected to show double-digit EPS growth over the next several years.

Yet, not all is positive for this FinTech giant as it has seen its business fundamentals deteriorate over recent years, after a boom in the business from the covid-19 pandemic. Revenue growth has fallen back to the single digits and user growth has been slowing down massively, even showing a decline in the latest quarter, most likely driven by a tough macroeconomic environment and increasing competition. As a result, my stance toward the company has become somewhat more conservative. Over recent months, I have thought about initiating a position multiple times but never saw enough of a margin of safety to buy some shares. This situation changes today as the share price has fallen back to the low $60s, resulting in depressed earnings multiples for the shares.

As a result, I believe shares are now attractive enough, despite a somewhat uncertain long-term outlook. In this article, I will take you through the latest developments and financial results and will provide my estimates and view on the company following my research.

PayPal’s Q1 top-line results were resilient

PayPal has been one of the biggest underperformers over the last year with the shares down 20% while the S&P 500 (SPY) is up about 7%. Shares are currently trading at around $61 per share while these reached a high of about $300 per share in July 2021 when PayPal was seen as one of the primary beneficiaries of an accelerating e-commerce trend following the covid-19 pandemic.

PayPal has shown impressive revenue growth over recent years with it being the leading FinTech platform for consumers and merchants. As a result of its strong moat and the increase in digital payments, PayPal doubled its revenue over the last five years and showed impressive growth in its total payments volume (TPV). And yet, PayPal’s share price is down 24% over the last five years, raising the question of whether shares might be oversold today, offering a great entry price for long-term investors willing to sit out the current share price volatility and weakness.

Yet, the selloff was not without reason as growth seen in the covid period was clearly unsustainable, PayPal is seeing increased competition, and a tough macroeconomic climate is weighing on the business. As a result, PayPal has been struggling in recent months, leading to a deterioration in the business fundamentals. I believe this was once more confirmed in the most recent earnings report, which included many positives but also plenty of negatives.

PayPal reported earnings on May 8 and positively surprised me with its headline numbers which showed an acceleration in both revenue and earnings growth YoY and sequentially, possibly indicating that fundamentals are improving for PayPal. Still, management is somewhat uncertain about the next couple of quarters as uncertainty in the macroeconomic and geopolitical environments weighs on the business.

PayPal reported revenue of $7.04 billion, beating estimates by $50 million and up 8.3% YoY. Revenue growth was driven by 13% growth in the US, while International was lagging somewhat with just 3% growth YoY, although in part due to a 400 basis points headwind from FX. Meanwhile, total transactions grew by 13% to 5.8 billion, while transactions per account grew by 13% to 53.1 from 47, showing greater user engagement. These initial numbers look very solid and show solid continued growth. Yet, I believe the two most important indicators for business health for PayPal are growth in its user base (active accounts) and TPV.

TPV from branded checkout growth accelerated by 200 basis points compared to the previous quarter to 6.5% YoY on constant currency. Management believes its PayPal Complete Payments platform opens it up to a $750 billion TAM in the small and midsize business market with stronger margins compared to enterprise customers. Revenue from Braintree which is the company’s unbranded payment processing business saw much stronger growth of 30% YoY as PayPal is gaining strength among enterprise customers. Yet, these unbranded payments do hold lower margins and with this outgrowing core business growth, this did have a slight negative effect on overall margins for PayPal. Still, most importantly, PayPal believes it most likely expanded its checkout market share last quarter.

Total Payment Volume (TPV) was up 10% YoY to $355 billion, which is decent considering the pressure on consumer spending, although this is also slightly driven by high inflation. This does illustrate that PayPal remains a preferred payment solution among businesses and consumers. The PayPal brand and moat remain strong.

PayPal still holds a mighty moat in digital payment processing

Shortly explaining the PayPal moat for those unfamiliar with it, this rests on a few essential factors. One of these is its wide user base of 433 million users in total. And although this is down from the 435 million at the end of the previous quarter, this massive user base still gives PayPal a strong competitive advantage versus many of its peers. This is because PayPal is one of the most widely accepted payment platforms among merchants. This also makes it a preferred option among consumers as it is excepted by most of the merchants they visit on a daily basis. This then results in additional interest from other and new merchants as they want to accept the payment platforms with the largest user base to make them more attractive to consumers. This cycle continues and, in the end, PayPal is the winner as its platform gets used more and more.

Partnerships are another driver of PayPal’s strong moat PayPal has successfully partnered with numerous e-commerce platforms, marketplaces, and online service providers. Its extensive network of partnerships and integrations makes it convenient for merchants to accept PayPal payments, giving the company an advantage over competitors. The most recent crucial additions here are partnerships with Amazon and Apple that allow PayPal users to use the service in combination with Apple Pay and use Venmo on Amazon.com.

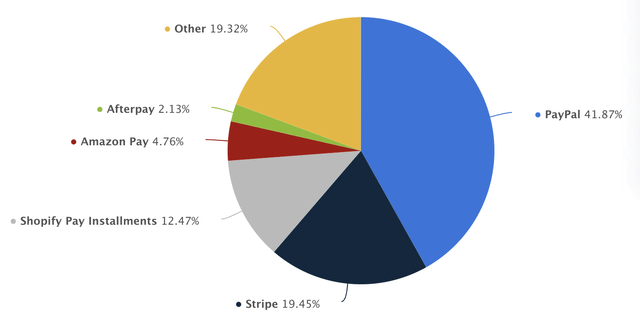

Finally, there is brand recognition and trust. PayPal is one of the most recognized and trusted names in online payments. Its reputation for security, reliability, and buyer protection instills consumer and merchant confidence. Building such a trusted brand takes time and is not easily replicated. And as a result of its strong moat, PayPal remains one of the leading FinTech companies in the world as shown by its 42% market share in online payment processing software technologies as of September 2022, according to data from Statista. Obviously, this strong moat does function as a buffer when times get tough and position PayPal favorably to benefit from general growth in digital payments which is projected to grow at an 11.8% CAGR until 2027.

online payment processing software technologies as of September 2022 (Statista)

PayPal growth drivers, active account growth, and competition

Back to the quarterly results, PayPal is seeing solid growth in BNPL activity on its platform with over 32 million consumers using this service on the PayPal platform by over 3 million merchants. This makes PayPal a strong player in the BNPL industry with a total payment volume of $70 billion for this segment alone, up 70% on constant currency. With PayPal as a leading platform in PNPL, it is well-positioned to benefit from strong growth in this payments segment which is expected to grow at a CAGR of 26.1% until 2030, according to Grand View Research. I expect this to be a leading growth driver for PayPal’s TPV growth over the remainder of the decade.

Venmo continues to be a growth driver as well for PayPal as revenue from the service continues to grow by double digits. Meanwhile, Venmo TPV growth accelerated by 550 basis points compared to last quarter to $63 billion. PayPal continues to grow its Venmo partnerships after recently integrating the payment method in Amazon and Starbucks (SBUX) payment options. Other newly announced integration deals were with McDonald’s (MCD) and Microsoft (MSFT) for Venmo BNPL services in the Xbox store.

And then onto PayPal user growth which is one of my main concerns as total users fell from 435 million at the end of the previous quarter to 333 million at the end of Q1, which shows a rare decline in user numbers but also confirms a trend we have seen over the last couple of quarters. User growth has clearly been slowing down rapidly over the last several quarters, which is a bad indicator for PayPal and one of my main worries here. PayPal’s moat is largely built on its strong user base and as this is not growing or even declining, this is a bad sign for PayPal.

PayPal active accounts growth (Statista)

The decline in active accounts is most likely the result of increasing competition, lower consumer spending which decreases the need for PayPal’s offering, and the decrease in trust from consumers in the PayPal platform after some blunders in its terms over previous years. Also, most important, fewer users translate into much slower payment volume growth as this is now only driven by increased spending by existing users. PayPal acknowledges that it is struggling to grow its user base as in its previous earnings call it already scrapped the account growth goal of 750 million by 2025. And for a company that grows its revenues from payment volume growth, a deteriorating user growth outlook is definitely far from great, and this should worry investors as it will be more challenging for PayPal to grow TPV and revenues without user growth.

Competition might be among the most discussed subjects concerning PayPal’s struggling user numbers. Yet, after conducting some research, I do not view competition as a massive concern for PayPal shareholders today. Yes, it could definitely be a drag on user growth which could cause somewhat depressed numbers, but I don’t think the impact of competition will be a reason for concern. I say this because I believe that PayPal still has a mighty moat as explained before, which competitors cannot easily challenge. Yes, Stripe also holds a strong market share, but its offering is a much better fit for larger companies as it is much broader. Meanwhile, the PayPal platform is more accessible and consumer-focused. Also, PayPal is available in many more regions and countries. Therefore, I do not view Stripe as a threat today.

Another one that needs to be mentioned is Apple Pay. Much has been said about Apple’s increasing focus on the payments industry recently. Apple Pay is a widely used payment wallet that allows Apple product users to easily access their credit and debit card in the Apple ecosystem for checkout or in-store payments. This could be a threat to PayPal as long as PayPal’s credit and debit cards are not available in Apple Pay. Consumers might choose the Apple Pay convenience over the PayPal platform and look for different solutions that work with Apple Pay. Yet, PayPal is closely working with Apple and is expected to introduce its credit and debit cards in Apple Pay later this year for US consumers, which will take away part of this risk. Yet, I should add to this that the Apple Pay functionality does remove some of the PayPal benefits like improved security and anonymity. This could cost PayPal some users as they might view the PayPal platform and its costs as unnecessary, but I don’t expect this to be overly impactful in the near term.

Merchants are already able to accept Apple Pay payments through their PayPal merchant platform. For the time being though, in other regions of the world, Apple Pay could cause some active account weakness for PayPal as Apple users might prefer this platform over PayPal. Still, I do not see any huge issues for PayPal unless Apple chooses to expand further into the payment processing space. I even think the integration of PayPal into Apple Pay will be beneficiary to PayPal as it will make its solutions even more accessible to the billion iPhone users worldwide while taking away part of the threat of users moving away from PayPal to use the Apple Pay functionality. Overall, I expect Apple Pay to be a slight drag on growth in active accounts for PayPal but do not view this as a massive problem today. Still, this is something to keep a close eye on going forward.

PayPal’s Q1 bottom line was supported by cost-saving initiatives

Moving to the bottom-line results for PayPal’s Q1, EPS of $1.17 beat estimates by $0.07 and was up 33% YoY. This significant increase and outperformance compared to revenue growth was driven by the cost-saving initiatives from management. Management has been executing its goals over the last year and seems to know how it wants to steer the business to improved profitability.

The transaction margin decline from 50.9% in 1Q22 to 47.1% last quarter offset some of the cost-saving measures by management. Many Wall Street analysts expect these margins to remain under pressure due to an unfavorable mix and pressure on consumer discretionary spending. Still, as non-transaction expenses declined by 12%, PayPal was still able to boost its operating margin by over 200 basis points to 22.7% and report an operating profit of $1.6 billion, up 19% YoY.

Free cash flow of $1.00B declined from $1.43B in the prior quarter and from $1.03B in the year-ago period. This decrease was primarily due to higher taxes. As a result, PayPal ended the quarter with cash, cash equivalents, and investments of $15.3 billion on the balance sheet and total debt of $10.9 billion. Despite recent weakness in the business, PayPal continues to be a FCF machine, allowing it to reward its shareholders handsomely. And it also did so in Q1 as it bought back $1.4 billion of its own shares and expects to buy back a total of $4 billion in shares in FY23, which is well covered by its expected $5 billion in FCF.

Overall, profitability remains impressive and is absolutely no reason for concern. Moreover, I expect margins to improve over the remainder of the decade as PayPal continues its cost-saving initiatives and makes the business leaner.

Outlook & PYPL stock valuation

Following the better-than-anticipated results, PayPal management upgraded their FY23 outlook.

First off, for Q2, PayPal expects to report revenue growth of between 6.5-7% which puts revenue at around $7.3 billion at the midpoint while growth is expected to slow down further from last quarter. In addition, non-GAAP EPS is expected to come in between $1.15 to $1.17, representing 25% at the midpoint.

For FY23, this results in an improved outlook as management now expect to report EPS growth of 20% to $4.95, following better-than-expected growth and cost-saving measures. For now, the revenue projection remains the same at mid-single digits, but management does see the potential for outperformance here as well as it expects growth to remain similar to the first half of the year, which would put it roughly around 7.5%.

Following my own research, PayPal’s Q1 results, and the outlook from management, I now project the following results for the years until FY26.

PYPL stock outlook (Daan Rijnberk)

Shortly explaining these estimates, I now expect PayPal to report FY23 revenue growth of 7.9% to $29.67 billion with Q2 revenue in line with estimates and Q3 and Q4 revenue of $7.36 billion and $7.96 billion, respectively. EPS will grow much faster due to some margin improvement and easy comparable quarters. I expect the economy to improve in FY24, which will be a good driver of user and TPV growth for PayPal, driving higher revenues. EPS will once more outgrow revenue due to continued share buybacks and margin improvement due to cost-saving initiatives. I continue to see plenty of margin improvement ahead for PayPal which will be a driver of EPS growth in the following years. Yet, I am less optimistic about revenue growth for PayPal as I expect the company to keep struggling with growth in active accounts and TPV as a result. The overall strong expected growth rates of the digital payments industry and the company’s exposure to BNPL will drive overall revenue growth due to primarily increased activity by existing users. I view PayPal’s current position in the industry as solid and believe it will be able to largely maintain its moat, although I expect it to start losing market share, which will cause below industry growth rates. Finally, I believe a new CEO could be a positive long-term catalyst for the company, which could cause potentially renewed growth, but we will have to keep a close eye on this. Yet, most of my attention will be on active accounts, TPV, and transactions per account growth as these remain important indicators of business health.

Moving to the valuation, I will keep this simple by saying that shares look oversold. The company trades at depressed earnings multiples while the growth outlook remains solid. Of course, there have been plenty of negatives over recent months and PayPal is not looking as strong as it once was, but it sure deserves to be trading at a higher forward P/E compared to the current 12.4x. My long-term growth projection above still shows double-digit EPS growth for the foreseeable future, and while this could definitely come down over the next couple of quarters if PayPal would see a further deterioration in user and TPV growth, this is already more than priced in today.

In addition, its strong moat and industry-leading FCF margins really deserve a higher valuation, even when projecting further user losses. Therefore, I am willing to assign a conservative 15x P/E to the shares today, which still leaves room for further downside and creates a fair margin of safety. Therefore, based on my FY24 EPS projection and forward P/E of 16x, I calculate a target price of $91 per share, leaving investors with an upside of approximately 49%. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.)

For comparison, 46 Wall Street analysts currently maintain a target price of $96 per share combined with a buy rating.

Conclusion

PayPal delivered very decent Q1 results but this could not stop the significant share price decline that has been going on over recent months. As a result, shares are trading at a completely unjustified valuation. While there definitely are some negatives and reasons for concern, the long-term outlook is still strong with the expectation for double-digit EPS growth over the next four years.

The current share price does not seem to represent this outlook and creates an attractive opportunity for investors. Even though I am not quite so certain about the future moat and vulnerability of PayPal due to worsening fundamentals and active account numbers, the current share price does offer a sufficient margin of safety for me to pick up some shares at the current price levels over the next couple of weeks. Also, the great FCF-generating ability of the company leaves it with plenty of room to invest in other verticals of the payments industry to strengthen its moat and diversify the business over the next couple of years or to buy back more of its own shares to drive EPS growth.

Considering the depressed share price, strong company moat, and solid outlook, I believe shares are a clear buy today with an upside of approximately 49% over the next 18 months. Yet, I do recommend that investors keep a close eye on user numbers and TPV growth as indicators of business health.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.