Summary:

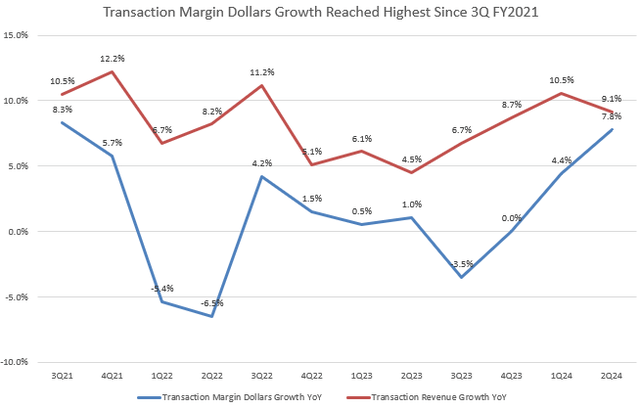

- PYPL has shown signs of a growth rebound in transaction revenue, with transaction margin dollar growth reaching its fastest pace since FY2021, driven by branded checkout.

- Its TPV growth remains resilient but suggests potential softness in the 2H FY2024, reflecting a conservative yet achievable revenue outlook as its take rate continues to decline.

- The company’s cost optimization efforts have significantly expanded operating margins but signal higher non-transaction operating costs in Q3 to fund growth opportunities.

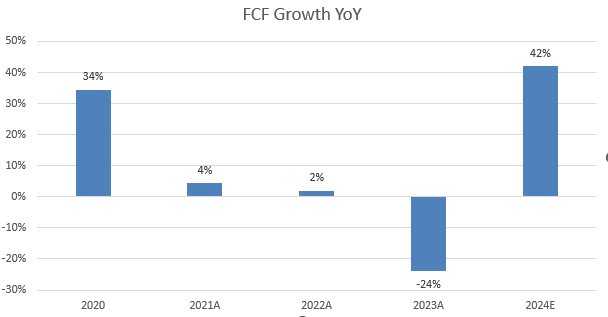

- The company’s earnings and FCF have experienced a significant rebound, enhancing stock quality and leading to a $1 billion increase in the share buyback program.

- The stock is currently trading at 15x non-GAAP P/E for FY2024, with other multiples near their five-year lows, indicating an attractive valuation.

ZeynepKaya/E+ via Getty Images

Investment Thesis

PayPal Holdings, Inc. (NASDAQ:NASDAQ:PYPL) has been trading sideways for more than a year due to sluggish revenue growth, which justifies its lower valuation. While the company topped both revenue and non-GAAP EPS consensus in Q2 FY2024, its Q3 revenue guidance suggests a continued YoY growth slowdown. Although there is slight softness in PYPL’s payment volume growth, active customer accounts have started to increase since Q1 FY2024. The company’s operating margin has significantly improved as they focus on reducing non-transaction-related expenses, a strategy that has been successful so far.

In my previous article, I upgraded the stock to a “buy.” Since then, PYPL has achieved a 17% rally but has underperformed the S&P 500 index, which is not surprising. As noted, most value stocks, including PYPL, have been under pressure since early this year, overshadowed by a strong GenAI-driven rally. Nevertheless, my primary focus on PYPL is transaction revenue and margin, where I see early signs of an inflection in Q2. Therefore, I reiterate my “buy” rating on the stock, as its low valuation continues to mitigate downside risk.

Early Signs of Growth Rebound in Transaction Revenue

Due to higher interest charges, Braintree, Branded Checkout, and Venmo have significantly contributed to a rebound in transaction revenue growth over the past few quarters. PYPL’s transaction revenue grew 9.1% YoY, a significant increase compared to the 4.5% YoY growth in 2Q FY2023. More importantly, the growth of transaction expenses has decreased to 11.3% YoY in the last quarter, down from 16.3% YoY in 2Q FY2023. Meanwhile, its transaction and loan losses dropped 16% YoY last quarter, following a 27% YoY decline 1Q FY2024. This led to an 7.8% YoY increase in transaction margin dollars (total revenue minus transaction expense and loan losses), marking the fastest growth since FY2021.

The company remains focused on small and medium businesses, which could be affected by cyclical consumer spending. PYPL’s total TPV grew 10.7% YoY in 2Q, down from 13.9% in 1Q FY2024, marking the lowest growth since 1Q FY2023. Recent economic data points to a softening consumer spending outlook, which justifies the slowdown in payment volume growth.

During the 2Q earnings call, management projected “a low to mid-single-digit percentage” growth for the full year. Given the nearly 8% YoY growth in 2Q, this guidance reflects a conservative tone amid current deteriorating economic trends. This aligns with the soft “mid-single-digit” revenue growth outlook for 3Q FY2024. Investors should keep in mind that PYPL has been facing significant pricing pressure due to increased competition over the past two years, leading to a substantial drop in its take rate (total revenue / total TPV). The company’s revenue growth now largely depends on TPV growth. If the U.S. economy can avoid a near-term recession and achieve a soft landing, I believe the company’s forward guidance is highly achievable.

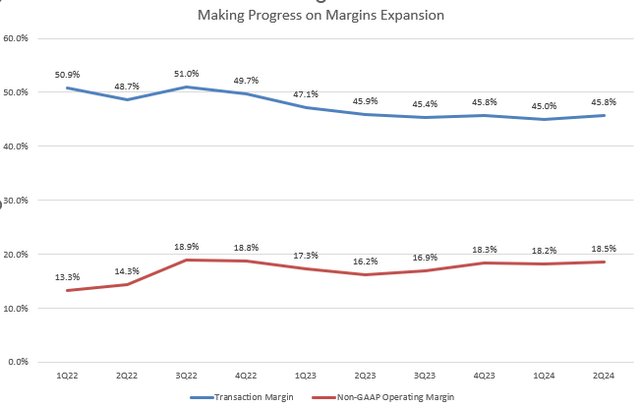

Cost Optimization Expands Margins

As mentioned in my previous analysis, PYPL has been actively managing its cost structure since FY2023. While the company remains focused on transaction revenue growth, it’s encouraging to see that its transaction margin has improved to 45.8% from the previous quarter. Additionally, the non-GAAP operating margin has significantly increased by 230 bps compared to a year ago, driven by 1% decline in non-transaction-related operating expense.

However, the management in the call mentioned that the company expects to slightly increase non-transaction operating expenses to funding their strategic growth opportunities. Therefore, I see a slightly QoQ decrease in non-GAAP operating margin in 3Q FY2024.

Profitability and FCF Profile is Improving

The company model

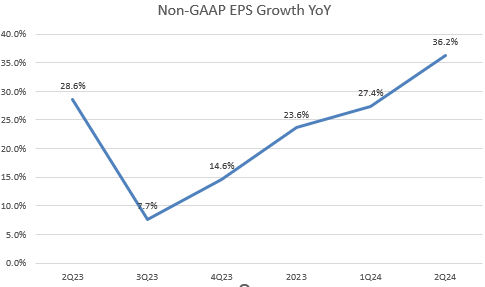

While PYPL has not experienced a significant growth rebound in total revenue, the company has achieved a 36.2% YoY growth in non-GAAP EPS in the last quarter, up from 28.6% in 2Q FY2023, and beating consensus by 20%. The guidance of “high single-digit” growth in 3Q may still indicate a YoY growth reacceleration compared to the 7.7% YoY growth in 3Q FY2023. Although the company raised FY2024 non-GAAP EPS guidance, the “low to mid-teens” growth outlook suggests a potential decline in growth in 4Q FY2024. The management in the call mentioned: “we expect lower volume and revenue growth as we move through the second half of the year.” Historically, 4Q non-GAAP EPS growth has been stronger than 3Q. I believe the company’s earnings guidance has factored in potential softness in payment volume due to a weakening economy.

The company model

Moreover, as a value stock, PYPL should focus on enhancing its quality metrics, such as earnings and FCF growth. The company raised its FY2024 FCF guidance to nearly $6 billion, implying a 42% YoY growth. PYPL also increased its share buyback plan to $6 billion, up from the previous $5 billion guidance, which I view as a positive signal.

Valuation

As shown in the chart, PYPL is currently trading at an appealing valuation, positioning it as a value stock. Given its value-oriented nature, it’s understandable that the stock has been underperforming broader indexes, which have been fueled by strong growth optimism driven by the GenAI boom. PYPL’s GAAP P/E and P/OCF are at their five-year lows, suggesting that investors are currently undervaluing its earnings and cash flow growth. Considering the company’s FY2024 non-GAAP EPS guidance of “low to mid-teens,” the adjusted P/E sits around 14.7x to 15x, below Block, Inc.’s (SQ) 17.6x, making it highly attractive for long-term investors. Therefore, I remain strategically long on PYPL, even though I don’t anticipate a significant rebound in top-line growth in the near term.

Conclusion

In summary, PYPL has been grappling with competitive pricing headwind and single-digit revenue growth, leading to a lower valuation following its pandemic boom. However, recent quarters have demonstrated early signs of a rebound in transaction revenue, robust transaction margin dollars, and significant growth in non-GAAP EPS. The company’s strategic focus on cost optimization has substantially improved its operating margin. The company has enhanced its quality by improving FCF profile, coupled with an additional $1 bullion share buyback, underscores a strong commitment to shareholder value. Although PYPL has underperformed broader indexes due to its value-oriented nature, its 15x non-GAAP P/E for FY2024 still makes it a compelling long-term investment. Therefore, I reiterate a “buy” on PYPL, as its current valuation effectively mitigates downside risks, assuming no near-term recession.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.