Summary:

- The initial market reaction to PayPal’s Q3 2024 results seems justified on the basis of next quarter guidance.

- The Q4 guidance aside, active users are back to growth a quarterly basis and margins continue to improve.

- PayPal’s remains attractively priced, both relative to peers and on a free cash flow basis.

filadendron/E+ via Getty Images

PayPal (NASDAQ:PYPL) just reported its third quarter earnings and the initial market reaction is one of disappointment.

The stock was down by nearly 7% in the trading hours and it appears that investors are not happy with the 3-month performance. Earnings were roughly in-line with consensus estimates, but the slight miss in revenues, higher than-expected costs and the somehow disappointing guidance for the next quarter took their toll on the share price.

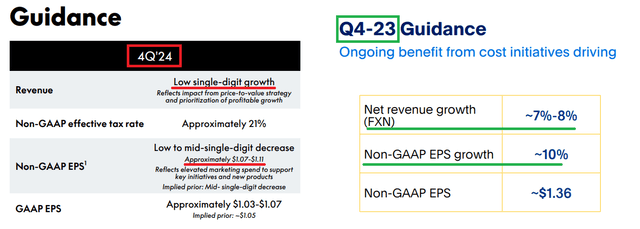

As a matter of fact, it appears that the Q4 2024 guidance is what caught the market off-guard as PayPal’s management now expects “low single-digit growth” in revenues and Non-GAAP EPS within the range of $1.07 to $1.11, which is a notable decline from the Non-GAAP EPS just reported of $1.20.

Moreover, when we compare the current guidance to the one for the fourth quarter of 2023 that was provided a year ago, it becomes clear why short-term investors are so disappointed by the current earnings release.

PayPal Investor Presentations

Even though the aforementioned results could explain the sharp fall of PYPL today, in a similar fashion to my first article on PYPL back in early 2023, I am still convinced that panicking as a result of quarterly trends and narratives is not a viable strategy to investing.

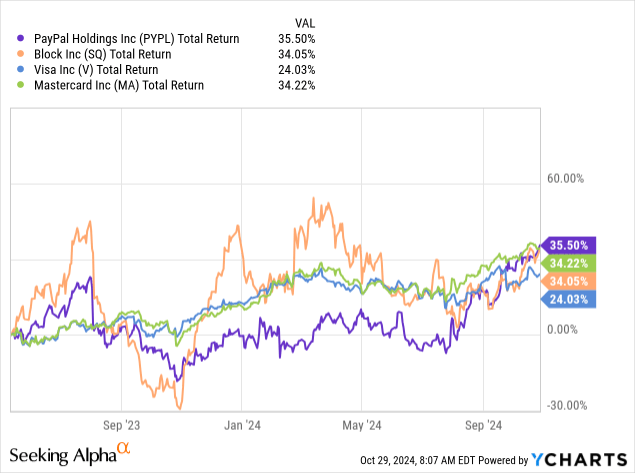

For example, the negative sentiment around PYPL was quite high in early 2023 and yet the stock went on to outperform Block (SQ), Visa (V) and Mastercard (MA).

It appears that this trend could change temporarily in the very near-term as investors digest the somehow lower-than-expected management expectations about the next 3-month period, but I don’t see a reason for long-term investors to reconsider their view on PYPL.

A Closer Look

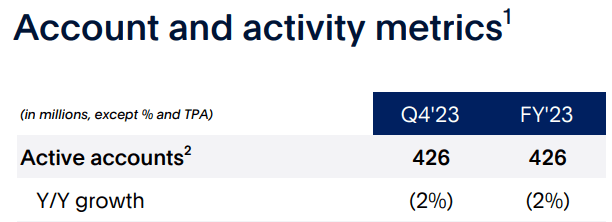

One of the big positives during the quarter was the year-on-year growth in active accounts. After active accounts fell by 2% in fiscal year 2023, investors have become worried that this is just a start of a trend. This was happening during a period of time of strong economic activity and significant growth for PayPal’s peers which only added fuel to the fire.

PayPal Investor Presentation

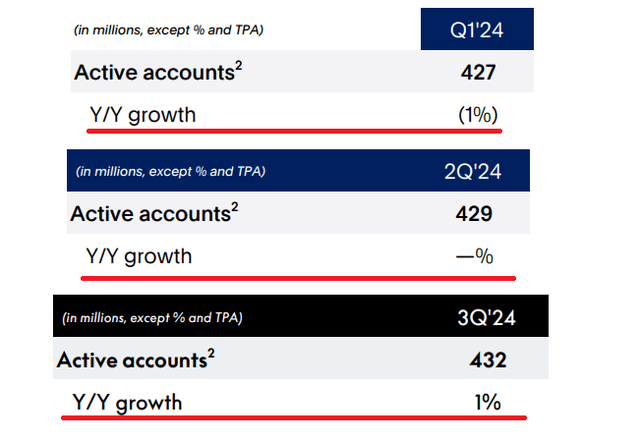

As the narrative that PYPL is likely to shrink in size continued to spread in 2024, it appears that we are finally back to quarterly growth in active accounts. On a year-on-year basis they fell by 1% in Q1 of 2024, stayed flat in the second quarter and are now up by 1% from a year ago.

PayPal Investor Presentations

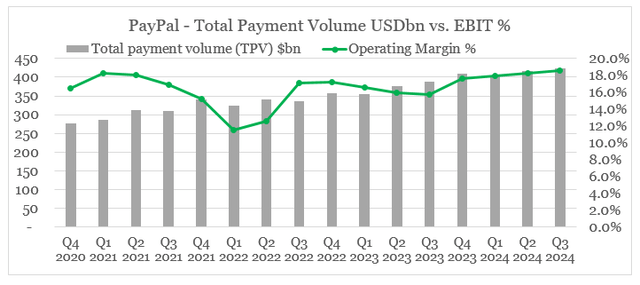

As a consequence, total payment volume continues to improve and with that PayPal’s operating margin now stands at a record-high as economies of scale kick in.

prepared by the author, using data from earnings releases

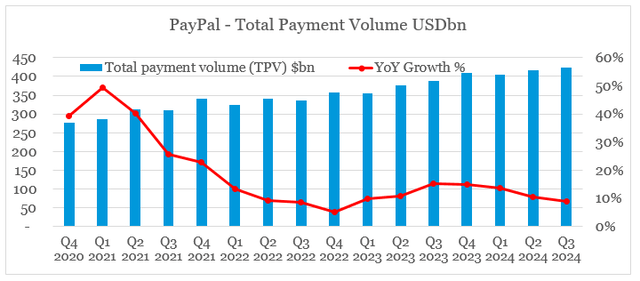

We should note that year-on-year growth in TPV has been declining and now stands at around 9%.

prepared by the author, using data from earnings releases

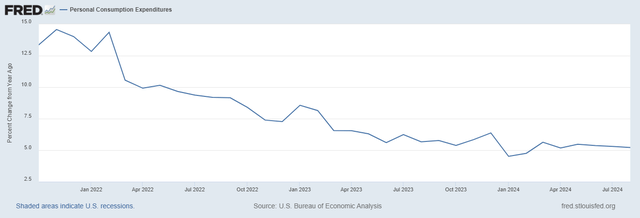

This, however, is expected as inflation cools off and annual changes in consumption expenditures revert back to historical norms (see the graph below).

FRED

As I recently noted, the risk of economic slowdown is significant and should not be ignored by investors in cyclical stocks like PayPal. This issue, however, has implications for overall portfolio construction and based on everything said above PYPL seems to be in a good position to continue outperforming its peers over coming years.

At What Price?

Even though PYPL’s share price could be severely impacted in an event of a recession in 2025, the stock is still priced attractively relatively to its business fundamentals and its competitors within the expanded peer group.

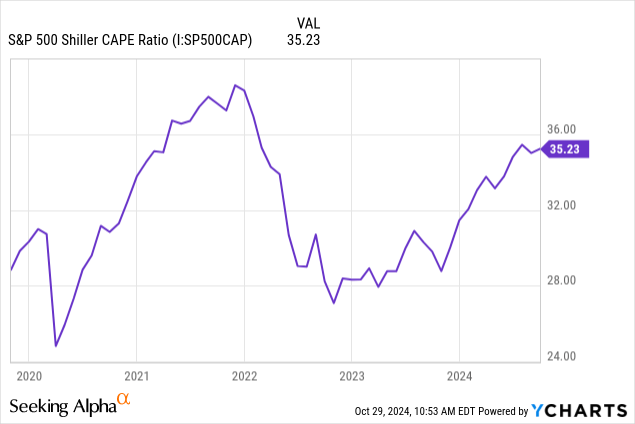

The sharp increase in equity valuations over the past year or so is a major risk when looking at PYPL potential returns on an absolute basis. However, as we will see down below, the stock remains reasonably priced which limits future downside risk.

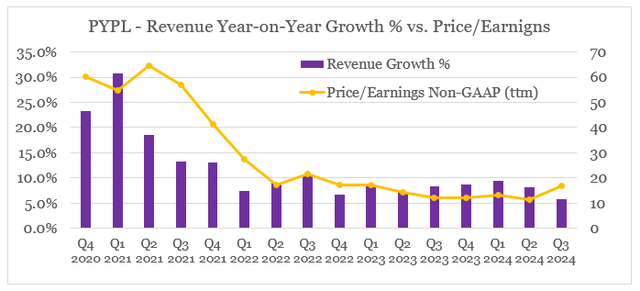

One way of looking at things is comparing PayPal’s quarterly revenue growth to the company’s Price/Earnings ratio on a Non-GAAP basis. In that regard, PYPL appears to be running ahead of fundamentals at least in the short-term as quarterly revenue growth fell below 6% during the last quarter, but the Non-GAAP P/E is at its highest levels since early 2023.

prepared by the author, using data from earnings releases

The graph above, however, tells us very little about future growth expectations and nothing about PayPal’s profitability, which as we saw above, has improved considerably in recent quarters.

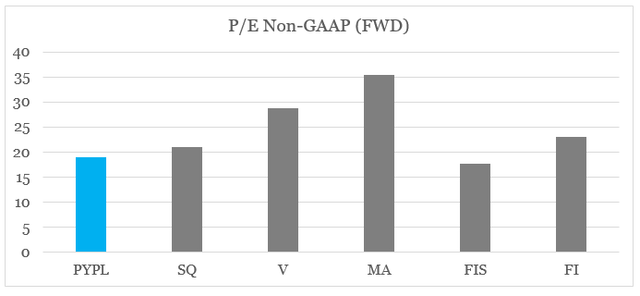

Moreover, PYPL also trades at one of the lowest P/E multiples within its peer group, with only Fidelity National Information Services (FIS) having a lower multiple.

prepared by the author, using data from Seeking Alpha

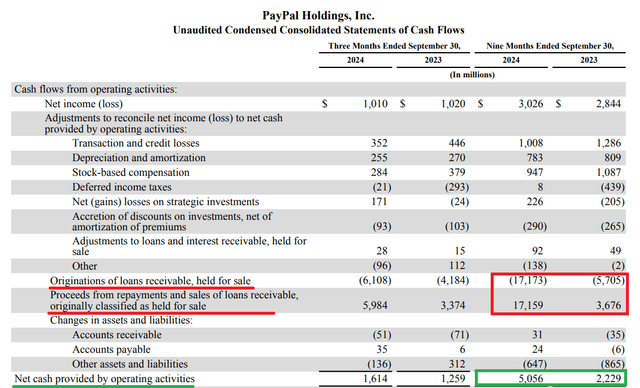

Things are even better when we look at PayPal’s free cash flow, which continues to increase at a higher rate than the share price. As we could see from the extract below, the company’s cash flow from operations has more than doubled over the first nine months of 2024 when compared to the same period a year ago. This is due to the net impact between originations and repayments of loans, which had a negative impact of roughly $2bn in the first nine months of 2023. In comparison, the net impact is now close to zero as proceeds from repayments have caught-up with the initial capital outlays.

PayPal Earnings Release

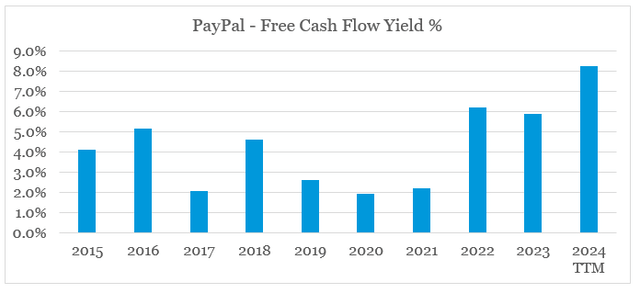

As a result, PayPal’s free cash flow has improved considerably and the stock now trades at a record-high fee cash flow yield of more than 8%.

prepared by the author, using data from SEC Filings and Seeking Alpha

Conclusion

In spite of the market’s negative reaction to PayPal’s most recent quarter, the stock remains an attractive long-term buy. Although the daily share price drop is justified on the basis of the somehow disappointing guidance, the company’s improving profitability and the stock’s attractive valuation are what long-term investors should be focused on.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similarly well-positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.