Summary:

- After months of underperforming the Nasdaq, the PayPal stock is now shifting the narrative, with even the smart money showing signs of interest again.

- PayPal’s next test will be the Q3 results, which are expected to be released on the 29th of October.

- Progress on transaction margin dollars, revenue growth, and earnings growth are all likely to dip from the levels seen in Q2.

- The stock’s valuations still look cheap, and it looks like one of the ideal mean-reversion candidates within the Fintech space.

- But the weekly charts point to some overextension now and investors would be better served by waiting for a retracement in the share price.

chameleonseye

The Market Is Finally Giving Alex Chriss His Flowers

It’s been a little over a year since Alex Chriss took over the helm at PayPal Holdings (NASDAQ:PYPL) (NEOE:PYPL:CA), the global payments specialist, and it appears that the market is now gradually warming up to his efforts in setting the company on the right track.

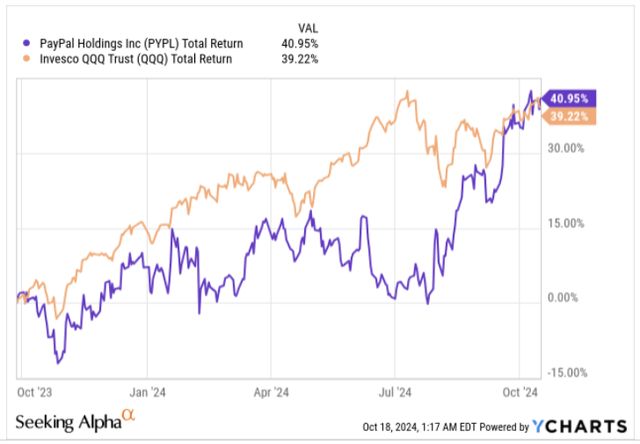

After his appointment in late September 2023, PYPL had lagged the Nasdaq for a considerable period, but in recent months, we’ve seen the gap being bridged; as things stand, the stock is effectively up by over 40%, whilst also now leading the benchmark by a few percentage points.

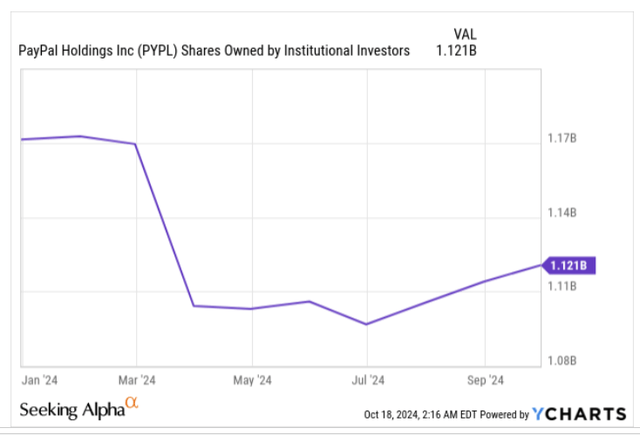

Even more validation appears to be coming from the smart money segment; after reducing their stake in PYPL quite significantly from the turn of the year through July 2024, institutions have once again started building small positions in this counter in recent months.

Another Test, In The Shape of Q3 Earnings, Which Seems Unlikely To Be As Good As Q2

11 days from today, PYPL will report its Q3 earnings (to be published before the market opens), and that could serve as the next big trigger in widening the positive return differential even further (or vice versa). If you may recall, the last time PayPal had reported earnings in late July, the stock had gapped up and closed +9% higher. So, can investors expect a similar performance in Q3? We don’t necessarily think so.

Firstly, based on how PYPL has fared in FY24 so far, we’d imagine investors wouldn’t necessarily be in a Zen-like state, as the delivery has been quite volatile (with regards to consensus estimates). In Q2, the earnings beat was quite stellar, with the non-GAAP EPS figure coming in+20% higher than street numbers, but conversely, in Q1, note that it had fallen short by quite a significant margin of -12%.

We would be very surprised to see PYPL deliver non-GAAP earnings growth which is anywhere close to the 36% levels seen in Q2, as the year-ago comparable for H2-24 are going to be more difficult. Indeed, as against a non-GAAP EPS of $0.98 in Q3-23, management only pointed to growth within the high-single-digit terrain, and consensus is currently budgeting for a figure of $1.07 (which would imply 9% growth).

Whilst the focus on EPS growth is a typically ubiquitous exercise for the investment community, in PayPal’s case, a lot more scrutiny will likely go towards the growth of transaction margin dollars which provides a more fitting gauge of the profitability of the company’s core business (transaction revenue accounts for 92% of PayPal’s total revenue).

One of the highlights of the previous quarter’s report was how transaction margin dollar growth expanded from 4% in Q1 to 8% in Q2 (also a 300bps improvement YoY), the best performance in 3 years! However, investors would do well not to expect the rate to expand even further, as the FY guide is only for an improvement of low to mid-single-digit growth levels. This basically implies that after hitting 6% growth in H1, we are more likely to see slower growth around the 3% levels in Q3 and Q4.

PYPL’s topline, which grew at an FX-adjusted rate of 9% in Q2, will also only come in at mid-single-digits in Q3. Lower volumes at Braintree (PayPal’s subsidiary) will play a part here, as management is now prepared to sacrifice growth there if the profitability quotient isn’t right.

Then, growth and the interest income on customer balances, won’t be as resilient as H1 (this contributed 3% to H1 transaction margin dollar growth) more so as the comparables in H2 are a lot tougher. In Q1 and Q2, PYPL had the good fortune of benefitting from transaction loss favorability, but this is likely to show some signs of normalization, starting Q3.

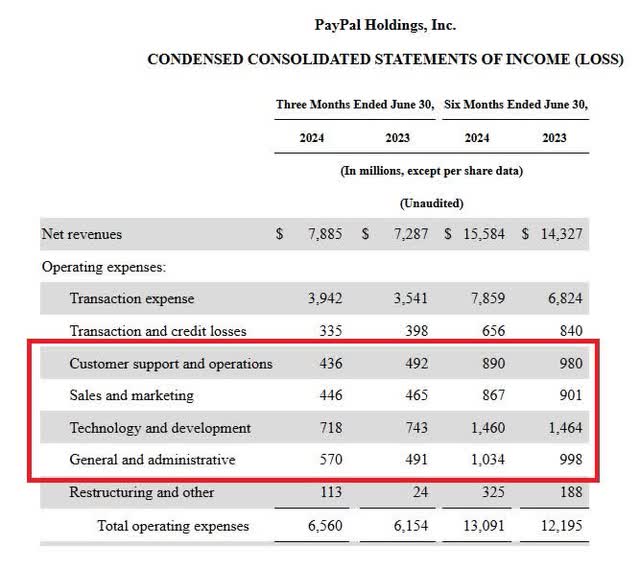

The company has also done well to trim its non-transaction Opex base by 1-2% in H1; note that besides, one-off restructuring costs, only the G&A component of the non-transaction OPEX has gone up in H1. Customer service, Sales & marketing, tech & development, have all come off by -0.3% to 9% YoY.

Whilst it’s been a commendable exercise in trimming the cost base so far, we are not convinced PYPL has too much more elbowroom to keep at this, particularly as they’ve launched a number of products, and marketing spend will likely need to be ramped up in H2. Take for instance, PayPal’s Fastlane (functionality designed to ease guest checkout experiences for businesses) which only went live for US merchants in August, where the emphasis in H2 will likely be on go-to-market initiatives for this offering, with monetization here likely to only take place with a lag of a few quarters. Even otherwise, we expect PayPal to dole out a higher threshold of in-app promotional offers, designed to stoke consumer engagement.

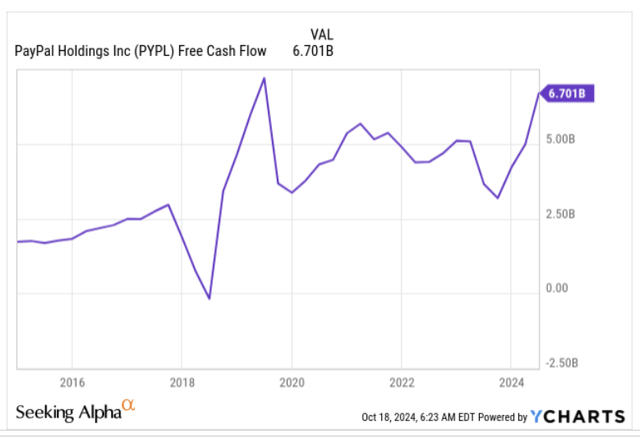

Then, PayPal also has a long history of serving as a useful free cash flow generator, with the current FCF pace of $6.7bn (on a trailing twelve-month basis), not far away from hitting its decade-highs. However, do consider that after generating FCF of $3.2bn in H1, the quantum in H2 will likely dip to $2.8bn, with total FCF for the year expected to come in only at $6bn.

Closing Thoughts – Some Encouraging Sub-Plots, But Don’t Get Overly Bullish Now

As implied in the previous section, PYPL’s upcoming Q3 event is unlikely to be as dazzling as Q2, but we can also see why investors are still eager to lap up the PYPL stock. Whilst management execution so far has raised confidence in the long-term sustainability of the story, enthusiasm for the stock has also been driven by relatively cheap valuations.

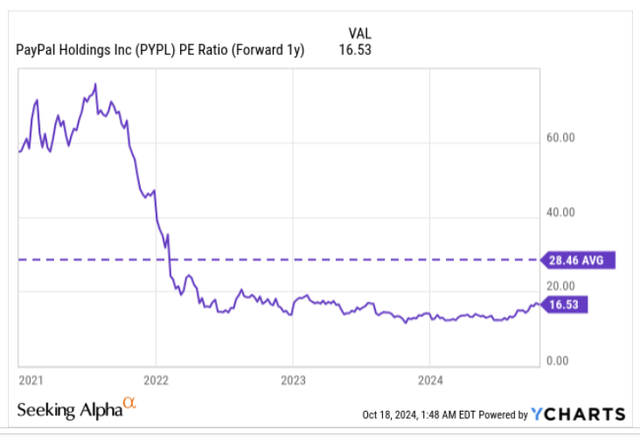

Based on the FY25 EPS, PYPL is still only priced at a multiple of 16.5x (whereas, on average, over the last 5 years, the stock has been priced at a much steeper multiple of 28.4x).

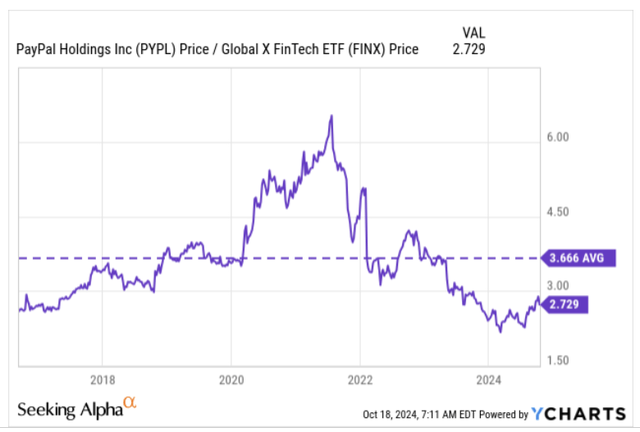

The chart below also suggests why PayPal stock could represent an ideal bet of mean-reversion for those interested in stocks from the Fintech universe. Note that PYPL’s current relative strength ratio versus other fintech peers is currently a good 25% lower than its long-term average, offering good scope for reversion.

On the weekly chart, note that for close to a year, the PYPL stock had been trending up within the boundaries of a certain ascending channel (marked by the two black lines), but by mid-September, it finally broke out from this channel. Even before that, PYPL had done well since August to make an upward thrust, followed by a healthy pullback.

However, we would advise investors not to get too carried away with the breakout, and rather wait for a pullback, and see how the stock trades near the channel boundary before making a decision. We believe this stance makes more sense, as volumes since the breakout appear to have dimmed, even as the candlesticks have grown smaller in size with the presence of quite a few upper wicks (indicating a lack of conviction). Meanwhile, the RSI also suggests an overextended stance for now.

Investors should also note that during earnings season, the PYPL stock typically sees some initial euphoria (reflected in a price gap), but this doesn’t last for too long, as the gap gets closed soon enough. We saw this happen in Q1 (highlighted in yellow), and Q2, and won’t be surprised to see a recurrence of this pattern.

All in all, we think prospective investors should wait for some retracement in the share price, before diving in. PYPL is a HOLD for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.