Summary:

- Despite mixed 3Q FY2024 earnings, PayPal’s stock rebounded, likely due to a broader market rally fueled by expected fintech deregulation under Trump’s administration.

- 3Q revenue missed estimates due to weak unbranded volume from Braintree and a lower transaction take rate, with YoY earnings growth expected to be negative in 4Q.

- While transaction margin dollars YoY growth accelerated in 3Q, the company expects similar momentum in FY2025, with modest headwind anticipated from the rate-cut cycle.

- The management expects “more visible impact on TPV and revenue over the next several quarters.”

- The stock is no longer trading at a significant bargain due to recent multiple expansion, which appears overdone amid an expected sharp growth slowdown in the near term.

Sundry Photography

What Happened

Despite an initial price drop following PayPal (NASDAQ:PYPL)’s mixed 3Q FY2024 earnings, the stock quickly recouped all losses. The company missed revenue consensus and projected “low single-digit” revenue growth in 4Q, signaling continued growth slowdown. Transaction revenue growth saw a YoY decline, driven by a significant QoQ decrease in transaction take rate, as implied by its Total Payment Volume (TPV). While PYPL’s margins improved, leading to earnings beat, the 4Q guidance indicates a YoY decline in non-GAAP EPS. Therefore, I believe the recent price action was largely due to a broader market rally fueled by potential policy tailwinds from Trump’s fintech-friendly and deregulatory outlook.

3Q-24 Earnings Release

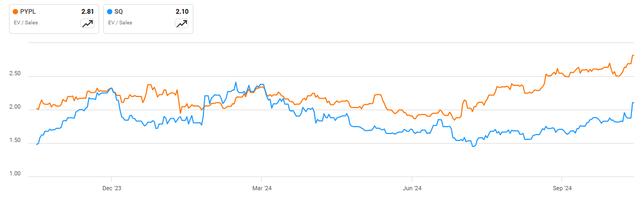

In my last analysis, I maintained a buy rating on PYPL in early August, citing an anticipated inflection in transaction revenue growth and margins. Since then, the stock has rallied 36%, outperforming the S&P 500 by 24%. Given this strong rally, I now believe the stock may be slightly overextended, as the 4Q guidance implies to a continued growth slowdown in transaction revenue and projected negative earnings growth, which undermines my earlier inflection thesis. Additionally, PYPL’s valuation is no longer trading at the significant discount anymore. Its non-GAAP P/E fwd is slightly higher than Block (SQ). Therefore, I’m downgrading the stock from buy to hold to reflect these concerns.

Where is Inflection Point?

The company model

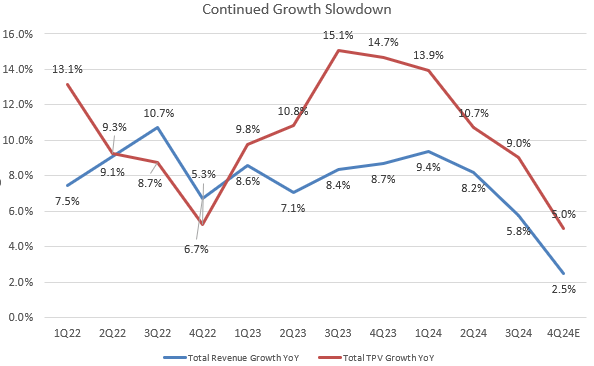

I had previously anticipated that PYPL’s growth momentum would persist, given the company’s accelerating YoY growth over the past three quarters, as shown in the chart. However, PYPL’s 3Q revenue fell short of market estimates, showing a growth slowdown to 5.8% YoY. 3Q TPV growth decelerated to 9% YoY, primarily due to a significant slowdown in PSP unbranded volume growth, which dropped to 11% YoY from 32% YoY in 3Q FY2023. I expect this slowdown to continue in 4Q FY2024, with YoY growth further decelerating to 2.5%, in line with the company’s guidance for “low single-digit” growth. During the 3Q FY2024 earnings call, the CFO Jamie Miller noted, “we expect that more visible impact on TPV and revenue over the next several quarters.”

The company model

While PYPL does not provide 4Q GPV outlook, I estimate its GPV growth will slow significantly to 5% YoY, reflecting weaker transaction revenue growth. Here’s how I estimate it: Over the past three quarters, transaction revenue growth has been 50 to 80 bps higher than total revenue growth. Therefore, I project a 3% YoY growth in transaction revenue for 4Q (50 basis points higher than the expected 2.5% revenue growth), bringing transaction revenue to $7.315 billion. Additionally, as shown on the chart, PYPL’s transaction take rate in 4Q has typically been slightly higher than in 3Q, which was around 1.67% last quarter. I estimate the take rate will improve to 1.7% in 4Q. Using this, I calculate the 4Q GPV to be approximately $430.3 billion ($7.315 billion / 1.7%), implying a 5% YoY growth.

During the call, management explained that they have reduced incentives, which boosted PYPL’s margins but came at the expense of top-line growth. They also noted that higher margins on Braintree (unbranded) are directly affecting the transaction take rate.

Boosting Margins Amid Slowing Growth

The company model

While PYPL’s top-line growth continues to decline, we see clear margin expansion over recent quarters. Management remains optimistic about the outlook for “transaction margin dollars” metric (total revenue minus transaction expenses and transaction and loan losses). As shown by the blue line on the chart, transaction margin dollars accelerated to 8.5% YoY growth in 3Q FY2024, largely driven by Braintree. Additionally, the company anticipates that transaction margin dollars will grow at least as fast in FY2025 as in FY2024. However, they also expect a 1% to 2% margin dollar headwind during FY2025, as the Fed is currently in a rate-cut cycle. They noted “a 25-basis point rate cut is equivalent to about $40 million of transaction margin”.

A growth acceleration in transaction margin dollars will benefit its net income margin. As shown by the red line above, PYPL’s non-GAAP net income margin has been gradually trending upward. However, we may see a dip in 4Q, given the guided “low to mid-single-digit decrease” in non-GAAP EPS. Assuming a -3.75% YoY growth rate for 4Q, we estimate that the non-GAAP net income margin will decline to 13.6%.

Valuation

Seeking Alpha

In my last article, I highlighted that PYPL’s non-GAAP P/E for FY2024 was expected to be around 15x, below SQ’s 17.6x. However, due to the recent rally, PYPL has experienced multiple expansion. Its EV/Sales TTM has risen to 2.8x, exceeding SQ’s 2.1x. Additionally, PYPL’s non-GAAP P/E fwd is now at 19x, slightly above SQ’s 18.2x, which I calculated based on SQ’s projected 30.5% YoY growth over the next 12 months. This comparison suggests that PYPL’s multiple expansion may be little overextended, given its anticipated negative YoY growth in non-GAAP EPS for 4Q and the consensus for a high single-digit YoY growth in fwd basis, according to Seeking Alpha.

PYPL’s valuation has dropped significantly since its peak in CY2021. Its current EV/Sales TTM and non-GAAP P/E TTM are 56.8% and 46.5% below their 5-year averages. However, it’s important to note that PYPL’s revenue growth TTM and diluted EPS growth TTM are also 43% and 58% below their 5-year averages. Despite an improving margin outlook, the consensus also expects forward EPS CAGR to be significantly below its historical trend. Until I see a clear inflection in growth acceleration, I don’t believe PYPL should continue to expand its valuation multiples, which supports my current hold rating on the stock.

Conclusion

In summary, I believe PYPL’s recent price recovery reflects broader market trends, as its mixed 3Q FY2024 results and weak 4Q guidance point to near-term growth challenges. The company is expected to see a sharp decline in transaction revenue growth and negative non-GAAP EPS growth for 4Q, which contradicts my previous growth inflection thesis. While improvements in active customer accounts show positive YoY growth in 3Q, they are not a key revenue driver compared to TPV growth. Although transaction margin dollars remain resilient, the company will face more margin headwinds from a potential rate-cut cycle in FY2025. With its valuation multiples expanded, PYPL is no longer an attractive bargain. As a result, I am downgrading the stock from buy to hold, as further upside is challenged by the disappointing 4Q outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.