Summary:

- PayPal continues to trade as one of the most undervalued tech stocks today.

- FedNow would allow for instantaneous cash transfers for consumers, but should not impact PayPal’s core payment processing business.

- PayPal’s proposed sale of BNPL assets may help accelerate its already robust share repurchase program.

- I reiterate my strong buy rating for the stock.

Derek White

PayPal (NASDAQ:PYPL) is one of the few tech stocks still trading at deep value valuations. The tough macro environment has pressured top-line growth, though the company is making great progress on boosting profit margins. Some investors may be worried that the release of the Federal Reserve’s FedNow payment system may pose an existential threat to PYPL due to it being left out from instantaneous money transfers. I discuss why such fears are misplaced and why FedNow might even be a surprising bullish catalyst for the stock. I reiterate my strong buy rating, as the valuation and generous share repurchase program can not persist forever.

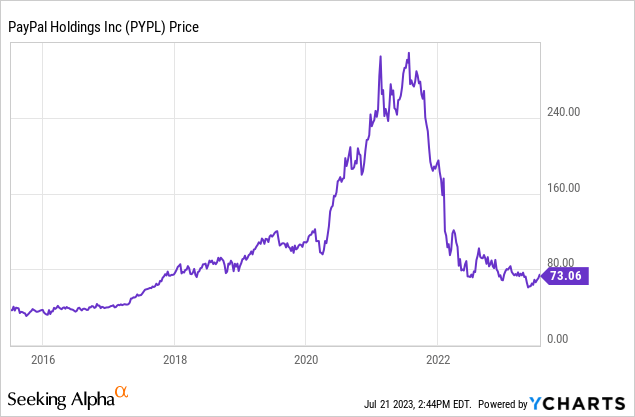

PYPL Stock Price

Like most tech stocks, PYPL was beaten down heavily in 2022 as the bubble burst. But unlike many tech stocks, PYPL is still trading near lows as investors have not been able to look past near-term headwinds.

I last covered PYPL in June, when I called it “deep value” in the tech sector, with the stock trading at 12x earnings. The stock is up 7% since then, but I see more upsides ahead.

How Will FedNow Impact PayPal Stock?

With the stock still struggling to rally despite a broader market rally, it’s important to check the thesis for unforeseen risks. One risk that I have not discussed in my prior reports is that of the FedNow payment service released by the Federal Reserve. In short, FedNow enables consumers to access funds instantaneously, assuming their bank participates in the program. I assume that a primary use case will be access to payroll funds faster.

One of my peers has made the case that FedNow makes PYPL a value trap. I’m of the view that competition risks from Apple (AAPL) are the more significant factor weighing on sentiment, but this is a good moment to discuss the perceived risk of FedNow.

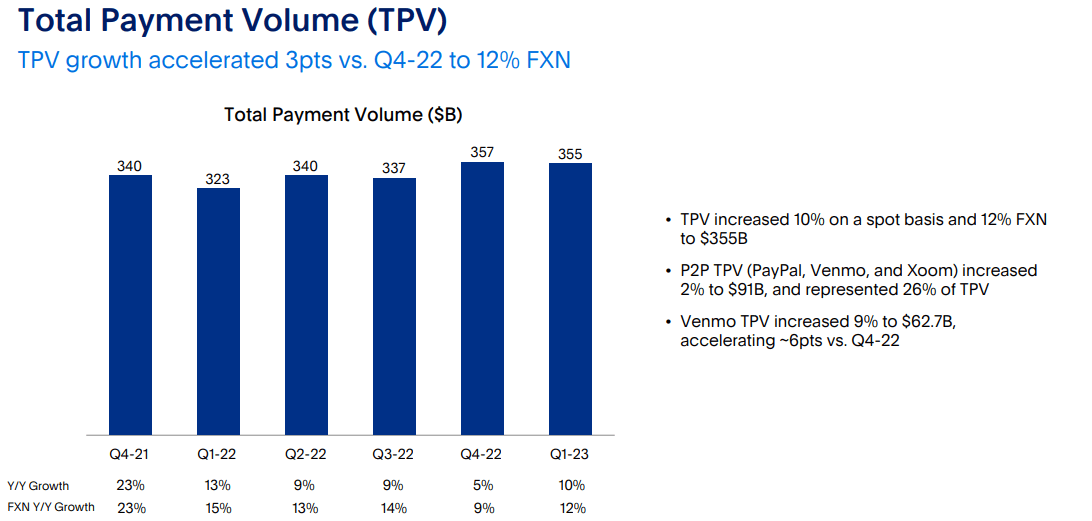

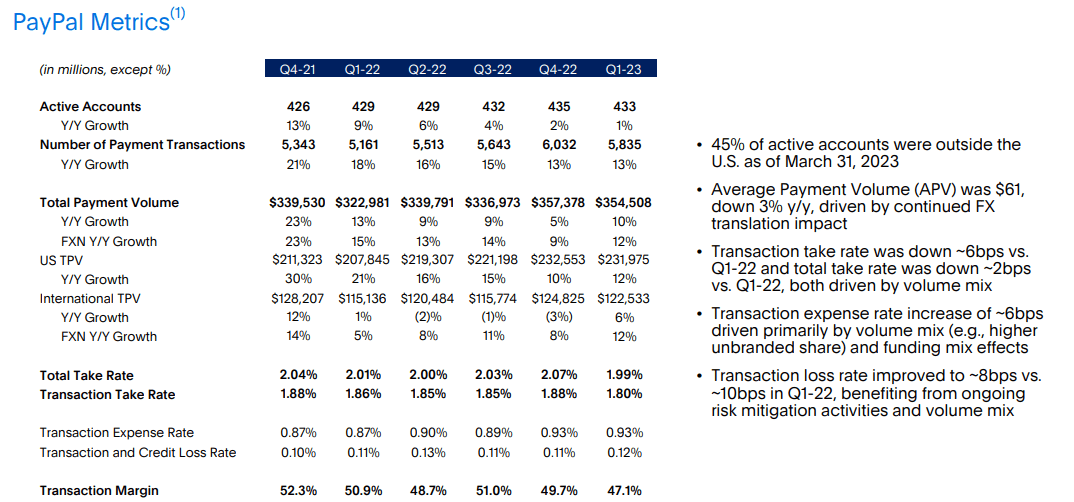

While PYPL may be most well-known to the average consumer for peer-to-peer payment transfers (such as through PayPal or Venmo), I note that P2P TPV made up only 26% of overall TPV.

2023 Q1 Presentation

Importantly, P2P transfers in general carry no transaction fee, unlike the ~2.75% fee that PYPL typically charges for either its PayPal branded button or unbranded Braintree business. We can see below that the overall company take rate of around 1.8%, which in conjunction with the breakdown of P2P TPV vs. overall TPV, makes it abundantly clear that any threat that FedNow poses to the P2P business is overstated.

2023 Q1 Presentation

FedNow is a service offered only between financial institutions and consumers and should have no impact on PYPL’s e-commerce payment transactions. If it does end up posing a risk to the company’s PayPal or Venmo services, then the cynic in me points out that this may help make the company more profitable overall, as those should be considered to be loss-generating growth levers.

Is PYPL Stock A Buy, Sell, or Hold?

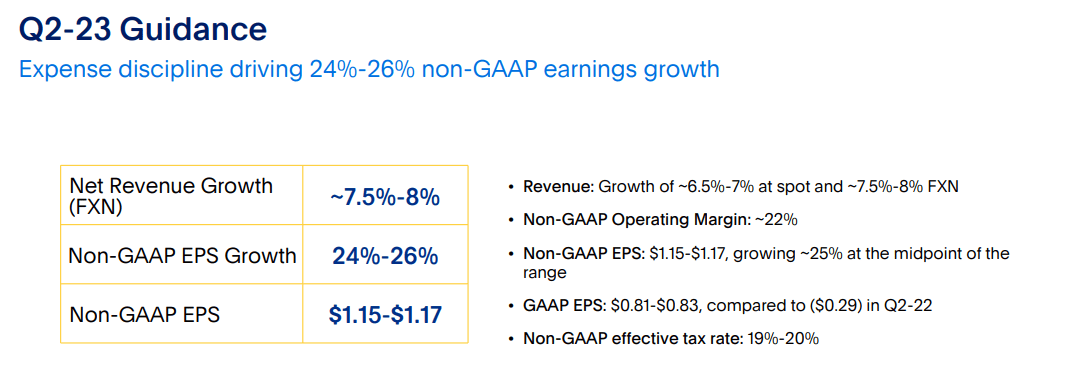

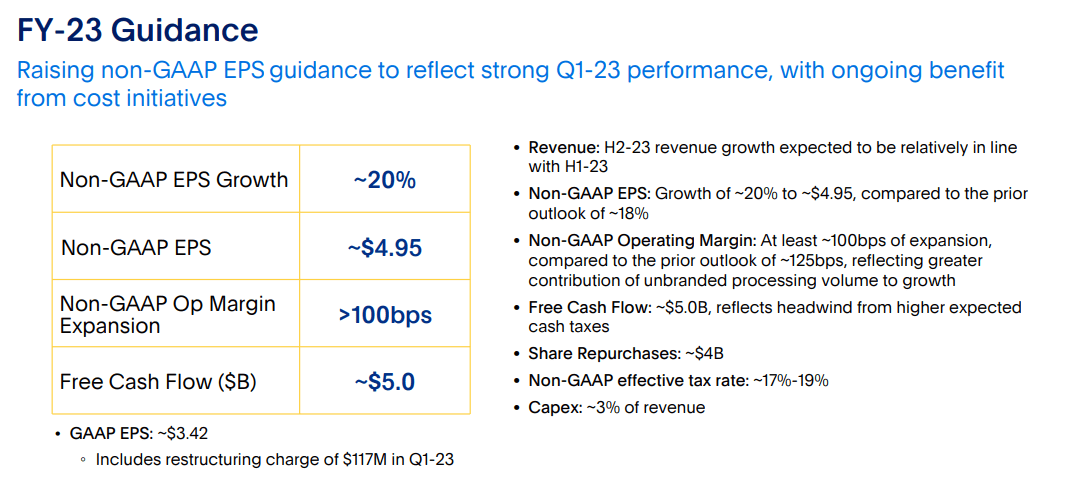

PYPL is expected to release second quarter earnings at the beginning of August. Management has guided for the quarter to see up to 8% constant currency revenue growth and 26% YOY growth in non-GAAP EPS.

2023 Q1 Presentation

For the full year, management has guided for around 20% in non-GAAP EPS growth with similar revenue growth. After many years of minimal operating leverage, PYPL is finally a margin expansion story.

2023 Q1 Presentation

I would not be surprised if PYPL does not raise full-year revenue growth guidance but shows strength on the bottom line, as management has made it clear on conference calls that profitability is now the near term focus.

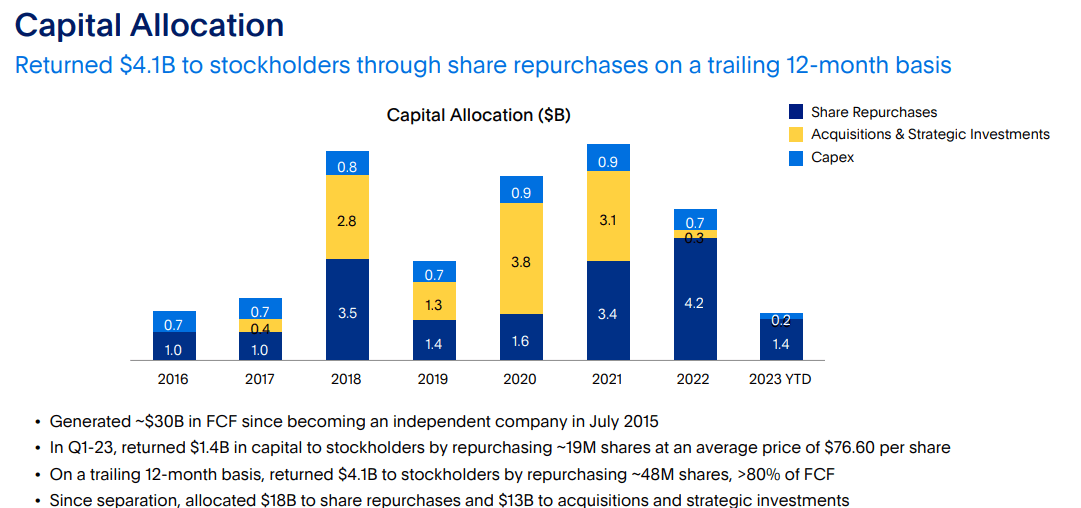

Subsequent to the quarter end, the company announced that it reached an agreement to sell $44 billion in European buy now pay later (‘BNPL’) assets to KKR. This is expected to initially lead to around $1.8 billion in proceeds, of which $1 billion has been slated for further share repurchases.

I expect management to continue to prioritize share repurchases, especially given where the stock stands today.

2023 Q1 Presentation

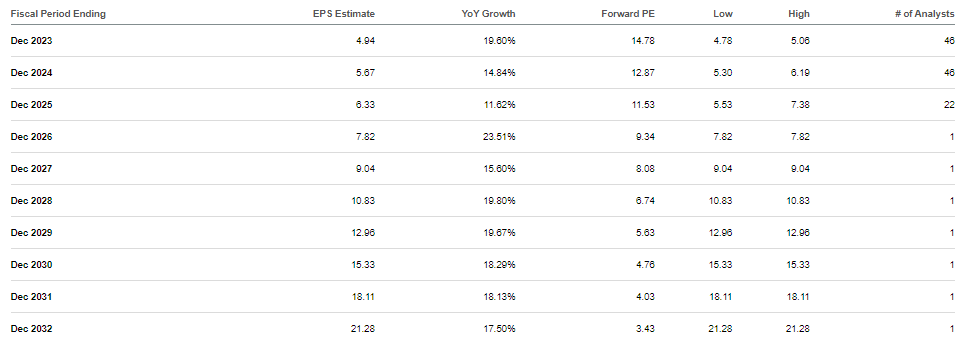

As of recent prices, PYPL was trading at around 15x earnings, but earnings are expected to compound rapidly given that management appears willing to allow operating leverage to take hold.

Seeking Alpha

I can see revenue growth accelerating to 15% over time, with the company sustaining at least 18% earnings growth over the medium term. Based on a 1.5x price to earnings growth ratio (‘PEG ratio’), that implies a valuation of around 27x earnings, implying close to triple-digit upside. I justify that PEG ratio due to the company’s aggressive share repurchase program and net cash balance sheet.

The key risk here is arguably not from FedNow, but instead from Apple Pay. I find PYPL’s positioning in unbranded checkout to be strong, but the company might face real competition in branded checkout for the first time in its history. The company has a first-mover advantage, but that goes out the window when you go up against mega-cap tech titans like AAPL. I’d argue that current valuations are not pricing in much growth at all, but it remains unclear if PYPL has reached a “bottom” in the growth story, especially given the uncertain macro environment. It’s possible that revenue growth rates do not accelerate from here, which would make it difficult for PYPL to sustain above-average earnings growth for as long as expected, given that there are only so many cost efficiencies that can be derived without negatively impacting the core businesses.

I reiterate my strong buy rating for the stock and look to the coming quarters for the company to reinstill confidence in the secular growth story.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!