Summary:

- PayPal reached a new all-time low price-to-earnings ratio, after a double beat earnings report.

- Unbranded business is dominating the US market, challenging Adyen and Stripe, while expanding into Latin America.

- On a valuation aspect, PayPal stock remains the cheapest in the sector, with a forward P/E of 12x and a free cash flow yield of 7.3%.

- The large share buybacks protect further downside and the new CEO Alex Chriss could soon blow new positive momentum in the stock.

Justin Sullivan

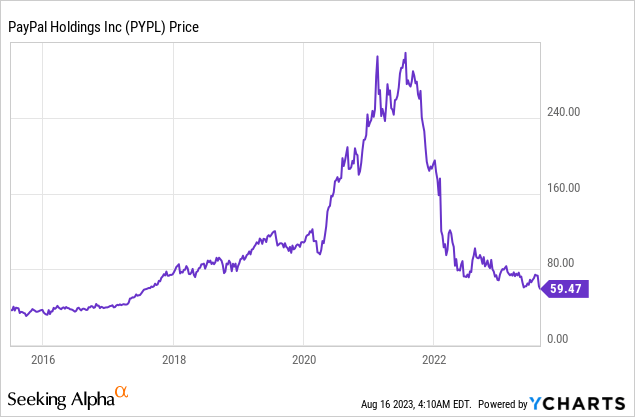

PayPal (NASDAQ:PYPL), once an investor darling, is one of the most unloved stocks in the second half of the year. The stock dropped again after a ‘double beat’ earnings report, with analysts referring to a decline in active accounts and slight miss in operating margins. Yet, PayPal’s payment processing segment Braintree is crushing it and is putting heavy pressure on Adyen and Stripe with attractive pricing. A CEO replacement, re-acceleration in the branded business and share buybacks make PayPal an interesting proposition.

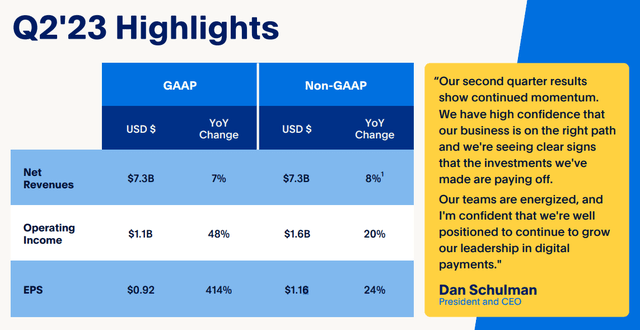

Double Beat

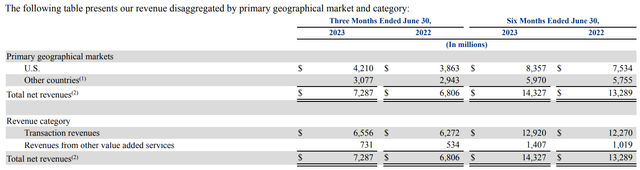

In the second quarter, PayPal was able to beat both revenue and earnings per share. Revenue came in at $7.3 billion compared to $7.27 billion estimated, showing revenue growth of 7% year-over-year. The company proved their cost cutting abilities again and earned $0.92 per share compared to the $0.82 per share estimated. Total payment volume is accelerating further to 11% year-over-year.

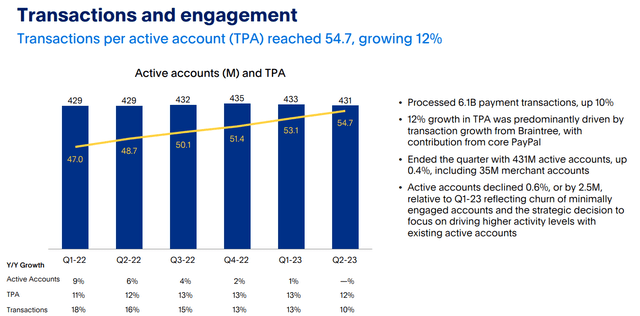

However, the double beat was not enough to satisfy investors, signaled by the drop in stock price after the earnings release. One of the reasons that scared off investors was the slowdown in the growth of active accounts year-over-year and the second decline quarter-over-quarter. The management has been focusing on higher quality users above quantity, leading to more transactions per active account. In the latest earnings call, the CEO Dan Schulman mentioned, that net new active users is likely to remain negative in Q3-Q4 and investors should expect it to increase again in 2024.

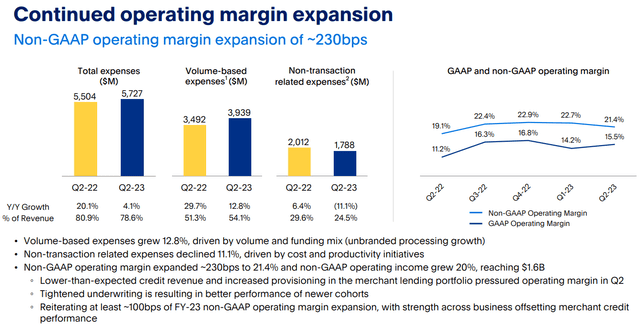

The second worrisome point in the earnings report was the sequential decline in non-GAAP operating margins, which missed the forecast estimates of PayPal itself. Nevertheless, operating margins are still up notable on an annual basis. Mainly, operating margins decreased due to a change in the product mix. Braintree is one of the fastest growing segments in PayPal, which is a lower margin business, therefore the average operating margins went down. Nonetheless, the company managed to beat revenue and earnings per share and the reaction on the miss in margins seems to be overdone.

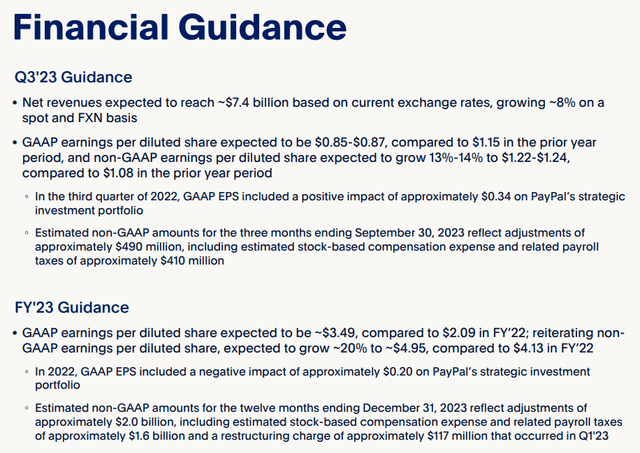

In the next quarters, management sees revenue accelerating towards double digits, as the branded part of the business is showing more strength. The branded business has higher margins and this is a positive sign for the stabilization of operating margins. PayPal reiterated their earnings guidance for 2023 of $4.95 per share, that is expected to grow 20%.

Growth In Unbranded Processing

Unbranded processing total payment volume grew around 30% in Q2 with Braintree as the main contributor and 42% in Q1. PayPal outperformed competitor Adyen (OTCPK:ADYEY), who saw processed volume slowdown to 23% in the first half of the year. The battle for processing volume is likely to put more pressure on the margins along the way. But Braintree slowly taking back some market share in the US from Stripe and Adyen.

Even more, Braintree has more growth opportunities left to pursue outside of the United States. The management had this to say in the latest earnings call:

Braintree is predominantly US. We’re now expanding that internationally. We just added six LatAm countries, which are also because we can orchestrate, providing tremendous authorization rate benefits to our largest customers there, but also at a higher margin.

The expansion will not only benefit the revenue growth, but also create a positive impact on margins and could mitigate the loss in margins in the US-based business.

In addition, PayPal recently launched a new service called PPCP. The service will focus on the SMB market or small and mid-sized businesses. While large merchants have the power to negotiate lower processing pricing, small and mid-sized merchants have lower transaction volumes and cannot secure the same low rates. Therefore, PPCP is another opportunity to rise up margins in the unbranded business.

Free Cash Flow, Buybacks & Stock-Based Compensation

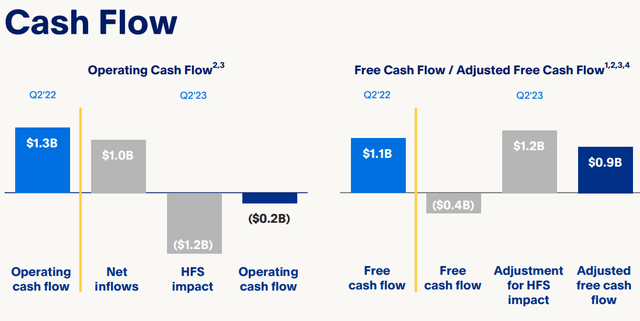

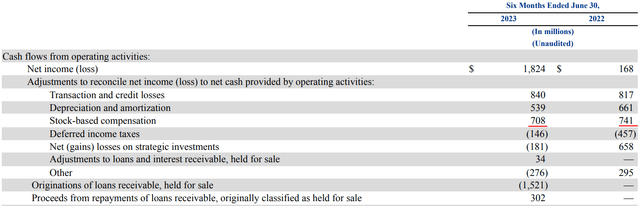

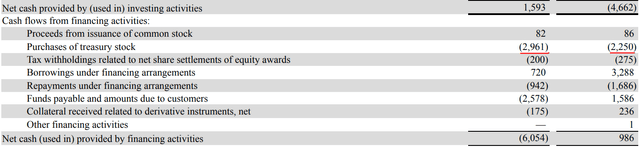

Free cash flow generation of PayPal was negative in the latest quarter due to the sale of the European buy now, pay later receivables to KKR. The transaction will optimize the balance sheet and upon closing PayPal is expected to receive $1.8 billion of proceeds. Adjusted free cash flow in the second quarter was $0.9 billion, down from $1.1 billion in last year’s quarter.

Free cash flow has been a big laggard for the company in the past years. Revenue went from $15.4 billion in 2018 to $28.5 billion in the TTM, yet free cash flow remained flat in the same period. Consequently, growing free cash flow should be a priority of management.

Finally, there is more progress in scaling back stock-based compensation. While the stock-based compensation remains a large percentage of net income and free cash flow, the business is moving in the right direction.

PayPal is buying back a lot of shares every quarter to reward shareholders and because they feel that the intrinsic value of the company is higher than what it is currently trading at. In the latest quarter, 22 million shares were repurchased, returning $1.5 billion to shareholders (2% of market cap). On a trailing twelve month basis, PayPal repurchased approximately 63 million shares of stock, returning $4.9 billion to stockholders (7.5% of market cap). If we subtract the stock-based compensation from the buybacks, we get to $3.7 billion of net share repurchases (5.7% of market cap).

Valuation

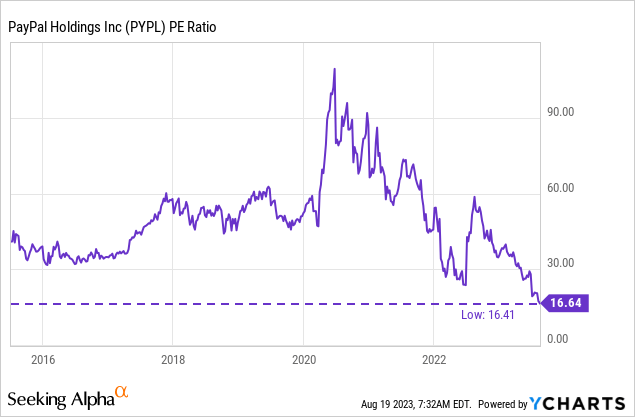

Historically, PayPal is trading at a new all-time low in price-to-earnings. Although most of the decrease in the PE ratio is due to the drop in share price, the company’s focus on efficiencies and profitability has been another large factor.

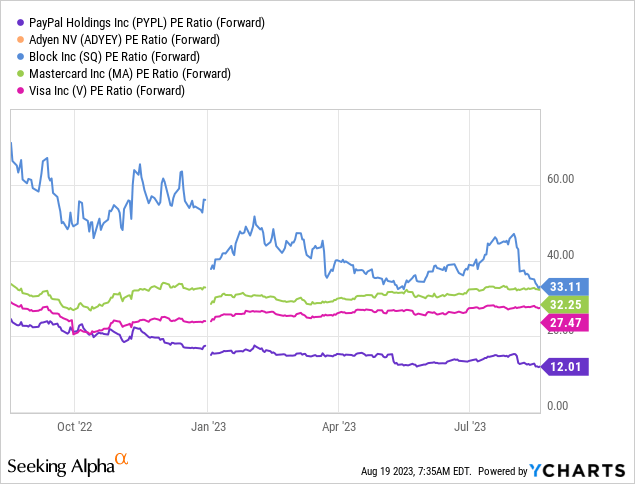

Further, if we include peers and competitors of PayPal, we can see a valuation discrepancy with the others. Based on forward price-to-earnings PayPal is priced at 12x, while the closest peer is Visa (V) with a multiple of 27. That makes the stock more than double so cheap compared to the peers.

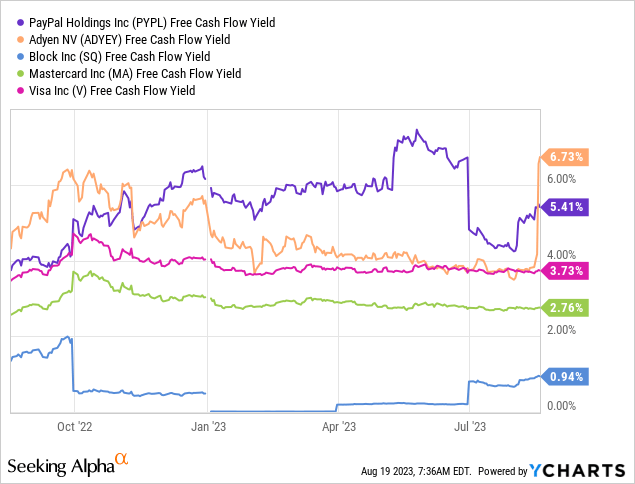

PayPal’s free cash flow yield, excluding the negative impact from European buy now, pay later loans originated as HFS, would be 7.3% (TTM FCF $4.9 billion/ current market cap of $66.3 billion) instead of the 5.41% stated in the graph below. In this way, PayPal remains the most attractive stock based on free cash flow generation. Adyen follows as a close second after the 40% drop in share price after earnings.

In case, we subtract the trailing twelve month stock-based compensation ($1.2B) from the TTM free cash flow and re-calculate the free cash flow yield, the result is 5.54%.

Takeaway

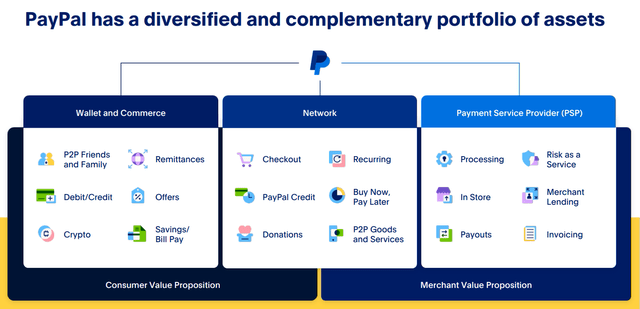

PayPal’s business size is often getting minimized and not completely understood by investors. The lesser known unbranded business serves thousands of companies with payment processes. Braintree provides a payment gateway that allows businesses to accept various payment methods. Recently, Braintree expanded its partnership with Booking.com and transitioned the Braintree platform to their website.

It is true that Apple pay and Google pay are competitors in PayPal’s online payment app, but the unbranded business has other competitors like Stripe and Adyen. PayPal is far from a one-trick pony and has a broad and diversified business in the financial industry. New ongoing initiatives pave the way for business growth in the following years (teen credit cards, Braintree global expansion, stablecoin, PPCP,…).

The long awaited CEO transition is about to happen on the 27th of September. Alex Chriss will take over the from Dan Schulman. The last years for PayPal have been lackluster, slowdown in innovation and growth combined with low profitability. As a result, the stock price has been mostly fairly punished.

Alex Chriss is in my opinion a great replacement, because of his proven dedication, innovative thinking, leadership. Alex worked 19 years at Intuit (INTU), where he grew ranks to EVP and general manager. He led a team of 8,000 employees, which worked on QuickBooks (banking app) and Mailchimp (AI business tool), that served more than 20 million customers. Alex is an expert in small business and should perfectly be able to lead the further expansion of PPCP into the SMB market.

I rate PayPal a “BUY” at $60 a share. I increased my own position again at $61 share and will add more in case we drop further down. The stock buybacks are likely going to protect further downside and a solid base should form around $60 a share. There are a few reason why I do not rate PayPal a “Strong Buy” yet. I am not a fan of the recent activist exit from Elliot management. They pushed PayPal to perform better on profitability and stimulated faster business progress. Though it might also be a great opportunity for the new CEO to prove what he is worth. Lastly, I am waiting on signs of free cash flow growth to support further investments and shareholders value creation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial advisor. Investing is your own responsibility. I am not accountable for any of your losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.