Summary:

- PayPal is focusing on payment transactions and launching innovative services to monetize their user base.

- The company has experienced growth in payment transaction volumes and profits, despite a slowdown in active user growth.

- PayPal’s strategic acquisitions and expansion of product services position them well to capitalize on the growing digital payment market.

Justin Sullivan/Getty Images News

PayPal (NASDAQ:PYPL) has experienced slow growth in the number of active users, as they have passed the rapid growth stage. Currently, the company is focusing on payment transactions and trying to launch some innovative services, including credit card and Fastlane, to better monetize their user base. I initiate with a ‘Buy’ rating with a fair value of $86 per share.

Payment Transaction and Profit Growth

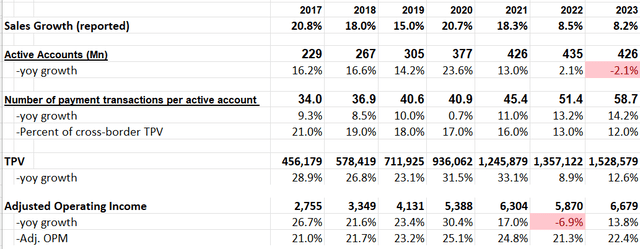

PayPal has transitioned beyond their fast growth stage for active accounts, Instead, the company is now focusing on payment transactions and profit growth. As illustrated in the table below, the number of payment transactions per active account went up 14.2% in FY23, with cross-border representing 12% of total. The total processed volume increased by 12.6% year-over-year in FY23, marking a notable improvement. Their adjusted operating income rose by 13.8% in FY23, and the company announced plan to reduce their global workforce by 9% through both direct reductions and the elimination of open roles over the course of FY24.

There are several reasons for their payment transaction growth over the past few years.

PayPal acquired Chicago-based Braintree in 2013, and Braintree and branded checkout services have been consistently increased total payment volumes. Braintree’s unbranded checkout services provides seamless, one-stop and affordable checkout services for merchants, gaining popularities among small and mid-size merchants.

In Q4 FY23, PayPal’s global branded checkout volumes grew by 5% on a constant currency basis, and the full year they grew 6% in FY23. As such, both their branded and unbranded checkout services have been experiencing volume growth.

In addition, PayPal’s Venmo provides digital wallets. In January 2024, PayPal unveiled six new innovations to revolutionize commerce. Strategically, PayPal has expanded Venmo’s product services to capitalize on the lucrative digital commerce and wallets market.

According to Mordor Intelligence, the digital payment market is expected to grow at a CAGR of 11.08% from 2019 to 2029, and the growth is primarily driven by factors such as mobile wallets, e-commerce, and the growing adoptions of government digital payment initiatives.

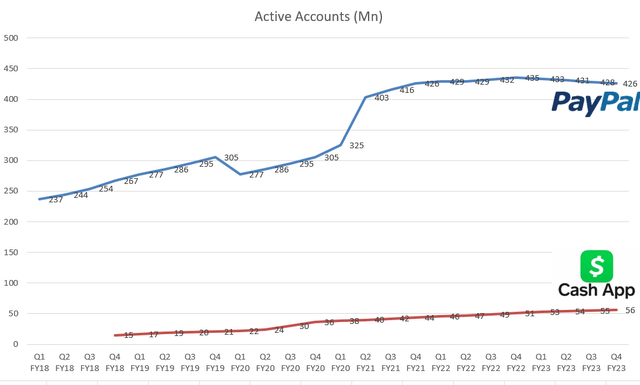

As such, despite the slowing growth of total number of PayPal’s active users, PayPal could continue to grow their payment transaction volumes and profits. The chart below compares the active accounts growth between PayPal and Block’s (SQ) Cash App, and PayPal still maintains a significant advantage in terms of user base compared to its competitors.

PayPal and Block Quarterly Earnings

Recent Result and Growth Projection

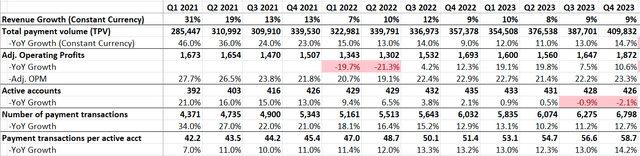

PayPal released their Q4 FY23 result on February 7th, reporting a 9% constant revenue growth, and a 14.7% year-over-year growth in total payment volume, as shown in the table below. However, the total active accounts declined by 2.1% year over year, due to their ongoing churn of unengaged accounts in developing countries including Latin America and Asia Pacific regions.

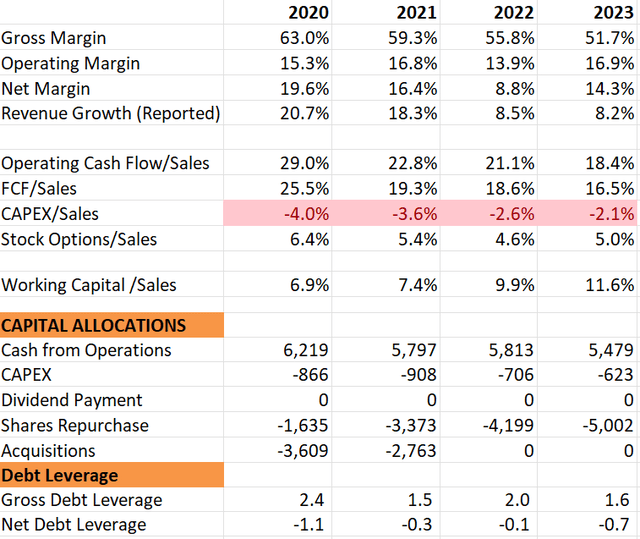

On the balance sheet, they ended up with $17.3 billion in total cash and $11.3 billion in total debts, maintaining a net cash position. For the full year, they generated $4.9 billion of free cash flow and repurchased $5 billion of own shares, demonstrating a quite generous shareholder return policy, as exhibited in the table below.

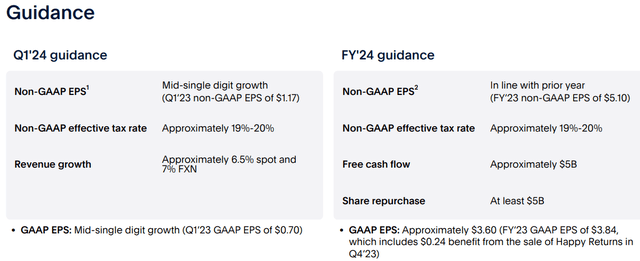

PayPal is guiding for flat non-GAAP EPS growth in FY24 and planning to allocate all the free cash flow towards share repurchase, as detailed in the table below.

I am considering the following factors for their full-year guidance:

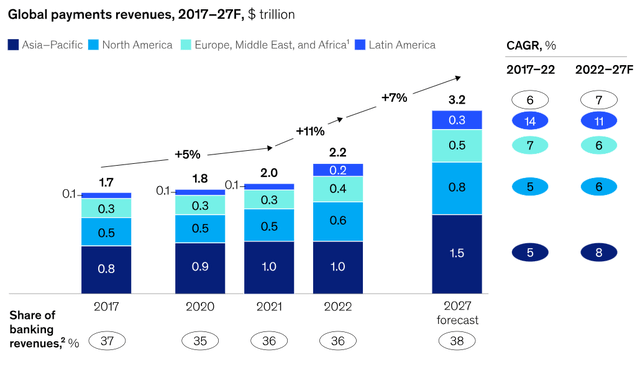

-2023 McKinsey Global Payments Report forecasts that the global payment revenue is expected to grow at a CAGR of 7% from 2022 to 2027, and the growth rate for electronic transactions has been nearly tripled the overall growth in payment revenue over the past five years. PayPal will benefit from structural growth tailwinds stemming from the increasing penetrations of digital payments, in my view.

-Interest rate does have some impacts on PayPal’s revenue growth. PayPal earns revenues from interest on their loans receivable, and interest on assets underlying customer balances. As such, when the interest rate moves down, they will earn less interest-related revenues. It is more likely for the Fed to cut the interest rate this year, which could potentially have some negative impacts on their revenue growth.

-PayPal has been promoting their Cashback Mastercard, with only 2% of active accounts currently possessing the cashback card. As highlighted over the earnings call, the average revenue per account with PayPal Cashback Mastercard is about 5x higher than that of the average checkout-only account. In response, PayPal has been redesigning their app to facilitate easier application processes for the cashback MasterCard. I anticipate significant growth in the penetration of their cashback card, which would result in better monetization rate.

-PayPal rolled out their Fastlane service in January 2024, enabling one-click guest checkouts by allowing users to save their data with PayPal. The company disclosed that they were witnessing the highest conversion rates thanks to the Fastlane service. Fastlane has the potential to enhance their unbranded checkout services and provide tremendous convenience to online shoppers.

Considering these factors, I anticipate mid-to-high single digit revenue growth over the next few years, almost in line with the global payment growth projections.

Valuations

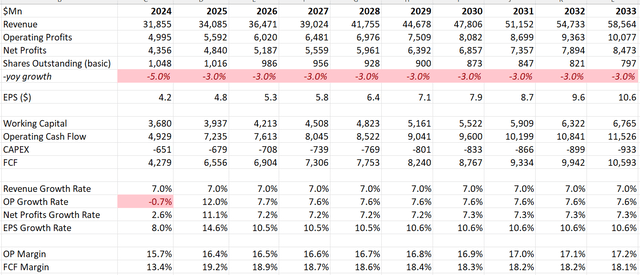

PayPal plans to repurchase at least $5 billion of own shares. According to today’s stock price, it would represent 7% of total market capitalization. Factoring in some dilutions from stock-based compensation, the total number of shares outstanding is projected to decrease by 5% in FY24.

As discussed previously, I assume PayPal will grow their revenue by 7% over the next few years, which aligns closely with the growth projections for the global payment market. The growth rate reflects the potential interest rate cuts, continued expansion of both branded and unbranded checkout services, and increasing penetration of their cashback credit cards.

As PayPal is a software infrastructure company, the incremental costs for handling additional transactional volumes are relatively small, as the company does not need to proportionally increase IT infrastructure expenses. In addition, their announced layoff could also contribute to their operating margin expansion in the near term. Based on these factors, I estimate that their operating expenses will grow by around 6.8% year-over-year, leading to around 10bps annual margin expansion.

With these assumptions, the DCF model can be summarized as follows:

PayPal DCF – Author’s Calculations

The WACC is calculated to be 12.6% with the following assumptions:

-Risk free rate: 4.32%. 10 Year U.S. Treasury Yield

– Beta: 1.55. SA’s 24-month beta

– Equity Market Premium: 7%

-Cost of debt: 7%

At the discount rate of 12.6%, the total enterprise value is estimated to be $90 billion. After adjusting the cash balance of $13.2 billion and debt of $9.6 billion, the fair value of PayPal’s stock price is projected to be $86 per share, as per my calculations.

Key Risks

Credit Risk: PayPal offers some credit products to their customers, thereby assuming some credit risks from their customers. They carry $5.4 billion of loans receivables on the balance sheet. A worsening economy situation could potentially increase their credit losses. For instance, their credit losses increased by $495 million in FY22 compared to FY21, primary because of the deterioration in the credit quality of loans outstanding. Over the earnings call, their management indicated that the company has begun to strengthen their loan underwriting criteria in order to enhance their loan quality.

Competition: The digital wallet is a highly competitive market with numerous existing players such as Google Pay, Apple Pay, Cash App, Zelle, Amazon Pay etc. In order to expand customer base, PayPal might be required to continue investing in new features, provide more value for users, and remain competitive in terms of pricing, in my view. I believe the best approach to enhance the monetization rate is to provide differentiated value-added services to existing users.

New CEO: PayPal named Alex Chriss as their President and CEO, effective September 2023. I acknowledge that Mr. Chriss brings a strong leadership background from his tenure at Intuit (INTU). Since joining PayPal, he has demonstrated a proactive approach in controlling the costs, improving monetization and improving margins, and tightening loan underwriting standards, which is quite encouraging.

Conclusion

Despite the slowdown in PayPal’s active-user expansion, their branded and unbranded checkout services and payment transactions could continue to grow, in my view. In addition, the digital payment end-market is still in the early stage, offering a substantial runway for future growth. I initiate with a ‘Buy’ rating with a fair value of $86 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.