Summary:

- PayPal’s valuation is extremely compelling, with a very low multiple relative to historical averages and compared to revenue and earnings growth.

- The company is focused on reshaping the business and improving innovation and cost efficiency.

- The potential of Venmo and its debit card to drive revenue growth is being overlooked in PayPal’s valuation.

- I expect PayPal to significantly outperform in 2025.

Alistair Berg

Prelude

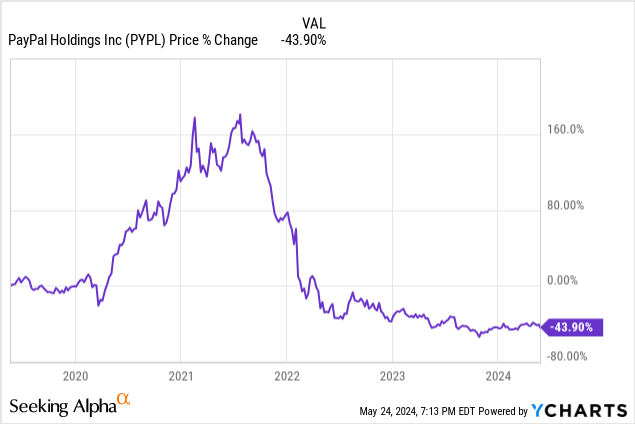

I first covered PayPal Holdings (NASDAQ:PYPL) at the end of December with a Strong Buy rating, stating that the bull case is compelling and bear case is crumbling. I followed this up with an earnings review after Q4 report and another Strong Buy rating. The company is lagging the S&P over both time frames. While the stock has been range bound for months, my conviction remains unchanged in the value presented by this stock. I reiterate my Strong Buy rating for the reasons I’ll discuss below.

It’s difficult to maintain an investment in a stock that is floundering while watching AI names rush forward. I understand the frustration of many investors with this company and the bullish analysts. I concurrently believe patient investors in PayPal will be rewarded quite well in the coming years. The business displays numerous reasons for optimism yet is priced for the most pessimistic outcome possible.

Grounds for Optimism: Valuation and Buyback

First and foremost, PayPal’s valuation remains extremely compelling. The company has a five-year revenue CAGR of 13.87% and earnings CAGR of 14.41%. The stock is down nearly 44% over the same period.

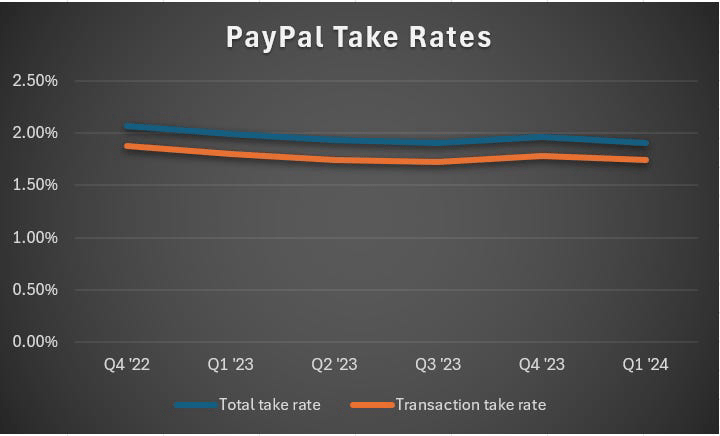

The stock is trading at 14.9x non-GAAP forward earnings versus the 32.7x five-year average. The current market cap of $64.42b represents a sales multiple of just 2x versus the 5-year average of 6.5x. Naturally, a low valuation suggests the market is worried about long-term growth. That threat is the recent trend of unbranded processing eating TPV share from branded, causing a sequential grinding lower of take rates. Take rates reflect in PayPal’s gross margin, which is currently 11.5% below the 5-year average and 33.9% below the sector median.

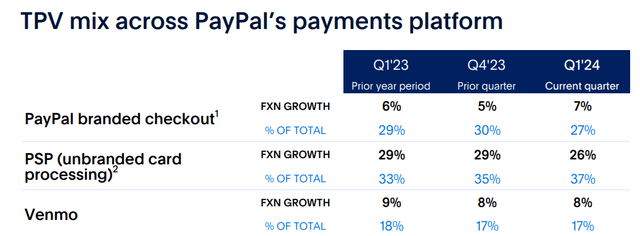

The company reported $29.7b in revenue in 2023 representing just 8.19% YoY growth while the lower-margin unbranded payment processing business segment continued to take share from the cash cow branded button. Branded grew only 7% YoY versus the 26% growth of Braintree (PSP / unbranded). Venmo grew 8% yet remains painfully under monetized.

TPV mix favoring the PSP segment is the core of the bear case. Branded checkout growth decelerating from long-term averages remains a threat to sustainable market beating earnings growth. Meanwhile, mid-to-high single digit revenue growth in branded and Venmo is not very promising. Why is this happening, and what is management doing to address this?

Most of this deceleration is caused by a proliferation of competition to the branded button; namely Apple (AAPL) Pay which remains a formidable competitive threat. Notably, Apple Pay is in the sights of regulators. Apple’s current iOS 17.4 included a major update; the NFC (near field communications) chip was opened up to third party apps for consumers in the European Economic Area. This means a company like PayPal can build its own digital wallet natively into its iPhone app, which can be utilized with an iPhone’s NFC capabilities separate from Apple Wallet. This will allow the company to capture a larger share of take rates on mobile payments.

This alone doesn’t solve the issue. The PayPal button is woefully behind some competitors, as the company lost its innovative edge in recent years. On the other hand, Venmo has a fundamental problem: of the $18b of average new inflows monthly, 80% of that leaves Venmo within 10 days. It’s clear that the 60 million monthly actives see Venmo through a singular lens: it’s a way to send money to friends. PayPal desperately needs to change this brand image to unlock sustainable long-term profitable growth.

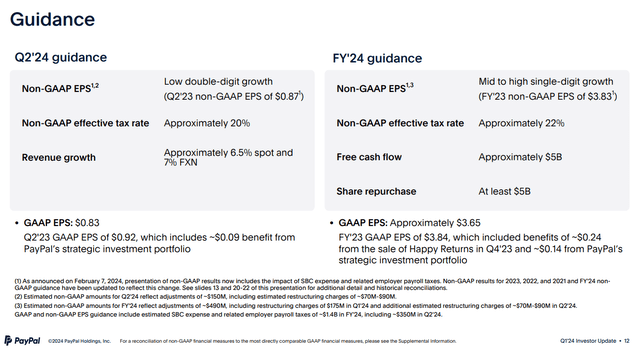

CEO Alex Chriss is taking a measured approach to tackling these problems. He’s been clear that 2024 is a year of reshaping the company, and the proof is in the pudding. The executive team has been overhauled and the new team is focused on two things: 1) reigniting the innovation engine, and 2) cost efficiency. One of Chriss’s first major moves as CEO was the First Look event, which featured 6 new innovations coming to the PayPal ecosystem. Among them were biometric authentication in checkout, more cash back offers, and a guest checkout journey. The market was largely underwhelmed by First Look and was even more underwhelmed when Chriss came out and sandbagged Q1 guidance in the Q4 report. He did much the same in the recent report with guidance that leaves much to be desired:

Single digit growth across both the quarterly and FY guide is lackluster, but the big positive here is the “at least” $5b in buybacks. At the current price of $61.64, that would represent roughly 81m shares. With 1.06b shares outstanding currently, this is a ~7.6% decrease of float in FY ’24. Further, PayPal has more cash on hand than total debt, so using the entirety of annual free cash flow on repurchases at the current valuation is a very efficient use of capital for investors.

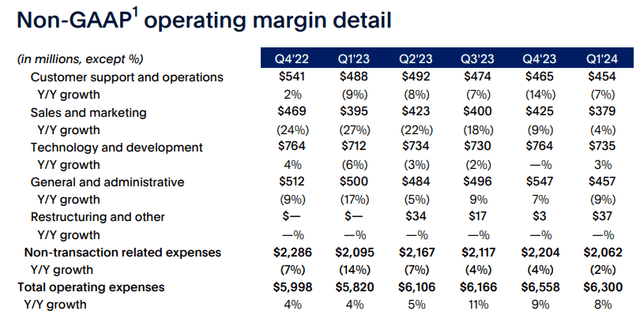

Meanwhile, OpEx is being contained quite well considering the company is still growing revenues and EPS at a steady clip:

The company is in the process of laying off 7% of total headcount and is working through a comprehensive review of current operations to find more cost efficiencies. This way, even if gross margin continues declining, the company can keep operating margin stable or moderately growing. Operating margin stability and buybacks contribute to a solid EPS outlook. That’s great, but for the stock to inflect on recent poor performance, the company will need to expand gross margin again.

The company will be well positioned to accomplish this in 2025. What we should expect for the remainder of 2024 is improvements in existing businesses (think: Xoom improvements), divestment announcements of stale businesses, and consistently decreasing OpEx. I do not expect a sustained inflection in take rates in 2024, but that is of utmost importance in 2025 for the long-term thesis. The decline in take rates was the worst part of the Q1 report.

Company Reports

Alex Chriss is bringing the company in the right strategic direction. PayPal is focused on exerting pricing power with Braintree, growing branded revenue with guest checkout and biometric auth, and more effectively monetizing Venmo. Venmo is the biggest untapped asset here.

The Venmo debit card user base was up 21% YoY and these users generate 6x more revenue than peer-to-peer (P2P) payments only users. Balance-funded P2P payments on Venmo grew 17% meaning more money is staying in the Venmo network. More debit card users will lead to a stickier network and a stickier network will lead to more Venmo card transactions. Venmo debit card will set off a strong flywheel effect.

This is already an app that many people use regularly; the company just needs to incentivize users to keep money within the platform. Venmo debit card establishes this incentive, now the company needs to work on attracting card users. They are regularly sending marketing emails and running enhanced cash back programs to accomplish this, but admittedly, I’d like to see a more compelling value proposition from Venmo. Capturing wallet share with these users will contribute immensely to PayPal’s gross margin inflection next year. The Venmo user base has disposable income 22% higher than the U.S. average, and it is massive with 60 million monthly active users and 90 million 12-month actives. Monetization will take time, but the process is underway. I believe Venmo is being ignored entirely in PayPal’s valuation.

Fears of sequential take rate declines are far overshadowing the opportunities presented here. The company took its eye off the ball in recent years and Alex Chriss is working to turn the ship. It takes time, but the company is turning and the horizon looks brighter. The stock is priced for very minimal growth and has been range bound for months. Once the market wakes up to the solid fundamentals here, the stock will reward patient investors.

Investor Takeaway

Patience, patience, patience. At the onset of 2024, many PayPal bulls were expecting a “Meta moment” and have been disappointed with the stagnant stock price. I believe patience is warranted. Alex Chriss is approaching his first year with the company and has made numerous solid strategic moves. The ship is moving in the right direction yet is priced as though the rudder is irreparable. A quote about stock picking that I like a lot goes, “The best time to buy a stock is when you don’t want to. The best time to sell a stock is when you don’t want to”.

It’s hard to watch week after week of stagnant price action from PayPal while AI names are running like crazy. It’s painful and emotional. For a patient, long-term investor, though, now is a wonderful opportunity to add a cheap tech stock that is being punished by fear.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.