Summary:

- PayPal era of strong growth seems long gone, registering a mere revenues growth rate of 8.5% in 2022 and 9% in the first quarter of 2023.

- Despite the market punishing PayPal for its poor growth performances, we long-term investors should start looking at PayPal no more as a growth stock but rather as a value stock.

- With growth no longer an option to drive the company’s value, it’s time for PayPal to start focusing on increasing its efficiency and profitability unlocking greater value for its shareholders.

Justin Sullivan

Investment Thesis

After five consecutive quarters in which PayPal (NASDAQ:PYPL) registered single digits revenues growth rates, it seems the company has lost its growth momentum, and the market, which was used to price PayPal’s stocks based on its strong growth, doesn’t seem to have taken the news very well, with PayPal stock price being down 80% since its peak of 2021, when the pandemic-induced explosion of online shopping, made the market think PayPal would have been able to growth at double digits rates forever.

But despite the market punishing PayPal for its poor growth performances, we long-term investors should start looking at PayPal no more as a growth stock but rather as a value stock.

In today’s analysis, we will assess why PayPal can represent a good investment opportunity as the company shifts from a strategy focused on user growth to a strategy more focused on increasing efficiency and profitability.

Business Model & Revenues Growth

PayPal era of strong growth seems long gone, registering a mere revenues growth rate of 8.5% in 2022, and 9% in the first quarter of 2023. With a CAGR of 17.13% since 2012, PayPal grew its revenues from $5.6 billion to $27.5 billion in 2022, however, while projecting PayPal future performances I assumed the revenues growth rate to remain around 9% in 2023 and to slowly decline in the following years, as PayPal become a mature company, until reaching the economy growth rate represented by the US 10-year Treasury Bond yield.

But how is it possible that PayPal, which historically registered solid double digits growth rates, is expected to deliver “poor” single-digit growth in the following years?

PayPal revenues, generated by offering digital payment processing services and digital checkout solutions to merchants and customers all around the globe, are strictly related to the state of the e-commerce industry. After the outbreak of the covid pandemic in 2020, the already flourishing e-commerce industry boomed, and not surprisingly, digital payments closely followed the same growth pathway.

However, even without the boost given by lockdowns, e-commerce and digital payments were already well-established concepts in people’s everyday lives, and while they couldn’t be described as mature industries, neither they could be considered youngsters. PayPal itself was already the dominant player in the digital payment industry before the pandemic, with the latest only helping to strengthen its position in the market.

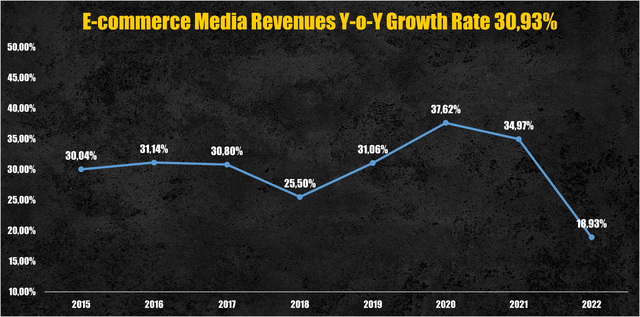

If we have a look at the revenue growth rates of the major e-commerce platforms, in 2022, the median growth rate was 18.9%, a respectable rate, but the lowest value registered since 2015.

Major e-commerce platforms revenues y-o-y growth rate (Personal Data)

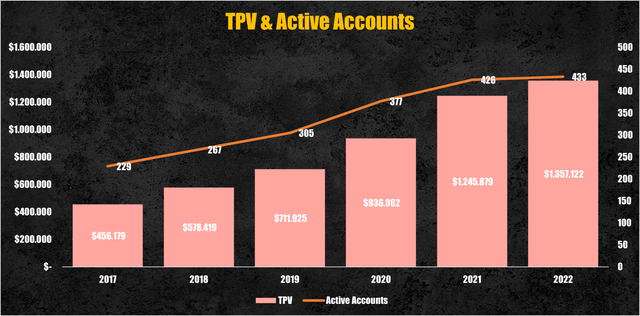

Given its already considerable size, is no more feasible for PayPal to keep expanding at double digits rates for prolonged periods. PayPal total payment volume (TPV) reached $1.36 trillion in 2022, which by itself is an astonishing number, but increased only 9% y-o-y, again, way less than the median growth rate of 24.7% for the last 5 years. And the same happened to the number of active accounts, which reached 433 million in 2022, up only 2% compared to a median growth rate of 13%.

PayPal’s TPV & active accounts (PayPal)

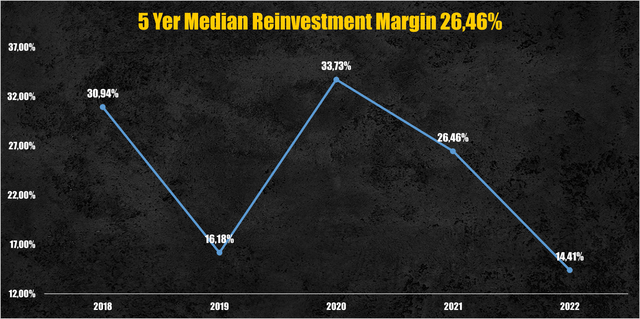

While the growth slowdown might be due to temporary headwinds, is worth to be mentioned that in 2022 PayPal reinvestment margin, comprising the investments made in R&D, capital expenditures, and acquisitions, was equal to 14.4%, significantly lower than the 26.5% median value that PayPal used to reinvest in the past, meaning that even the management has started to adopt a more cautious approach for future growth.

PayPal’s reinvestment margin (Personal Data)

With all this evidence, I think PayPal has hit a wall in terms of growth momentum.

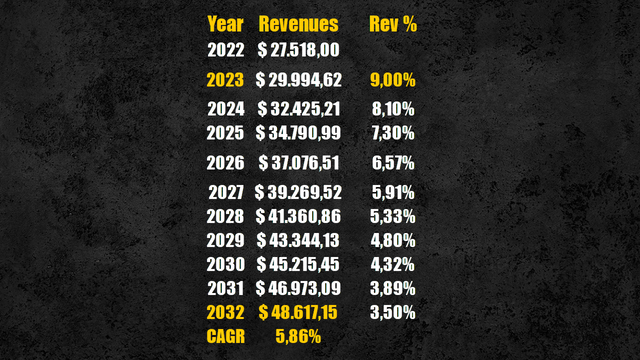

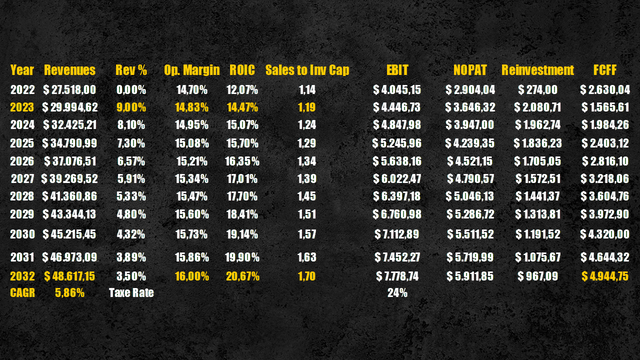

Therefore, starting by applying a growth rate of 9%, and letting it slowly decline as PayPal enters the steady state, we can expect revenues to be close to $50 billion by 2032, at a CAGR of 5.86%.

PayPal’s future revenues (Personal Data)

Efficiency & Profitability

With growth no longer an option to drive the company’s value, it’s time for PayPal to start focusing on increasing its efficiency and profitability.

During the fourth quarter earnings call of 2021, the management started to express its intention to focus more on increasing profitability rather than solely growth, stating:

We will continue to grow our users, but our focus will be on sustainable growth and driving engagement.

and reinforcing their intention during the 2022 full-year earnings call

Over the past year, we significantly increased the operational rigour with which we run our business…we believe we’re well positioned to scale more profitably and sustainably going forward.

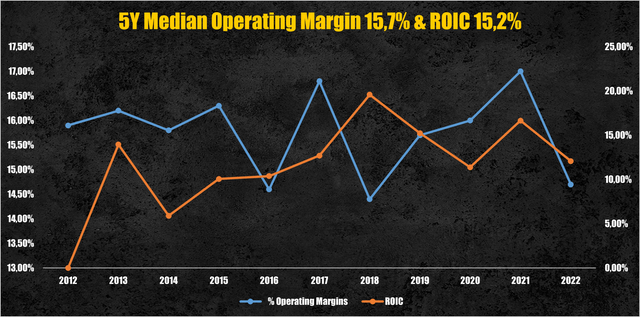

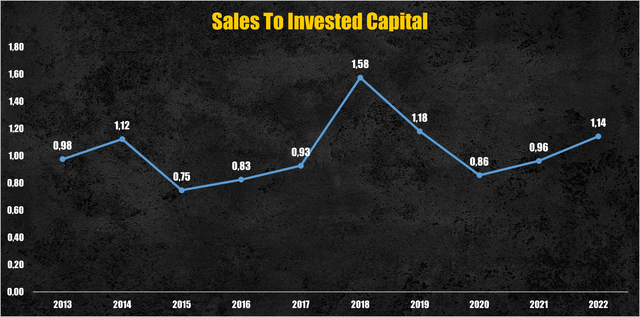

PayPal 5-year median operating margin and return on invested capital (ROIC) are respectively, 15.7% and 15.2%, while its sales to invested capital, which shows how much revenue PayPal can generate given each dollar reinvested into the company, was equal to 1.14 in 2022 and seems to have been following a slightly upward trend.

PayPal’s operating margin & ROIC (PayPal) PayPal’s sales to invested capital (PayPal)

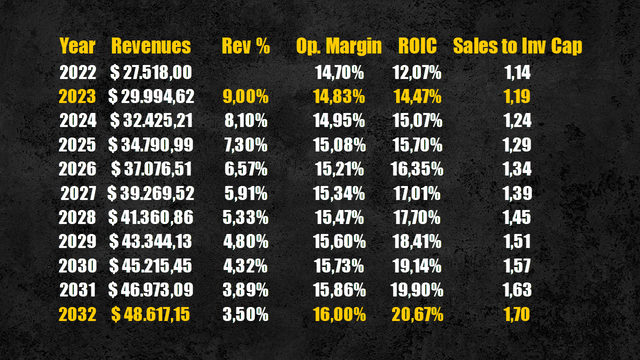

In my analysis I assumed PayPal’s operating margin to remain flat in the coming years, around 16%, while I’ve assumed the sales-to-invested capital ratio to increase from 1.14 in 2022 to 1.7 by 2032, as a consequence of minor reinvestments for growth and consequent greater profitability for PayPal, which is expected to achieve a higher ROIC around 20%, always by 2032.

PayPal’s future operating margin & ROIC (Personal Data)

Despite the management pledge to reduce costs, I expect the operating margin to remain flat given the strong competition in the digital payment processing industry which, whether directly or indirectly, will pressure PayPal to reduce its commission fees.

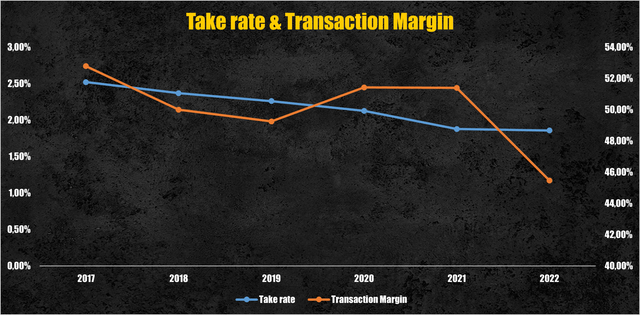

Since 2017, PayPal’s take rate, equal to transaction revenues divided by TPV, decreased from 2.52% to 1.86% in 2022. The transaction margin instead, obtained by subtracting transaction expenses and losses from transaction revenues, declined from 52% to 45%.

PayPal’s take rate & transaction margin (PayPal)

Hence, assuming PayPal’s management will be successful with their cost-saving strategy, we can expect the positive effect on the overall operating margin to be offset by the declining take rate, as competition in the payment processing industry increases.

On the other hand, with PayPal being more cautious with its capital allocation, we can expect both the sales to invested capital and ROIC to witness major improvements through the years as PayPal will be able to leverage its immense scale of operations and strong brand, maintaining its leading position with relatively small reinvestment needs.

Cash Flow Projections

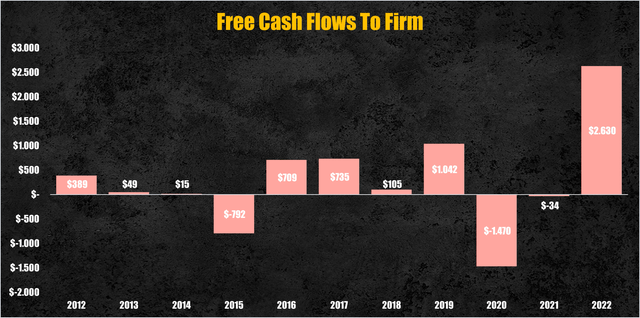

With the assumption of PayPal shifting its focus from user growth to increasing profitability and consequent reduction of heavy reinvestments, we can expect PayPal to start delivering solid and consistent free cash flows to the firm (FCFF) in the coming years.

In the past, PayPal’s FCFF has been highly volatile given the several acquisitions made every now and then which made the FCFF turn negative, however, after the adoption of more conservative capital allocation policies, in 2022 PayPal registered FCFF equal to $2.6 billion and we can expect the company to deliver FCFF close to $5 billion by 2032.

PayPal’s cash flows projection (Personal Data)

Valuation

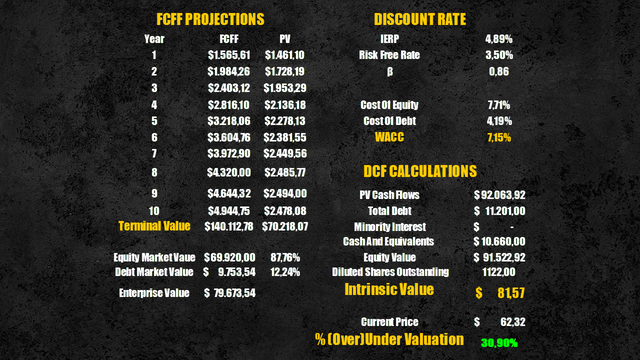

Applying a discount rate of 7.15%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $91 billion or $81 per share.

Compared to the current prices, PayPal stock’s result undervalued by 30%.

PayPal’s intrinsic value (Personal Data)

Market & Risks

As we have seen throughout the analysis, PayPal future is strongly linked to the e-commerce industry. Despite continuing to grow, in 2022 the e-commerce sector has started to slow down, registering growth rates well below the median value of 30% for the period 2015-2022.

In the future, especially in the short term, it’s highly possible for the e-commerce industry to partially recover its growth momentum, however, ten years from now is hard to believe that the industry will grow again at a CAGR superior to 30% given its already huge size.

Another major threat discussed in the analysis is the presence of strong competitors in the digital payment industry. Despite PayPal is the undisputed king of digital payments, with a more than 40% market share and 433 million users, companies like Stripe and Adyen (OTCPK:ADYEY) pose a serious threat to PayPal.

Even without a strong brand as the latter, payment processors like Stripe can implement pricing strategies that will force PayPal to keep its fees competitive with the current market levels to not lose market shares, resulting in limited capabilities for the company to considerably increase its operating margins despite increasing its operational efficiency.

Last but not least, the current macroeconomic headwinds, such as high-interest rates and high inflations, might negatively affect the purchasing power of people inducing them to postpone or cancel discretionary purchases.

Considering that for the greatest part, the products acquired through e-commerce platforms are classified as discretionary products, like apparel, electronics, and unessential household products, a prolonged weakening of the economy will likely translate into lesser e-commerce sales volume, and therefore, lesser payment processing needs which will negatively affect PayPal bottom line.

Conclusion

So in conclusion, given my analysis and assumptions, PayPal represents a good investment opportunity at today’s prices.

The shift from a growth company to a value company might unlock greater value for PayPal shareholders, which at the expense of more modest growth in revenues, will receive stable and consistent cash flows as PayPal capitalizes on its huge size and leading position in the digital payment industry.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.