PayPal Holdings: Don’t Ignore The Game Changer

Summary:

- I believe the recent shift in PayPal Holdings, Inc.’s management has been a real game changer Mr. Market ignored, but you shouldn’t.

- PYPL issued disappointing EPS guidance for 1Q 2024 and FY2024, but if the management keeps focusing more on margins (the CFO’s words), I think the current fears should appear overblown.

- PayPal launched a new service that enables US customers to use PYUSD for international payments through the Xoom platform. I think this niche may bring more growth to the top-line.

- Anticipating a gradual increase in PayPal’s margins alongside improved profitability, I expect a corresponding rise in its valuation multiples, making a strong case for the stock to appreciate.

- I’m reaffirming my “Buy” rating and foresee a continuation of the recovery rally in PayPal stocks for the next few months.

bizoo_n

My Thesis

I believe the recent shift in PayPal Holdings, Inc.‘s (NASDAQ:PYPL) management has been a real game changer. Against the backdrop of continued product expansion, underestimated market expectations for future earnings, and favorable valuations, PYPL stock remains one of the most obvious large-cap”Buy” ideas right now.

My Reasoning

In January 2024, I initiated coverage of PYPL stock with a “Buy” rating, saying that the strategic change that management was set to announce on January 25, 2024, would change the game for PayPal Holdings. When the strategy was announced, the market sold PYPL on facts, assuming that 2024 would be a “business transition period” and therefore uncertainty would increase. However, I believe that transition periods are usually perfect times to think about entry points into businesses whose prospects will become obvious to the whole market after that very transition ends – otherwise, the ship may sail without you.

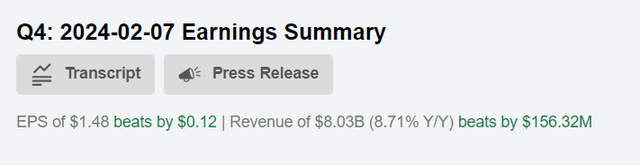

Before I talk about the new strategy, I’d like to briefly discuss the company’s latest financials. First of all, it’s worth noting that PayPal’s fourth quarter 2023 results beat market consensus expectations on both revenue and EPS:

For FY2023, PYPL’s sales went up 8% to $29.8 billion, while adjusted EPS rose to $5.10 from $4.12 (+23.8% YoY). Following a recent peak in active accounts, PayPal saw a decline of ~2.1% (from 435 million to 426 million) as of December 31, 2023. In the period spanning 2020-2021, PayPal managed to add 122 million net new active accounts, largely attributed to the pandemic’s influence, so today’s deterioration looks like a natural process to me as the pandemic is gone. As we might know from the latest earnings calls, the company has adjusted its marketing strategy to prioritize greater utilization by existing users over acquiring new ones. They also try to shift towards a higher base of accounts, driving increased payment volumes. And it’s working well so far: last quarter PYPL’s total payment volume surged by 15% YoY to $409.8 billion, primarily fueling the top-line expansion. The number of payment transactions increased by 13% to 6.8 billion, indicating sustained engagement within the platform.

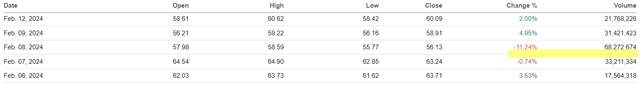

However, PYPL issued disappointing EPS guidance for 1Q 2024 and full-year 2024 as recently announced innovation efforts “take time to meaningfully add to EPS” – hence the sell-off of over 11% right after the press release appeared.

Seeking Alpha, PYPL’s historical prices, Oakoff’s notes

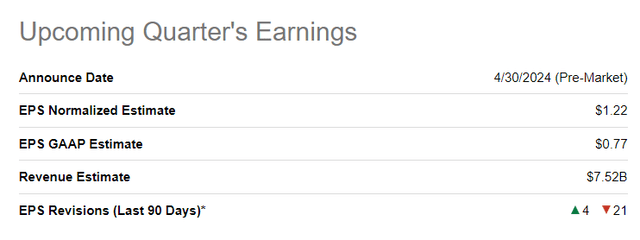

Some investment banks downgraded the stock after the guidance, apparently wanting to ensure the success of their calls and stock ratings – I think they just want to wait for this transitory period for PYPL to end. The words that the company will take some time to reposition itself also prompted analysts to lower their expectations for PYPL’s EPS growth:

Seeking Alpha, PYPL’s Upcoming Quarter’s Earnings

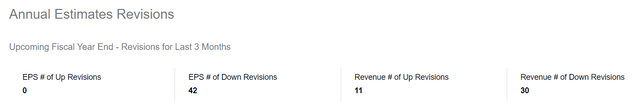

Expectations for the first quarter 2024 results, to be published on April 30, 2024, were lowered 21 times for the past 3 months – that’s 84% of all estimates revisions. If we take a closer look at the annual estimates, we’ll see an even worse picture – especially true for the EPS estimates:

Seeking Alpha, PYPL’s Earnings Revisions

However, I wouldn’t be so pessimistic about PYPL’s margins. At Wolfe Research’s recent FinTech Forum [March 13, 2024], the CFO was asked what he thinks investors expect from PYPL. From his answer, we can see how well he knows what the market really needs PayPal to demonstrate. He also made it clear that PayPal will probably pay more attention to its margins – future growth promises to be of higher quality in my opinion.

Darrin Peller:

Do you [Jamie Miller – CFO] and Alex [the CEO] and team, really know that its gross profit, growth acceleration, that’s what’s really what investors are looking for versus earnings? Or do you think something – it’s more about a mix, a balance? I’m just curious, how you view, what investors are really looking for?

Jamie Miller

I think investors, are looking for all three. I think they’re looking for top line, margin growth, and bottom line operating leverage. However, I think our emphasis over the last couple of years, has been perhaps more on top line and operating leverage. And we are really squarely focused on, repositioning the sights of the team, on that gross margin line, and we’re overemphasizing that right now.

Having said that, if I pull back, our goal over time is, that we need to bring to the market an algorithm that, really makes sense and works for us. We can be convicted around delivering it, but it’s something that investors can also say, okay, got it. That’s a really great place.

Note: emphasis added by the author

PayPal’s new management continues to change the company and its own ranks so to speak: on March 28, 2024, we found out that the company plans to appoint an outgoing CEO of the Big Four accounting firm to its board. This is big news because Di Sibio is not just a former employee of EY – he was their CEO:

Di Sibio, who has been with EY since 1985, was named chairman and CEO in 2019. He previously said he will retire from the firm in June 2024. He is only allowed to join a public company board upon his retirement, according to EY policy and practice.

I take a positive view of such a person among the members of the Board and believe that he can add value to the functioning of the company’s auditing and accounting processes.

But apart from observing PYPL’s internal processes, investors also need to understand where the business growth will come from. Here I see PYPL’s approach of tapping into market niches that are still relatively underpenetrated as very correct. For instance, just a few days ago PayPal introduced a new service that is going to allow U.S.-based customers to use the stablecoin PYUSD for international payments through the Xoom platform. Through the Xoom cross-border payment service, American customers will be able to convert PYUSD into US dollars and then transfer funds to recipients in ~160 countries without transaction fees. As Funstrat Global Advisors wrote (proprietary source), this initiative “aims to enhance the utility and popularity of the PayPal stablecoin and potentially positions PayPal as a key player in reducing the cost of international money transfers – a market traditionally burdened by high expenses for consumers.” Also important to note here: The launch of this service coincides with a significant resurgence in the stablecoin market, resulting in the total market volume of stablecoins reaching $153 billion, marking the highest point in roughly 18 months.

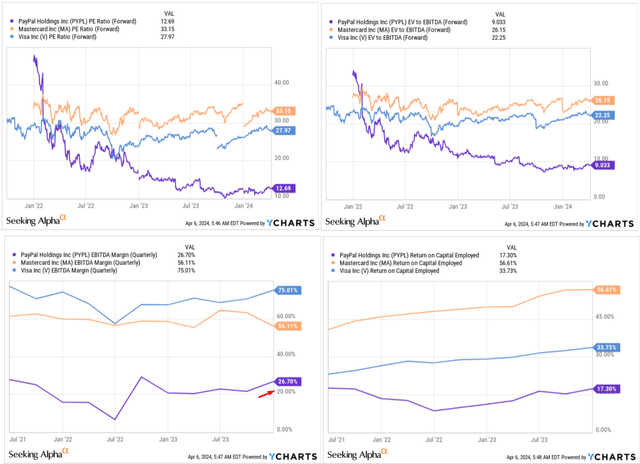

The growth prospects for PYPL’s business seem quite good to me, but the depressed valuation picture is not pricing that in. To illustrate this, let’s look at a comparison with Visa (V) and MasterCard (MA), which the analysts at Argus Research (proprietary source) believe are best suited to find a fair valuation by COMPs analysis:

To value the stock, we believe that processing pure-plays Visa and MasterCard still offer the best comparisons. PayPal is a smaller player in the payments market, though it also has a strong brand and a record of innovation.

Source: Argus Research

PYPL is trading at a very wide discount to V and MA, both in terms of P/E ratio and EV/EBITDA ratio – the difference is more than two times. However, we see that this may be explained by a large discrepancy in terms of margins and profitability. However, we already know that management plans to focus on gross margin growth in the future – the main driver of any company’s profitability. Therefore, PYPL’s current depressed multiples are likely to rise along with the margins – I think 20x earnings in 2025 seems fair, given what we’re observing among other peers today. If we assume the consensus EPS forecast of $5.64 for the full year 2025, that gives us a price target of $112.8 – about 73% higher than the stock’s current price.

Therefore, due to a combination of factors such as the strategic shift, new growth projects, and favorable valuation, I think market participants should not ignore PayPal’s growth potential – it’s still a “Buy” even if Mr. Market doesn’t notice the apparent game changer.

Risks To My Thesis

One major concern I have with my thesis right now is that I might be overly optimistic. It’s possible that I’m not fully grasping the potential risks. There are several factors at play here, especially given the neutral stance of most banks toward PayPal. As far as I see, almost everyone is eagerly anticipating the results of this pivotal year – the level of uncertainty is quite significant. So, what should one do in this situation? Here’s my take: If you have confidence in the company’s future and you notice signs pointing to a positive turn of events, why not consider buying the stock now while it’s just above $60? Waiting might mean having to purchase it at a higher price, say around $80. But before buying, I recommend everyone to do their own due diligence.

Another significant concern is the uncertainty surrounding the new management. Some executives may lack the necessary experience or competence to effectively steer the company toward the margin expansion I anticipate – this uncertainty adds another layer of complexity to the situation.

And, of course, we can’t overlook the risk associated with company valuations. In my today’s article, I conclude that PayPal stock is undervalued by ~73%, considering an investment horizon of a year or a year and a half. Interestingly, the same analysts at Argus Research, whom I referenced today in comparing PayPal with Visa and Mastercard, suggest that the current P/E valuation multiple is likely fair, taking into account all the existing risks and uncertainties surrounding the company.

We now see the shares fairly valued at about 11-times our 2024 EPS estimate, a sizeable discount to the multiples of Visa and MasterCard as PayPal works through revenue and operating margin headwinds.

Your Takeaway

It’s been almost 3 months since I initiated my coverage of PayPal stock here on Seeking Alpha, and I’m noticing gradual improvements in the company’s business setup, despite the slightly negative price action.

We’re awaiting the Q1 2024 results in just three weeks – they should validate whether my optimism was justified. However, even if Q1 shows weaker numbers, I still believe there are ample reasons for the stock to rise over the next 1-2 years. Firstly, I anticipate a gradual increase in the company’s margins and profitability. Secondly, with this margin expansion, I expect to see a corresponding increase in the valuation multiple. Combining these 2 factors, there’s a strong case for the stock to appreciate. Additionally, I anticipate more effective management results and a shift away from the currently pessimistic estimates on Wall Street. This is why I’m reaffirming my “Buy” rating and foresee a continuation of the recovery rally in PayPal stocks for the next few months.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.