Summary:

- PYPL is now trading above its 30-week EMA, showing a series of higher highs and higher lows, indicating bullish price action.

- Momentum is bullish both short and long term, with the PPO indicator showing positive signs above the zero level.

- Institutional investors are accumulating shares, as evidenced by significant volume spikes, suggesting PYPL is undervalued.

- Relative strength has improved, with PYPL now outperforming the S&P 500, targeting $87 and potentially $103, with a stop loss below the 30-week EMA.

blackred

When I think of PayPal Holdings (NASDAQ:PYPL), I often think of PYPL as a technology company. It is actually considered a member of the financial sector of the economy in the transactions and payment processing services industry. Fellow companies in that industry are Visa (V) and Mastercard (MA). While that did surprise me, I was also surprised by what I saw when I looked at the price chart of the stock. It looks like a buy to me. In this article, I will outline the investment thesis of PayPal Holdings using my technical analysis methodology of price action, momentum, volume, and relative strength.

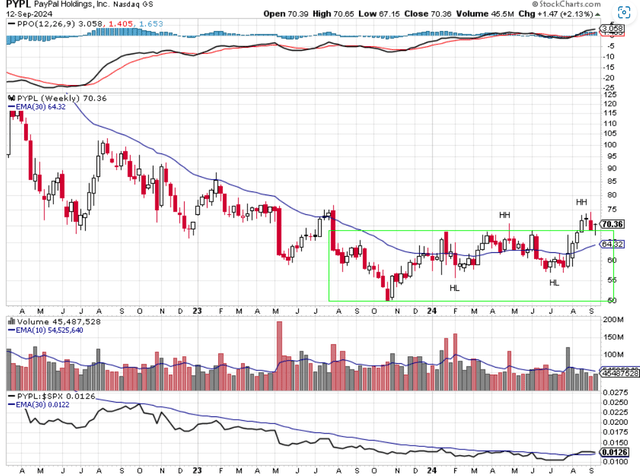

Chart 1 – PYPL Weekly with Momentum, Volume, and Relative Strength

When I look at a stock to invest in, I start with its price action. I want to invest in stocks that are in an uptrend. These are stocks that are making a series of higher highs and higher lows and are trading above an upward sloping 30-week exponential moving average (EMA). There is nothing magical about the 30-week EMA. It is just that I have found it to be a good proxy of the medium to long-term trend. Looking at Chart 1 you can see PYPL spent much of 2022 and 2023 below a downward sloping 30-week EMA. That type of price action is what I want to avoid. I don’t want to own stocks making a series of lower lows and lower highs. After the long stretch of trending lower, PYPL went into an area of consolidation or base building. You can see this outlined by the green box. This period of consolidation lasted about a year. During this time, PYPL stayed in a price range between $50 and $68. This was an important period however because the trend began to change. PYPL made its low at $50.25 in October 2023. It then rallied to the top of the box at $68.21 in January 2024. PYPL declined from there but only to $55.77 in February 2024. This represented a higher low than the previous low set in October 2023. Therefore, the “HL” designation. This HL is a subtle distinction in price action. From there PYPL then rallied to $70.66 in April 2024 which represented a higher high than the previous high of $68.21 therefore the “HH” designation. This higher low and higher high combination represents a change in trend. PYPL is now trending higher versus trending lower. From there PYPL declined to $56.97 in July 2024 earning another HL designation. PYPL then reversed course and rallied outside of the green box to a recent high of $74.70 earning another HH designation. Now, PYPL has put in a series of higher highs and higher lows and now trades above an upward sloping 30-week EMA. This is what I consider to be bullish price action and therefore is a stock I am interested in owning.

Another factor I look at when investing is momentum. I use the Percentage Price Oscillator (PPO) indicator to determine momentum. This is an easy indicator to understand. When the black PPO line is above the red signal line, then momentum is considered to be short term bullish. Conversely, when the black PPO line is below the red signal line, then momentum is considered to be short bearish. Right now, momentum is short term bullish. When the black PPO line is above the centerline of the chart or the zero level, then momentum is considered to be long term bullish. Conversely, when the black PPO line is below the centerline of the chart or the zero level, then long-term momentum is considered bearish. The black PPO reading is now above 3, which is greater than zero, long term bullish. I say long term because you can see that the black PPO line doesn’t oscillate above or below zero too often. It tends to stay above or below zero for months at a time. Looking at PPO in the top pane of Chart 1, you can see that PPO has been long term bearish for most of the time and has only recently made its way above zero. Again, that is another indication that the trend of PYPL has changed from bearish to bullish. I see momentum as bullish.

Volume is the next factor I consider when making an investment. I want to see indications of institutional investors buying shares. The only reason institutional investors buy shares is because they think the company is undervalued. The big black volume bars are signs of large share purchases when the stock advances. Notice the big black volume bar in July 2024. Over 120 million shares traded that week when the stock advanced. That is bullish in my opinion because it shows that institutional investors were accumulating shares. Retail investors such as I don’t purchase millions of shares. Large share purchases are signs of institutional money. I consider the volume signs to be bullish.

My last consideration when investing is relative strength. My goal is to buy stocks that outperform the SP 500 index. The relative strength indicator on the bottom pane of Chart 1 helps me with this goal. The black line represents the price ratio of PYPL to the SP 500 index. When the black line is rising, that means that PYPL is outperforming the SP 500 index. When the black line is falling, PYPL is underperforming the SP 500 index. Notice that the black relative strength line has spent much of its time in the chart falling. Whenever you see a price line move from the upper-left side of the chart to the lower-right side of the chart, then that is a bearish indication. Recently, there has been a change of relative strength. The black line has perhaps bottomed out and is now trading above its 30-week EMA. Relative strength is now favoring PYPL over the SP 500 index.

If you are considering buying PYPL I think an initial price target of $87 is reasonable. A second price target of $103 is also reasonable in my opinion. These price targets are not predictions or guarantees of what will happen. They are reasonable targets based on previous price action. My analysis could very well be wrong for any number of reasons. Earnings could disappoint the market. The economy could go into a recession. Interest rates could stay higher for longer, etc. With all of that being said you should consider having a stop loss in place. I always have a stop loss when I make a trade, this way I will keep my losses to a minimum. It is easier to recover from a small loss. It is much harder to recover from a 50% setback. My stop loss for PYPL would be a close below the 30-week EMA. If PYPL closes below the 30-week EMA I would sell my shares or at least sell a portion of my position. Once I sell, I can reevaluate my options. I can always buy back later if PYPL continues to rally.

In summary, PYPL looks bullish to me. It is now trading above its 30-week EMA while putting in a series of higher highs and higher lows. It has broken out of an area of consolidation. Momentum is bullish both in the short and long term. Institutions have recently been accumulating shares. Relative strength has perhaps bottomed out and is now trending higher. Looking at the chart it seems that PYPL can get to $87 and perhaps even $103. Knowing that things could play out differently, I will use a stop loss of a close below the 30-week EMA as an indication that my analysis is not correct.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.