Summary:

- PayPal Holdings, Inc.’s stock fell after reporting a decline in active accounts in Q2, but the company’s financial results exceeded expectations.

- Revenue for the second quarter increased by 7.1% and the number of transactions jumped 10.2%.

- PayPal’s earnings per share improved significantly, and the company has engaged in successful initiatives, such as selling its European BNPL loan portfolio.

- Shares are attractively priced and likely to rise in the long run.

Justin Sullivan

August 2nd ended up being a rather disappointing day for shareholders of payment processing giant PayPal Holdings, Inc. (NASDAQ:PYPL). In addition to seeing the stock fall 3.1% during trading hours, it fell another 12.3% on August 3rd in response to reporting financial results covering the second quarter of the company’s 2023 fiscal year. Even though the company exceeded analysts’ forecasts when it came to both revenue and profits, a decline in the overall number of active accounts, the second sequential decline seen this year, sent shares reeling.

While this is painful, it does not change the fact that the company looks fundamentally attractive at this point in time. This is true both on an absolute basis and relative to similar firms. In fact, given the data provided by management, I would argue that now would make for a solid buying opportunity for those who are bullish on the company.

Assessing performance

Before we get into the deeper details, it would be helpful to cover the headline news that the market always gravitates toward for any company when that company announces financial results. At the very top of the list, we have revenue. During the second quarter of the 2023 fiscal year, revenue reported by PayPal Holdings totaled $7.29 billion. That represents an increase of 7.1% over the $6.81 billion the company reported one year earlier. In addition, this came in $30 million above what analysts were forecasting.

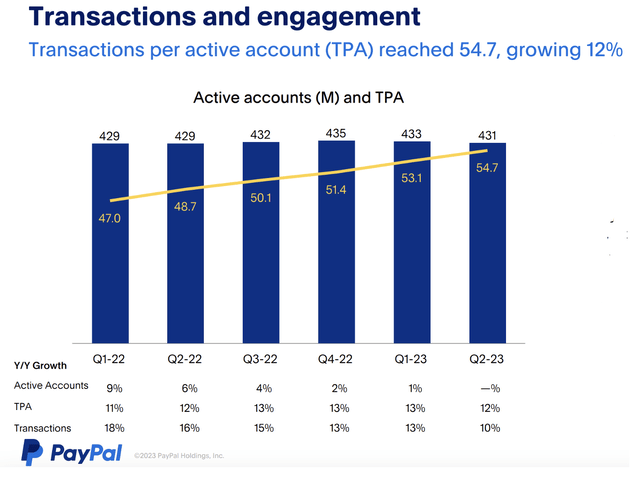

There were a couple of big drivers behind this growth. For starters, the number of active accounts that the company had totaled 431 million. This is slightly higher than the 429 million that the company reported the same time last year. Overall transactions for the company, meanwhile, jumped 10.2% from 5.51 billion to 6.07 billion.

There are a couple of other important metrics to drill into here. For instance, in addition to having a larger active user base, the company also boasted growth in the number of payment transactions per active account. During the quarter, this number came in at 54.7. That’s up 12.3% over the 48.7 that the company reported one year earlier. It’s also 3% above the 53.1 million reported in the first quarter of this year. So not only are there more members year over year, they are also using the platform more regularly. In addition to this, TPV, or Total Payment Volume, jumped 10.8% year over year from $339.79 billion to $376.54 billion.

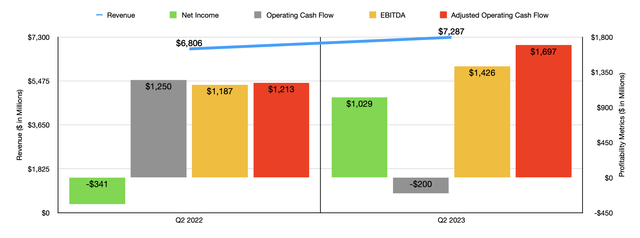

The bottom line for the company also came in strong. Earnings per share totaled $0.92. That compares nicely against the $0.29 per share loss that the company reported the same time last year. On an adjusted basis, earnings grew from $0.93 per share to $1.16 per share. Put in other terms, total profits for the company went from negative $341 million to $1.03 billion.

Other profitability metrics were somewhat mixed but mostly positive. Operating cash flow, for starters, was negative to the tune of $200 million. That’s a significant decline compared to the $1.25 billion that the company reported in the second quarter of last year. But if we adjust for changes in working capital and make adjustments for the origination of loans that are being held for sale, as well as proceeds from repayments of said loans receivable, then operating cash flow would have been $1.70 billion. That’s up nicely from the $1.21 billion reported last year. And finally, EBITDA for the company went from $1.19 billion to $1.43 billion.

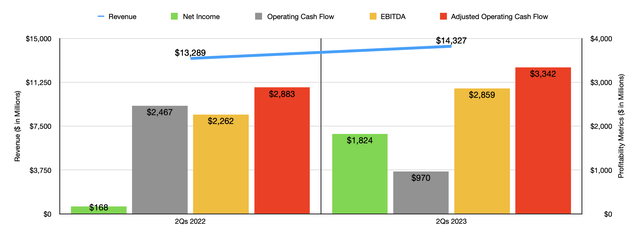

For context, I also, in the chart below, provided financial results covering the first half of 2023 as a whole relative to the same time of 2022. The overall trend for revenue, profits, and cash flows, matches with the company achieved in the second quarter alone.

So far, there is very little to be pessimistic about. In addition to the strong financial results, the company has also been successful in some other initiatives recently. In an article that I wrote earlier this year, for instance, I discussed how the company had agreed to sell up to $44 billion of its European BNPL (Buy Now, Pay Later) loan portfolio to KKR & Co. (KKR). Management even updated investors on this in their quarterly earnings release by saying that they expect this deal to close sometime in the second half of this year. As a reminder, PayPal Holdings is slated to receive $1.8 billion in proceeds from this transaction, $1 billion of which will go toward increasing the company’s share buyback program for this year from $4 billion to $5 billion.

Speaking of share buybacks, management told investors that, during the quarter, the company bought back 22 million shares for $1.5 billion. That follows the $1.4 billion that management allocated toward purchasing 19 million shares during the first quarter. Given the company’s closing share price on August 2nd, allocating the rest of the $5 billion would allow the company to buy back a further 28.7 million shares this year. But of course, the total quantity should change as share prices also change.

The most recent development announced by the payment giant came on July 26th. On that day, Microsoft (MSFT) announced that it had “deepened” its relationship with PayPal Holdings by integrating the company’s Pay Later solution across the U.S., as well as five different European countries and Australia. Here at home, Xbox users will also be able to use Venmo in the Microsoft Store. Obviously, we have no idea how impactful this development will be. We do know that, across all markets in which it operates, Xbox had about 120 million monthly active users by the end of the 2022 calendar year. So this could be potentially significant for the payment processor.

For all of this positive, there was one negative that seemed to overshadow the picture. And this is related to the number of active accounts using PayPal Holdings. According to management, the company had 431 million active accounts on its platform at the end of the quarter. As I mentioned earlier, this is an increase over the 429 million reported the same time last year. However, it’s down from the 433 million seen in the first quarter this year and down from the 435 million seen at the end of 2022. This may seem like a small issue, and in many respects it is. But what could start off as a trickle could turn into a flood.

The market is clearly concerned, and the likely culprit can probably be found by looking through all of the other payment processing companies that exists today. Even though PayPal Holdings boasts an estimated 54% market share, there are a number of other businesses out there looking to compete. Management did not really discuss this matter in any detail in their earnings call. But you can bet that investors will continue to keep an eye on this front.

In terms of valuation, it’s difficult to know what to expect for the year. Management did say that earnings per share should be around $3.49, while adjusted earnings per share should be $4.95. I have an issue with the adjusted earnings figure because it adds back stock-based compensation. So I made a further adjustment to this by removing that and accounting for the taxes that would likely be associated with removing it. This implies net profits for the year of $3.91 billion. That’s up from my own adjusted earnings estimate for 2022 of $3.62 billion.

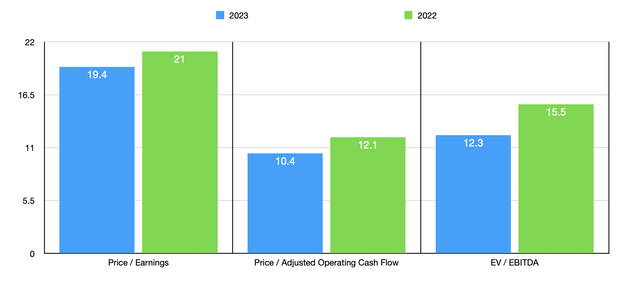

Annualizing financial results for the other profitability metrics, we would expect adjusted operating cash flow of $7.27 billion and EBITDA of $6.23 billion. Using these results, you can see how the stock is priced on both a forward basis and using the figures from 2022 in the chart above. I then used the more conservative estimates for 2022 and, in the table below, compared the company to five similar firms.

Using the price to earnings approach, I found that PayPal Holdings was the cheapest of the group. Using the price to operating cash flow approach, only one of the companies was cheaper, while this number increases to two if we use the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PayPal Holdings | 21.0 | 12.1 | 15.5 |

| Automatic Data Processing (ADP) | 30.2 | 24.4 | 19.7 |

| Fiserv (FI) | 31.4 | 16.4 | 13.9 |

| Fidelity National Information Services (FIS) | 44.4 | 9.7 | 10.5 |

| Global Payments (GPN) | 234.5 | 14.9 | 24.3 |

| Paychex (PAYX) | 28.9 | 26.5 | 19.7 |

Takeaway

From what I can tell at this moment, PayPal Holdings, Inc. is doing a really solid job. I am also somewhat concerned about the continued decline in active accounts. This is definitely something management needs to address and rectify. But beyond that, the financial data provided by management is great. Revenue and earnings exceeded forecasts. Even adjusted earnings did. Cash flows are robust and should only improve from here. And while the company is not the cheapest on the market, it is definitely attractive compared to similar firms. Given all of these factors, I have no problem keeping PayPal Holdings, Inc. stock rated a ‘buy’ at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!