Summary:

- PayPal’s 3Q earnings report shows strong growth in total payment volume and sales, despite a decline in net new active accounts.

- The company is cutting costs and has a strong guidance for 2023, making it a cheap stock with undervalued profit growth.

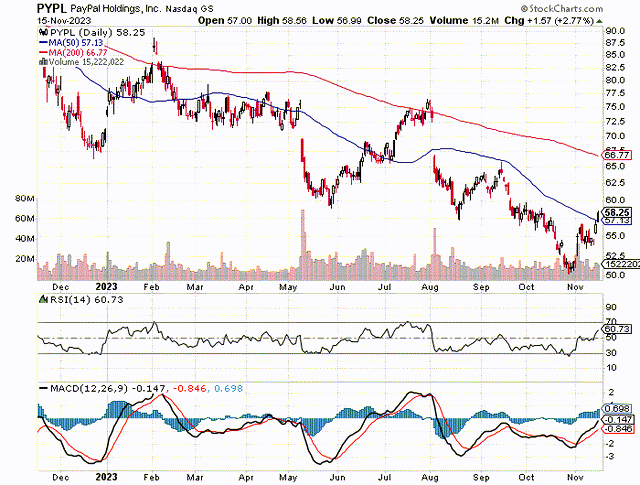

- The technical setup for PayPal stock has improved, with a breakout expected to reach at least $66.77.

JasonDoiy

The 3Q earnings report for PayPal Holdings (NASDAQ:PYPL) has breathed new life into the fintech’s embattled stock and, I think, PayPal could be set for a breakout based on the technical setup as well as based on the underlying business performance.

Even though 3Q was not a particularly great quarter for the company as it reported a third consecutive decline in net new active accounts, PayPal has a strong guidance for 2023 in place, is continuing to slash costs, and the stock is truly cheap for a fintech company.

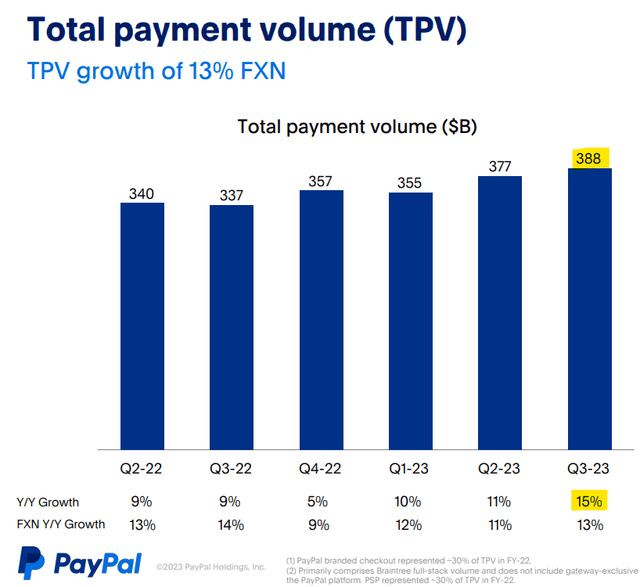

Furthermore, total payment volume on PayPal’s payment network is growing in the double digits and enjoyed a four percentage point boost in the third quarter. The stock is cheap and PayPal’s profit growth, in my view, is undervalued.

My Rating History

PayPal attracted my interest only fairly recently as I thought that the fintech’s stock was a good deal amid a solid amount of underlying core earnings power. After Elliott Investment Management disclosed that it divested of the fintech I jumped into the fray and loaded up on the fintech’s stock.

I did so again after PayPal released quarterly results for 3Q which showed momentum in total payment volume and the fintech makes progress slashing expenses. The chart picture also looks promising and PayPal’s earnings power continues to be underpriced.

PayPal has been volatile and caught in a down channel for a number of years now and the stock is down about 10% from when I first bought it. Be that as it may, I think the underlying earnings value is there for PayPal and taking into account that total payment volume and sales are still growing, PayPal’s stock is very decent value, in my view.

PayPal’s Core Value

PayPal’s core value is reflected in a rising payment volume, also called total payment volume (TPV), which quantifies the gross monetary value that flows through a payment platform.

In the third quarter, PayPal’s TPV hit a record-high of $388 billion, reflecting 15% YoY growth. The third quarter, thus, marked an acceleration of growth in this important metric, as PayPal’s TPV rose only 11% in the prior quarter. The last quarter, 3Q-23, was also the third consecutive quarter of growth in this metric.

A growing TPV means that customers spend more money using PayPal’s processing services and it is ultimately a driver of sales and profit growth as well.

Total Payment Volume (PayPal Holdings)

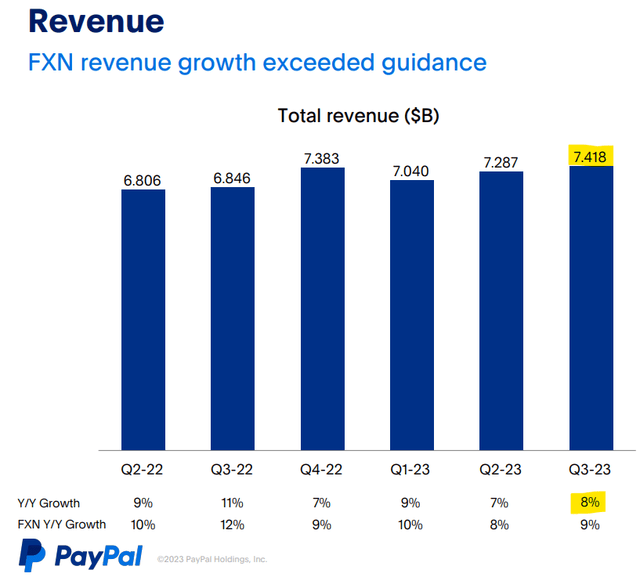

PayPal’s TPV fuels its sales growth which rose to $7.42 billion in the third quarter. As a consequence, PayPal’s sales were up 8% YoY in 3Q-23 and 9% on a currency-adjusted basis. What I think is noteworthy is that PayPal’s TPV and sales growth was supported by fewer customers.

PayPal’s net new active accounts fell to 428 million in 3Q-23, down from 431 million in 2Q-23 and it was the third consecutive decline in customers since 4Q-22. Moving forward, the trend in customer accounts may very well stay negative, but since PayPal manages to generate growing sales with lower customers, I think PayPal should be set for profit growth regardless.

To add yet another point: Inflation came down to 3.2% in October which could be a boost for consumer spending and further help sustain growth in PayPal’s annual TPV.

FXN Revenue Growth (PayPal Holdings)

PayPal Continues To Cut Costs

PayPal is putting the screws to its cost structure and is making an impact as an aggressive and effective cutter of corporate expenses. PayPal’s non-transaction operating expenses were down 12% in 3Q-23 and the biggest expensive category that is being cut was sales & marketing.

A growing TPV and lower non-transaction operating expenses together can be expected to drive PayPal’s profit growth moving forward.

Non-Transaction Operating Expenses (PayPal Holdings)

PayPal Is Breaking Out

The technical setup for PayPal stock has substantially improved following the earnings report for 3Q, with PYPL now selling 16% above the 52-week low of $50.25.

PayPal just surged above the 50-day moving average line which is a bullish signal, particularly because the breakout happened so shortly after the fintech presented its results for the third quarter.

The Relative Strength Index reflects a value of 60.73, so PYPL right now is not technically overbought. From a chart perspective, I would expect PayPal’s breakout to at least go to $66.77 which is where PayPal’s 200-day moving average line runs right now.

Relative Strength Index (Stockcharts.com)

PayPal’s Core Value Is Underpriced

Why should investors buy PYPL at $58, particularly when considering that PayPal lost 3 million customers in the last quarter?

It comes down to earnings value. PayPal is the largest processing-focused fintech in the Western hemisphere with a market value of $62.8 billion and 428 million customers, and its profits are still growing.

The market models $5.54 per share in profits for 2024, reflecting 12% YoY profit growth. The average anticipated profit growth rate in 2023 is much higher, however, at 20%.

Based on the 2024 profit estimate, PayPal sells for just 11x earnings which is a steal considering that PayPal is a leading fintech.

Block (SQ), formerly known as Square, is selling for an earnings multiple of 19x. Though the market models stronger profit growth for Block, PayPal is nonetheless a very good deal as the low earnings multiple implies a high margin of safety.

Earnings Estimate (Yahoo Finance)

Why PayPal Could See A Higher/Lower Earnings Multiple

I think a headwind is the trajectory of net new active accounts. The third quarter resulted in the third consecutive quarter of account losses and the trend is a bit of concern, despite TPV and sales growing with a lower number of customers in the network.

A customer base that shrinks for a long time might ultimately translate into falling TPVs and sales which in turn might affect PayPal’s profit potential. Despite those risks, I think that PayPal’s valuation is low enough (or the margin of safety is high enough) to properly compensate investors for the risk of a shrinking customer base.

My Conclusion

PayPal lost 3 million customers in the third quarter, but TPV and sales were growing, and in the case of TPV, by double digits.

When I look at PayPal, I see an irresistibly priced fintech with favorable, underlying business trends. PayPal also translates this growth into actual profit growth which is why the fintech is set for a 20% YoY profit jump this year.

With an 11x earnings multiple I think that PayPal is selling at a compelling valuation that embeds a very high margin of safety.

Since PayPal’s stock has started to see positive momentum after 3Q and recaptured its 50-day moving average line, I expect an ongoing push to the upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.