Summary:

- PayPal is making steady progress in its efforts to regain investor interest and confidence.

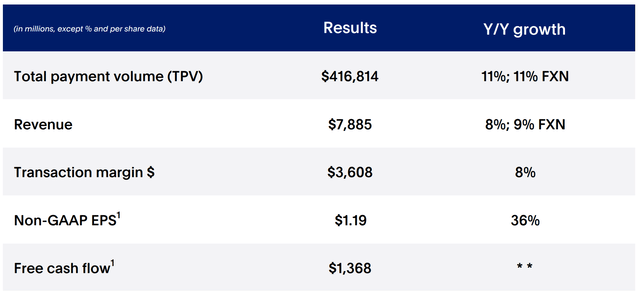

- The company’s Q2 results underscore a 9% YoY revenue growth and a 36% increase in EPS, while nearly all profits are being used to repurchase its stock at currently undervalued.

- I remain optimistic about PYPL’s potential, driven by strategic initiatives such as refining pricing, launching new products, and expanding its rewards program to regain market share.

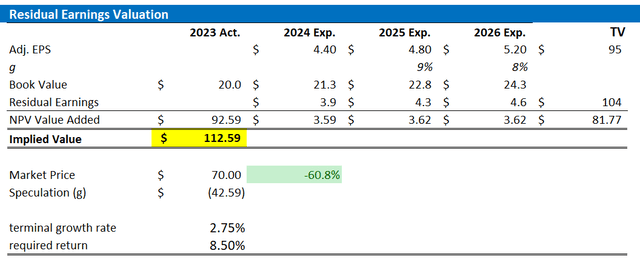

- Building on PayPal’s robust momentum in the first half of the year, I have updated my earnings outlook for the company. I now calculate an implied share price of $112.6.

serg3d/iStock Editorial via Getty Images

PayPal (NASDAQ:PYPL) is making solid progress in its ambition to regain investor interest and confidence. Indeed, Q2 results highlight a 9% YoY revenue growth and a 36% YoY jump in EPS, while the company is using basically all of its profits to repurchase its equity at depressed prices ($1.5 billion worth of buybacks in Q2, annualized 8% of market cap). Looking ahead, I continue to be bullish on PayPal’s commercial potential by refining pricing, launching new products, and expanding its rewards program to regain market share and drive user engagement. Building PayPal’s better-than-expected momentum in H1, I update my earnings outlook for the company through 2026, and I now calculate a fair implied share price for PayPal of $112.59.

To provide some context on share price momentum, PayPal stock has lagged behind the broader market this year. While PYPL shares have risen around 14%, the S&P 500 has gained roughly 18%.

PayPal Q2 2024 Financial Update: Key Highlights And Outlook

PayPal reported robust financial performance for Q2 2024, exceeding expectations and demonstrating positive momentum in several key areas. During the April-June period, PayPal generated total revenues of $7.89 billion, reflecting a 9% YoY growth on a constant currency basis, outperforming the company’s guidance of 7% growth and exceeding the Street’s estimate of $7.82 billion. Notably, Total Payment Volume (TPV) grew by 11% YoY FXN.

On profitability, PayPal managed to post strong transaction margin dollar growth of 8%, driven by better-than-expected performance in Braintree and stable contributions from branded checkout and Venmo. Venmo maintained strong growth with an 8% increase in total payment volume YoY, while the Venmo debit card and “Pay with Venmo” users grew by 30%. Operating profit margin improved to 18.5%, above both the Street estimate of 16.8% and guidance. The company posted an adjusted EPS of $1.19, significantly above the consensus estimate of $1.00.

Update on share repurchases: PayPal repurchased approximately $1.5 billion worth of shares in Q2 2024, raising its full-year share buyback target to $6 billion from the prior $5 billion.

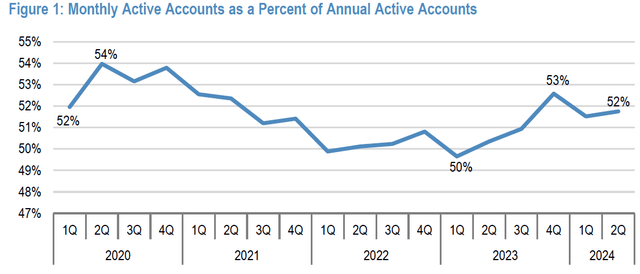

It is noteworthy to highlight that PayPal’s user engagement may be recovering, after bottoming about a year ago: According to data collected by JPMorgan, in Q2 PayPal’s Monthly Active Accounts increased by 3% YoY to 222 million (a rise of 2 million sequentially), while the total number of accounts remained relatively stable YoY …

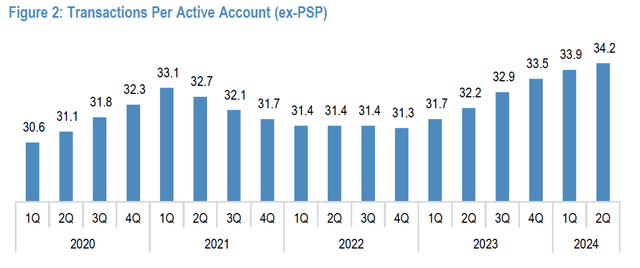

…and while transactions per active account are making new all-time highs again.

Q3 2024 and Full-Year Guidance:

PayPal provided a mixed outlook for Q3 and FY 2024. The company guided Q3 revenue growth in the mid-single digits YoY, slightly below the consensus of 7.4%. Adjusted EPS for Q3 is expected to grow in the high single digits, indicating a deceleration from the strong Q2 performance due to increased marketing investments and higher tax rates. However, for FY 2024, PayPal raised its adjusted EPS growth expectations to the low to mid-teens from the prior mid-to-high single-digit range, supported by continued growth in transaction margin dollars.

Bullish On Commercial Upside

Building on Q2 reporting and management commentary, I am bullish on PayPal’s positioning to drive commercial upside over the next few quarters. And there are a few arguments to this:

Firstly, I highlight PayPal’s renewed focus on profitable growth: Under new CEO Alex Chriss, PayPal has shifted its strategy to prioritize profitable growth, particularly in its Braintree segment, which has already started contributing meaningfully to transaction margin dollar growth. This focus on profitability, along with new management initiatives to reverse branded share loss and roll out innovative products like “PPCP” and “FastLane” suggests a strengthened approach to market positioning and revenue generation.

Secondly, I am optimistic that PayPal’s expansion of its rewards (cash-back) program for the PayPal debit card, which offers 5% cash back on selected categories (e.g., groceries, gas, restaurants), is likely to drive greater habituation of PayPal products both in-store and online. In my view, this move may lead to as much as 2x lift in transaction activity and a 20% increase in average revenue per account.

Thirdly, PayPal is poised to capture value from new growth opportunities through partnerships: Specifically, PayPal has been making significant progress with its “FastLane” initiative by adding strategic partners like Adyen and Fiserv, which is expanding its availability in the U.S. eCommerce market. Although FastLane’s immediate financial impact may be modest, its long-term potential to increase market share through enhanced partnerships and greater consumer adoption presents a significant growth opportunity.

Lastly, I am bullish on Venmo’s monetization upside, as I highlight that Venmo continues to be a critical asset for PayPal, particularly in capturing the younger Gen Z and Millennial demographics. With an increase of 30% YoY in monthly users for both “Pay with Venmo” and the Venmo debit card, Venmo is contributing to higher gross profit growth for PayPal. Additionally, more aggressive marketing campaigns and further expansion of Venmo acceptance at top merchants are expected to enhance user engagement and transaction volumes, positioning PayPal to capture a larger share of the eCommerce market in the future.

Attractive Valuation

PayPal’s valuation looks still attractive: Following PayPal’s Q2 2024 earnings report and management’s expressed confidence in continued robust commercial momentum, I am updating my earnings outlook for the company through 2026. I now forecast EPS to be around $4.4 in 2024, $4.8 in 2025, and $5.2 in 2026. At the same time, while I continue to apply a conservative terminal growth rate of 2.75% post-2026, which represents a modest +25-50 bps premium to the estimated nominal GDP growth, I slightly lower my cost of equity assumption by 50 bps, to 8.5%, mostly as a consequence of a softening interest rate backdrop. Based on these projections, I calculate a fair implied share price for PayPal at $112.6.

Analyst Consensus; Company Financials; Author’s Calculations

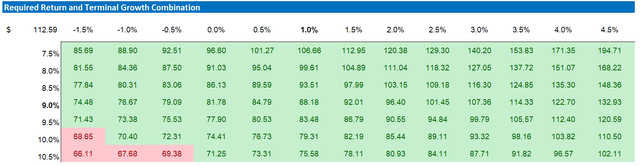

Below also the sensitivity table, which tests different assumptions for cost of equity (row) as well as terminal growth rate (column).

Analyst Consensus; Company Financials; Author’s Calculations

Downside Risk Remains Salient

While PayPal’s momentum is improving, I highlight a few potential downside catalysts that investors should be aware of: Firstly, PayPal’s business skews towards lower to middle-income consumers who spend on more discretionary purchases. These consumers could be more significantly impacted by a higher inflation and interest rate environment, potentially reducing transaction volumes and revenue. Secondly, PayPal’s ongoing strategic initiatives, such as improving transaction profit and unbranded margins, may take longer than expected to implement. Thirdly, PayPal faces increasing competition from other digital payment platforms and fintech companies. Indeed, debates around PayPal’s market share and its ability to sustain growth remain unsettled, which could affect investor sentiment and valuation.

Investor Takeaway

PayPal is making steady progress in its efforts to regain investor interest and confidence. The company’s Q2 results underscore a 9% YoY revenue growth and a 36% increase in EPS, while nearly all profits are being used to repurchase its stock at currently undervalued prices ($1.5 billion in buybacks in Q2, which equates to an annualized 8% of its market cap). Looking ahead, I remain optimistic about PayPal’s growth potential, driven by strategic initiatives such as refining pricing, launching new products, and expanding its rewards program to regain market share and boost user engagement. Building on PayPal’s stronger-than-expected momentum in the first half of the year, I have updated my earnings outlook for the company through 2026 and now estimate a fair implied share price for PayPal at $112.59.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.