Summary:

- PayPal’s new CEO, Alex Chriss, focuses on SMBs with innovations like Fastlane and an ad platform, boosting merchant conversion rates and customer retention.

- Fastlane offers a seamless checkout experience, significantly increasing guest conversion rates from 40%-50% to around 80%, benefiting both customers and merchants.

- PayPal’s ecosystem expansion includes partnerships with Meta, Salesforce, Adobe, and BigCommerce, enhancing its presence and potential in digital payments and advertising.

- Despite market volatility, I believe PayPal’s long-term growth potential and innovations make it a valuable investment, with an intrinsic value of around $100 per share.

Andrii Dodonov/iStock via Getty Images

Introduction

I wanted to discuss a little more on some of the biggest reasons PayPal (NASDAQ:PYPL) is still early in its process of a turnaround, and it is still not too late to start a position even after a recent rally if you can call it that. Since the last update on the company, in which it looks like I timed the bottom almost perfectly, PYPL’s share price caught wind and is currently up over 16% compared to S&P 500’s (SPY) flat performance in the same period.

I hear often that PayPal is dead, no one uses it for anything. But that reminds me of when everyone said no one uses Facebook (META) anymore. People fail to realize that PayPal and Facebook are only some of the products that these companies offer. Meta Platforms is known for many products right now, and PYPL is currently building out its ecosystem as well and already isn’t a one-trick pony any longer. Can we expect a similar situation to unfold in terms of PYPL value as we saw when META went from sub-$100 to over $500 a share in less than two years? Hard to tell, but I wouldn’t rule it out.

What I am going to talk about in this update is the innovations that the company is currently working on that seem to be the most promising and lean very well into the new CEO’s expertise, which is helping SMBs to higher profits, thus helping PYPL in return.

I will mainly focus on how Fastlane and the newly announced Ad platforms will help SMBs retain customers. I will also discuss how the company is trying to go beyond online checkouts to round it off. So, let’s get into it.

Overarching Theme – Untapped Potential of SMBs

I mentioned in my previous article that Alex Chriss, the newly appointed CEO, is starting strong in his new role. Instead of trying something completely offhand, he is playing into his strengths. In this case, he is strategically putting focus on the untapped potential of SMBs, in which he has a long experience from his 20-year stint in Intuit (INTU), where he held high-ranking roles in INTU’s Small Business and Self-Employed Group segment.

Fastlane

So, let’s look at what the products that PYPL has been introducing ever since the arrival of the new CEO look like these days and how they are going to help future and current entrepreneurs. Starting with Fastlane. In my opinion, Fastlane is one of the best ideas the company had in a while. PayPal is one of only a few platforms that have the ability to support the infrastructure needed as an end-to-end platform. The company has the customer side and the merchant side, so I think it has everything necessary to keep scaling up. What is Fastlane’s value proposition? So, briefly, what it does is it gives customers a streamlined experience when checking out from any supported merchant. It is supposed to be a lot more seamless and aims to reduce friction. Once the company has the data from the first purchase, it can easily grab that data when the customer comes back to purchase something else, as it will recognize them. That’s great value for customers, but what is the value for the merchants? The main value proposition for merchants is the well above the industry average conversion rate. In the most recent earnings call, and even more recently at the Communacopia Conference, Mr. Chriss said that the merchants are very excited to add Fastlane to their payment offerings because, from the tests, it looked like the guest conversion rates went from 40% -50% to around 80% if the customers are using Fastlane. And how does that work? At the same conference, the CEO gave an example of a purchase by a customer, and there may have been a pop-up saying something along the lines of “If you had checked out through PayPal, you could have saved 5% or 10%”. So, this must have been an appealing proposition. The customer gets the benefits of an existing customer of PYPL without the need to set up an account. Fastlane is now available in the US since August, and according to the CEO, the checkout process is 32% faster also. So, the customer is happier; the merchant is happier because the customer sticks around, how does this benefit PYPL? Through charging the merchant a fee. I am sure that if my conversion rate ends up over 80%, a small fee isn’t going to break the bank, and as I mentioned earlier, merchants are excited to add the Fastlane option.

Partnerships

PayPal is used on a lot of websites that require some sort of payment. PayPal checkout is still my go-to for any purchase online that supports the feature, it’s a no-brainer. I’ve had the account for well over a decade and never had any issues with it. There are a lot of opportunities in terms of more partnerships that the company can strike to get PayPal to become the go-to for everyone when it comes to purchases. The company already has a strong partnership with Meta Platforms on many fronts across all of the family of apps. The payment system is used by Meta to pay its creators and developers on the platforms using Hyperwallet, which is a PayPal service that allows to send payments and other features, Meta uses Braintree for any credit card processing needs, so the partnership is very deep and beneficial to all. There are over 200m SMBs on Meta’s platforms, and I’m sure not everyone opts for PayPal, but I wouldn’t be surprised if many of them do.

Fastlane is now also available through the company’s other partnerships with Salesforce (CRM), Adobe (ADBE), and BigCommerce (BIGC). I have no doubt the momentum in terms of partnerships will continue to increase, and I expect a lot more over the next years.

The progress is going strong on the SMB side of things. PayPal Complete Payments Platform, or PPCP for short, has seen SMB volume surge 40% through the first half of the year, thanks to the integration of new partners and merchants.

Getting into the Lucrative Business of Advertising

Back at the beginning of the summer, the company announced that they were going to create an ad platform called PayPal Ads. I think this is going to be a huge opportunity for the company. This is an opportunity that will certainly be accretive to the company’s margins in the long run, as the advertising business typically operates with much higher margins. Digital advertising has relatively low setup costs and can reach a wide audience, which in turn leads to higher profits. To lead this venture, the company appointed Mark Grether, who previously worked for Uber (UBER) as VP of Advertising. Mark has over 20 years of experience in advertising, which means the company has a good shot at making it a real revenue generator in the long run.

For this venture to work out, PayPal’s ecosystem has to be large enough, and with over 429m active accounts, the company has a good base to start with. What is also exciting about this opportunity is that, through Fastlane, customers are converted into repeat purchasers, as I mentioned earlier, so the network effect is going to increase the potential reach. Merchants will be able to target a specific person with a specific ad, which means they are not shooting blindly out in the open and see what gets caught. They can personalize ads, which means the success of a sale increases, thus increasing the merchant’s ROI in the long run. Everybody wins. Customers find what they are looking for, merchants get better ROI, and PYPL gets even more data to continue to feed the loop and improve the services for a fee, of course.

PayPal Everywhere and NFC Potential

The company has also been trying to break out from online-only payment services and wants people to have the ability to use their payment platforms in person at a coffee shop or pay for their hired handyman who was fixing their house. The company’s debit card has been around for a while now, and it has been received quite well, especially the 5% cash back on purchases. The recently introduced PayPal Everywhere expands that cashback offering even further by allowing you to select a specific category of spending every month, whether that is clothing or groceries, and get 5% cashback. What’s even more interesting is that users will be able to add PYPL’s Debit Card to the Apple (AAPL) Wallet, and I am sure there will be a lot of potential customers who will opt for this feature.

Speaking of Apple, back in June, the company announced its Apple Pay online, and for some reason, people thought that was the end for PYPL. PYPL’s share price took a 10% dive on the news like it was the nail in the coffin.

About a month later, the European Commission made Apple give access to the tap-and-go technology on iPhone to other payment providers like PYPL. So, now Apple has agreed to open the Near-Field-Communication or NFC technology so that people can use other payment cards for contactless purchases. This is a big deal for PYPL because the management is looking to expand its presence more internationally, especially in Europe, where contactless payments have been very popular even before the pandemic. PayPal is quite popular in Europe, so this is going to be a great way of getting the PayPal ecosystem in many pockets around the world. This is what Alex Chriss had to say about the NFC’s potential when he was asked how the company is going to benefit from that:

“[.] omnichannel is an important part for us and an important part for the future, that is customer back. Customers are looking to use PayPal as their solution for every purchase, everywhere, every time. And we need to meet customers where they are. And that means we need to be not just online, where we have ubiquity around the world, but we also need to be able to be in their pocket when they go to check out and buy their groceries and buy their gas. NFC is one how. It is not the only how, but where it’s available, we will move quickly to be able to offer it.

As you mentioned, it opens up in Europe. We will start with one country in Europe likely this fall and then continue to expand over time. And if it happens to work in the U.S. as well, we’ll do that, but we’re not waiting. You saw with PayPal Everywhere. We are now launching and meeting customers where they are. They already have a phone in their pocket. They’ve got a wallet that works. PayPal can now be the default solution for them as they go and check out.”

So, the management is ready to pounce and grab the opportunity that has presented itself organically.

Now, I usually try not to involve any political talk, but Kamala Harris, if elected, has an ambitious policy proposed that will help SMBs overcome the hardest part of owning a business, and that is the rough start that many face. She is proposing to increase the tax credit from the current $5,000 to a whopping $50,000. So, I think that is also worth noting. It may not happen, but it could be a big deal if she gets elected and is able to pass it.

In summary, all the above products and innovations will certainly help the SMBs in a great way, which in turn will prove to be the catalyst for PayPal’s long-term success.

Risks to the Thesis

In the short run, the risk I see that is the most problematic right now is the recession fears once again. The markets have been very volatile because of the uncertainty of whether we are going to get a 50bps rate cut, 25bps, or something else completely. The economic reports coming out show a cooling of the economy with massive revisions to the employment numbers, and I am expecting more of that over the next few quarters. This volatility will affect most if not all stocks in the markets, but surprisingly, even in the last couple of weeks, PYPL’s stock was rather resilient, which is a nice change.

In the long run, the company’s efforts listed below do not play out as well as I had hoped. The company’s efficiency doesn’t improve, and revenues start to fall or stagnate. The naysayers will continue to be in control and say the company is dead. The competition managed to win, and the new CEO will scramble to come up with some idea on how to improve the business or resign.

Valuation

I decided to update my model after doing some research on what can be achieved if the company does turnaround completely and becomes a much more efficient and profitable company.

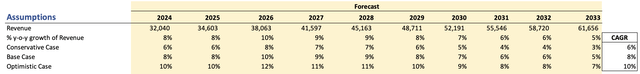

For revenues, I went with around 8% CAGR, which, I think, is still on the lower end of the company’s potential. However, I like to keep it conservative.

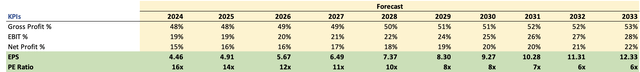

For margin and EPS, the company’s innovations like the ad platform and further streamlining of the business could help its operational efficiency further, just last quarter, adjusted EPS increased by 36%, so the below assumptions are reasonable, in my opinion.

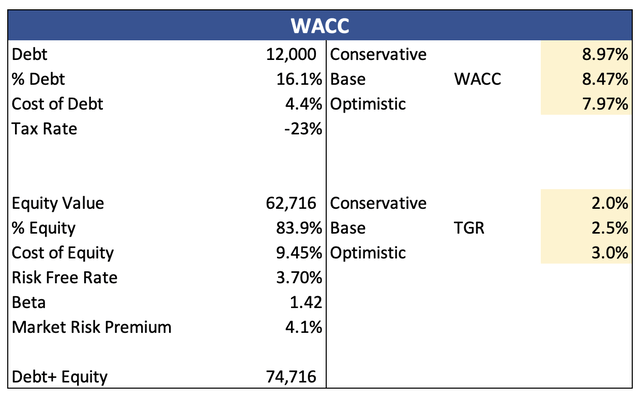

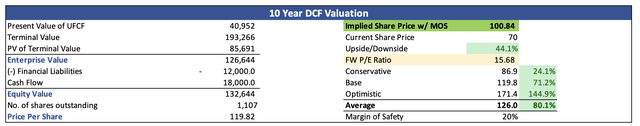

I also went with the company’s WACC as my discounting rate, which is 8.5%, and a terminal growth rate of 2.5%.

In case these assumptions are not perfect, which they aren’t, I am going to discount the final intrinsic value by an additional 20% to give me some room for error. With that said, PYPL’s intrinsic value is around $100 a share.

Closing Comments

So, I believe the company is still just getting started, and I am very excited to see how the mentioned products and innovations are going to help the company’s operations going forward. I don’t expect to see a lot of progress right away, but I am in it for the long haul. I wish I bought more over the last while, but I don’t think it is too late to add more, as I believe the company is worth a lot more than what I am modeling in this article.

I may wait a little while before adding more here only because I am not a fan of how the markets are right now. Once we get some clarity, I will be back accumulating more, and honestly, I wouldn’t mind if all the jitters bring the stock price down for me. I am patient.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.