Summary:

- PayPal’s growth days are over as user numbers have plateaued and competition from payment apps and digital currencies is increasing.

- The arrival and increased adoption of cryptocurrencies have also contributed to PayPal’s user decline and X is set to launch in-app payments.

- The decline in users has led to a plateau in financial performance, with stagnating gross profit and rising costs. The company’s valuation is higher than its competition.

Justin Sullivan

I watched last year as a large number of analysts told investors to jump into PayPal (NASDAQ:PYPL). It was the bottom pickers’ darling of 2023 and when the majority starts to get behind an idea, it is a reason to be cautious. Here are the big-picture reasons that I believe investors are missing on PayPal.

Rising competition and an end to high fees

The first obvious reason to avoid the stock is that the growth days are over. This is evident in its user numbers and its finances.

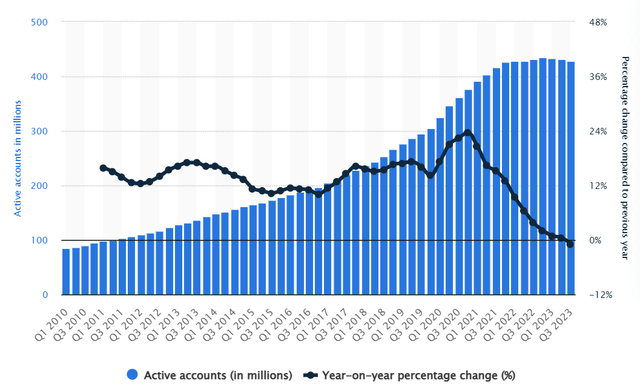

PayPal Users by Quarter (Statista)

PayPal user numbers soared for a decade from 2010 to 2020. It is a worrying sign for the company that user numbers have plateaued at the onset of a gig working boom. The year-on-year percentage change in user numbers has now gone negative for the first time in the company’s history.

The number of individuals with income from online-only jobs jumped by 3.1 million between 2020 and 2021, according to NEBR. PayPal saw some benefit from that growth but has seen users dip for the last three quarters. After years of higher fees, users may have started to see the reality that after a gig platform and PayPal took their cut, the actual hourly fee for a job decreased dramatically.

The other big problem for PayPal has been twofold- a rise in digital payments and cryptocurrencies.

The first competitors to arrive were phone apps such as Apple Pay, which saw global iPhone users activating the payments app grow by 65 million in 2020. As the pandemic ushered in a new era of moneyless transactions, more and more consumers were exposed to using their cell phones as a payment app. That immediately reduces the need for PayPal, which adds a third-party element with a need for a separate platform and passwords.

Worse still for PayPal, it was announced that the big banks were seeking to get into the payments game. A year ago, it was reported that Bank of America (BAC), Wells Fargo (WFC), and JPMorgan (JPM) were working on a digital payments offering to compete with Google Pay (GOOG) and Apple (AAPL). The three banks own the Zelle payments app and want to expand its reach. Mastercard (MA) and Visa (V) were also said to be supporting the initiative, according to the WSJ. I believe PayPal has seen its best days as the company will no longer be able to charge high fees as the dominant digital payments player.

Central bank digital currencies and micropayments are the next obstacle

In my view, PayPal’s falling user growth rate was also driven by the arrival and increased adoption of cryptocurrencies. The pandemic brought a lot of speculative activity in crypto and retail stock trading and this would have been a drag on monies that were held, or flowing through PayPal.

Growth in the crypto industry brought new elements such as blockchain gambling and gaming, which again, means that monies are not circulating through PayPal.

Alongside the growth in payment apps, I think a bigger problem for PayPal is the push toward Central Bank Digital Currencies [CBDC] in Western nations. If governments or central banks start to issue payment wallets for digital currency, then it could be game over for PayPal. Spain’s central bank was the latest to announce testing of a CBDC and others such as the U.S., U.K., and the ECB have been studying the technology.

All of these trends also mean that fees on its platform are at risk if it wants to attract and hold users. That is not happening and the competition is growing. A CBDC wallet would come with almost zero transaction fees and that would be a death knell for PayPal, which I believe could render its business and its global footprint irrelevant.

Yet another new layer of competition is now coming this year in the form of micro-payments. Elon Musk’s X, formerly known as Twitter, has stated previously that it wants to be an “everything app.” The company confirmed in a blog this week that payments are a goal for the year ahead.

“We will launch peer-to-peer payments, unlocking more user utility and new opportunities for commerce, and showcasing the power of living more of your life in one place.”

PayPal was often used as a link for artists to receive tips or payment for their work. Now they can upload the material directly to X and receive tips at the click of a button. No more need for third-party tipping apps- sorry PayPal.

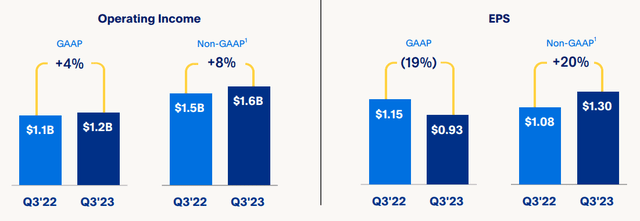

The end of growth is clear in the financial performance

The stalling of user growth has led to a plateau in financial performance, and I believe that this will get worse over the coming years due to the threats I have outlined.

Yes, PayPal trades at a cheap valuation with the company currently selling for 12.3 times earnings, but that is still 28% higher than its competition. The forward P/E of 16.6X is more than 50% of the competition.

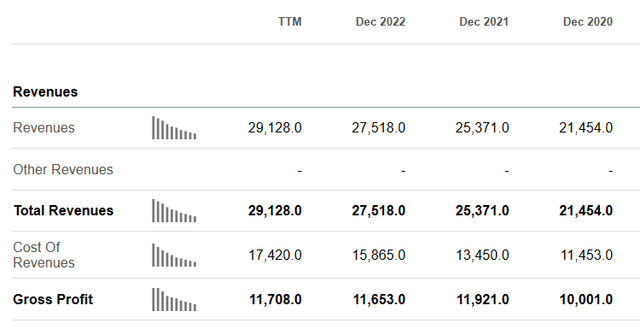

One problem in the valuation is a price/cash flow ratio of 17X. On an annual basis, PayPal’s gross profit has stagnated since 2020.

PayPal Revenues (Seeking Alpha)

Revenue has been increasing over that period, but there is a worrying rise in Cost of Revenues. Despite some revenue increase in the latest third-quarter results, PayPal’s income was flat quarter-over-quarter.

Operating margin and net income were both lower over the period with the company generating only $1.3bn in free cash flow for the quarter. The company has around $15.4 billion in cash and $10 billion in debt. It was also committing to share buybacks and I believe that shows management is out of ideas for acquisitions.

New CEO Alex Chriss said the company will “become more efficient so we can innovate and execute with higher velocity.” The acting CFO took a similar tone, saying that the company was showing “disciplined expense management and capital allocation… focused on accelerating our profitable growth.”

She added in the analyst call: “wouldn’t call out any real change in what we’re seeing overall in our branded checkout experience. The trends are healthy. Clearly, we want them to accelerate.”

I believe these statements from management highlight the growth days over for PayPal. I also think that the level of competition that is coming also means there is no technological breakthrough or acquisition that can regain PayPal’s dominance.

On stock performance, there is potential for a price recovery but I believe that will be short-lived and the medium-term will see these competitive trends start to eat into PayPal’s dominance as a payments platform.

The risks to my bearish thesis are probably in the short term with the potential for a rebound in the company’s stock price. PYPL stock is down over 25% over the last 12 months and the valuation metrics are getting lower. It will take more time for the issues in my bearish thesis to play out in full, such as the completion of the X payment setup and a CBDC. Investors should keep that in mind if they want to sell or cut a stake in PayPal.

Conclusion

PayPal stock peaked in July 2021 as investors started to price in the company’s decline in user growth and stagnant profitability. Many are looking for a turnaround in fortunes but I see the company as fairly valued. There is growing competition in digital payments and I believe the company does not have the ability or the ideas to hold onto its market share. With the X platform set to introduce tipping and small payments, and central banks moving toward digital currency apps, I believe the best days are over for PayPal.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.