Summary:

- PayPal has seen struggles to branded processing growth amidst stiff competition.

- The company maintains a net cash balance sheet and is repurchasing shares.

- I see Braintree eventually driving long-term profitable growth.

- The stock is too cheap given the strong balance sheet and share repurchase program, I reiterate my strong buy rating.

Prykhodov

PayPal Holdings, Inc. (NASDAQ:PYPL) may be making investors impatient. 2024 is intended to be a transition year, and investors may be wondering where the company fits amidst growing competition including from the likes of Apple Inc. (AAPL). Yet I argue that the stock is not pricing in anything heroic, and the company maintains a net cash balance sheet. The company remains highly profitable and is repurchasing shares, and I continue to expect the market to eventually reward the stock for the strong growth in the Braintree unit. I reiterate my strong buy rating for the stock.

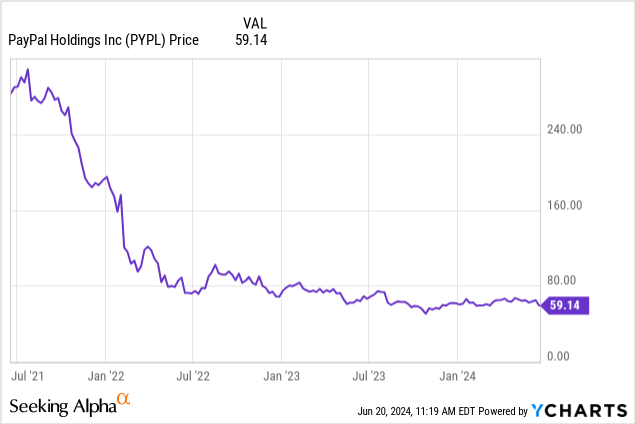

PYPL Stock Price

I last covered PYPL in April where I rated the stock a strong buy due to the torrid Braintree growth. The stock has been stubbornly stagnant for many quarters even amidst a tech recovery.

It isn’t clear when typical levers like share repurchases and margin expansion might lead to a re-rating, but I still find the stock mispriced given the net cash balance sheet.

PYPL Stock Key Metrics

PYPL is perhaps best known for its peer-to-peer payment transfers as well as its e-commerce checkout experience.

The company initially benefitted from a first-mover advantage, but is now facing great competition.

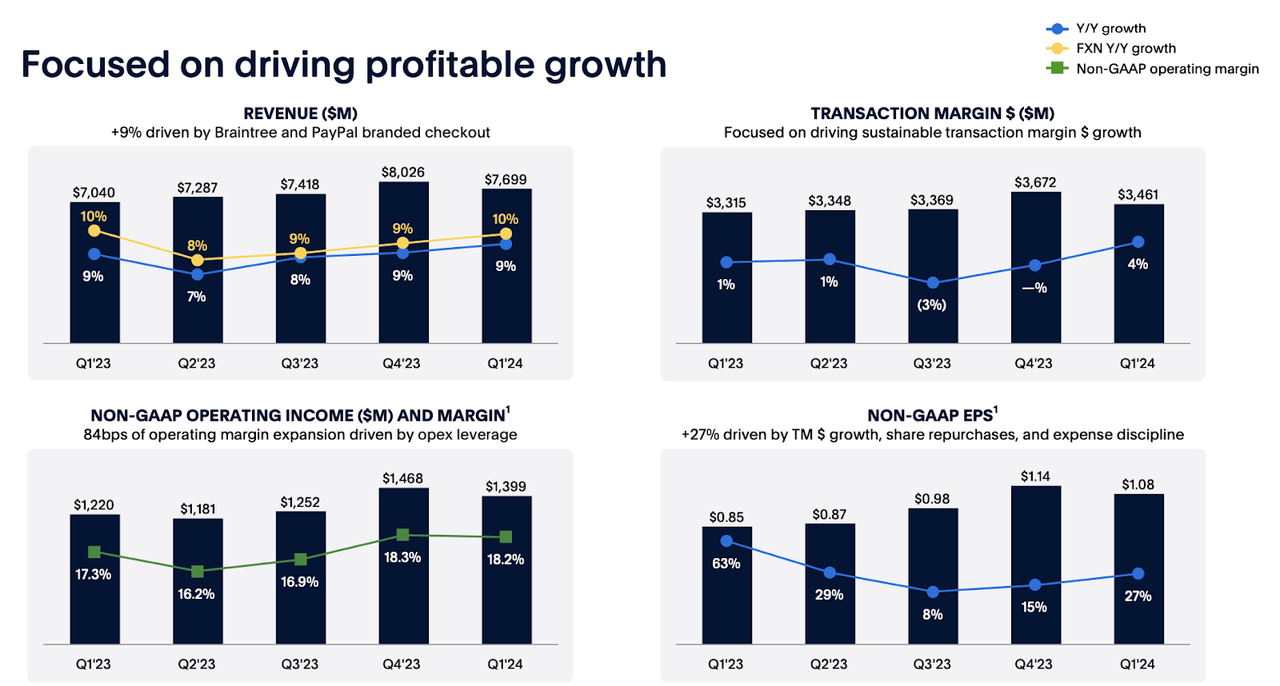

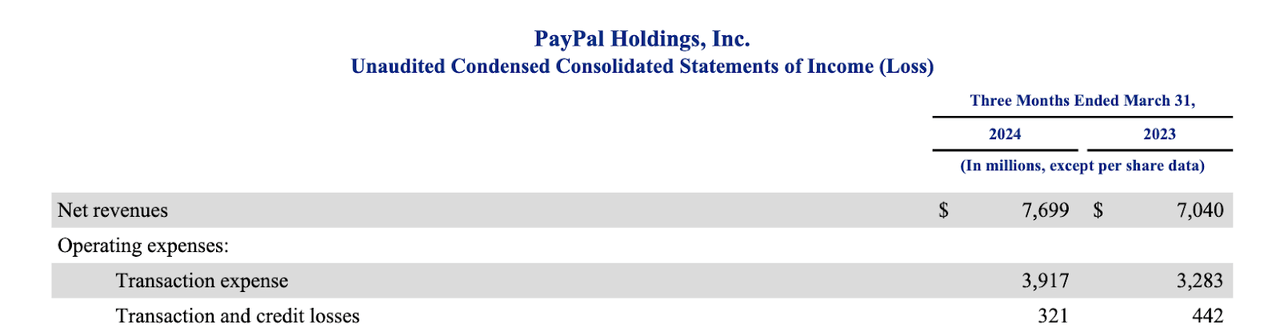

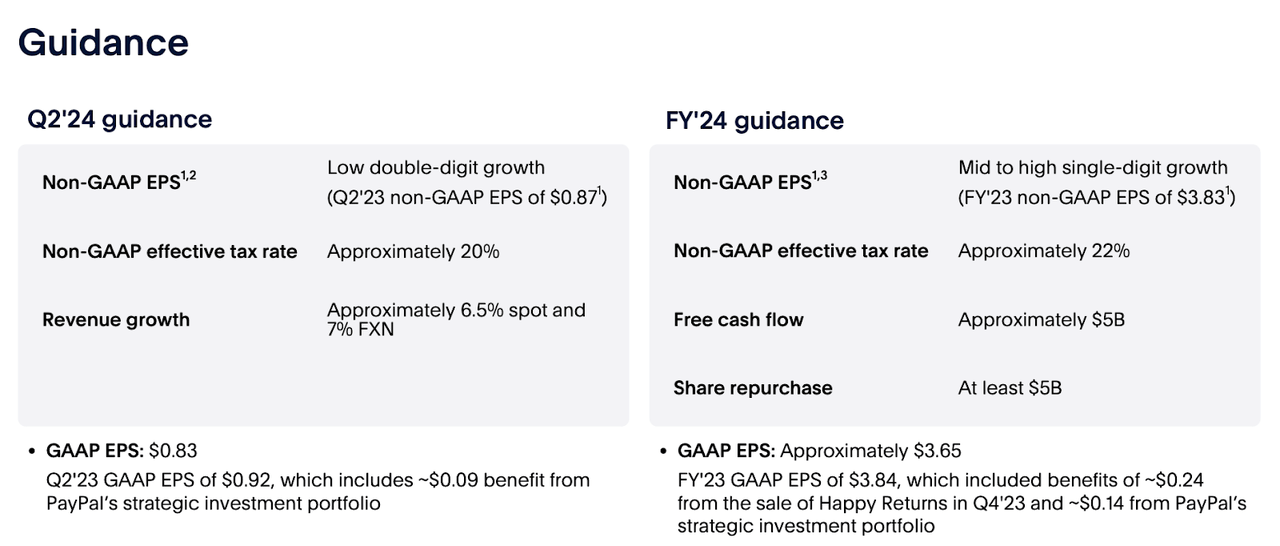

Even so, the company beat on management guidance, with revenues jumping 9% YoY (ahead of 6.5% guidance) and Non-GAAP EPS growing by 27% YoY (exceeding guidance for mid-single digit growth).

I note that much of the revenue growth appears to be driven by low-margin revenues at Braintree, as transaction expense growth essentially wiped out net revenue growth. The earnings growth instead came from cost discipline. Some investors might view the deteriorating margin profile with pessimism, but I see PYPL as being in a customer-acquisition period, with the potential to benefit from the low-hanging fruit of cross-selling moving forward.

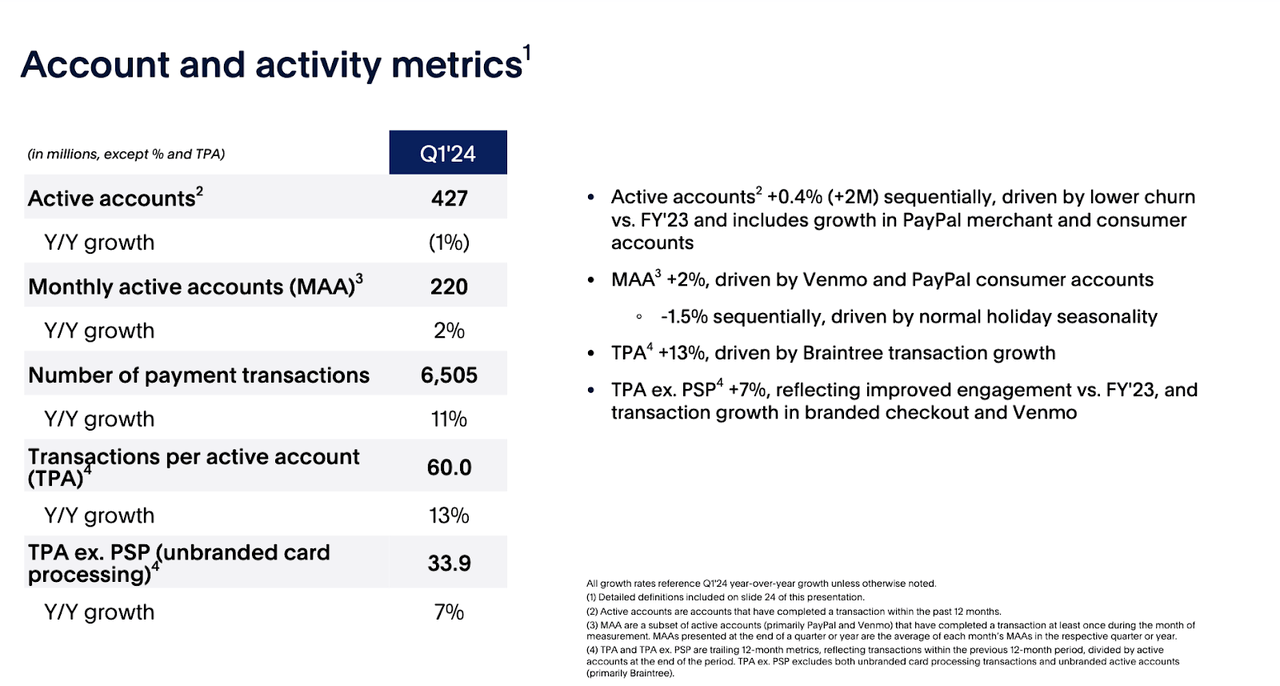

PYPL saw active accounts decline by 1% YoY, clearly showing competitive pressures. E-commerce penetration soared following the pandemic, and PYPL might no longer benefit from a “rising tide lifts all boats” argument.

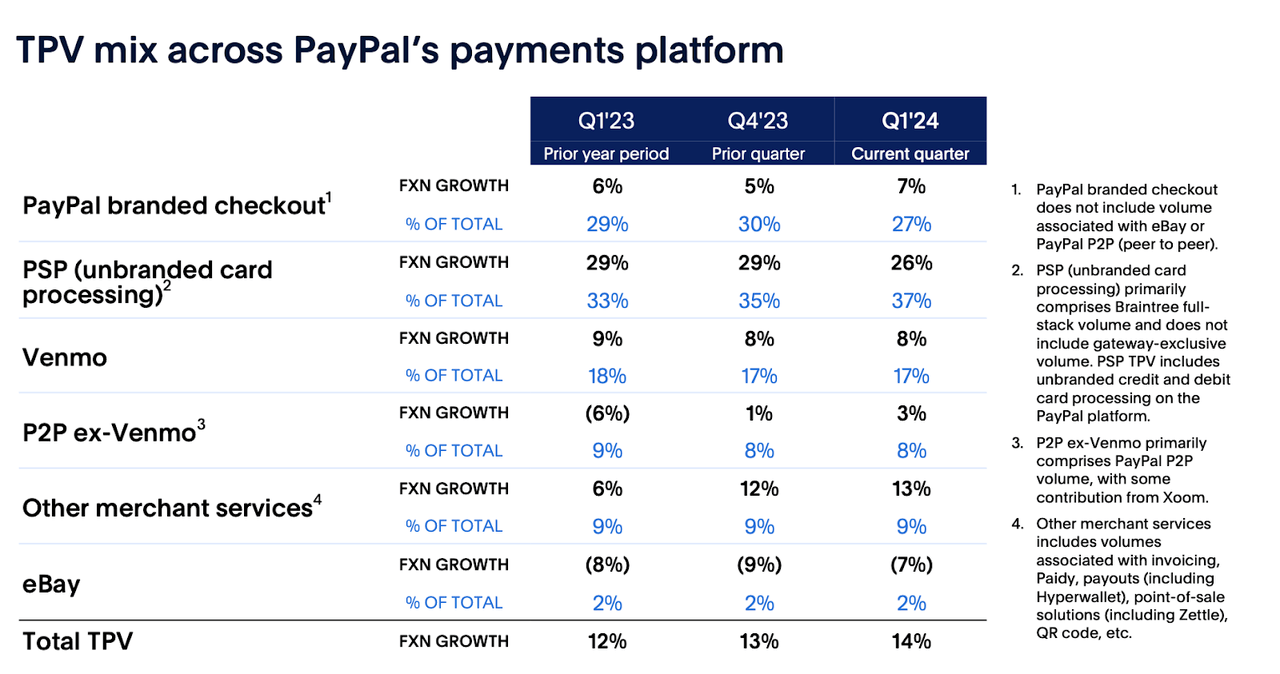

We can see below that PYPL’s payment volume growth appears to be driven by unbranded processing growth (Braintree). Braintree is gradually becoming a bigger and bigger portion of the overall payment volume. It is well known that PYPL has been very competitive on pricing and we have already seen how the rising Braintree payment volume has negatively impacted transaction margins.

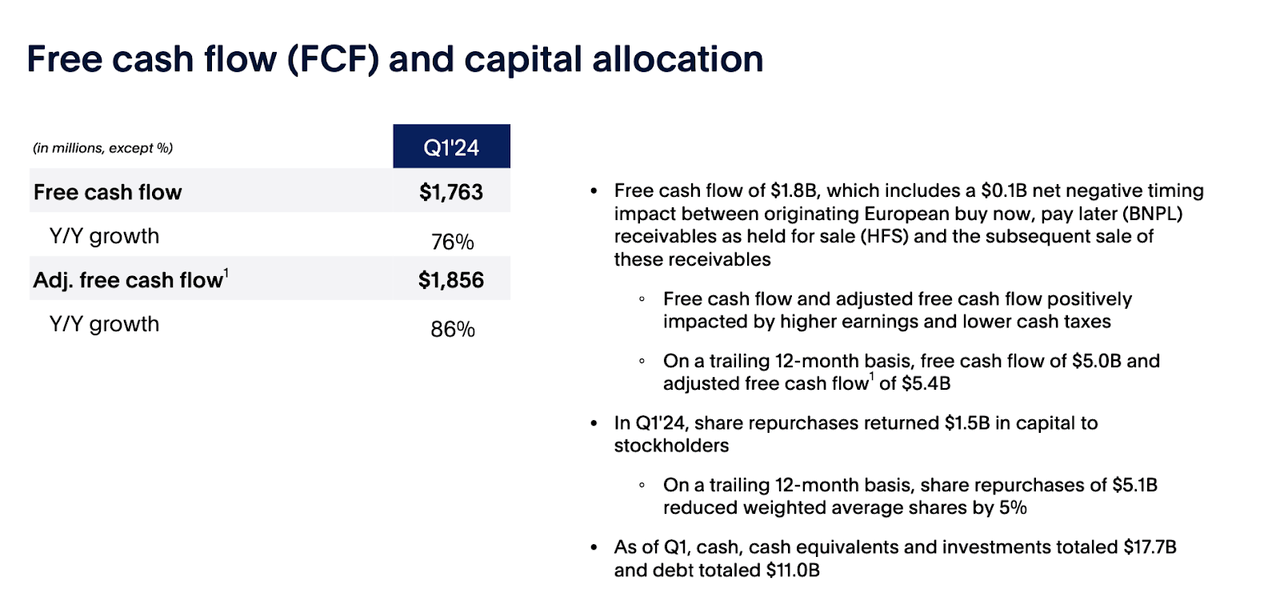

PYPL generated $1.8 billion of free cash flow in the quarter and returned $1.5 billion to shareholders through share repurchases. The committed share repurchase program against the low stock valuation is an important part of the investment thesis.

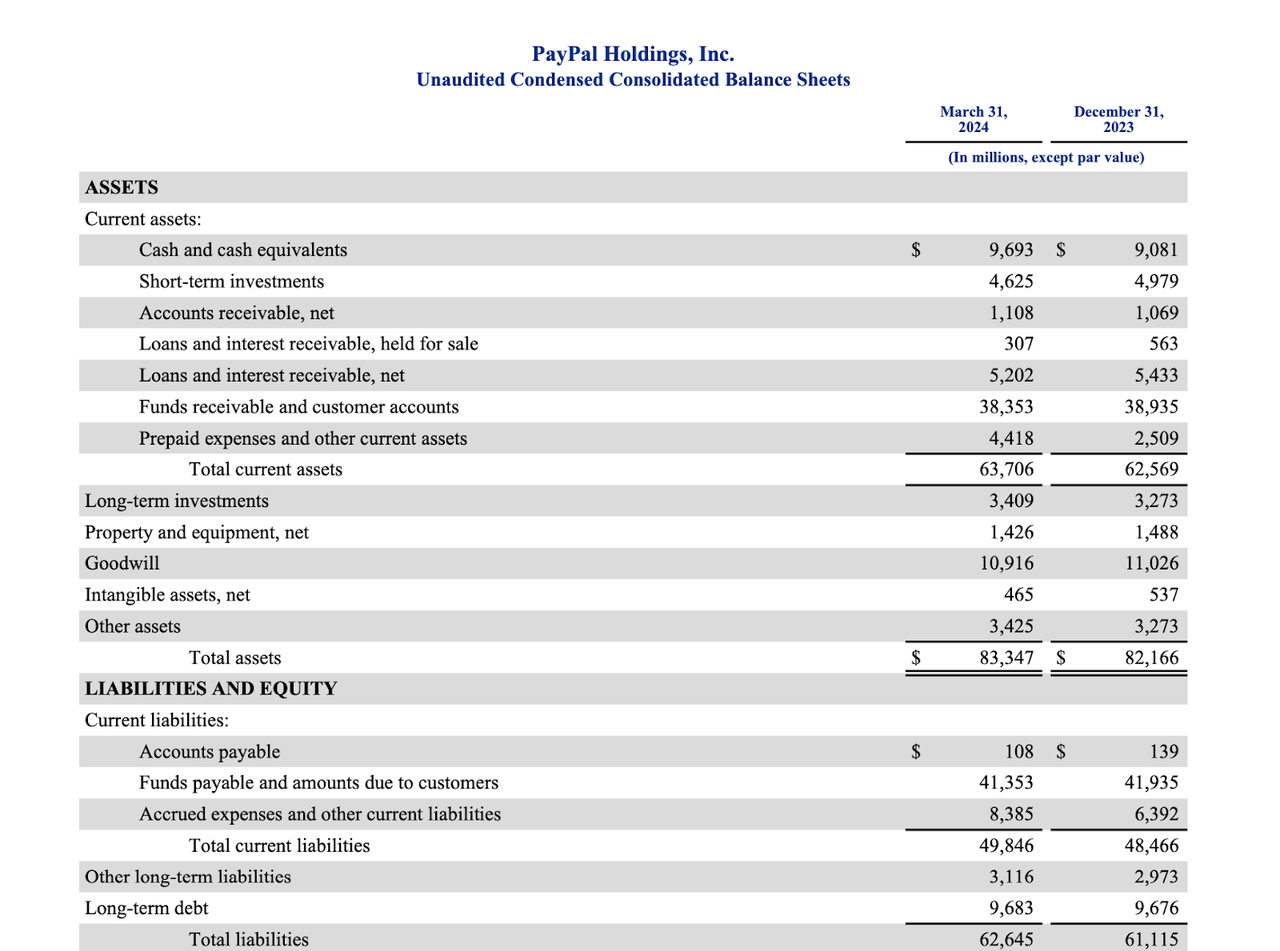

PYPL ended the quarter with $17.7 billion in cash versus $11 billion in debt, representing a strong net cash balance sheet position.

Looking ahead, management has guided for the second quarter to see 6.5% YoY revenue growth (versus 6.9% consensus) and low double-digit non-GAAP EPS growth. For the full year, management expects up to high single-digit non-GAAP EPS growth, implying a dramatic slowdown in earnings growth in the second half.

On the conference call, management noted that the projected second half slowdown may be due to the company lapping tough comparables, as the company has already been executing on cost discipline for many quarters now.

Management reiterated their view that 2024 is a “transition year” in which they are focused on setting the company up for “long-term success.” Management highlighted some low-hanging fruit, including improving retention of Venmo funds. Management noted that $18 billion of net new funds flow into Venmo every month, but 80% leave within 10 days.

Is PYPL Stock A Buy, Sell, or Hold?

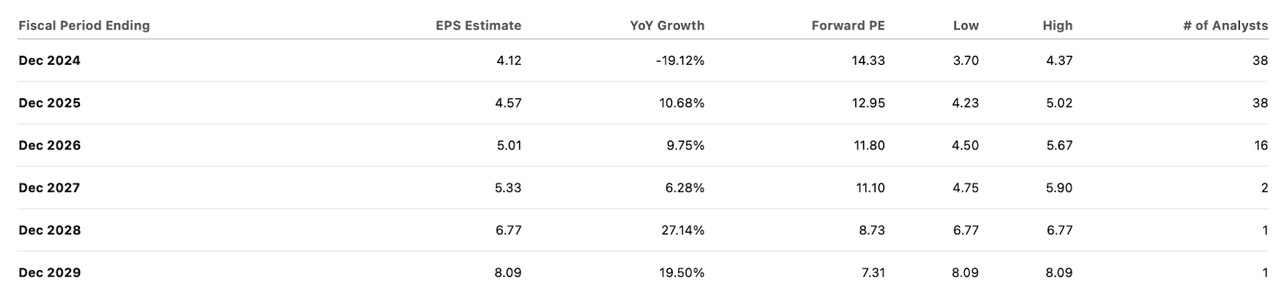

I have the opinion that Wall Street sometimes has a delayed reaction to transition periods. PYPL’s transition from a high revenue growth flier to a slow-growing share repurchaser is a case in point. The stock trades at a low valuation of just 14x earnings.

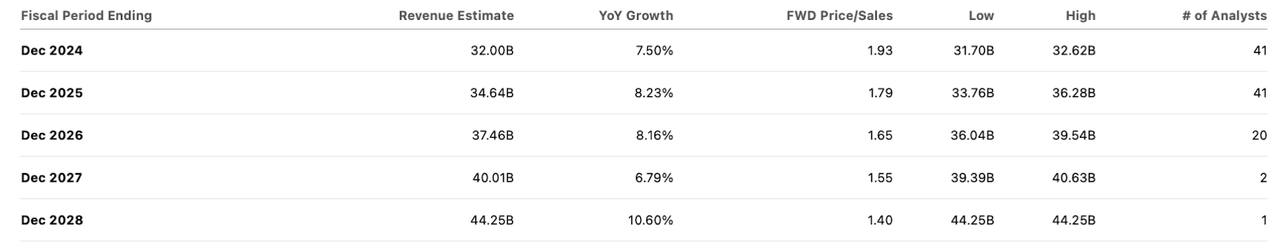

That is in spite of consensus estimates calling for single-digit top-line growth moving forward.

It is possible that the market is concerned about a lack of operating leverage with Braintree revenues apparently having negative margins. That can explain the cheap valuation somewhat, but even assuming just low-single digit earnings growth, a 14x earnings multiple still looks too low given the net cash balance sheet. Moreover, management is actively taking advantage of the low valuation with its share repurchase program, which in my view is the most reliable play in the re-rating playbook.

Is the market thinking that PYPL is a bank? I would be surprised by that view given that PYPL has not aggressively invested funds held for customers whatsoever, meaning it has minimal to no fleeing deposit risk.

Perhaps the market is concerned that PYPL might become more like a bank in the future, but the company’s decision to offload buy-now, pay-later loans to KKR suggests otherwise. The only explanation I can think of is if the company eventually sees earnings growth turning negative, perhaps due to the low-single digit growth in branded processing being unable to offset the dilutive growth in unbranded processing. But this thinking seems overly pessimistic as well. I find it highly unlikely for the company to not eventually monetize its growing unbranded processing client list. I do not know management’s exact strategy given that they have not disclosed it, but perhaps they intend to eventually raise prices in the future, jump-start its branded processing business (perhaps by signing exclusivity agreements), or by cross-selling other products. In the worst case, one would think that the unbranded processing business has at least zero value instead of the negative value implied in the stock price.

I instead view PYPL as benefitting from being the low-cost unbranded processing provider, a position which may mean it faces less disruption risk than more expensive peers like Adyen N.V. (OTCPK:ADYEY). I expect both growth to accelerate (to the double-digit level) and multiples to re-rate (to the 20x to 25x level) as the market appreciates the resilience of the business model. Yet even just assuming 7% to 9% forward growth and no multiple expansion, the stock is still priced for around 13% to 15% annual returns between growth and earnings yield alone.

PYPL Stock Risks

PYPL might not see growth accelerate, or at least not on a profitable basis. While I still come across e-commerce sites with only PayPal integration every now and then, it is admittedly unclear if new e-commerce sites will accept PayPal. It is possible that branded processing growth turns negative as competitive risks offset e-commerce tailwinds. It is possible that PYPL does not have plans or ways to further monetize its Braintree customers. If growth were to slow to the low-single digit range, then the valuation multiple might sink to around 12x earnings, though I’d still think that the 14x earnings multiple looks easily justifiable given the net cash balance sheet.

PYPL Stock Conclusion

PYPL is a messy story in transition. Revenue growth remains muted and gross margins appear to be diluted from the company’s one attractive growth story in Braintree. However, the net cash balance sheet, low PE ratio, and ongoing share repurchase program make the stock highly attractive at current levels. I reiterate my strong buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!